Toyota lease insurance requirements Idea

Home » Trend » Toyota lease insurance requirements IdeaYour Toyota lease insurance requirements images are available. Toyota lease insurance requirements are a topic that is being searched for and liked by netizens today. You can Download the Toyota lease insurance requirements files here. Download all royalty-free images.

If you’re looking for toyota lease insurance requirements pictures information connected with to the toyota lease insurance requirements keyword, you have pay a visit to the right site. Our site always provides you with hints for seeing the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

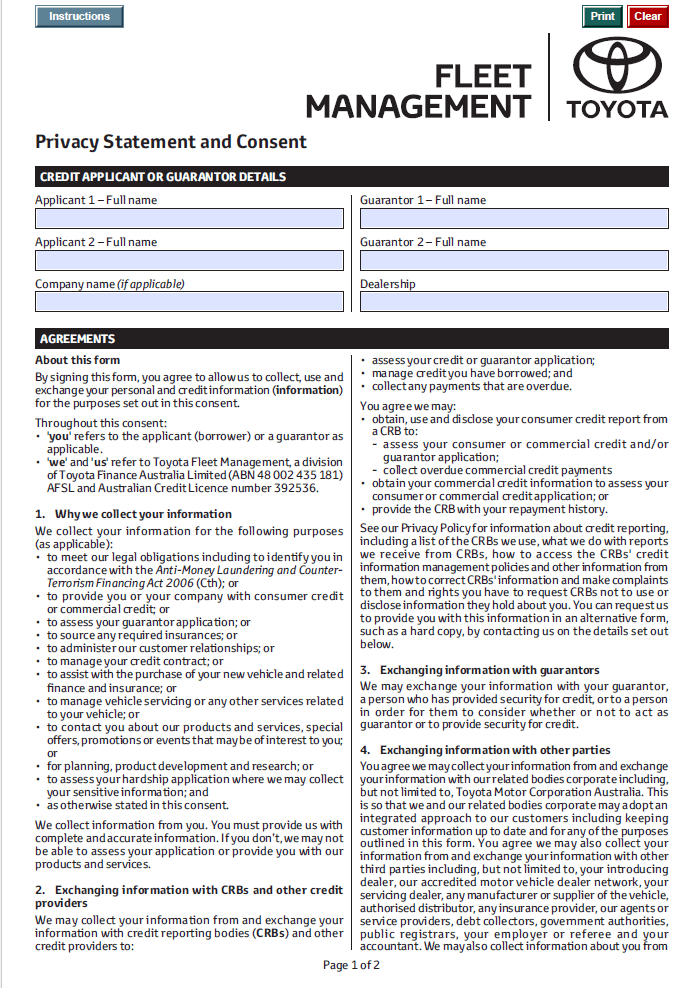

Toyota Lease Insurance Requirements. These insurance requirements must be met in conjunction with the affirmation contained in item 16. Toyota motor credit lease insurance requirements. Author markus posted on categories leasing faqs tags apartment lease insurance, do you pay insurance on a leased car, insurance for leased car vs. Please refer to the back of your contract for proper insurance limits.

Toyota Lease Car Insurance Requirements References Link Pico From linkpico.com

Toyota Lease Car Insurance Requirements References Link Pico From linkpico.com

Toyota motor credit lease insurance requirements. Additionally, your lessor might require gap insurance or set a maximum deductible—say $500 to $1,000—for collision and comprehensive coverage. These insurance requirements must be met in conjunction with the affirmation contained in item 16. We’re undergoing a bit of scheduled maintenance. Toyota motor credit lease insurance requirements. (1) one valid government id.

The dealership will inform you of the insurance you’ll be required to purchase to protect your leased car.

Typically, dealers require $100,000 in bodily injury liability insurance, $50,000 in property damage liability, comprehensive and collision coverage, and a. What insurance coverage amounts are required for my leased vehicle? Comprehensive and collision for actual value with no more than $1000 deductible. What are the insurance requirements for a leased vehicle? Author markus posted on categories leasing faqs tags apartment lease insurance, do you pay insurance on a leased car, insurance for leased car vs. If possible, it would be helpful to generate a reminder message on the dealer system that higher insurance requirements apply if the vehicle being leased is a truck of.

Source: leasemorecarforlessmoney.com

Source: leasemorecarforlessmoney.com

A credit score of 690 to 719, which is considered “great.” it means you “use my credit wisely. Toyota financial services is a service mark used by toyota motor credit corporation (tmcc), toyota motor insurance services, inc. In canada, $1,000,000 in liability coverage is required. What insurance coverage amounts are required for my leased vehicle? Physical damage insurance is required for the full value of the vehicle, with a maximum deductible of $1,000.

Source: toyotaofbrookfield.com

Source: toyotaofbrookfield.com

There are no deductible limitations. Toyota lease trust should be listed as an additional insured and loss payee. Insurance i have completed repairs on my damaged vehicle. March 25, 2020 by masuzi. What insurance coverage amounts are required for my leased vehicle?

Source: toyotafleetmanagement.com.au

Source: toyotafleetmanagement.com.au

When it comes to toyota credit lease tiers and toyota financing tier rates, a credit score of 720 and above is considered “excellent” and tier 1 credit. Physical damage insurance is required for the full value of the vehicle, with a maximum deductible of $1,000. We’re undergoing a bit of scheduled maintenance. Your online account access will be available shortly. There are no deductible limitations.

Source: linkpico.com

Source: linkpico.com

Physical damage insurance is required for the full value of the vehicle, with a maximum deductible of $1,000. S and trading toyota financial toyota motor corporation global website unsecured term debt toyota financial fwp 1 dp96915 htm form issuer. Typically, leasing companies require $100,000 of bodily injury liability coverage per person and $300,000 per accident, as well as $50,000 in property damage liability insurance. Please provide the following address to your insurance company: To request a copy of your contract through the secure message center, please follow these steps:

Source: thelemonlawcalifornia.com

Source: thelemonlawcalifornia.com

To request a copy of your contract through the secure message center, please follow these steps: Physical damage insurance is required for the full value of the vehicle, with a maximum deductible of $1,000. Refer to your contract for more information. We do not have minimum liability requirements for financed vehicles. There are no deductible limitations.

Source: kenyachambermines.com

Source: kenyachambermines.com

We do not have minimum liability requirements for financed vehicles. March 25, 2020 by masuzi. In canada, $1,000,000 in liability coverage is required. Author markus posted on categories leasing faqs tags apartment lease insurance, do you pay insurance on a leased car, insurance for leased car vs. Certificate of emplyoment / poea employment contract.

Source: pinterest.com

Source: pinterest.com

There are no deductible limitations. There are no deductible limitations. If there�s any damage beyond normal wear, an excessive wear and use fee may be collected. (1) one valid government id. Latest payslip (3 months) (1) one valid government id.

Source: homeworklib.com

Source: homeworklib.com

Author markus posted on categories leasing faqs tags apartment lease insurance, do you pay insurance on a leased car, insurance for leased car vs. Insurance what insurance coverage amounts are required for my leased vehicle? (1) one valid government id. Additionally, your lessor might require gap insurance or set a maximum deductible—say $500 to $1,000—for collision and comprehensive coverage. Other companies may require as much as $150,000/$300,000/$50,000 liability.

Source: revisi.net

Source: revisi.net

Typically, dealers require $100,000 in bodily injury liability insurance, $50,000 in property damage liability, comprehensive and collision coverage, and a. If possible, it would be helpful to generate a reminder message on the dealer system that higher insurance requirements apply if the vehicle being leased is a truck of. $20,000 per person / $40,000 per occurrence. You can find your ideal toyota car for lease at a local dealer today. Business registration papers and articles of incorporation (if applicable) itr and latest financial statements.

Source: enquetemarcada.blogspot.com

Source: enquetemarcada.blogspot.com

Toyota financial services is a service mark used by toyota motor credit corporation (tmcc), toyota motor insurance services, inc. This is explained as follows: We do not have minimum liability requirements for financed vehicles. If you leased your vehicle, tfs will accept the minimum liability required by the state in which your leased vehicle is garaged. If at any time lessee does not have required insurance, lessee is in breach of the lease and lessor shall have, in addition to any other rights under the lease, the right but not the obligation to purchase

Source: toyotakeene.com

Source: toyotakeene.com

You are required to keep insurance on your vehicle during the term of the contract, but you are not required to forward us a copy of your insurance policy. S and trading toyota financial toyota motor corporation global website unsecured term debt toyota financial fwp 1 dp96915 htm form issuer. We�re taking you to toyota.com website to connect you to the information you were looking for. If there�s any damage beyond normal wear, an excessive wear and use fee may be collected. Insurance what insurance coverage amounts are required for my leased vehicle?

Source: youtube.com

Source: youtube.com

According to toyota, this means you “have a long, established, positive credit history.” additional toyota credit tiers. Physical damage insurance is required for the full value of the vehicle, with a maximum deductible of $1,000. Insurance what insurance coverage amounts are required for my vehicle if it was financed with a retail installment contract? The dealership will inform you of the insurance you’ll be required to purchase to protect your leased car. We do not have minimum liability requirements for financed vehicles.

Source: sayinsurance.com

Source: sayinsurance.com

Toyota motor credit lease insurance requirements. You are required to keep insurance on your vehicle during the term of the contract, but you are not required to forward us a copy of your insurance policy. March 25, 2020 by masuzi. There are no deductible limitations. Insurance i have completed repairs on my damaged vehicle.

Source: leasemorecarforlessmoney.com

Source: leasemorecarforlessmoney.com

What insurance coverage amounts are required for my leased vehicle? If you leased your vehicle, tfs will accept the minimum liability required by the state in which your leased vehicle is garaged. Toyota lease trust should be listed as an additional insured and loss payee. Other companies may require as much as $150,000/$300,000/$50,000 liability. (1) one valid government id.

Source: empowered-crazybitch.blogspot.com

Source: empowered-crazybitch.blogspot.com

There are no deductible limitations. And its subsidiaries, and toyota credit de puerto rico corp. There are no deductible limitations. Refer to your contract for more information. If you leased your vehicle, lfs will accept the minimum liability required by the state in which your leased vehicle is garaged.

Source: enquetemarcada.blogspot.com

Source: enquetemarcada.blogspot.com

(1) one valid government id. Physical damage insurance is required for the full value of the vehicle, with a maximum deductible of $1,000. Your online account access will be available shortly. Toyota motor credit lease insurance requirements. Please refer to the back of your contract for proper insurance limits.

Source: billkiddstoyota.com

Source: billkiddstoyota.com

If possible, it would be helpful to generate a reminder message on the dealer system that higher insurance requirements apply if the vehicle being leased is a truck of. Physical damage insurance is required for the full value of the vehicle, with a maximum deductible of $1,000. Toyota financial services is a service mark used by toyota motor credit corporation (tmcc), toyota motor insurance services, inc. And its subsidiaries, and toyota credit de puerto rico corp. There are no deductible limitations.

There are mileage limits calculated by dividing the number of months in the term by 12 and multiplying this amount by 15,000 (standard lease) or 12,000 (low mileage lease). We do not have minimum liability requirements for financed vehicles. (1) one valid government id. There are no deductible limitations. Insurance i have completed repairs on my damaged vehicle.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title toyota lease insurance requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information