To sell variable life insurance policies an agent must receive Idea

Home » Trend » To sell variable life insurance policies an agent must receive IdeaYour To sell variable life insurance policies an agent must receive images are ready in this website. To sell variable life insurance policies an agent must receive are a topic that is being searched for and liked by netizens now. You can Download the To sell variable life insurance policies an agent must receive files here. Find and Download all free photos.

If you’re searching for to sell variable life insurance policies an agent must receive pictures information related to the to sell variable life insurance policies an agent must receive interest, you have pay a visit to the right blog. Our website frequently provides you with hints for refferencing the highest quality video and image content, please kindly surf and find more informative video articles and images that match your interests.

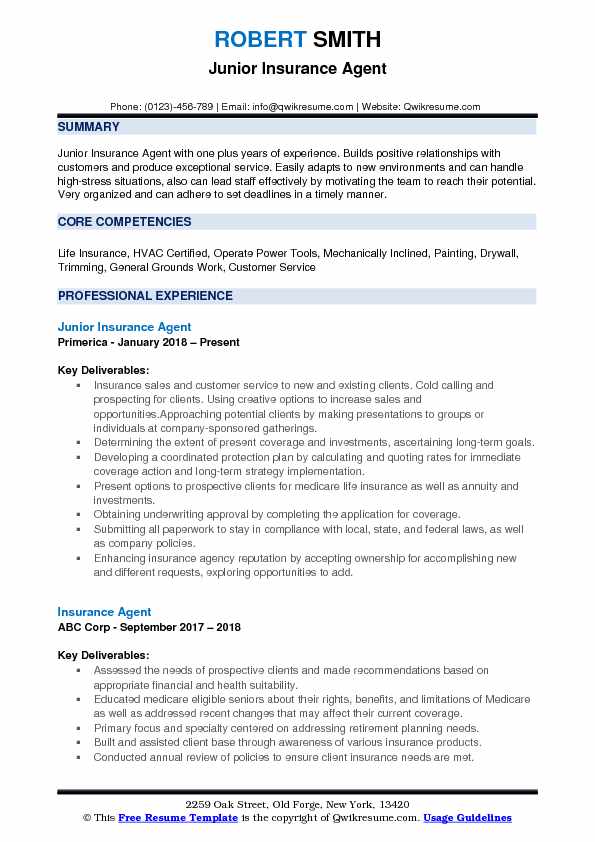

To Sell Variable Life Insurance Policies An Agent Must Receive. To sell variable life insurance, you must provide special sales material and literature to your clients. There are two forms of commission payments to life insurance agents: A life insurance policyowner may sell their policy to a(n) _____ in order to receive a percentage of the policy’s face value. To sell variable life insurance policies, an agent must receive all of the following except a) a securities license.

From venturebeat.com

From venturebeat.com

First year commission payments and renewal commission payments. This license is also required for insurance agents that sell variable products of any kind, because securities constitute the underlying investments within those products. Life insurance agents are not getting rich by selling term life insurance unless they are selling it in massive quantities. To sell variable life insurance policies, an agent must receive what three things? Whether to cash in a life insurance policy is an important decision. To sell variable life insurance, you must provide special sales material and literature to your clients.

To sell variable life insurance policies, an agent must receive what three things?

To sell life insurance, you must be licensed by the state you are practicing in. He also needs to be registered with finra. B) a life insurance license. In florida, agents who have fully satisfied the requirements for a life insurance license, including successful completion of a licensing exam that covers variable annuities, may sell or solicit variable. A life insurance license 3. To sell them, an agent will have to pass either a series 7 test (which entitles them to sell most types of securities) or both series 63 and series 6 tests (which are tests more specifically focused on mutual funds, retirement plans, insurance products, and variable annuities).

Source: psmbrokerage.com

Source: psmbrokerage.com

It also discloses how the mutual funds work, and what type of investments they will make to achieve the desired returns. To sell variable insurance products, an individual must hold a life insurance license and a financial industry regulatory authority (finra) registered representative�s license. When replacing or exchanging an annuity, the agent must disclose to the annuitant Anyone who sells variable life insurance policies or variable annuities is required to have an nasd license, along with an insurance license. Agents who sell variable life insurance in texas must have a federal securities license and a state insurance license.

There are two forms of commission payments to life insurance agents: This is because the underlying subaccounts found within a. Life insurance agents are not getting rich by selling term life insurance unless they are selling it in massive quantities. A life insurance policyowner may sell their policy to a(n) _____ in order to receive a percentage of the policy’s face value. A producer agent must do all of the following when delivering a new policy to the insured except disclose commissions earned from the sale of the policy.

Source: fsco.gov.on.ca

Source: fsco.gov.on.ca

A producer agent must do all of the following when delivering a new policy to the insured except disclose commissions earned from the sale of the policy. License, finra registration, not sec registration which option allows beneficiary to get death benefit and cash value on death of insured? An agent and an applicant for a life insurance policy fill out and sign the application. In florida, agents who have fully satisfied the requirements for a life insurance license, including successful completion of a licensing exam that covers variable annuities, may sell or solicit variable. If a licensed life insurance agent wants to sell variable life policies what additional license must the agent obtain ?

Source: venturebeat.com

Source: venturebeat.com

This literature is called a prospectus; To sell variable life insurance, you must provide special sales material and literature to your clients. The sale of life insurance is regulated. You would have to pay surrender charges to make a withdrawal during the first several years. This also applies if you surrender the policy.

Source: careerbuilder.com

Source: careerbuilder.com

A producer agent must do all of the following when delivering a new policy to the insured except disclose commissions earned from the sale of the policy. License, finra registration, not sec registration which option allows beneficiary to get death benefit and cash value on death of insured? This literature is called a prospectus; First year commission payments and renewal commission payments. The choice can have a number of financial implications, including tax.

Source: sec.gov

Source: sec.gov

D) a finra registration the death benefit can be increased by providing evidence of insurability the policyowner of an adjustable life policy wants to increase the death benefit. To sell variable insurance products, an individual must hold a life insurance license and a financial industry regulatory authority (finra) registered representative�s license. This is because the underlying subaccounts found within a. A producer agent must do all of the following when delivering a new policy to the insured except disclose commissions earned from the sale of the policy. In florida, agents who have fully satisfied the requirements for a life insurance license, including successful completion of a licensing exam that covers variable annuities, may sell or solicit variable.

Source: carringtonlife.com

Source: carringtonlife.com

That�s because variable annuities are classified as securities. In florida, agents who have fully satisfied the requirements for a life insurance license, including successful completion of a licensing exam that covers variable annuities, may sell or solicit variable. A finra registration which policy would be classified as a traditional level premium contract, with a level guaranteed face amount & a level premium for the life of the insured? If you feel shortchanged on the advice you�ve received, or question whether your agent is selling you something with an ulterior motive, you can always report these concerns to your state insurance commissioner. A viatical settlement is one someone sells their life insurance policy upon discovering they are terminally ill with less than a 2 year life expectancy.

Source: venturebeat.com

Source: venturebeat.com

A viatical settlement is one someone sells their life insurance policy upon discovering they are terminally ill with less than a 2 year life expectancy. Agents who sell variable life insurance in texas must have a federal securities license and a state insurance license. This literature is called a prospectus; Anyone who sells variable life insurance policies or variable annuities is required to have an nasd license, along with an insurance license. To sell variable life insurance, you must provide special sales material and literature to your clients.

Source: sec.gov

Source: sec.gov

D) a finra registration the death benefit can be increased by providing evidence of insurability the policyowner of an adjustable life policy wants to increase the death benefit. To sell variable life insurance policies, an agent must receive all of the following except a. A life insurance license c. D) a finra registration the death benefit can be increased by providing evidence of insurability the policyowner of an adjustable life policy wants to increase the death benefit. He also needs to be registered with finra.

Source: venturebeat.com

Source: venturebeat.com

To sell variable life insurance policies, an agent must receive all of the following except a. To sell variable life insurance policies, an agent must receive what three things? There are two forms of commission payments to life insurance agents: The sale of life insurance is regulated. A viatical settlement is one someone sells their life insurance policy upon discovering they are terminally ill with less than a 2 year life expectancy.

Source: venturebeat.com

Source: venturebeat.com

To sell variable life insurance policies, an agent must receive all of the following except a) a securities license. For variable life insurance policies, if you withdraw a greater amount of cash value than the total amount you’ve paid in premiums, you pay taxes on the difference. A life settlement is the sale of a life insurance policy by someone who is over the age of 65 with a life expectancy that ranges from 2 years up to 10 years. If a licensed life insurance agent wants to sell variable life policies what additional license must the agent obtain ? That�s because variable annuities are classified as securities.

Source: hancockbrokerage.net

Source: hancockbrokerage.net

If you feel shortchanged on the advice you�ve received, or question whether your agent is selling you something with an ulterior motive, you can always report these concerns to your state insurance commissioner. A life settlement is the sale of a life insurance policy by someone who is over the age of 65 with a life expectancy that ranges from 2 years up to 10 years. A life insurance license c. Securities an agent delivers a policy to an insured and 9 days later the insured returns the policy and wants a complete refund. To sell variable life ins.

Source: integratedlearning.net

Source: integratedlearning.net

It discloses the fees and the investment objectives of the mutual funds in the policy. In florida, agents who have fully satisfied the requirements for a life insurance license, including successful completion of a licensing exam that covers variable annuities, may sell or solicit variable. Policies, an agent must receive: To sell life insurance, you must be licensed by the state you are practicing in. To sell variable insurance products, an individual must hold a life insurance license and a financial industry regulatory authority (finra) registered representative�s license.

Source: masonfinance.com

Source: masonfinance.com

For variable life insurance policies, if you withdraw a greater amount of cash value than the total amount you’ve paid in premiums, you pay taxes on the difference. A life insurance license 3. Anyone who sells variable life insurance policies or variable annuities is required to have an nasd license, along with an insurance license. Policies, an agent must receive: Agents who sell variable life insurance in texas must have a federal securities license and a state insurance license.

Source: venturebeat.com

Source: venturebeat.com

A finra registration which policy would be classified as a traditional level premium contract, with a level guaranteed face amount & a level premium for the life of the insured? If you feel shortchanged on the advice you�ve received, or question whether your agent is selling you something with an ulterior motive, you can always report these concerns to your state insurance commissioner. The agent needs a life insurance license. To sell variable life insurance policies, an agent must receive all of the following except a) a securities license. That�s because variable annuities are classified as securities.

Source: venturebeat.com

Source: venturebeat.com

The choice can have a number of financial implications, including tax. For variable life insurance policies, if you withdraw a greater amount of cash value than the total amount you’ve paid in premiums, you pay taxes on the difference. To sell variable life ins. When replacing or exchanging an annuity, the agent must disclose to the annuitant There are two forms of commission payments to life insurance agents:

Source: settlementbenefits.com

Source: settlementbenefits.com

This is because the underlying subaccounts found within a. That�s because variable annuities are classified as securities. To sell variable life insurance policies, an agent must receive what three things? To sell variable life ins. A life settlement is the sale of a life insurance policy by someone who is over the age of 65 with a life expectancy that ranges from 2 years up to 10 years.

Source: sec.gov

Source: sec.gov

A life insurance policyowner may sell their policy to a(n) _____ in order to receive a percentage of the policy’s face value. This also applies if you surrender the policy. He also needs to be registered with finra. A viatical settlement is one someone sells their life insurance policy upon discovering they are terminally ill with less than a 2 year life expectancy. There are two forms of commission payments to life insurance agents:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title to sell variable life insurance policies an agent must receive by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information