Tort insurance information

Home » Trend » Tort insurance informationYour Tort insurance images are available. Tort insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Tort insurance files here. Download all royalty-free vectors.

If you’re looking for tort insurance pictures information related to the tort insurance topic, you have visit the ideal blog. Our site always gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

Tort Insurance. Purchaser confirmation opportunities are a huge issue in current days. Periodicals postage paid at chicago, illinois, and additional mailing offices. Tort insurance is when a state is operating under the tort system for insurance claims. Malpractice insurance is a type of liability coverage that professionals such as doctors use when employed by hospitals or other medical facilities.

Tort Claims & Investigations through Congress YouTube From youtube.com

Tort Claims & Investigations through Congress YouTube From youtube.com

Rental reimbursement, roadside assistance, guaranteed auto protection (gap), tire damage, towing and breakdown. This discussion must include a discussion on the doctrine of respondent superior. Those that are found guilty without the benefit of liability insurance, often find that it takes a lifetime to pay off any judgments made against them. You are responsible for paying the damages if you are at fault. Tort insurance is a broad system of auto insurance that allows drivers to recover damages from other parties at fault in an accident. Tort insurance is a common form of car insurance.

The insurance company says, rejected, you have limited tort. the insurance companies aren�t in the business to pay claims, so if they have a reason to deny a claim, whether it�s meritorious or not, they�re going to take that reason and deny the claim.

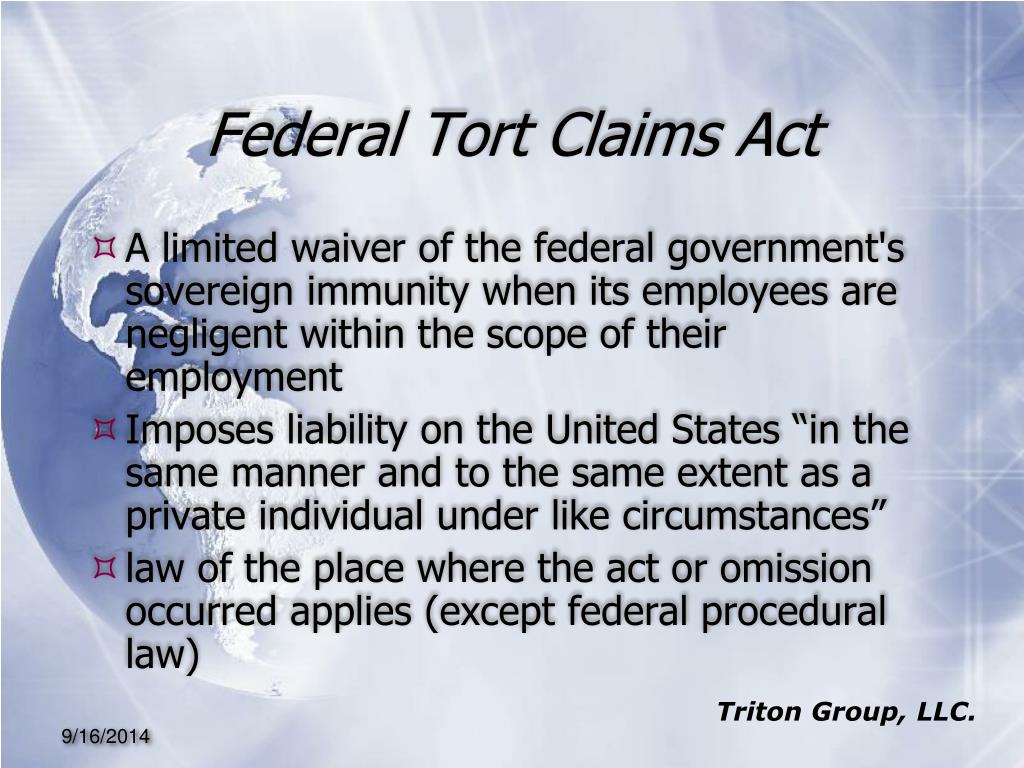

One is the deterrence model in which tort law takes the leading role, whereas insurance is an auxiliary, and at times problematic, device. Tort insurance is when a state is operating under the tort system for insurance claims. Malpractice insurance is a specific type of liability insurance which is utilized by those that are employed in the medical field. Purchaser confirmation opportunities are a huge issue in current days. In tort systems, insurers include your choice of tort as a “defined” clause on your policy. Malpractice insurance is a type of liability coverage that professionals such as doctors use when employed by hospitals or other medical facilities.

Source: cle.tba.org

Source: cle.tba.org

Liability insurance provides protection against tort law cases and includes legal representation for these matters as well. A tort, in common law jurisdiction, is a civil wrong (other than breach of contract) that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act. The insurance company says, rejected, you have limited tort. the insurance companies aren�t in the business to pay claims, so if they have a reason to deny a claim, whether it�s meritorious or not, they�re going to take that reason and deny the claim. Tort law involves assigning the responsibility of liability in a car accident to determine the assignment of a penalty to the right person. Periodicals postage paid at chicago, illinois, and additional mailing offices.

Source: daviskelin.com

Source: daviskelin.com

Tort insurance is an auto insurance system in which drivers can seek compensation from the other party who caused the accident. This endeavor has been a shocker for me. Rental reimbursement, roadside assistance, guaranteed auto protection (gap), tire damage, towing and breakdown. Malpractice insurance is a specific type of liability insurance which is utilized by those that are employed in the medical field. The alternative approach is the.

One is the deterrence model in which tort law takes the leading role, whereas insurance is an auxiliary, and at times. A tort is a wrongful act or civil wrong that gives rise to injury. States fall into two main categories when it comes to car insurance: A tort system puts a greater emphasis on liability insurance to cover injuries a driver might cause but. Malpractice insurance is a type of liability coverage that professionals such as doctors use when employed by hospitals or other medical facilities.

Source: cofetariaarmand.ro

Source: cofetariaarmand.ro

Fortunately for you, your business is able to shield itself from tort claims by purchasing a general liability insurance policy. Tort law covers most incidents where a person has suffered a financial loss, been injured, or had their property damaged as a result of the actions or omissions of another party. Tort guides how your insurance coverage will handle your case in the event of an accident. Tort insurance is a common form of car insurance. A tort system puts a greater emphasis on liability insurance to cover injuries a driver might cause but.

Source: slideserve.com

Source: slideserve.com

Our firm serves as the defense counsel for many insurance carriers as well as their corporate insureds. The tort system says that if two parties are involved in a collision, the driver who is at fault is responsible for paying the victim�s medical bills, property damage costs, additional lost wages, damages, and even pain and suffering resulting from the accident. Tort insurance is when a state is operating under the tort system for insurance claims. You are responsible for paying the damages if you are at fault. Tort is a legal term that refers to a wrongful act that infringes on another person�s rights and leads to civil legal liability.

Source: yalejreg.com

Source: yalejreg.com

Rental reimbursement, roadside assistance, guaranteed auto protection (gap), tire damage, towing and breakdown. Those that are found guilty without the benefit of liability insurance, often find that it takes a lifetime to pay off any judgments made against them. In tort systems, insurers include your choice of tort as a “defined” clause on your policy. Tort insurance is a law that guides insurance compensation. Is california a tort state?

Source: fpelaw.com

Source: fpelaw.com

This article provides a broad overview by distinguishing two approaches or models of the tort/insurance interface. The alternative approach is the. Tort insurance is a law that guides insurance compensation. In tort law cases, liability insurance is vital for the accused to protect their assets. In tort systems, insurers include your choice of tort as a “defined” clause on your policy.

Source: schwartzandschwartz.com

Source: schwartzandschwartz.com

In tort law cases, liability insurance is vital for the accused to protect their assets. We handle cases that involve toxic tort liability. The tort system says that if two parties are involved in a collision, the driver who is at fault is responsible for paying the victim�s medical bills, property damage costs, additional lost wages, damages, and even pain and suffering resulting from the accident. Tort law involves assigning the responsibility of liability in a car accident to determine the assignment of a penalty to the right person. Tort law covers most incidents where a person has suffered a financial loss, been injured, or had their property damaged as a result of the actions or omissions of another party.

Source: walmart.com

Source: walmart.com

It can include intentional infliction of emotional distress, negligence, financial loss, injury, invasion of privacy, and numerous other harms. Tort law covers most incidents where a person has suffered a financial loss, been injured, or had their property damaged as a result of the actions or omissions of another party. A tort system puts a greater emphasis on liability insurance to cover injuries a driver might cause but. The interaction between tort law and liability insurance is a complex problem that is difficult to deal with. It can include intentional infliction of emotional distress, negligence, financial loss, injury, invasion of privacy, and numerous other harms.

Source: digital.library.unt.edu

Tort law involves assigning the responsibility of liability in a car accident to determine the assignment of a penalty to the right person. Tort law covers most incidents where a person has suffered a financial loss, been injured, or had their property damaged as a result of the actions or omissions of another party. Full tort liability insurance coverage is a product in some states that is offered to allow the policy�s covered persons to claim and sue for damages without condition. The tort system says that if two parties are involved in a collision, the driver who is at fault is responsible for paying the victim�s medical bills, property damage costs, additional lost wages, damages, and even pain and suffering resulting from the accident. The insurance company says, rejected, you have limited tort. the insurance companies aren�t in the business to pay claims, so if they have a reason to deny a claim, whether it�s meritorious or not, they�re going to take that reason and deny the claim.

Source: walmart.com

Source: walmart.com

A tort is a wrongful act or civil wrong that gives rise to injury. Liability insurance provides protection against tort law cases and includes legal representation for these matters as well. Tort law covers most incidents where a person has suffered a financial loss, been injured, or had their property damaged as a result of the actions or omissions of another party. A tort, in common law jurisdiction, is a civil wrong (other than breach of contract) that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act. Tort law involves assigning the responsibility of liability in a car accident to determine the assignment of a penalty to the right person.

Source: theworldlink.com

Source: theworldlink.com

Tort insurance is an auto insurance system in which drivers can seek compensation from the other party who caused the accident. The interaction between tort law and liability insurance is a complex problem that is difficult to deal with. This discussion must include a discussion on the doctrine of respondent superior. Tort guides how your insurance coverage will handle your case in the event of an accident. Tort law highlights the many deficiencies in liability insurance.

The tort system says that if two parties are involved in a collision, the driver who is at fault is responsible for paying the victim�s medical bills, property damage costs, additional lost wages, damages, and even pain and suffering resulting from the accident. Malpractice insurance is a type of liability coverage that professionals such as doctors use when employed by hospitals or other medical facilities. Practical operation of the law of tort cannot be fully comprehended without closely looking at the fact and extent of insurance, whether it be liability insurance, loss insurance, or legal expenses insurance. Periodicals postage paid at chicago, illinois, and additional mailing offices. In general and in several cases, it is only the fact that the defendant is insured against liability which makes it worthwhile to sue him.

Source: thefinelawfirm.com

Source: thefinelawfirm.com

In fact, the courts can garnish wages. Our firm serves as the defense counsel for many insurance carriers as well as their corporate insureds. Those that are found guilty without the benefit of liability insurance, often find that it takes a lifetime to pay off any judgments made against them. Generally speaking, a tort is when one person or entity inflicts an injury upon another in which the injured party can sue for damages. This discussion must include a discussion on the doctrine of respondent superior.

Source: youtube.com

Source: youtube.com

This endeavor has been a shocker for me. Those that are found guilty without the benefit of liability insurance, often find that it takes a lifetime to pay off any judgments made against them. In general and in several cases, it is only the fact that the defendant is insured against liability which makes it worthwhile to sue him. One is the deterrence model in which tort law takes the leading role, whereas insurance is an auxiliary, and at times. This endeavor has been a shocker for me.

Rental reimbursement, roadside assistance, guaranteed auto protection (gap), tire damage, towing and breakdown. Our firm serves as the defense counsel for many insurance carriers as well as their corporate insureds. Practical operation of the law of tort cannot be fully comprehended without closely looking at the fact and extent of insurance, whether it be liability insurance, loss insurance, or legal expenses insurance. One is the deterrence model in which tort law takes the leading role, whereas insurance is an auxiliary, and at times. Fortunately for you, your business is able to shield itself from tort claims by purchasing a general liability insurance policy.

Source: kjerstinem.blogspot.com

The tort system says that if two parties are involved in a collision, the driver who is at fault is responsible for paying the victim�s medical bills, property damage costs, additional lost wages, damages, and even pain and suffering resulting from the accident. Tort insurance is a common form of car insurance. Malpractice insurance is a type of liability coverage that professionals such as doctors use when employed by hospitals or other medical facilities. Tort law involves assigning the responsibility of liability in a car accident to determine the assignment of a penalty to the right person. We handle cases that involve toxic tort liability.

Source: insuranceinforme.blogspot.com

Source: insuranceinforme.blogspot.com

Full tort liability insurance coverage is a product in some states that is offered to allow the policy�s covered persons to claim and sue for damages without condition. Tort insurance is a common form of car insurance. Malpractice insurance is a specific type of liability insurance which is utilized by those that are employed in the medical field. The tort & insurance law journal (issn: The alternative approach is the.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tort insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information