Tn flood insurance Idea

Home » Trend » Tn flood insurance IdeaYour Tn flood insurance images are ready. Tn flood insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Tn flood insurance files here. Get all free images.

If you’re searching for tn flood insurance pictures information related to the tn flood insurance keyword, you have pay a visit to the right site. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

Tn Flood Insurance. Nfip policies are sold by property insurance agents, which means a producer must be up to date on the national flood insurance program, its coverage, conditions and more. The fema flood map service center (msc) is the official online public source for flood hazard information produced in support of the national flood insurance program (nfip). This insurance offers an insurance alternative to disaster assistance to meet the escalating costs of repairing flood. It is not covered by homeowners insurance.

Franklin residents can look at new flood maps From tennessean.com

Franklin residents can look at new flood maps From tennessean.com

Generally tn commercial flood insurance covers damage to your building and contents caused by flood. That being said, there are multiple important benefits to having a flood insurance policy in tennessee: The federal emergency management agency (fema) recently. That’s why it’s so important for tennessee residents and business owners to be equipped with the right flood insurance policy. There are currently about 33,000 flood insurance policies in effect in this state. This coverage is specifically excluded in standard.

We have multiple options for your flood insurance in tennessee:

So, if the weather forecast announces a flood alert for your area and you go to purchase coverage, it’s already too late. The fema flood map service center (msc) is the official online public source for flood hazard information produced in support of the national flood insurance program (nfip). Your standard tennessee flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. If you live in a community that participates in the national flood insurance program (nfip), you are eligible to purchase flood insurance. Private flood insurance & the national flood insurance program (nfip; Typically, your flood insurance policy is dependent on your flood zone risk.

Source: lakelandtn.gov

Source: lakelandtn.gov

Compare tennessee flood insurance quotes from multiple companies in minutes! Fema’s national flood insurance program (nfip) and all federally backed lenders rely on these tennessee flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. If you live in a community that participates in the national flood insurance program (nfip), you are eligible to purchase flood insurance. These claims resulted in $11.8 million in compensation paid to policyholders. Use the msc to find your official flood map, access a range of other flood hazard related products such as letter of map changes.

Source: bnainsurancegroup.com

Source: bnainsurancegroup.com

That’s why it’s so important for tennessee residents and business owners to be equipped with the right flood insurance policy. Nashville — the tennessee department of commerce & insurance (tdci) is raising awareness of recent changes to the national flood insurance program (nfip) that will mean lower flood insurance premiums for some tennessee flood insurance consumers. Less than 2% of tn residents have flood insurance coverage. All other areas in collierville), it is still available and strongly recommended. First, here’s a deep dive into this critical coverage.

Source: tnindependentagents.com

Source: tnindependentagents.com

That being said, there are multiple important benefits to having a flood insurance policy in tennessee: Typically, your flood insurance policy is dependent on your flood zone risk. Less than 2% of tn residents have flood insurance coverage. This is the purpose of the online continuing education course, flood insurance made simple. The national flood insurance program (nfip), managed by the federal emergency management agency (fema), enables homeowners, business owners and renters in participating communities to purchase federally backed flood insurance.

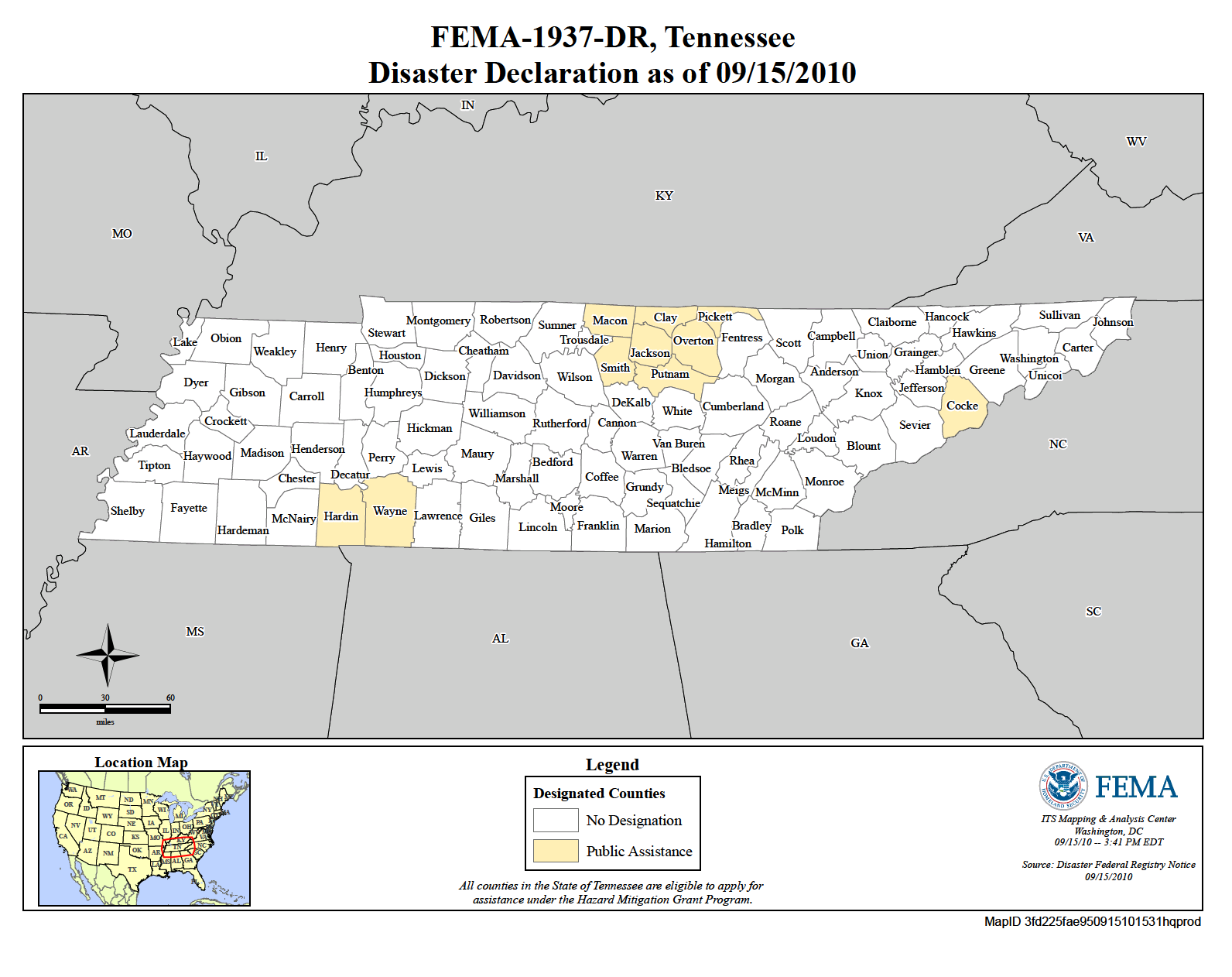

Source: fema.gov

Source: fema.gov

If you live in a community that participates in the national flood insurance program (nfip), you are eligible to purchase flood insurance. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris. Protection for your home or office building’s structure: The average cost per policy in tennessee through the nfip is $727.71. Since 1978, federal flood insurance policyholders in tennessee have received over $343 million in claim payments.

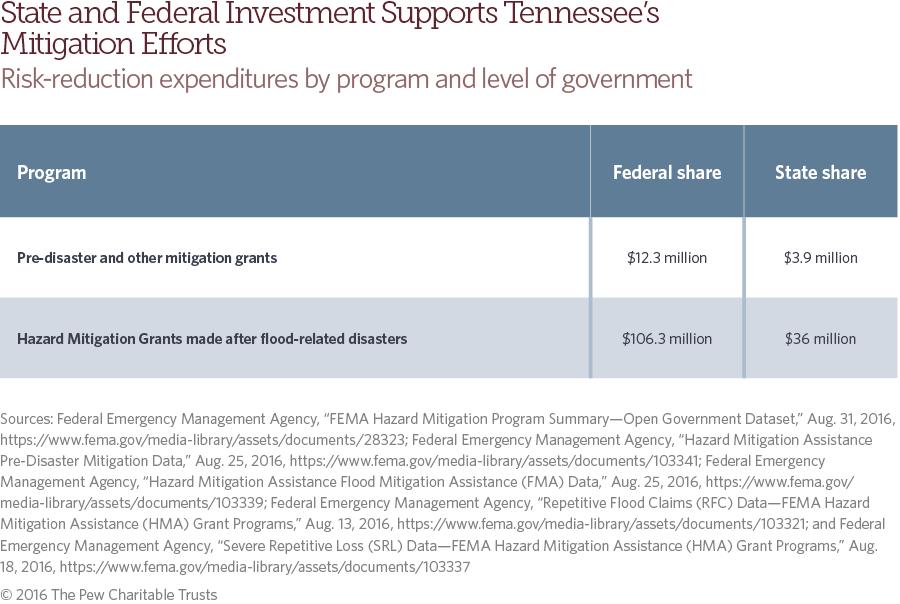

Source: pewtrusts.org

Source: pewtrusts.org

This insurance offers an insurance alternative to disaster assistance to meet the escalating costs of repairing flood. The fema flood map service center (msc) is the official online public source for flood hazard information produced in support of the national flood insurance program (nfip). Tn residents filed 553 flood insurance claims in recent years. This insurance offers an insurance alternative to disaster assistance to meet the escalating costs of repairing flood. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris.

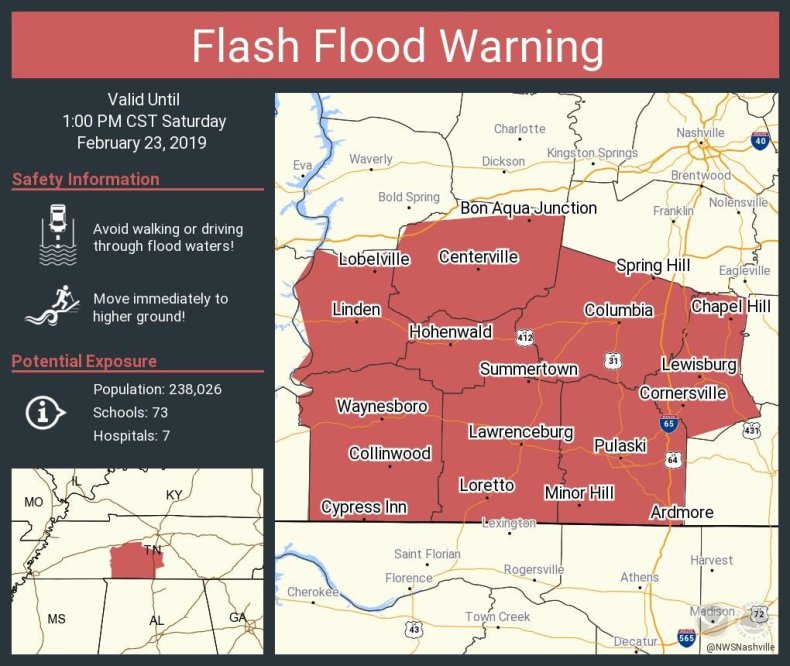

Source: floodinsuranceguru.com

Source: floodinsuranceguru.com

Typically, your flood insurance policy is dependent on your flood zone risk. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris. Recent tennessee flood insurance facts as reported by fema. These claims resulted in $11.8 million in compensation paid to policyholders. Typically, your flood insurance policy is dependent on your flood zone risk.

Source: dickeymccay.com

Source: dickeymccay.com

Is flood insurance required in tn? The federal emergency management agency (fema) recently. The average cost per policy in tennessee through the nfip is $727.71. Fema’s national flood insurance program (nfip) and all federally backed lenders rely on these tennessee flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Without the proper coverage, homeowners and business owners could easily go bankrupt trying to pay for damages out of pocket.

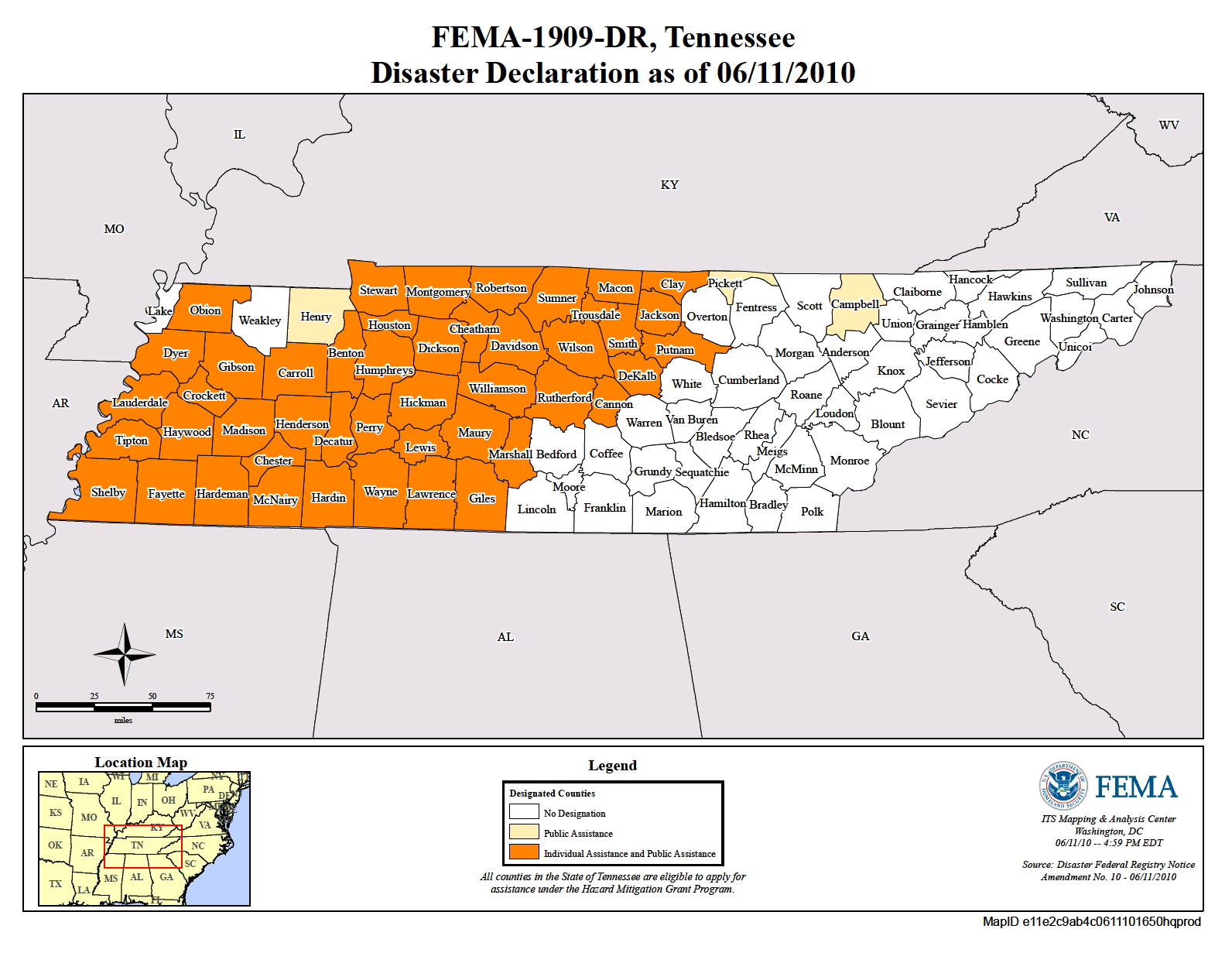

Source: fema.gov

Source: fema.gov

In general, a policy does not take effect until 30 days after you purchase flood insurance. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris. These claims resulted in $11.8 million in compensation paid to policyholders. Typically, your flood insurance policy is dependent on your flood zone risk. All other areas in collierville), it is still available and strongly recommended.

Source: betterflood.com

Source: betterflood.com

Typically, your flood insurance policy is dependent on your flood zone risk. It is not covered by homeowners insurance. To buy a flood insurance policy, you can find a tennessee flood insurance provider using the link below. The average cost per policy in tennessee through the nfip is $727.71. We have multiple options for your flood insurance in tennessee:

Source: averybessed.blogspot.com

Source: averybessed.blogspot.com

Fema’s national flood insurance program (nfip) and all federally backed lenders rely on these tennessee flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. There are currently about 33,000 flood insurance policies in effect in this state. The average cost per policy in tennessee through the nfip is $727.71. Is flood insurance required in tn? Typically, your flood insurance policy is dependent on your flood zone risk.

Source: averybessed.blogspot.com

Source: averybessed.blogspot.com

Whether you live in memphis, nashville, knoxville, chattanooga, clarksville or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year. All other areas in collierville), it is still available and strongly recommended. Flood insurance policies provide protection against property damage to residential homes and office spaces or storefronts that’s caused by flooding. There are two options for flood insurance in tennessee: The fema flood map service center (msc) is the official online public source for flood hazard information produced in support of the national flood insurance program (nfip).

Source: betterflood.com

Source: betterflood.com

There are currently about 33,000 flood insurance policies in effect in this state. Not participating in the flood insurance program hurts communities in a number of ways, according to chad berginnis, executive director of. Generally tn commercial flood insurance covers damage to your building and contents caused by flood. Flood insurance means you’ll be reimbursed for all your covered losses. Use the msc to find your official flood map, access a range of other flood hazard related products such as letter of map changes.

Source: youtube.com

Source: youtube.com

Your standard tennessee flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. This includes losses resulting from water from over flowing rivers or streams, rain, storm surge, snow melt, blocked storm drainage systems, broken dams or other like causes. There are two options for flood insurance in tennessee: Your standard tennessee flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. There are currently about 33,000 flood insurance policies in effect in this state.

Source: wbir.com

Source: wbir.com

Is flood insurance required in tn? Building, contents, replacement cost coverages Whether you live in memphis, nashville, knoxville, chattanooga, clarksville or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year. Depending on where you live, this average could vary substantially! And unlike federal aid, it never has to be repaid.

Source: pewtrusts.org

Source: pewtrusts.org

Typically, your flood insurance policy is dependent on your flood zone risk. First, here’s a deep dive into this critical coverage. Tn residents filed 553 flood insurance claims in recent years. Flood insurance means you’ll be reimbursed for all your covered losses. It is not covered by homeowners insurance.

Source: tennessean.com

Source: tennessean.com

Depending on where you live, this average could vary substantially! The federal emergency management agency (fema) recently. It is not covered by homeowners insurance. Depending on where you live, this average could vary substantially! How much is flood insurance in tennessee?

Source: usatoday.com

Source: usatoday.com

This includes losses resulting from water from over flowing rivers or streams, rain, storm surge, snow melt, blocked storm drainage systems, broken dams or other like causes. This coverage is specifically excluded in standard. That’s why it’s so important for tennessee residents and business owners to be equipped with the right flood insurance policy. Thursday, june 24, 2021 | 09:32am. There are currently about 33,000 flood insurance policies in effect in this state.

Source: pewtrusts.org

Source: pewtrusts.org

This insurance offers an insurance alternative to disaster assistance to meet the escalating costs of repairing flood. It is not covered by homeowners insurance. The fema flood map service center (msc) is the official online public source for flood hazard information produced in support of the national flood insurance program (nfip). This coverage is specifically excluded in standard. The average cost per policy in tennessee through the nfip is $727.71.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tn flood insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information