Transfer life insurance policy to employee Idea

Home » Trend » Transfer life insurance policy to employee IdeaYour Transfer life insurance policy to employee images are ready in this website. Transfer life insurance policy to employee are a topic that is being searched for and liked by netizens now. You can Find and Download the Transfer life insurance policy to employee files here. Find and Download all royalty-free vectors.

If you’re searching for transfer life insurance policy to employee pictures information related to the transfer life insurance policy to employee topic, you have come to the ideal site. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

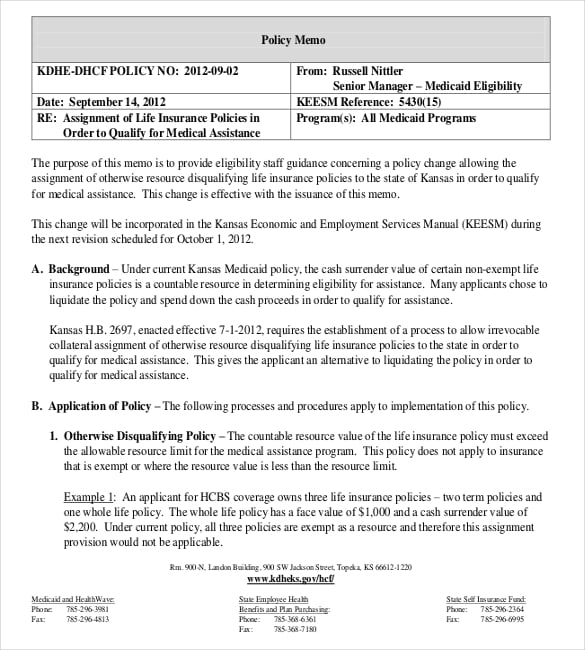

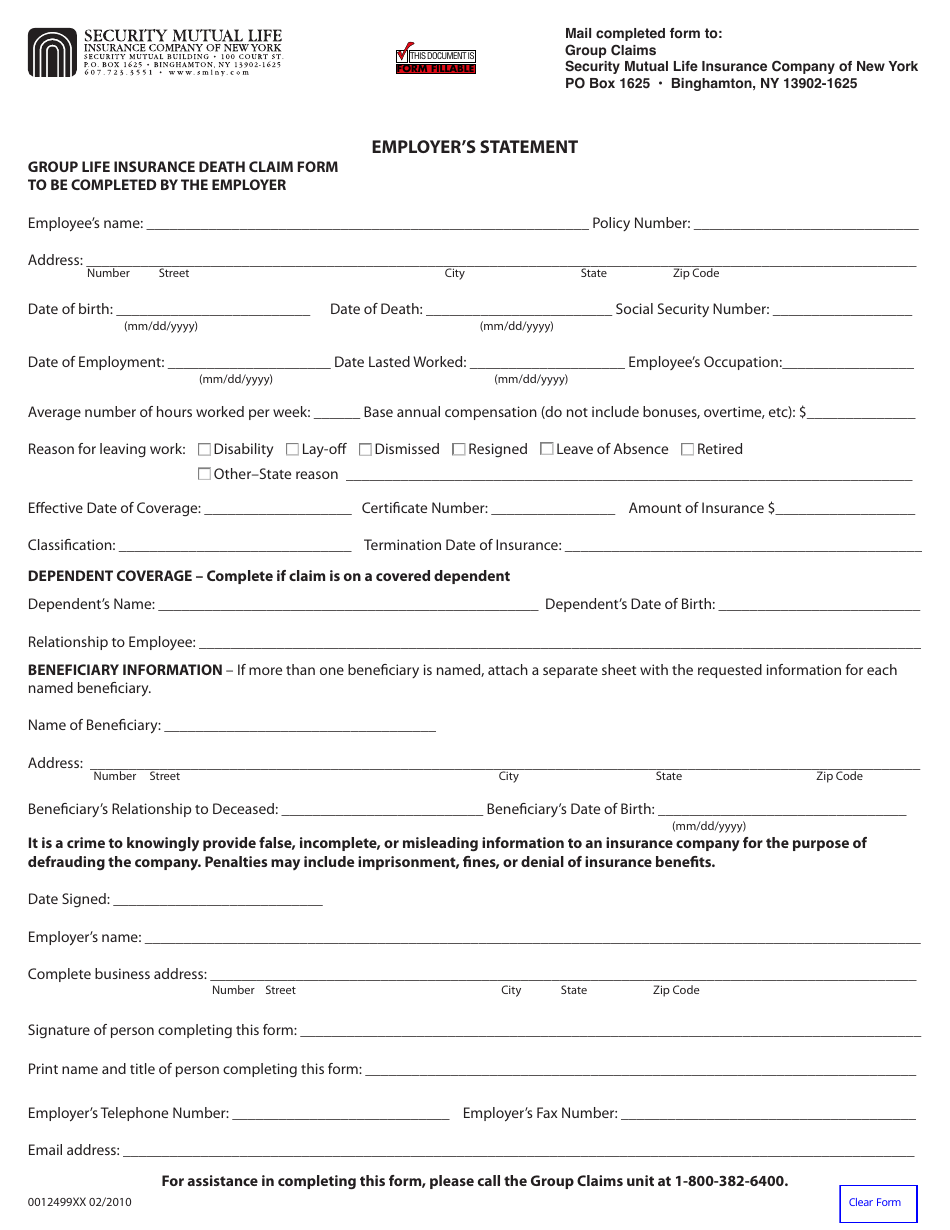

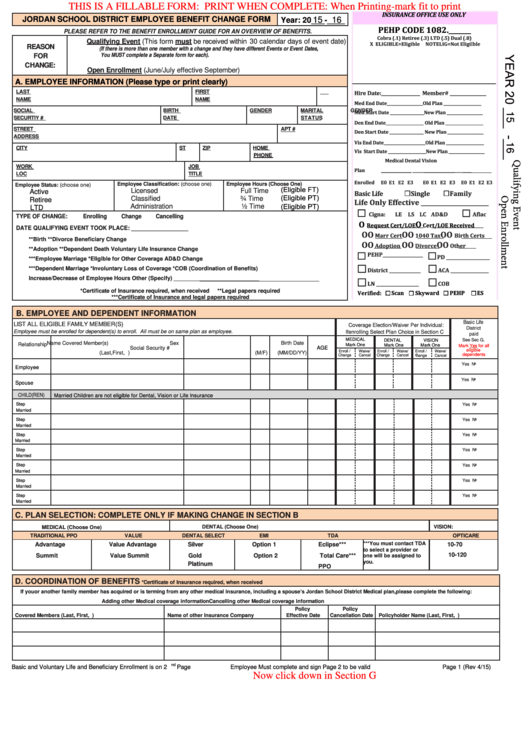

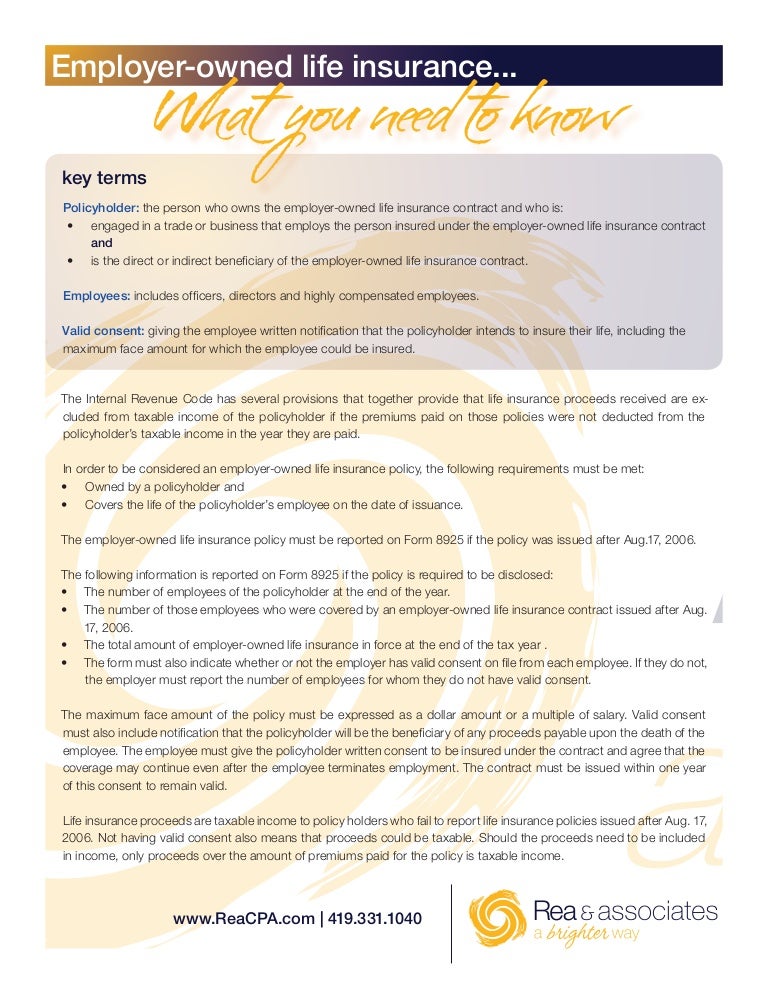

Transfer Life Insurance Policy To Employee. 5) what happens if the death occurs during the conversion period. A business may transfer ownership of a policy to the insured at some point for various reasons, such as the insured retiring and wanting to use the policy for personal planning purposes, the insured business owner selling his or her business interest and wanting to. Employee compensation, or shareholder distribution Transfer of business owned life insurance policy to the insured employee or shareholder policy transfer as compensation.

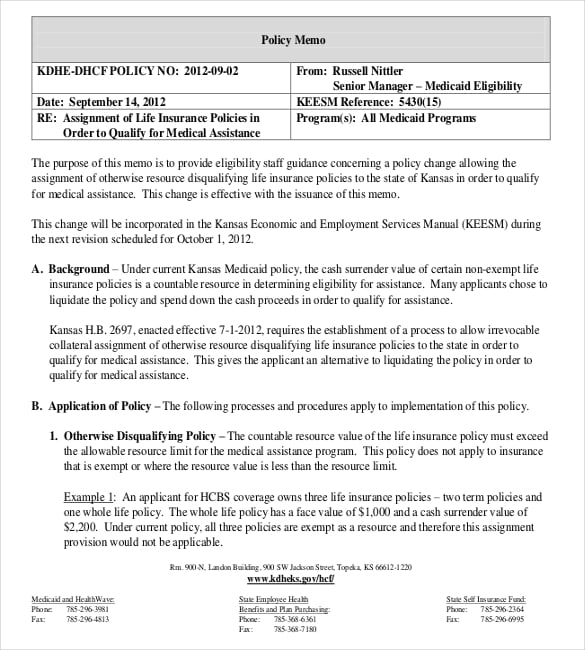

15+ Policy Memo Templates Sample Word, Google Docs From template.net

15+ Policy Memo Templates Sample Word, Google Docs From template.net

And as a shareholder/employee, ms. However, permanent life insurance can be structured as an employee benefit, as the policy, and its cash value, can be transferred to the insured after a certain number of years or at a particular milestone. Interest in open position available in another department/branch of organization A life insurance policy transfer is a “disposition” within the meaning of subsection 148(9) of the income tax act (ita). Types of insurance offered include life insurance auto insurance, health insurance, travel insurance, dental insurance, etc. First, the transfer of the policy will trigger a taxable gain to the original owner — the corporation.

And as a shareholder/employee, ms.

Interest in open position available in another department/branch of organization No matter the type of policy you choose, make sure your key man life insurance offers flexible terms. A business may transfer ownership of a policy to the insured at some point for various reasons, such as the insured retiring and wanting to use the policy for personal planning purposes, the insured business owner selling his or her business interest and wanting to personally own his or her life insurance policy, or the business paying a bonus to a key. The employer can continue the premium payment even after the assignment, if he wishes. The deeming rule applies to the following transfers: No matter how much ms.

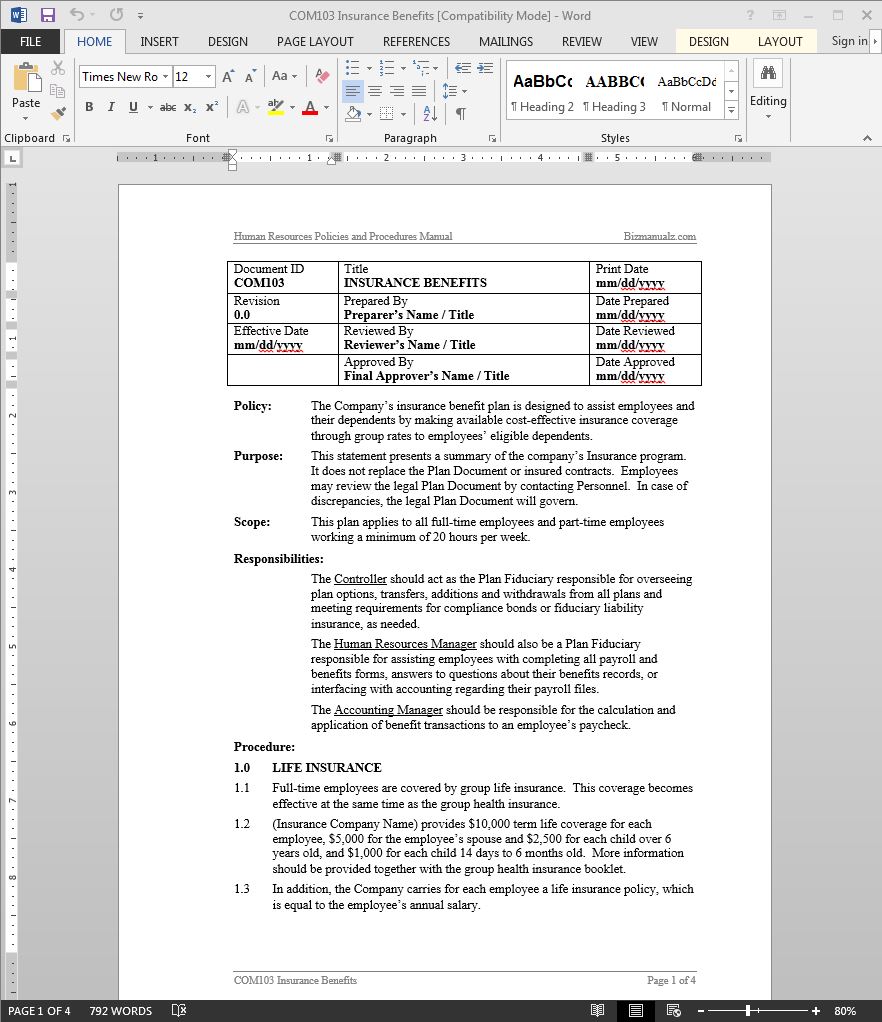

Source: bizmanualz.com

Source: bizmanualz.com

And as a shareholder/employee, ms. No matter how much ms. Smith will receive a taxable shareholder/employee benefit. The value of the policy is treated as taxable income as a transfer of a corporate asset under the guidance of irc section 83 and rev. 4) the premium amount and due date;

Source: dgmagency.com

Source: dgmagency.com

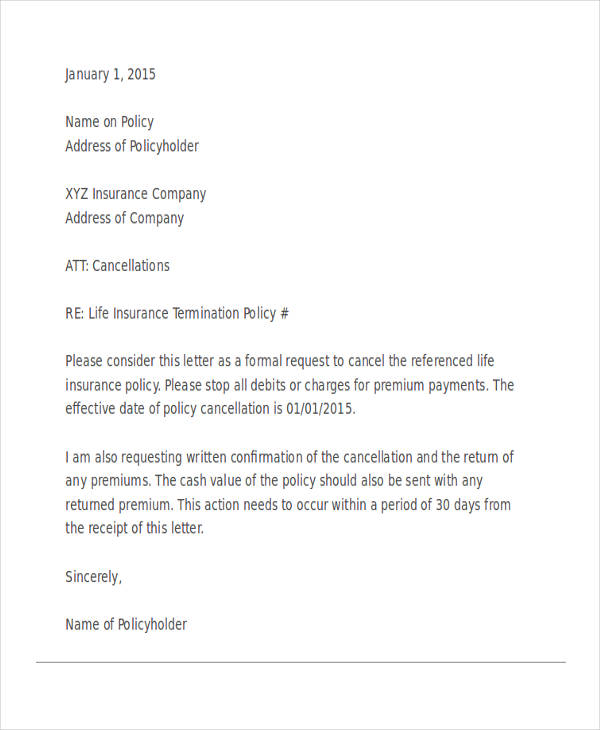

- what happens if the death occurs during the conversion period. Types of insurance offered include life insurance auto insurance, health insurance, travel insurance, dental insurance, etc. To cancel the policy, to port the policy to another group plan with your new employer (if your policy is with the same company), or to convert. Transfer life insurance policy to employee.it also includes the transfer documents which are used to. The employer can continue the premium payment even after the assignment, if he wishes.

Source: hoorayinsurance.co.uk

Source: hoorayinsurance.co.uk

Transfers of the policy during the insured’s lifetime for value 2. If you’re young and healthy, this probably isn’t the best option for you, since your premiums will go way up and you might have to pay to convert. If the policy is transferred as compensation then the receiver has to include its fair. As per the health regulations 2016, portability guidelines, individual members, including the family members covered under any group health insurance policy of a general insurer or health insurer shall have the right to migrate from such a group policy to an individual health insurance policy or a family floater policy with the same insurer. Transfers of the policy during the insured’s lifetime for value 2.

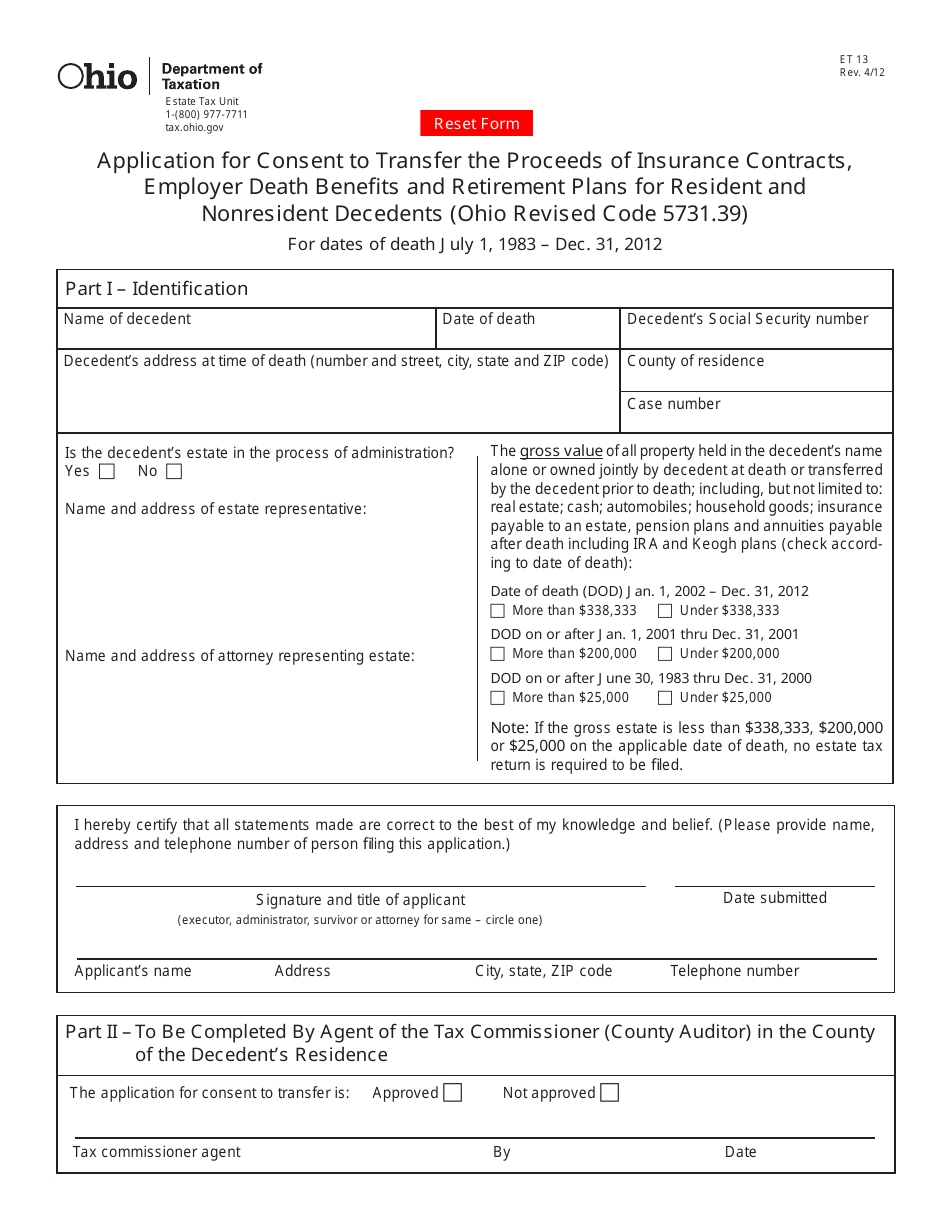

Source: templateroller.com

Source: templateroller.com

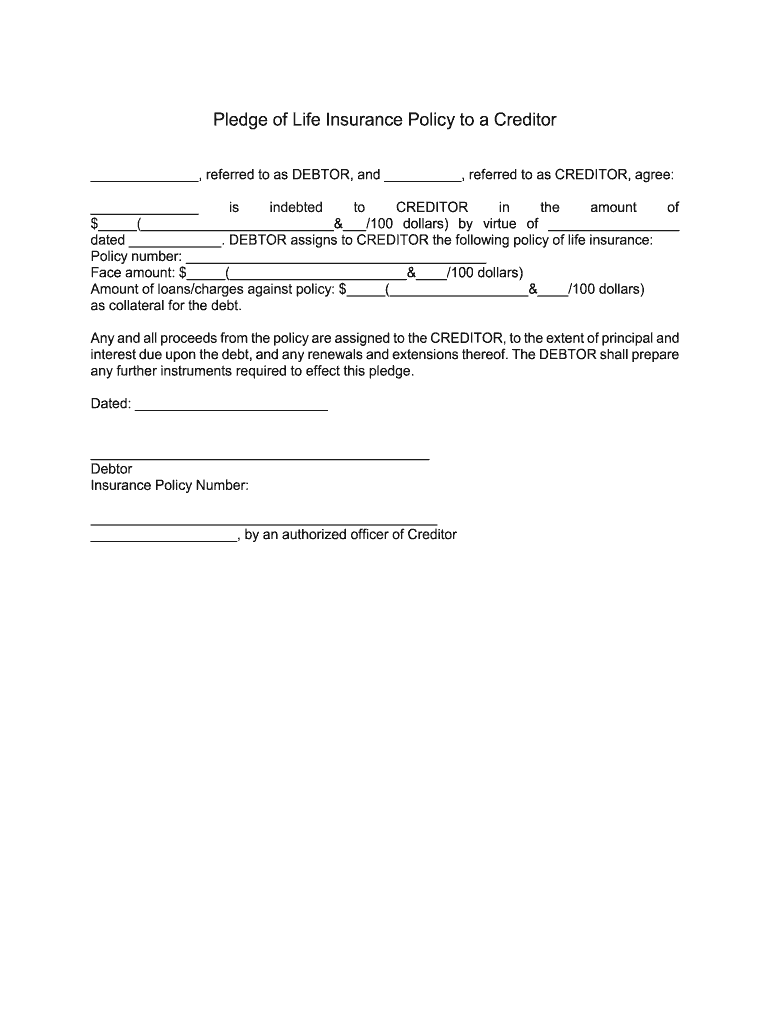

Transfer life insurance policy to employee.it also includes the transfer documents which are used to. Transfer of business owned life insurance policy to the insured employee or shareholder policy transfer as compensation. Transfers of the policy during the insured’s lifetime for value 2. A transfer from a the value of the policy is treated as taxable income to the participant under the guidance of irc section 402 and rev. 3) a step by step instruction on how to convert the group policy into an individual policy;

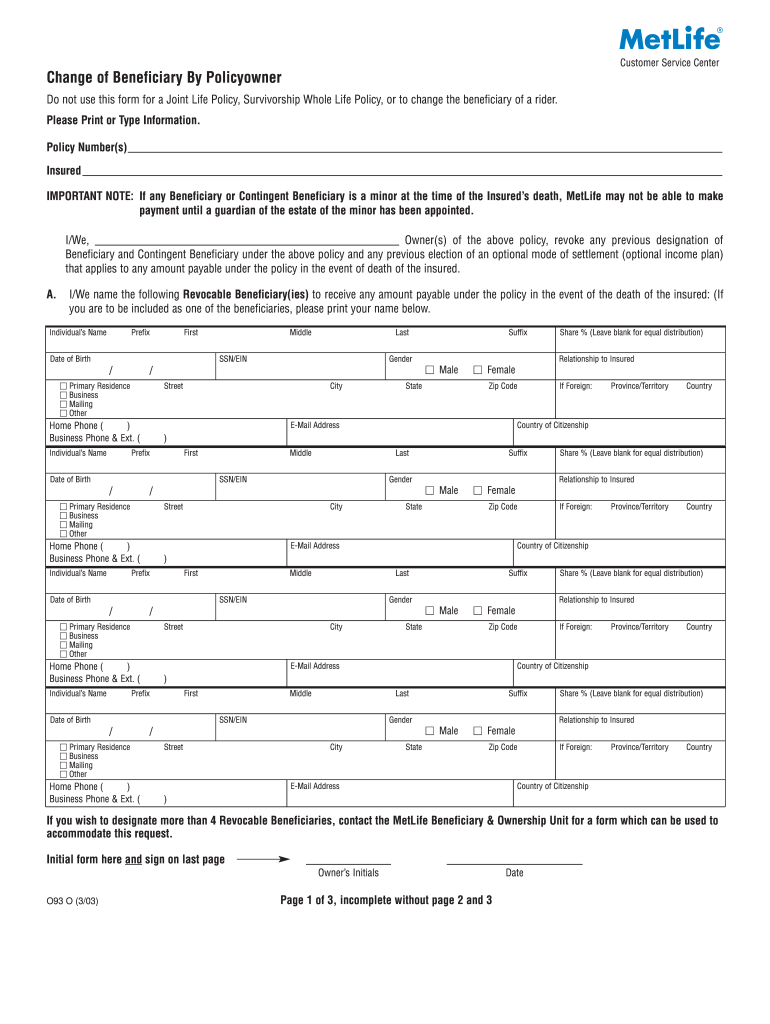

Source: pdffiller.com

Source: pdffiller.com

In a defined contribution plan, the policy is part of the participant’s account. In a defined contribution plan, the policy is part of the participant’s account. 2) the deadline for submitting a conversion application; Unless your plan provides you with additional options, in many cases you�ll have only three choices: A life insurance policy transfer is a “disposition” within the meaning of subsection 148(9) of the income tax act (ita).

Source: indiamart.com

Source: indiamart.com

No matter how much ms. First, the transfer of the policy will trigger a taxable gain to the original owner — the corporation. Such a purchase must be authorized by the plan document but the decision to buy a policy may be made by either the plan administrator (employer) or the participant. A life insurance policy transfer is a “disposition” within the meaning of subsection 148(9) of the income tax act (ita). A transfer from a the value of the policy is treated as taxable income to the participant under the guidance of irc section 402 and rev.

Source: template.net

Source: template.net

Subsection 148(1) sets out the general rules that apply to the computation of tax in respect of a disposition. 4) the premium amount and due date; The cash value is accessed and the policy is a modified endowment contract; A clear conversion notice will inform the departing employee of 1) the date his/her group life insurance coverage will end; No matter how much ms.

Source: templateroller.com

Source: templateroller.com

No matter the type of policy you choose, make sure your key man life insurance offers flexible terms. Transfer life insurance policy to employee.it also includes the transfer documents which are used to. A qualified retirement plan may purchase life insurance to provide death benefits. A clear conversion notice will inform the departing employee of 1) the date his/her group life insurance coverage will end; The employer can continue the premium payment even after the assignment, if he wishes.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

Such a purchase must be authorized by the plan document but the decision to buy a policy may be made by either the plan administrator (employer) or the participant. As per the health regulations 2016, portability guidelines, individual members, including the family members covered under any group health insurance policy of a general insurer or health insurer shall have the right to migrate from such a group policy to an individual health insurance policy or a family floater policy with the same insurer. The deeming rule applies to the following transfers: 4) the premium amount and due date; Subsection 148(1) sets out the general rules that apply to the computation of tax in respect of a disposition.

Source: formsbank.com

Source: formsbank.com

- the premium amount and due date; Employee compensation, or shareholder distribution A life insurance policy transfer is a “disposition” within the meaning of subsection 148(9) of the income tax act (ita). If the policy is transferred as compensation then the receiver has to include its fair. First, the transfer of the policy will trigger a taxable gain to the original owner — the corporation.

Source: pt.slideshare.net

Source: pt.slideshare.net

- a step by step instruction on how to convert the group policy into an individual policy; Smith will receive a taxable shareholder/employee benefit. The value of the policy is treated as taxable income as a transfer of a corporate asset under the guidance of irc section 83 and rev. And as a shareholder/employee, ms. No matter how much ms.

Source: sellmyforms.com

Source: sellmyforms.com

Transfer life insurance policy to employee.it also includes the transfer documents which are used to. Employee compensation, or shareholder distribution The value of the policy is treated as taxable income as a transfer of a corporate asset under the guidance of irc section 83 and rev. Transfer life insurance policy to employee.it also includes the transfer documents which are used to. No matter the type of policy you choose, make sure your key man life insurance offers flexible terms.

Source: theearthe.com

Source: theearthe.com

No matter the type of policy you choose, make sure your key man life insurance offers flexible terms. And as a shareholder/employee, ms. Such a purchase must be authorized by the plan document but the decision to buy a policy may be made by either the plan administrator (employer) or the participant. A transfer from a the value of the policy is treated as taxable income to the participant under the guidance of irc section 402 and rev. Transfer of business owned life insurance policy to the insured employee or shareholder policy transfer as compensation.

Source: mycirclecare.com

Source: mycirclecare.com

- what happens if the death occurs during the conversion period. To cancel the policy, to port the policy to another group plan with your new employer (if your policy is with the same company), or to convert. A business may transfer ownership of a policy to the insured at some point for various reasons, such as the insured retiring and wanting to use the policy for personal planning purposes, the insured business owner selling his or her business interest and wanting to. 3) a step by step instruction on how to convert the group policy into an individual policy; A business may transfer ownership of a policy to the insured at some point for various reasons, such as the insured retiring and wanting to use the policy for personal planning purposes, the insured business owner selling his or her business interest and wanting to personally own his or her life insurance policy, or the business paying a bonus to a key.

Source: bdhealthinsurance.com

Source: bdhealthinsurance.com

The employer can continue the premium payment even after the assignment, if he wishes. To cancel the policy, to port the policy to another group plan with your new employer (if your policy is with the same company), or to convert. No matter the type of policy you choose, make sure your key man life insurance offers flexible terms. A qualified retirement plan may purchase life insurance to provide death benefits. A transfer from a corporation to the insured employee.

Source: theglobeandmail.com

Source: theglobeandmail.com

Employee compensation, or shareholder distribution If you’re young and healthy, this probably isn’t the best option for you, since your premiums will go way up and you might have to pay to convert. In a defined contribution plan, the policy is part of the participant’s account. No matter the type of policy you choose, make sure your key man life insurance offers flexible terms. No matter how much ms.

Source: examples.com

Source: examples.com

Types of insurance offered include life insurance auto insurance, health insurance, travel insurance, dental insurance, etc. 4) the premium amount and due date; Types of insurance offered include life insurance auto insurance, health insurance, travel insurance, dental insurance, etc. Transfers of the policy during the insured’s lifetime for value 2. Transfer life insurance policy to employee.it also includes the transfer documents which are used to.

The value of the policy is treated as taxable income as a transfer of a corporate asset under the guidance of irc section 83 and rev. In exchange for the policy, the taxable policy gain will be based on the policy’s csv of $100,000. If you’re young and healthy, this probably isn’t the best option for you, since your premiums will go way up and you might have to pay to convert. A life insurance policy transfer is a “disposition” within the meaning of subsection 148(9) of the income tax act (ita). First, the transfer of the policy will trigger a taxable gain to the original owner — the corporation.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title transfer life insurance policy to employee by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information