Trade credit insurance pricing information

Home » Trend » Trade credit insurance pricing informationYour Trade credit insurance pricing images are available in this site. Trade credit insurance pricing are a topic that is being searched for and liked by netizens today. You can Get the Trade credit insurance pricing files here. Download all royalty-free photos.

If you’re looking for trade credit insurance pricing images information related to the trade credit insurance pricing interest, you have come to the right site. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

Trade Credit Insurance Pricing. Selective accounts single contract domestic/ export political risk special risks; The cost of trade credit insurance is calculated as a percentage of your turnover combined with the level of risk. Starting at below rs 2.50 per day. Typically however, a company will currently pay 0.15% and 0.3% of insurable turnover although this could be much higher particularly for certain political risks and for clients with a poor credit management history.

Trade Credit Insurance Eventpop อีเว้นท์ป็อป Eventpop From eventpop.me

Trade Credit Insurance Eventpop อีเว้นท์ป็อป Eventpop From eventpop.me

Wholeturnover, structured credit, single risk, political risk, medium term, excess of loss, top up, all provided for ; Computation of the embedded valued of life insurance companies [8] and has also been proposed in a. 15+ insurers, 5+ banks, 5+ private equity providers. If your sales were $20 million last year and you want to cover that entire revenue, your premium would typically be less than $50,000. Trade credit allows the supplier to take advantage of the retailer’s financial weakness, yet it may also benefit both parties when the retailer’s cash is reasonably high. Because no matter how carefully you run your business, debtors can be a problem.

If you have any questions regarding the trade credit insurance scheme or invoice finance funding, please contact tim on the for form below.

Policies are designed on a sales turnover basis. This article was written by matt howard, at price bailey. If you have any questions regarding the trade credit insurance scheme or invoice finance funding, please contact tim on the for form below. The average cost of trade credit insurance premiums normally range from less than 0.1% of turnover to more than one percent. This kind of approach has been used to price technical risks in the. Trade credit allows the supplier to take advantage of the retailer’s financial weakness, yet it may also benefit both parties when the retailer’s cash is reasonably high.

Source: eulerhermes.com

Source: eulerhermes.com

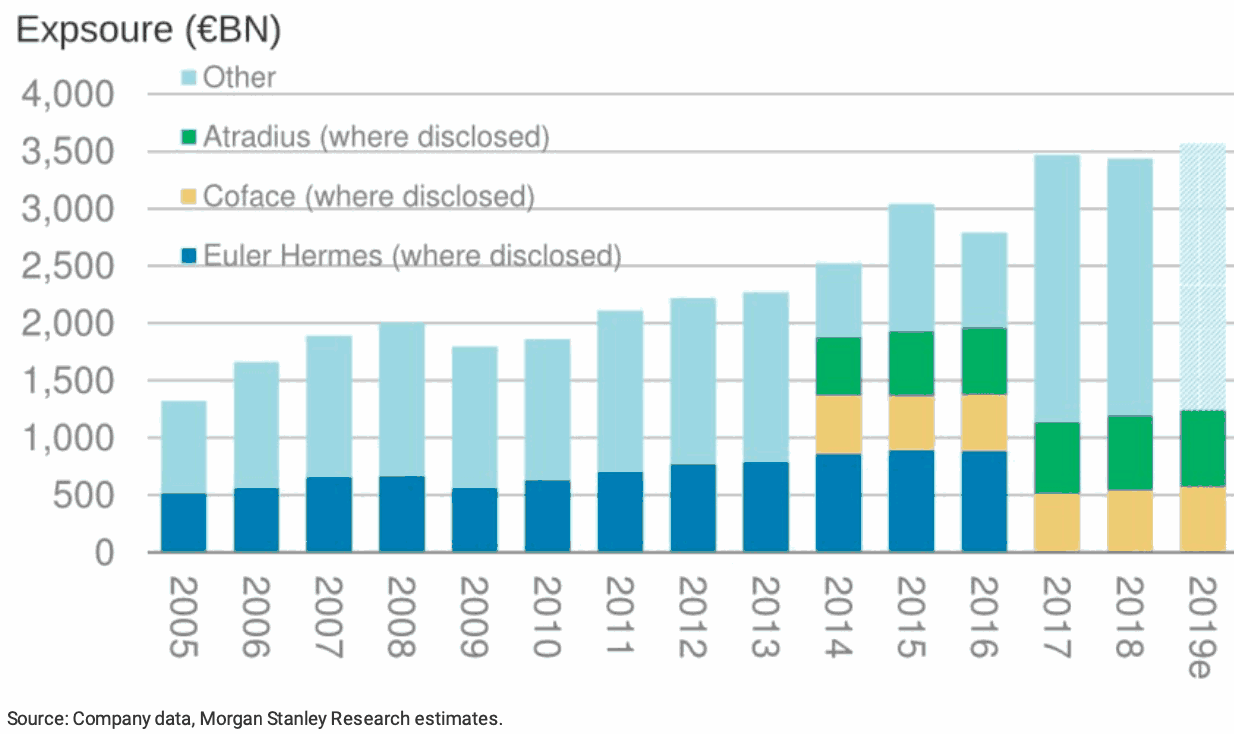

This improves funding access at competitive rates. China and italy) and trade sectors as above, particularly to reduce unutilised credit limit capacity to actual/current trading levels. Philips says the policy increases are not unreasonable. The credit insurance market is expecting a significant increase in payment defaults and insurers have started to implement plans to review and reduce their insured exposures in certain countries and (e.g. Policies are designed on a sales turnover basis.

Source: eventpop.me

Source: eventpop.me

If you have any questions regarding the trade credit insurance scheme or invoice finance funding, please contact tim on the for form below. Get yourself covered and buy a personal accident insurance now. Factors affecting trade credit insurance pricing: Minimum premium of $20,000 and sales of at least $10m for corporate clients. As the leading insurance broker of trade credit insurance and interrelated products such as accounts receivable puts, political risk insurance, and other insurance products relating to international trade and experts, credit eureka works with you to quickly get pricing, accounts & the countries eligible for coverage.

Source: thinkpreferred.com

Source: thinkpreferred.com

The global trade credit insurance market attained a value of more than usd 10.2 billion in 2021, driven by the flourishing bfsi industry. China and italy) and trade sectors as above, particularly to reduce unutilised credit limit capacity to actual/current trading levels. “they are offering a lot less for a lot more money,” philips says, noting a policy that used to cost $40,000 before 2020 may now be $70,000. Philips says the policy increases are not unreasonable. For certain types of credit insurance, such as our sme solution simplicity , you pay a.

Source: blog.apruve.com

Factors affecting trade credit insurance pricing: This kind of approach has been used to price technical risks in the. If your sales were $20 million last year and you want to cover that entire revenue, your premium would typically be less than $50,000. The credit insurance market is expecting a significant increase in payment defaults and insurers have started to implement plans to review and reduce their insured exposures in certain countries and (e.g. Get yourself covered and buy a personal accident insurance now.

Source: cashflowsignals.com

Source: cashflowsignals.com

This kind of approach has been used to price technical risks in the. How much does trade credit insurance cost? This improves funding access at competitive rates. This article was written by matt howard, at price bailey. This kind of approach has been used to price technical risks in the.

Source: slideserve.com

Source: slideserve.com

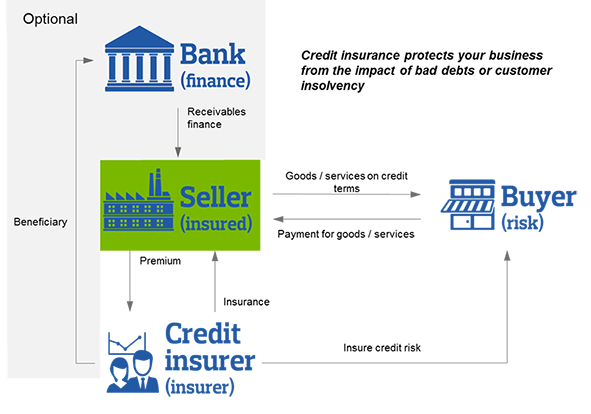

The global trade credit insurance market attained a value of more than usd 10.2 billion in 2021, driven by the flourishing bfsi industry. Trade credit insurance provides cover for businesses if customers who owe money for products or services do not pay their debts, or pay them later than the payment terms dictate. For certain types of credit insurance, such as our sme solution simplicity , you pay a. Trade credit insurance covers your receivables due within 12 months so that your cash flow is safeguarded. Credit risk underwriting, rating and automation;

Source: hermes.global

Source: hermes.global

Let us calculate your cost for you If you have any questions regarding the trade credit insurance scheme or invoice finance funding, please contact tim on the for form below. Trade credit insurance policies indemnify a seller of goods or services against their buyers’ failure to pay, either through insolvency or protracted default. This improves funding access at competitive rates. Philips says the policy increases are not unreasonable.

Source: youtube.com

Source: youtube.com

Selective accounts single contract domestic/ export political risk special risks; Get a price for business credit/accounts receivable insurance with our free tool in 5 minutes or less. Trade credit insurance covers your receivables due within 12 months so that your cash flow is safeguarded. For certain types of credit insurance, such as our sme solution simplicity , you pay a. Get yourself covered and buy a personal accident insurance now.

Source: tldallas.com

Source: tldallas.com

Minimum premium of $20,000 and sales of at least $10m for corporate clients. 15+ insurers, 5+ banks, 5+ private equity providers. Cam credit can manage and report on multiple product types; How much does trade credit insurance cost? As the leading insurance broker of trade credit insurance and interrelated products such as accounts receivable puts, political risk insurance, and other insurance products relating to international trade and experts, credit eureka works with you to quickly get pricing, accounts & the countries eligible for coverage.

Source: aon.com

Source: aon.com

Trade credit insurance provides cover for businesses if customers who owe money for products or services do not pay their debts, or pay them later than the payment terms dictate. Cam credit can manage and report on multiple product types; For certain types of credit insurance, such as our sme solution simplicity , you pay a. This is an insurance for short term account, due within 12 months. Philips says the policy increases are not unreasonable.

Source: coface.com.sg

Source: coface.com.sg

It gives businesses the confidence to extend credit to new customers and improves access to funding, often at more competitive rates. The credit insurance market is expecting a significant increase in payment defaults and insurers have started to implement plans to review and reduce their insured exposures in certain countries and (e.g. Cam credit can manage and report on multiple product types; Check what are the factors that would affect your credit insurance cost & premiums. Risk horizons and run off monitoring

Source: eventpop.me

Source: eventpop.me

Trade credit insurance policies indemnify a seller of goods or services against their buyers’ failure to pay, either through insolvency or protracted default. Starting at below rs 2.50 per day. If you have any questions regarding the trade credit insurance scheme or invoice finance funding, please contact tim on the for form below. How is your trade credit insurance premium calculated? China and italy) and trade sectors as above, particularly to reduce unutilised credit limit capacity to actual/current trading levels.

Source: gscsconsulting.com

Source: gscsconsulting.com

This kind of approach has been used to price technical risks in the. Philips says the policy increases are not unreasonable. Typically however, a company will currently pay 0.15% and 0.3% of insurable turnover although this could be much higher particularly for certain political risks and for clients with a poor credit management history. You can also offer credit to new customers. Because no matter how carefully you run your business, debtors can be a problem.

Source: hectorbonilla.com

Source: hectorbonilla.com

How much does trade credit insurance cost? Get a price for business credit/accounts receivable insurance with our free tool in 5 minutes or less. The cost of trade credit insurance is calculated as a percentage of your turnover combined with the level of risk. Risk horizons and run off monitoring Get yourself covered and buy a personal accident insurance now.

Source: reinsurancene.ws

Source: reinsurancene.ws

Philips says the policy increases are not unreasonable. You can also offer credit to new customers. “they are offering a lot less for a lot more money,” philips says, noting a policy that used to cost $40,000 before 2020 may now be $70,000. Because no matter how carefully you run your business, debtors can be a problem. This article was written by matt howard, at price bailey.

Source: shekal.com

Source: shekal.com

Factors affecting trade credit insurance pricing: Factors affecting trade credit insurance pricing: Wholeturnover, structured credit, single risk, political risk, medium term, excess of loss, top up, all provided for ; If your sales were $20 million last year and you want to cover that entire revenue, your premium would typically be less than $50,000. Because no matter how carefully you run your business, debtors can be a problem.

Source: avinon-medic.com

As the leading insurance broker of trade credit insurance and interrelated products such as accounts receivable puts, political risk insurance, and other insurance products relating to international trade and experts, credit eureka works with you to quickly get pricing, accounts & the countries eligible for coverage. Credit risk underwriting, rating and automation; China and italy) and trade sectors as above, particularly to reduce unutilised credit limit capacity to actual/current trading levels. Get yourself covered and buy a personal accident insurance now. As a business credit insurance specialist, we bring the market to you.

Source: crombielockwood.co.nz

Source: crombielockwood.co.nz

Minimum premium of $20,000 and sales of at least $10m for corporate clients. Check what are the factors that would affect your credit insurance cost & premiums. If you have any questions regarding the trade credit insurance scheme or invoice finance funding, please contact tim on the for form below. More choice means finding a plan that will provide more coverage, at a much lower premium. This is an insurance for short term account, due within 12 months.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title trade credit insurance pricing by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information