Trade credit insurance policy example information

Home » Trend » Trade credit insurance policy example informationYour Trade credit insurance policy example images are available in this site. Trade credit insurance policy example are a topic that is being searched for and liked by netizens today. You can Find and Download the Trade credit insurance policy example files here. Get all free images.

If you’re looking for trade credit insurance policy example images information connected with to the trade credit insurance policy example topic, you have pay a visit to the right site. Our website always provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

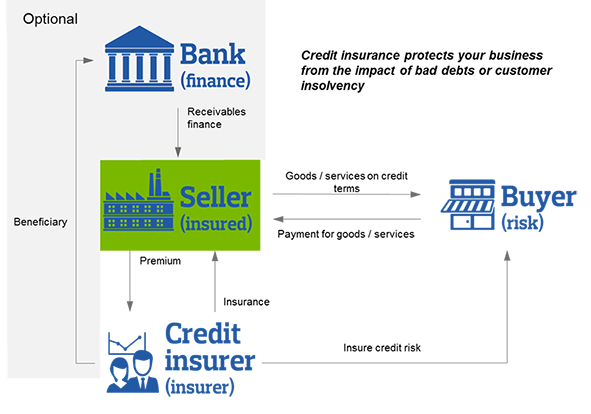

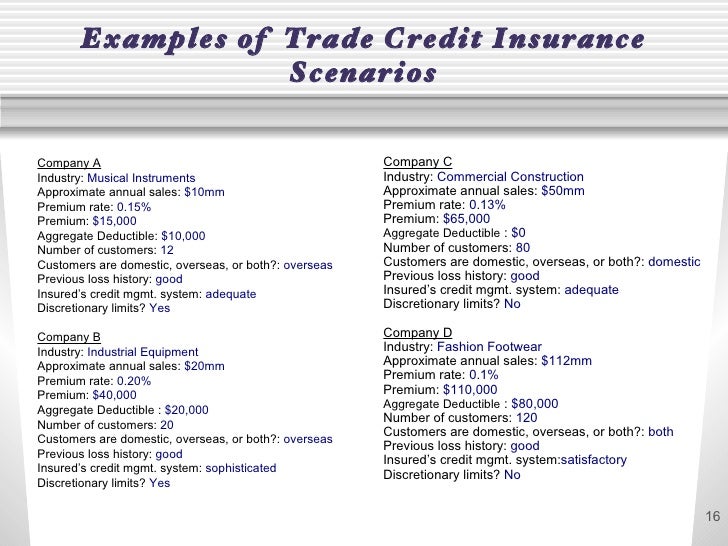

Trade Credit Insurance Policy Example. The “excess of loss” formula, based on reinsurance principles and formerly restricted to insurers, grants b2b companies a credit insurance coverage which allows them to keep the independence of their credit and debt. Trade credit insurance protects businesses that sell goods and services on credit. Trade credit re insurance company sa/nv (trade credit) is specialized in a specific technique for covering commercial credit risk in b2b: Trade credit is usually offered for 7, 30, 60, 90, or 120 days, but a few businesses, such as goldsmiths and jewelers, may extend credit for a longer period.

Insurance Policy Card My Excel Templates From myexceltemplates.com

Insurance Policy Card My Excel Templates From myexceltemplates.com

Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted default, insolvency or bankruptcy. There are four types of credit, namely: Yes, credit insurance policy helps business by optimising bank financing options by providing insurance cover to the trade receivables. This discount would be referred to as 2%/10 net. Does credit insurance help businesses in borrowing at lower rates? A few other events may also be covered.

Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted default, insolvency or bankruptcy.

The basic form of credit is a maximum credit of $10,000, with no security interest. It is the credit insurer’s responsibility to proactively monitor its customers’ (you) buyers (your customers) throughout the year to ensure their continued creditworthiness. Risks or losses arising due to such a situation are covered by credit insurance policies. Below is an example of a sample business credit policy that can be adapted to fit the needs of any company. They do this by gathering information about. Now, according to terms, $20,000 trade credit is given to the.

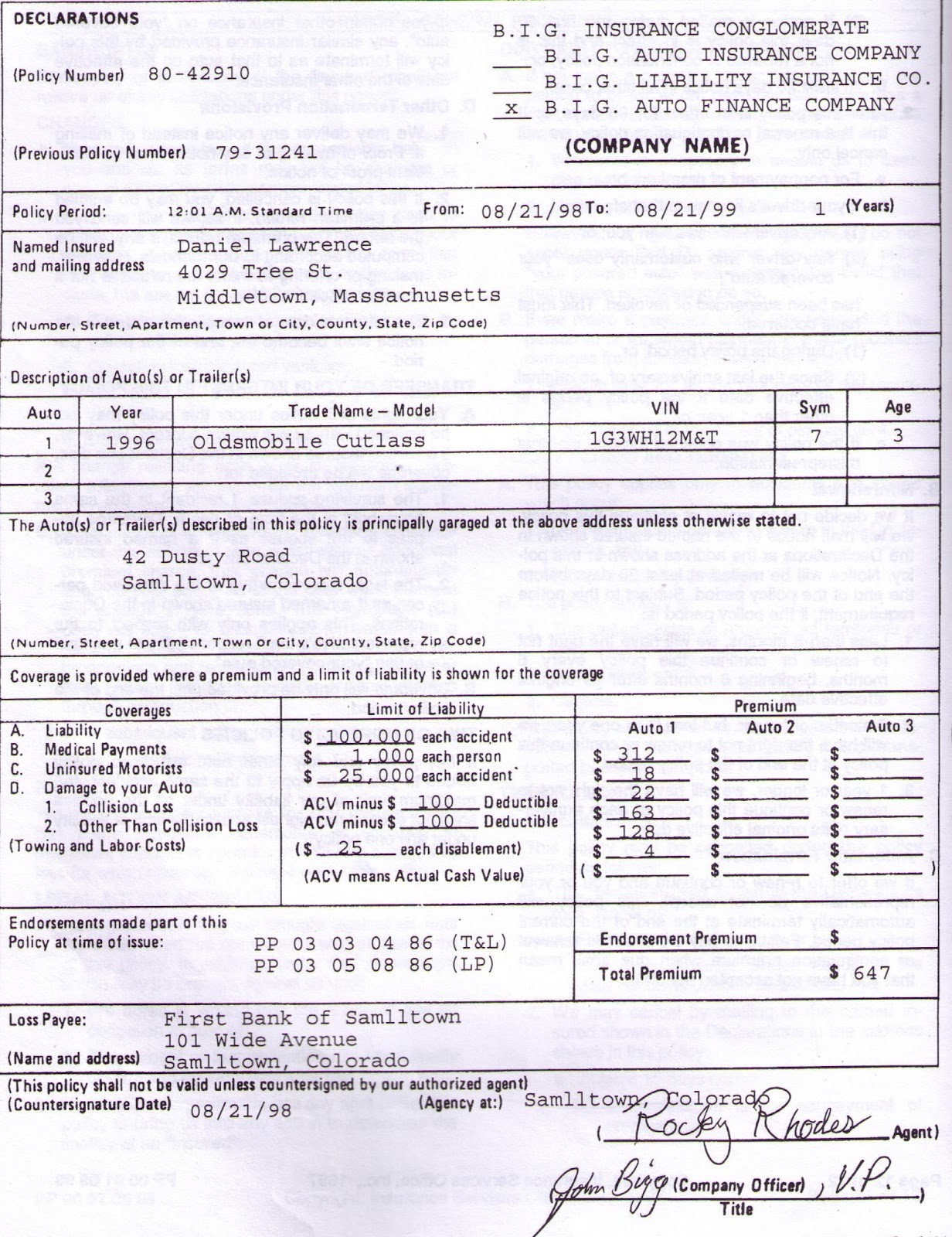

Source: insuranceplanet.blogspot.com

Source: insuranceplanet.blogspot.com

The assignee is the sole insured under the policy. The trade credit insurance policy would cover the risk of non payment due to insolvency or protracted default only and political risks can be covered only in case of buyers outside india. There are four types of credit, namely: Firstly, a credit insurance policy is not an unconditional instrument, and on the other hand, for example, business relationships between the contracting parties may be complicated, documents are often in foreign language, applicable laws can be unknown or untested, foreign jurisdiction can be involved, etc. A specific credit limit will be approved for each of your foreign customers or, if you qualify for a discretionary limit, your policy will insure the credit decisions you make yourself based on your own experience.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

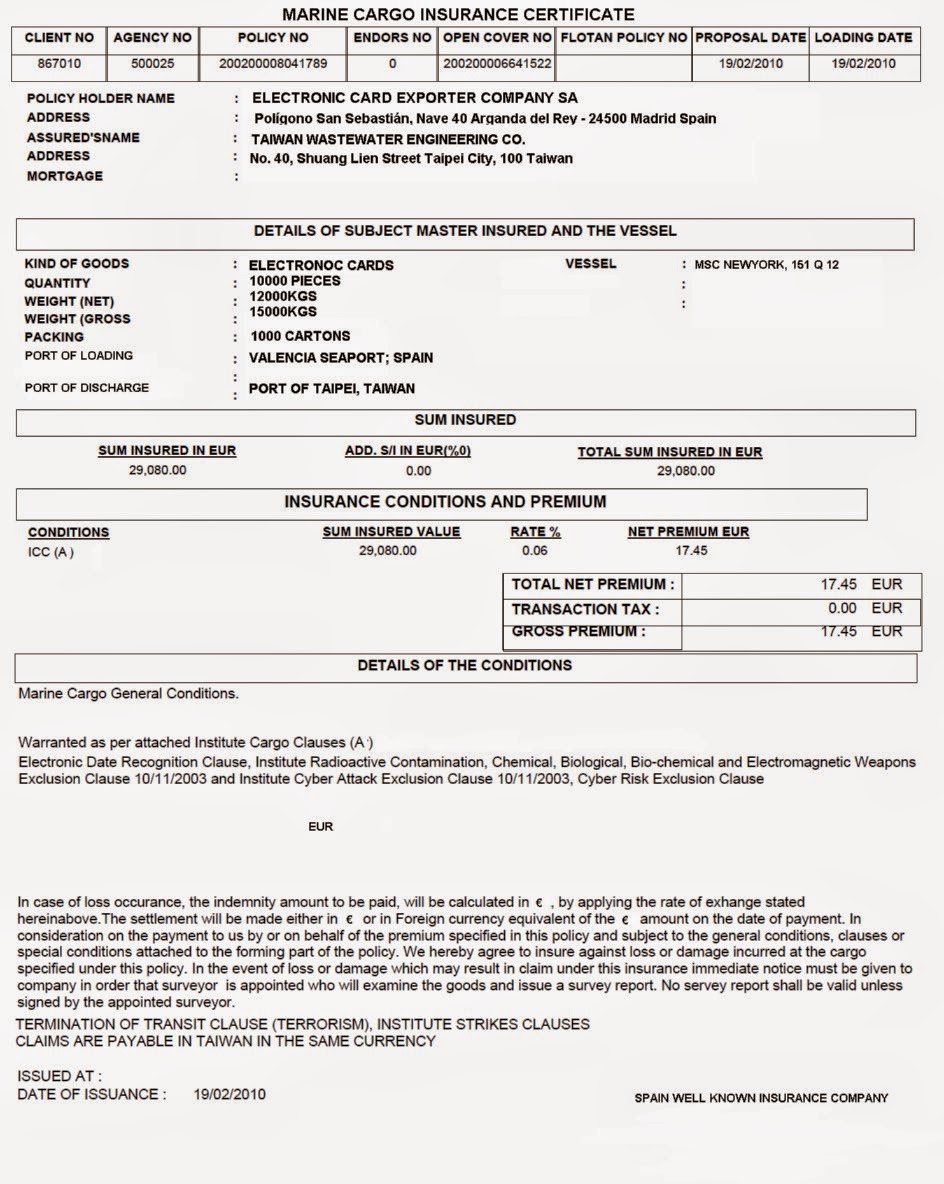

The “excess of loss” formula, based on reinsurance principles and formerly restricted to insurers, grants b2b companies a credit insurance coverage which allows them to keep the independence of their credit and debt. (isbp 2007) insurance policy sample: They do this by gathering information about. There are four types of credit, namely: Chubb trade credit insurance provides cover to companies who sell goods and services on credit terms.

Source: aon.com

Source: aon.com

Operative clause this policy is issued by sbi general insurance company limited (hereinafter referred to as the company’) to the proposer (hereinafter referred to as the insured’) named in the schedule attached herewith. A few other events may also be covered. (isbp 2007) insurance policy sample: Firstly, a credit insurance policy is not an unconditional instrument, and on the other hand, for example, business relationships between the contracting parties may be complicated, documents are often in foreign language, applicable laws can be unknown or untested, foreign jurisdiction can be involved, etc. Commercial trade insurance is critical for businesses in today’s competitive global economy.

Source: pinterest.com

Source: pinterest.com

The company will extend credit to customers if they meet its threshold criteria for the granting of credit. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay. A few other events may also be covered. Alternatively you can apply for an export credit insurance policy covering only. Charge cards, these are similar with revolving credit only that the customer is ought to pay the total balance monthly;

Source: termly.io

Source: termly.io

Charge cards, these are similar with revolving credit only that the customer is ought to pay the total balance monthly; Chubb provides protection against the risk of not being paid by customers, enabling our business customers to carry on trading. Attached to the inquiry is a sample credit insurance policy that would be issued to a financial institution under the foregoing circumstances and described the salient features of such a policy. Now, according to terms, $20,000 trade credit is given to the. They do this by gathering information about.

Source: myexceltemplates.com

Source: myexceltemplates.com

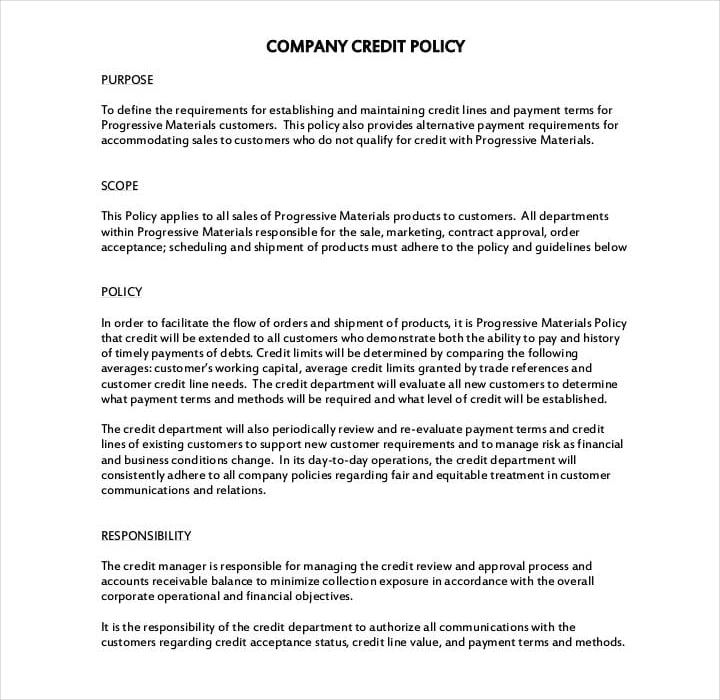

Below is an example of a sample business credit policy that can be adapted to fit the needs of any company. All of your insurable foreign receivables can be covered under one credit insurance policy. The basic form of credit is a maximum credit of $10,000, with no security interest. Risks or losses arising due to such a situation are covered by credit insurance policies. The insurance document must indicate the amount of insurance coverage and be in the same currency as the credit.

Source: advancedontrade.com

Source: advancedontrade.com

• trade credit insurance indemnifies the policyholder for the invoice value of goods delivered to a customer but unpaid due to the customer’s insolvency or default. Sample credit policy a company’s credit policy can vary in length, from a couple of pages to hundreds of pages. • trade credit insurance indemnifies the policyholder for the invoice value of goods delivered to a customer but unpaid due to the customer’s insolvency or default. Credit management success, but you have to know how to use it. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay.

Source: sampleforms.com

Source: sampleforms.com

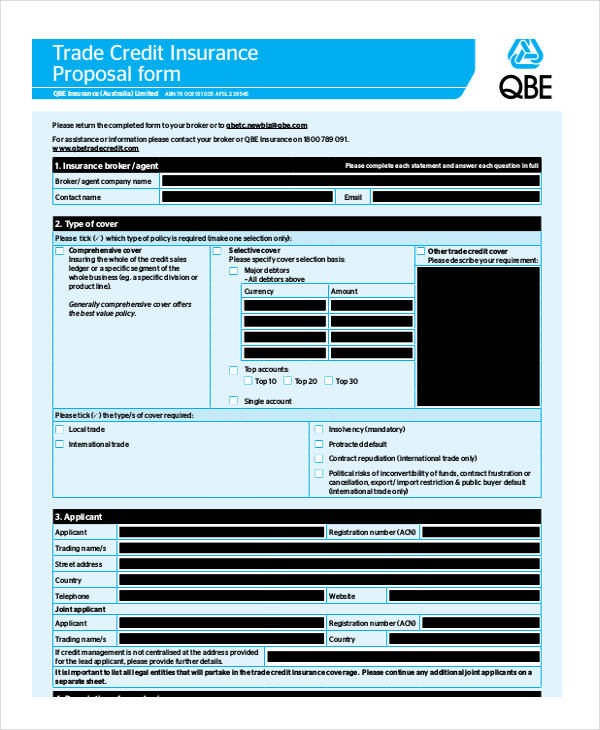

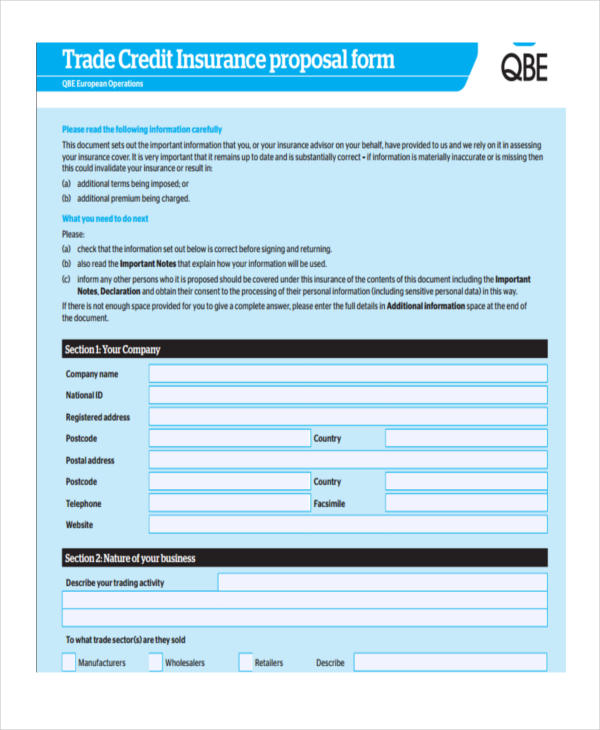

Trade credit re insurance company sa/nv (trade credit) is specialized in a specific technique for covering commercial credit risk in b2b: A few other events may also be covered. For example, a customer is granted credit with terms of 4/10,. Cover the insured has applied to qbe trade credit for trade credit insurance by a proposal in writing and qbe trade credit has • trade credit insurance indemnifies the policyholder for the invoice value of goods delivered to a customer but unpaid due to the customer’s insolvency or default.

Source: slideshare.net

Source: slideshare.net

Cover the insured has applied to qbe trade credit for trade credit insurance by a proposal in writing and qbe trade credit has • trade credit insurance indemnifies the policyholder for the invoice value of goods delivered to a customer but unpaid due to the customer’s insolvency or default. Below is an example of a sample business credit policy that can be adapted to fit the needs of any company. The main body of the policy can include a number of statements regarding credit policy, along with more detailed application information. Whereas the insured has made a written proposal and declaration (`the

Source: pinterest.com

Source: pinterest.com

The basic form of credit is a maximum credit of $10,000, with no security interest. Sample credit policy a company’s credit policy can vary in length, from a couple of pages to hundreds of pages. • goods delivered to customers during the policy period. Service credits, the types of products and service a customer can acquire from service credits are cellular phones, cable. Firstly, a credit insurance policy is not an unconditional instrument, and on the other hand, for example, business relationships between the contracting parties may be complicated, documents are often in foreign language, applicable laws can be unknown or untested, foreign jurisdiction can be involved, etc.

Source: slideshare.net

Source: slideshare.net

Revolving credit, is when a customer is given a maximum credit limit and a perfect example for it credit cards; For example, a customer is granted credit with terms of 4/10,. Does credit insurance help businesses in borrowing at lower rates? Service credits, the types of products and service a customer can acquire from service credits are cellular phones, cable. The company will extend credit to customers if they meet its threshold criteria for the granting of credit.

Source: bansarchina.com

Source: bansarchina.com

What is trade credit insurance? Firstly, a credit insurance policy is not an unconditional instrument, and on the other hand, for example, business relationships between the contracting parties may be complicated, documents are often in foreign language, applicable laws can be unknown or untested, foreign jurisdiction can be involved, etc. Capital, and accelerate your growth. Yes, credit insurance policy helps business by optimising bank financing options by providing insurance cover to the trade receivables. Revolving credit, is when a customer is given a maximum credit limit and a perfect example for it credit cards;

Source: unbrick.id

Source: unbrick.id

The main body of the policy can include a number of statements regarding credit policy, along with more detailed application information. It shields them against the risk that clients won�t pay what they owe due to insolvency. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay. The trade credit insurance policy would cover the risk of non payment due to insolvency or protracted default only and political risks can be covered only in case of buyers outside india. There are four types of credit, namely:

Source: gscsconsulting.com

Source: gscsconsulting.com

The credit granted as per the term of sale with the terms of 3/15 net 40. Now, according to terms, $20,000 trade credit is given to the. Commercial trade insurance is critical for businesses in today’s competitive global economy. Credit management success, but you have to know how to use it. Risks or losses arising due to such a situation are covered by credit insurance policies.

Source: template.net

Source: template.net

The trade credit insurance policy would cover the risk of non payment due to insolvency or protracted default only and political risks can be covered only in case of buyers outside india. There are several different types of insurance for. Bad debt, provide you with predictive knowledge, enhance your working. Chubb trade credit insurance provides cover to companies who sell goods and services on credit terms. Revolving credit, is when a customer is given a maximum credit limit and a perfect example for it credit cards;

Source: sampleforms.com

Source: sampleforms.com

Revolving credit, is when a customer is given a maximum credit limit and a perfect example for it credit cards; Trade credit insurers will generally cover two types of risk that a business can include in their cover: Alternatively you can apply for an export credit insurance policy covering only. The main body of the policy can include a number of statements regarding credit policy, along with more detailed application information. Does credit insurance help businesses in borrowing at lower rates?

Source: slideshare.net

Source: slideshare.net

Does credit insurance help businesses in borrowing at lower rates? Credit management success, but you have to know how to use it. They do this by gathering information about. The main body of the policy can include a number of statements regarding credit policy, along with more detailed application information. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay.

Source: unbrick.id

Source: unbrick.id

What is trade credit insurance? Yes, credit insurance policy helps business by optimising bank financing options by providing insurance cover to the trade receivables. Placed on a credit hold and the order will be held or cancelled. The trade credit insurance policy would cover the risk of non payment due to insolvency or protracted default only and political risks can be covered only in case of buyers outside india. Now, according to terms, $20,000 trade credit is given to the.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title trade credit insurance policy example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information