Traders insurance policy explained information

Home » Trending » Traders insurance policy explained informationYour Traders insurance policy explained images are ready. Traders insurance policy explained are a topic that is being searched for and liked by netizens today. You can Get the Traders insurance policy explained files here. Download all royalty-free images.

If you’re searching for traders insurance policy explained pictures information connected with to the traders insurance policy explained topic, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

Traders Insurance Policy Explained. This includes, but is not limited to: Trade insurance makes sense if you have a high turn over of cars, however your domestic no claims is only accepted for a partial discount from a couple of companies. As traders insurance broker who are insured. Traders combined insurance can include employers’ liability, public liability, and business insurance.

Compare Cheap Motor Trade Insurance Quotes From Over 22 From pinterest.com

Compare Cheap Motor Trade Insurance Quotes From Over 22 From pinterest.com

The term motor trade insurance or traders insurance is the name given to the category of insurance policy the is recommended for those individuals who work in the motor industry. This includes adding personal family cars to trade policies. The latter is known as traders’ combined (or combined motor trade) insurance. It doesn’t matter if you are a sole trader or if you’re a limited company and hire employees, you will need traders insurance. You can build your motor trade insurance policy to meet your needs. The insurance provides protection for businesses in the united kingdom such as car dealerships, motor traders, van drivers, and commercial vehicles.?

Motor trade insurance or traders insurance is used by a wide range of businesses, and usually by those who are involved in repairing or selling vehicles.

It�s a special insurance policy tailored to your exact business needs. Every motor trader, regardless of their line of work, must have a motor trader insurance policy. This includes adding personal family cars to trade policies. Drive cars that you don’t own. As traders insurance broker who are insured. Traders combined insurance can include employers’ liability, public liability, and business insurance.

Source: pinterest.com

Source: pinterest.com

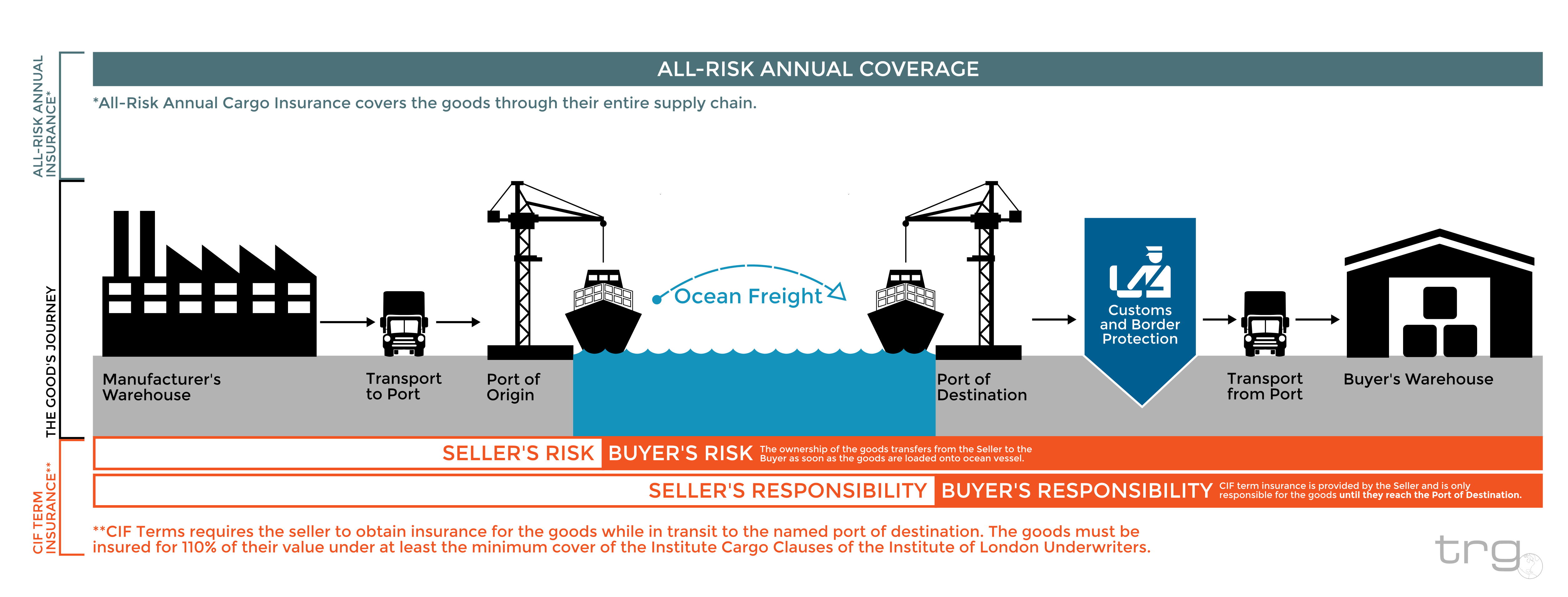

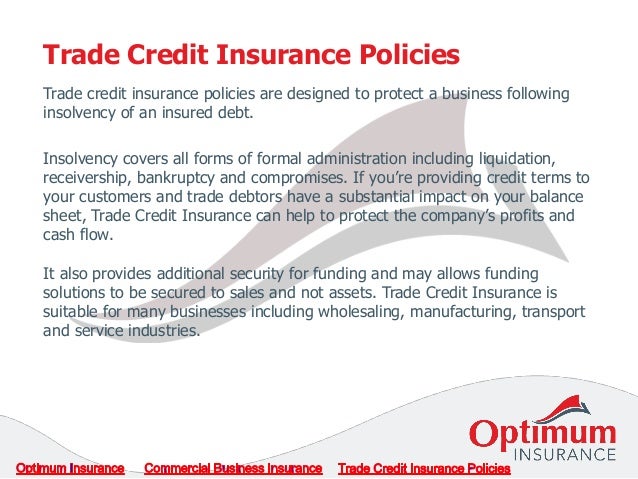

Trade insurance makes sense if you have a high turn over of cars, however your domestic no claims is only accepted for a partial discount from a couple of companies. Traders combined insurance can include employers’ liability, public liability, and business insurance. A broker will build a trade insurance policy that covers indemnity for work carried out, will cover tools and equipment. There are two main types of motor trade insurance policy that are most common, road risks and motor trade combined insurance. Trade credit insurance is the type of insurance provided to trading companies who wish to protect their receivables from credit risks.

Source: beavercityrecreation.blogspot.com

Source: beavercityrecreation.blogspot.com

Each type of insurance is designed to cover specific risks. We have been providing part time traders insurance cover since 1995, making us the market leaders in offering great value insurance cover for your motor trade business. However, as with a personal policy, care must be taken to read the small print of each policy and adhere to any specific limitations. This means that you can: What is trade credit insurance?

Source: traderiskguaranty.com

Source: traderiskguaranty.com

Businesses also use credit insurance to help at secure finance and working. The latter is known as traders’ combined (or combined motor trade) insurance. Each type of insurance is designed to cover specific risks. But beep is either a secure asset until it but paid. Traders’ combined cover can include liability insurance and protection for buildings, tools, and equipment.

Source: cashflowsignals.com

Source: cashflowsignals.com

That means if you employ a new driver, you must notify your insurance company and get them registered on your policy. A broker will build a trade insurance policy that covers indemnity for work carried out, will cover tools and equipment. That means if you employ a new driver, you must notify your insurance company and get them registered on your policy. A motor trade insurance policy is an insurance product that protects someone who deals with cars as their profession or business; Traders combined insurance can include employers’ liability, public liability, and business insurance.

Source: beavercityrecreation.blogspot.com

Source: beavercityrecreation.blogspot.com

Drive cars that you don’t own. Motor trade insurance policies generally provide three different types of cover: There are two main types of motor trade insurance policy that are most common, road risks and motor trade combined insurance. Drive cars that you don’t own. But beep is either a secure asset until it but paid.

Source: thebalance.com

Source: thebalance.com

This includes buying and selling vehicles for profit (traders), fixing vehicles (mechanics & mobile mechanics), cleaning vehicles (valeters), moving vehicles (car jockeys) or recovering them if they’ve broken down (vehicle recovery agents). What is trade credit insurance? The exporter may need to declare periodically (say, once a month) the detail of all shipments made during the period, type of goods, modes of transport, destinations, etc. Motor traders insurance offers policyholders the ability to use any vehicle either directly owned or under their control for motor trade purposes with relatively few restrictions. It covers your employees when they’re driving or working on your customers’ vehicles, as well as those owned by the business.

Source: slideshare.net

Source: slideshare.net

There are two main types of motor trade insurance policy that are most common, road risks and motor trade combined insurance. This means that you can: This includes adding personal family cars to trade policies. The most important factor will be flexibility. Motor trade insurance policies generally provide three different types of cover:

Source: beavercityrecreation.blogspot.com

Source: beavercityrecreation.blogspot.com

Businesses also use credit insurance to help at secure finance and working. This means that you can: This includes adding personal family cars to trade policies. This is a more personalised insurance and builds on the road risk insurance. Drive cars that you don’t own.

Source: youtube.com

Source: youtube.com

But beep is either a secure asset until it but paid. You can build your motor trade insurance policy to meet your needs. Trade insurance makes sense if you have a high turn over of cars, however your domestic no claims is only accepted for a partial discount from a couple of companies. Motor trade insurance is different to a private car policy in many ways. While the cover provided for driving is similar, it is designed for motor trade businesses.

Source: beavercityrecreation.blogspot.com

Source: beavercityrecreation.blogspot.com

But beep is either a secure asset until it but paid. This is a more personalised insurance and builds on the road risk insurance. This includes, but is not limited to: A motor trade insurance policy is an insurance product that protects someone who deals with cars as their profession or business; The insurance provides protection for businesses in the united kingdom such as car dealerships, motor traders, van drivers, and commercial vehicles.?

Source: thinkinsurance.co.uk

Source: thinkinsurance.co.uk

The term motor trade insurance or traders insurance is the name given to the category of insurance policy the is recommended for those individuals who work in the motor industry. Businesses also use credit insurance to help at secure finance and working. The motor trade policy you need to drive vehicles is called road risks cover. That means if you employ a new driver, you must notify your insurance company and get them registered on your policy. It�s a special insurance policy tailored to your exact business needs.

Source: traders-insurances.co.uk

Source: traders-insurances.co.uk

The most important factor will be flexibility. Motor traders insurance offers policyholders the ability to use any vehicle either directly owned or under their control for motor trade purposes with relatively few restrictions. It covers your employees when they’re driving or working on your customers’ vehicles, as well as those owned by the business. While the cover provided for driving is similar, it is designed for motor trade businesses. The exporter may need to declare periodically (say, once a month) the detail of all shipments made during the period, type of goods, modes of transport, destinations, etc.

Source: beavercityrecreation.blogspot.com

Source: beavercityrecreation.blogspot.com

Trade insurance makes sense if you have a high turn over of cars, however your domestic no claims is only accepted for a partial discount from a couple of companies. We have been providing part time traders insurance cover since 1995, making us the market leaders in offering great value insurance cover for your motor trade business. Each type of insurance is designed to cover specific risks. However, as with a personal policy, care must be taken to read the small print of each policy and adhere to any specific limitations. This includes adding personal family cars to trade policies.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

This includes adding personal family cars to trade policies. The most important factor will be flexibility. Motor trade insurance or traders insurance is used by a wide range of businesses, and usually by those who are involved in repairing or selling vehicles. Every motor trader, regardless of their line of work, must have a motor trader insurance policy. Each type of insurance is designed to cover specific risks.

Source: inthemoneystocks.com

Source: inthemoneystocks.com

Drive cars that you don’t own. A motor trade insurance policy is an insurance product that protects someone who deals with cars as their profession or business; While the cover provided for driving is similar, it is designed for motor trade businesses. However, if the driver is not registered on the policy, any claim made will be invalid. Explaining motor trade insurance policies from £39.25 per month an insurance broker needs to be able to explain your policy, and why it is a good fit for your business

Source: motorinsuraswa.blogspot.com

The term motor trade insurance or traders insurance is the name given to the category of insurance policy the is recommended for those individuals who work in the motor industry. Every motor trader, regardless of their line of work, must have a motor trader insurance policy. A broker will build a trade insurance policy that covers indemnity for work carried out, will cover tools and equipment. A motor trade insurance policy is an insurance product that protects someone who deals with cars as their profession or business; If you buy and sell or repair vehicles on a part time basis, then choicequote can provide for your insurance needs.

Source: slideshare.net

Source: slideshare.net

However, as with a personal policy, care must be taken to read the small print of each policy and adhere to any specific limitations. Traders’ combined cover can include liability insurance and protection for buildings, tools, and equipment. What is trade credit insurance? But beep is either a secure asset until it but paid. Motor trade insurance is different to a private car policy in many ways.

Source: slideshare.net

Source: slideshare.net

Traders combined insurance can include employers’ liability, public liability, and business insurance. A motor trade insurance policy is an insurance product that protects someone who deals with cars as their profession or business; Motor trade insurance (also known as trade insurance or traders insurance), is an insurance policy that�s taken out by someone who runs a business that involves vehicles. We have been providing part time traders insurance cover since 1995, making us the market leaders in offering great value insurance cover for your motor trade business. Motor traders insurance offers policyholders the ability to use any vehicle either directly owned or under their control for motor trade purposes with relatively few restrictions.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title traders insurance policy explained by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information