Top captive insurance companies information

Home » Trend » Top captive insurance companies informationYour Top captive insurance companies images are available. Top captive insurance companies are a topic that is being searched for and liked by netizens today. You can Get the Top captive insurance companies files here. Download all royalty-free photos.

If you’re searching for top captive insurance companies pictures information connected with to the top captive insurance companies topic, you have pay a visit to the ideal blog. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Top Captive Insurance Companies. Facing higher insurance rates, a lack of capacity, and more stringent terms and conditions, many leaders are exploring alternative ways to finance their risk. • put their own capital at risk; Captives—a special type of insurer set up by a company to insure its own risks—first emerged in the 1980s. Captive domicile in 2020, based on data in an annual survey of the world�s largest captive domiciles conducted by business insurance magazine.

Top Captive Insurance Companies / Captives Insurance The From i-love-books-forever.blogspot.com

Top Captive Insurance Companies / Captives Insurance The From i-love-books-forever.blogspot.com

With 589 licensed captives, vermont was the largest u.s. Are captives legitimate insurance companies? There are additional benefits to creating a captive, but they should be ancillary to the primary purpose of risk management. Over the past 30 years, there has been significant growth in the captive market. Captives are special insurance companies set up in order to mitigate the risks of their parent companies. But first, what is a captive insurance company (“captive”)?

There are additional benefits to creating a captive, but they should be ancillary to the primary purpose of risk management.

Captive insurance companies are normally formed to supplement commercial insurance, allowing companies to retain the money that would otherwise be spent on insurance premiums. Any insured who purchases captive insurance must be willing and able to invest its own resources. Captives—a special type of insurer set up by a company to insure its own risks—first emerged in the 1980s. The insured in a captive insurance company not only has ownership in and control of the company but also benefits from its profitability. But first, what is a captive insurance company (“captive”)? The balance is assumed by another insurance company known as a “reinsurance” company.

Source: businesspartnermagazine.com

Source: businesspartnermagazine.com

Over the past 30 years, there has been significant growth in the captive market. Those 12 formations were down from 2019, when bermuda licensed 22 new captive insurance companies. A passionate, innovative leader in the captive industry, charnley has led the way in captive insurance innovations over the past year. As this pool increases in size, there is a corresponding increase in claims predictability and decrease in. Bermuda, the world�s largest captive insurance domicile with 680 captives, licensed 12 new captive insurance companies in 2020.

Source: inspiralviral.com

Source: inspiralviral.com

There are now approximately 24 us states that are captive insurance company domiciles and well over 35 foreign countries or territories with captive insurance company legislation that serve as excellent captive insurance company domiciles. As this pool increases in size, there is a corresponding increase in claims predictability and decrease in. Any insured who purchases captive insurance must be willing and able to invest its own resources. Captives are special insurance companies set up in order to mitigate the risks of their parent companies. What is a captive insurance company?

Source: abiweb.com

Source: abiweb.com

Captive insurance companies have been in existence for over 100 years. But first, what is a captive insurance company (“captive”)? A captive insurance company may be. Lexon insurance pte ltd is a wholly owned subsidiary of the queensland law society and is a captive insurer providing professional indemnity insurance to members of the legal profession in accordance with the qls indemnity rule 2005. Captives—a special type of insurer set up by a company to insure its own risks—first emerged in the 1980s.

Source: abiweb.com

Source: abiweb.com

There were 680 captive insurance companies in bermuda in 2020. Are captives legitimate insurance companies? Reiss established the first captive insurance company in bermuda in 1962. A captive is a legitimate licensed insurance or reinsurance company, but it does often have a limited scope in that typically it will only cover the risks of the parent company and its subsidiaries. There are now approximately 24 us states that are captive insurance company domiciles and well over 35 foreign countries or territories with captive insurance company legislation that serve as excellent captive insurance company domiciles.

Source: immanenthub.com

Source: immanenthub.com

Captives are special insurance companies set up in order to mitigate the risks of their parent companies. Are captives legitimate insurance companies? The first active captive insurance company in the united states was started in ohio by fred reiss, who in 1953 founded steel insurance company of america for youngstown sheet. At the same time, you need to allocate capital to. A policyholder in a mutual insurance company is theoretically entitled to receive dividends if the company makes a profit.

Source: csgtax.com

Source: csgtax.com

The first active captive insurance company in the united states was started in ohio by fred reiss, who in 1953 founded steel insurance company of america for youngstown sheet. As the world’s largest captive manager, marsh offers a comprehensive approach to innovative captive solutions, helping organizations of all sizes navigate complex global risks. A captive insurance company may be. Captive insurance companies have been in existence for over 100 years. Captives—a special type of insurer set up by a company to insure its own risks—first emerged in the 1980s.

Source: i-love-books-forever.blogspot.com

Source: i-love-books-forever.blogspot.com

There were 680 captive insurance companies in bermuda in 2020. With 589 licensed captives, vermont was the largest u.s. A policyholder in a mutual insurance company is theoretically entitled to receive dividends if the company makes a profit. Over the past 30 years, there has been significant growth in the captive market. As this pool increases in size, there is a corresponding increase in claims predictability and decrease in.

Source: abiweb.com

Source: abiweb.com

There are additional benefits to creating a captive, but they should be ancillary to the primary purpose of risk management. Captive insurance companies have been in existence for over 100 years. With 589 licensed captives, vermont was the largest u.s. Facing higher insurance rates, a lack of capacity, and more stringent terms and conditions, many leaders are exploring alternative ways to finance their risk. • put their own capital at risk;

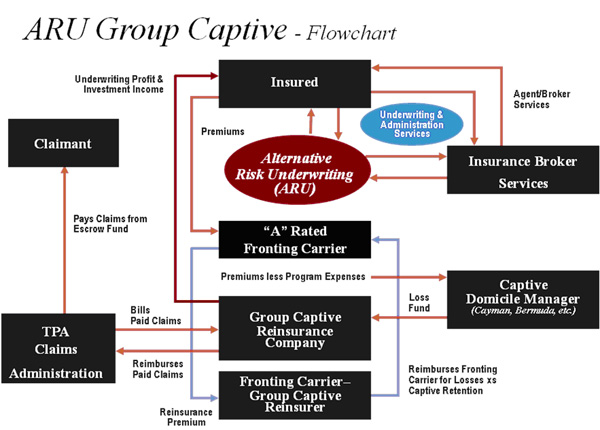

Source: arucaptiveinsurance.com

Source: arucaptiveinsurance.com

Facing higher insurance rates, a lack of capacity, and more stringent terms and conditions, many leaders are exploring alternative ways to finance their risk. The insured in a captive insurance company not only has ownership in and control of the company but also benefits from its profitability. Bermuda, the world�s largest captive insurance domicile with 680 captives, licensed 12 new captive insurance companies in 2020. There were 680 captive insurance companies in bermuda in 2020. A “captive” is a licensed insurance company utilized to insure a wide range of risks depending on business needs.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

At the same time, you need to allocate capital to. There were 680 captive insurance companies in bermuda in 2020. The insured in a captive insurance company not only has ownership in and control of the company but also benefits from its profitability. Captives—a special type of insurer set up by a company to insure its own risks—first emerged in the 1980s. Facing higher insurance rates, a lack of capacity, and more stringent terms and conditions, many leaders are exploring alternative ways to finance their risk.

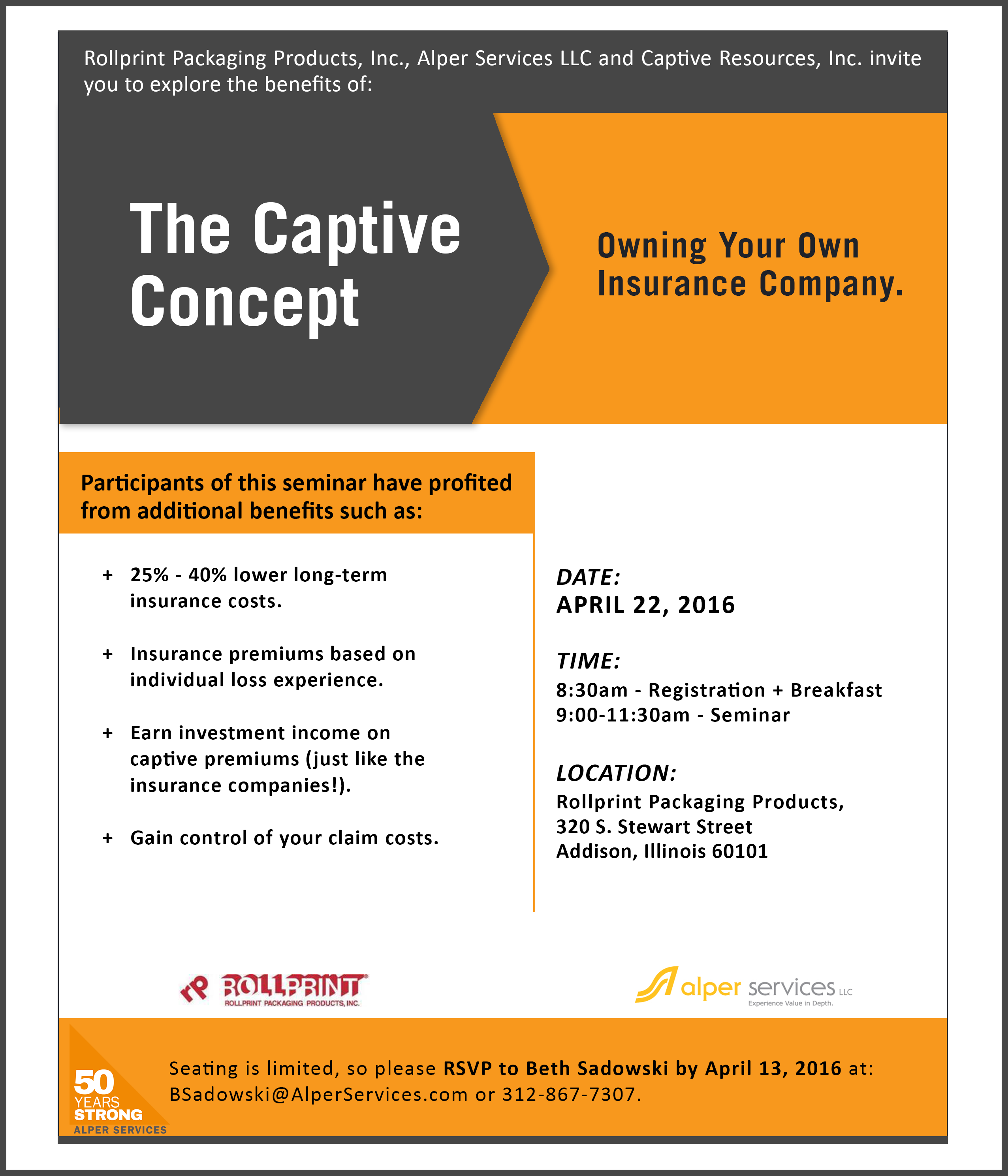

Source: capstoneassociated.com

Source: capstoneassociated.com

Captive insurance companies that are formed , licensed, managed and operated outside the us or offshore can make an irc section. There are additional benefits to creating a captive, but they should be ancillary to the primary purpose of risk management. Captive insurance companies that are formed , licensed, managed and operated outside the us or offshore can make an irc section. There are now approximately 24 us states that are captive insurance company domiciles and well over 35 foreign countries or territories with captive insurance company legislation that serve as excellent captive insurance company domiciles. But first, what is a captive insurance company (“captive”)?

Source: earneasycash20.blogspot.com

Source: earneasycash20.blogspot.com

A passionate, innovative leader in the captive industry, charnley has led the way in captive insurance innovations over the past year. Those 12 formations were down from 2019, when bermuda licensed 22 new captive insurance companies. A passionate, innovative leader in the captive industry, charnley has led the way in captive insurance innovations over the past year. Captive insurance companies have been in existence for over 100 years. A policyholder in a mutual insurance company is theoretically entitled to receive dividends if the company makes a profit.

Source: proassetprotection.com

Source: proassetprotection.com

Captives are special insurance companies set up in order to mitigate the risks of their parent companies. What is a captive insurance company? Captive insurance companies that are formed , licensed, managed and operated outside the us or offshore can make an irc section. Over the past 30 years, there has been significant growth in the captive market. A captive is a legitimate licensed insurance or reinsurance company, but it does often have a limited scope in that typically it will only cover the risks of the parent company and its subsidiaries.

Source: youtube.com

Source: youtube.com

Those 12 formations were down from 2019, when bermuda licensed 22 new captive insurance companies. A captive is a legitimate licensed insurance or reinsurance company, but it does often have a limited scope in that typically it will only cover the risks of the parent company and its subsidiaries. Bermuda has long been recognised as an industry leader for captives, and this traces back to 1962 when the first modern day captive was incorporated on the island. Captive domicile in 2020, based on data in an annual survey of the world�s largest captive domiciles conducted by business insurance magazine. As this pool increases in size, there is a corresponding increase in claims predictability and decrease in.

Source: capstoneassociated.com

Source: capstoneassociated.com

There are additional benefits to creating a captive, but they should be ancillary to the primary purpose of risk management. Over the past 30 years, there has been significant growth in the captive market. As this pool increases in size, there is a corresponding increase in claims predictability and decrease in. What is a captive insurance company? There were 680 captive insurance companies in bermuda in 2020.

Source: enalgunlugardemioscuramente.blogspot.com

Source: enalgunlugardemioscuramente.blogspot.com

Captive domicile in 2020, based on data in an annual survey of the world�s largest captive domiciles conducted by business insurance magazine. A captive is a legitimate licensed insurance or reinsurance company, but it does often have a limited scope in that typically it will only cover the risks of the parent company and its subsidiaries. Lexon insurance pte ltd is a wholly owned subsidiary of the queensland law society and is a captive insurer providing professional indemnity insurance to members of the legal profession in accordance with the qls indemnity rule 2005. Captives are special insurance companies set up in order to mitigate the risks of their parent companies. There are now approximately 24 us states that are captive insurance company domiciles and well over 35 foreign countries or territories with captive insurance company legislation that serve as excellent captive insurance company domiciles.

Source: captivatingthinking.com

Source: captivatingthinking.com

Captives are special insurance companies set up in order to mitigate the risks of their parent companies. A captive is a legitimate licensed insurance or reinsurance company, but it does often have a limited scope in that typically it will only cover the risks of the parent company and its subsidiaries. There are additional benefits to creating a captive, but they should be ancillary to the primary purpose of risk management. But first, what is a captive insurance company (“captive”)? At the same time, you need to allocate capital to.

Source: adjuvancy.com

Source: adjuvancy.com

Bermuda, the world�s largest captive insurance domicile with 680 captives, licensed 12 new captive insurance companies in 2020. Bermuda has long been recognised as an industry leader for captives, and this traces back to 1962 when the first modern day captive was incorporated on the island. Those 12 formations were down from 2019, when bermuda licensed 22 new captive insurance companies. Are captives legitimate insurance companies? But first, what is a captive insurance company (“captive”)?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title top captive insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information