Transfer ownership of life insurance policy to funeral home information

Home » Trend » Transfer ownership of life insurance policy to funeral home informationYour Transfer ownership of life insurance policy to funeral home images are available in this site. Transfer ownership of life insurance policy to funeral home are a topic that is being searched for and liked by netizens now. You can Download the Transfer ownership of life insurance policy to funeral home files here. Download all royalty-free images.

If you’re searching for transfer ownership of life insurance policy to funeral home images information linked to the transfer ownership of life insurance policy to funeral home topic, you have come to the right blog. Our site frequently provides you with hints for downloading the highest quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

Transfer Ownership Of Life Insurance Policy To Funeral Home. Though many types of life insurance policies and coverage exist, in general, a life insurance policy obligates an insurance company to pay the beneficiaries of the policy a certain amount of money when the policyholder dies or becomes terminally ill. If your life insurance claim has been denied and you would like to discuss the life insurance claim. Page a of instructions customer keeps this page comb 85580 ed. If so, she is currently not qualified for benefits if her assets are over the threshold.

Guaranteed Funeral Plans Sullivan Funeral Care, Kensett From sullivanfuneralcare.com

Guaranteed Funeral Plans Sullivan Funeral Care, Kensett From sullivanfuneralcare.com

At our firm, our life insurance lawyers focus on recovering denied life insurance claims and collecting lapsed policies. Before taking any actions with a life insurance policy, you should talk to your attorney to find out what is the best. Page a of instructions customer keeps this page comb 85580 ed. A life insurance company may provide an individual with the option of irrevocably transferring ownership of a revocable life insurance policy that funds a burial contract to a trust established by the funeral company. When you review your policy, make sure it is “assignable.”. Transfer ownership of the policy to a funeral home.

Any change of owner to a funeral home may be subject to state limitations.

Any transfer needs to be for healthcare. This reduces the cash value and the death benefit, but keeps the policy in place. A life insurance policy is a type of financial contract between an individual person and the insurer. The type of policy you signed up for and the life insurance company determine whether a policy is assignable. Any transfer needs to be for healthcare. Transferring to that third party rights of ownership under a policy can be limited to certain costs related to burial and funeral services, or for amounts up to the value of the.

Source: tier1capital.com

Source: tier1capital.com

Transferring to that third party rights of ownership under a policy can be limited to certain costs related to burial and funeral services, or for amounts up to the value of the. When you review your policy, make sure it is “assignable.”. The type of policy you signed up for and the life insurance company determine whether a policy is assignable. Any transfer needs to be for healthcare. Transfer ownership of the policy to a funeral home.

Source: riskinfonz.co.nz

Source: riskinfonz.co.nz

A life insurance policy is a type of financial contract between an individual person and the insurer. No, the cash value of the policy is a countable asset and any transfer would cause a period of ineligibility for benefits based on that cash value. Request to change beneficiary/ownership on life insurance policies the prudential insurance company of america pruco life insurance company of new jersey pruco life insurance company all are prudential financial companies. When you review your policy, make sure it is “assignable.”. That’s the peace of mind we offer you.

Source: funeralcoverfinder.co.za

Source: funeralcoverfinder.co.za

If you are the owner of your policy, you can transfer ownership. If your life insurance claim has been denied and you would like to discuss the life insurance claim. Please consider naming a family member as owner or assigning benefits through a revocable. Take out a loan on the cash value. If so, she is currently not qualified for benefits if her assets are over the threshold.

Source: cartefinancial.com

Source: cartefinancial.com

If your life insurance claim has been denied and you would like to discuss the life insurance claim. When considering life insurance policies and medicaid eligibility, the owner of the policy is who matters. You can breathe easier knowing that final expenses will be paid through your insurance policy, but many people ask if there is a way to cut to the chase and have the funeral home listed as the beneficiary. Therefore, a medicaid applicant can have a friend or relative, such as an adult child, niece, or nephew purchase the insurance policy at the cash surrender value, pay the premiums, and. At our firm, our life insurance lawyers focus on recovering denied life insurance claims and collecting lapsed policies.

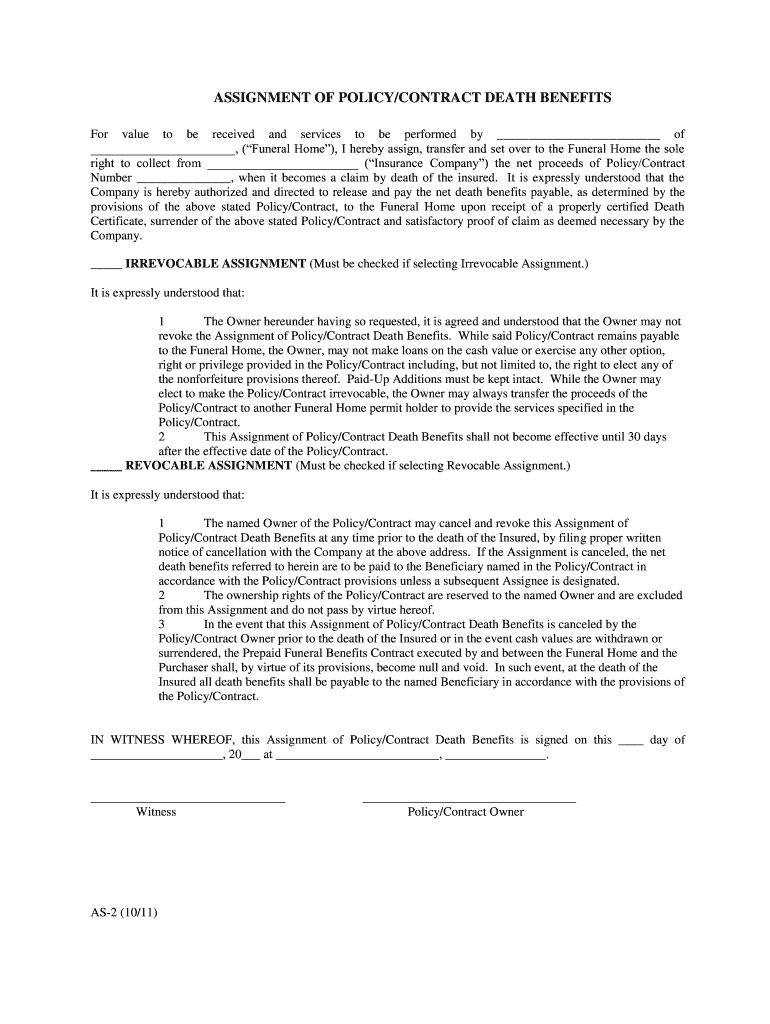

Source: signnow.com

Source: signnow.com

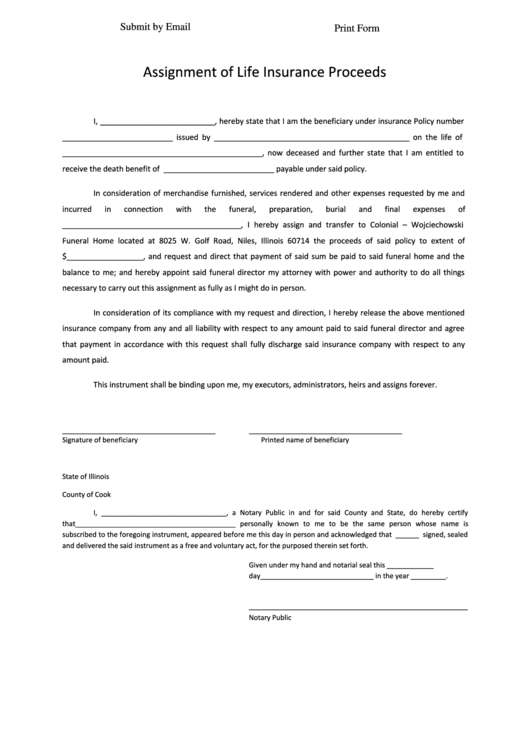

That’s the beauty of having funeral insurance—it’s your policy to do with whatever you want, whenever you want. How can i change the owner of my life insurance policy? All you need to do is fill out a simple form and send it to the life insurance company. A beneficiary of a life insurance policy can fill out an assignment form at the funeral home, which will allow payment of the settlement to go directly to the funeral home. This reduces the cash value and the death benefit, but keeps the policy in place.

Source: sullivanfuneralcare.com

Source: sullivanfuneralcare.com

The irs also has a stipulation about the “incidents of ownership”. Take out a loan on the cash value. The type of policy you signed up for and the life insurance company determine whether a policy is assignable. In our opinion, a funeral trust is really the simplest way to protect your final expense life insurance assets from nursing homes. That’s the peace of mind we offer you.

Source: coastlendmortgage.com

Source: coastlendmortgage.com

This reduces the cash value and the death benefit, but keeps the policy in place. A life insurance company may provide an individual with the option of irrevocably transferring ownership of a revocable life insurance policy that funds a burial contract to a trust established by the funeral company. A life insurance assignment is a document that allows a beneficiary to transfer the ownership rights of a policy to a third party such as a funeral home or funeral assignment funding company. Transferring to that third party rights of ownership under a policy can be limited to certain costs related to burial and funeral services, or for amounts up to the value of the. If so, she is currently not qualified for benefits if her assets are over the threshold.

Source: pdffiller.com

Source: pdffiller.com

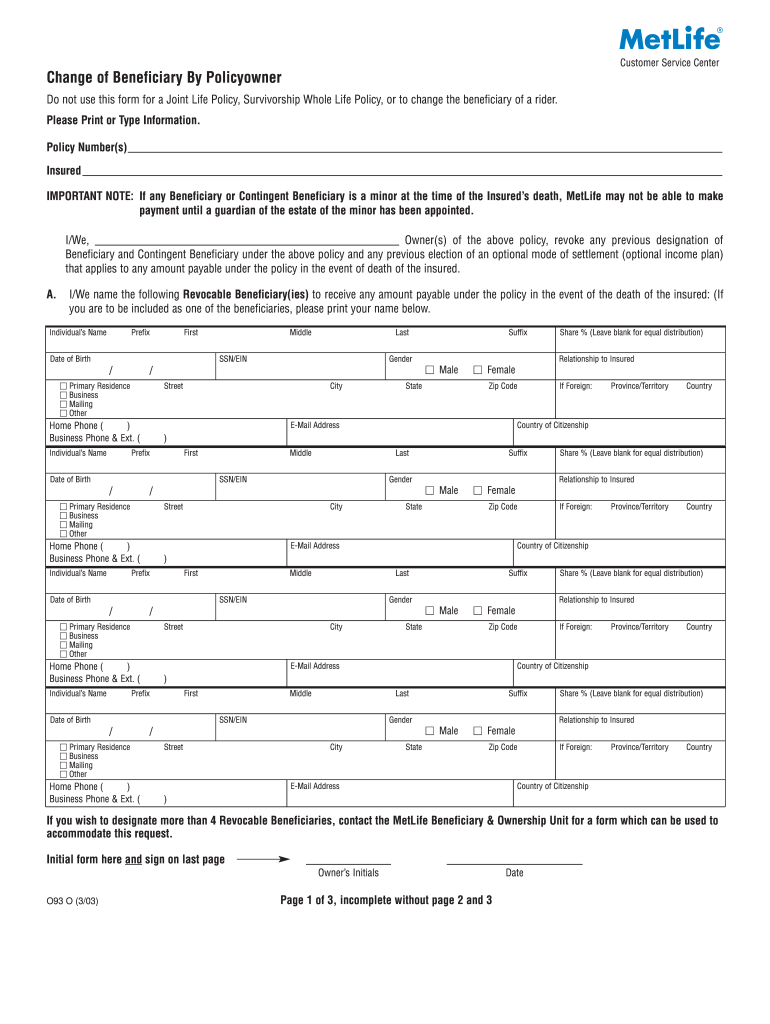

The short answer is “no.”. A beneficiary of a life insurance policy can fill out an assignment form at the funeral home, which will allow payment of the settlement to go directly to the funeral home. Request to change beneficiary/ownership on life insurance policies the prudential insurance company of america pruco life insurance company of new jersey pruco life insurance company all are prudential financial companies. A life insurance company may provide an individual with the option of irrevocably transferring ownership of a revocable life insurance policy that funds a burial contract to a trust established by the funeral company. Transferring to that third party rights of ownership under a policy can be limited to certain costs related to burial and funeral services, or for amounts up to the value of the.

Source: slideshare.net

Source: slideshare.net

No, the cash value of the policy is a countable asset and any transfer would cause a period of ineligibility for benefits based on that cash value. As a licensed funeral director, i suggest an insurance policy made as irrevocable change of ownership to funeral home, no one can cash it out during life, but premiums still have to be paid regularly. If so, she is currently not qualified for benefits if her assets are over the threshold. Every state allows a maximum amount of money contributed to this particular trust (up to $15,000, depending on the state). Any transfer needs to be for healthcare.

Source: lifeinsuranceadvisor.us

Source: lifeinsuranceadvisor.us

All you need to do is fill out a simple form and send it to the life insurance company. No, the cash value of the policy is a countable asset and any transfer would cause a period of ineligibility for benefits based on that cash value. A life insurance company may provide an individual with the option of irrevocably transferring ownership of a revocable life insurance policy that funds a burial contract to a trust established by the funeral company. When you review your policy, make sure it is “assignable.”. You can call the life insurance company directly and.

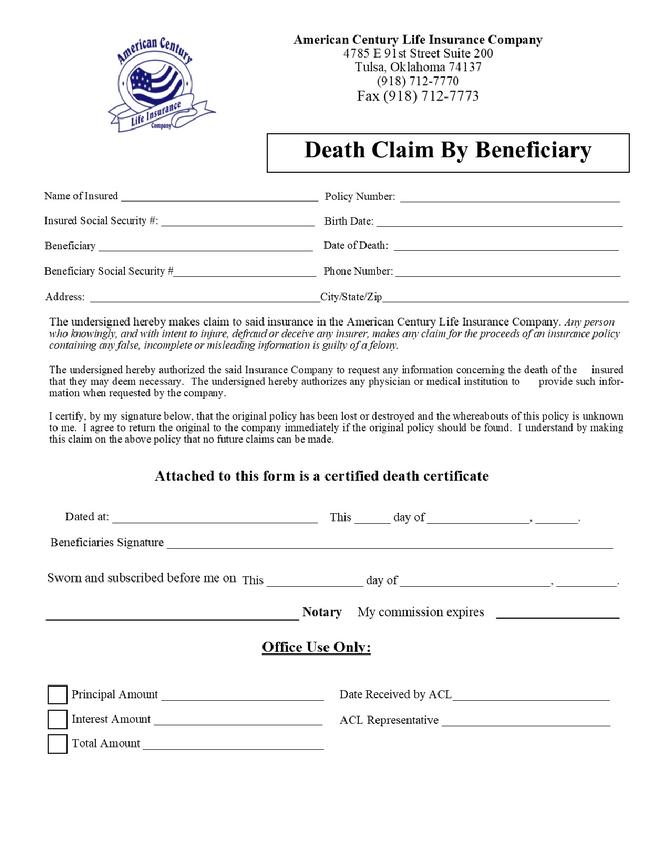

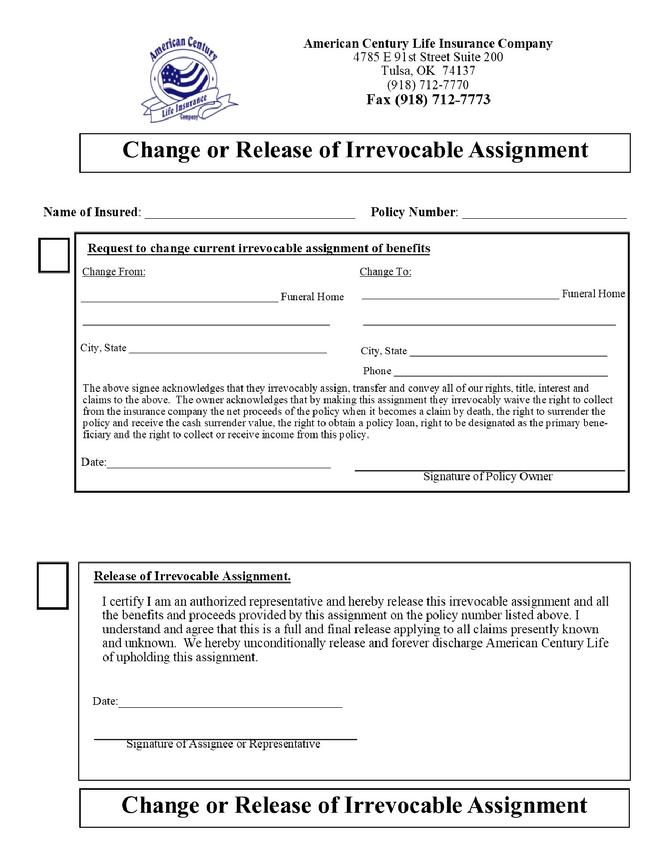

Source: acl-ok.com

Source: acl-ok.com

A life insurance claim denied due to lapse following change in ownership may be reversed with the help of an experienced life insurance attorney. As a licensed funeral director, i suggest an insurance policy made as irrevocable change of ownership to funeral home, no one can cash it out during life, but premiums still have to be paid regularly. The type of policy you signed up for and the life insurance company determine whether a policy is assignable. When considering life insurance policies and medicaid eligibility, the owner of the policy is who matters. However, if there is a significant difference between the policy’s cash value and the death benefit, it can make sense to eliminate the cash value by borrowing against it and spending down the.

Source: acl-ok.com

Source: acl-ok.com

If you transfer a policy and die within three years of the transfer date, it’s still considered part of your estate for taxation purposes. A life insurance assignment is a document that allows a beneficiary to transfer the ownership rights of a policy to a third party such as a funeral home or funeral assignment funding company. The short answer is “no.”. Therefore, a medicaid applicant can have a friend or relative, such as an adult child, niece, or nephew purchase the insurance policy at the cash surrender value, pay the premiums, and. A beneficiary of a life insurance policy can fill out an assignment form at the funeral home, which will allow payment of the settlement to go directly to the funeral home.

Source: slideshare.net

Source: slideshare.net

Any transfer needs to be for healthcare. Though many types of life insurance policies and coverage exist, in general, a life insurance policy obligates an insurance company to pay the beneficiaries of the policy a certain amount of money when the policyholder dies or becomes terminally ill. How can i change the owner of my life insurance policy? Most areas have laws against this. If so, she is currently not qualified for benefits if her assets are over the threshold.

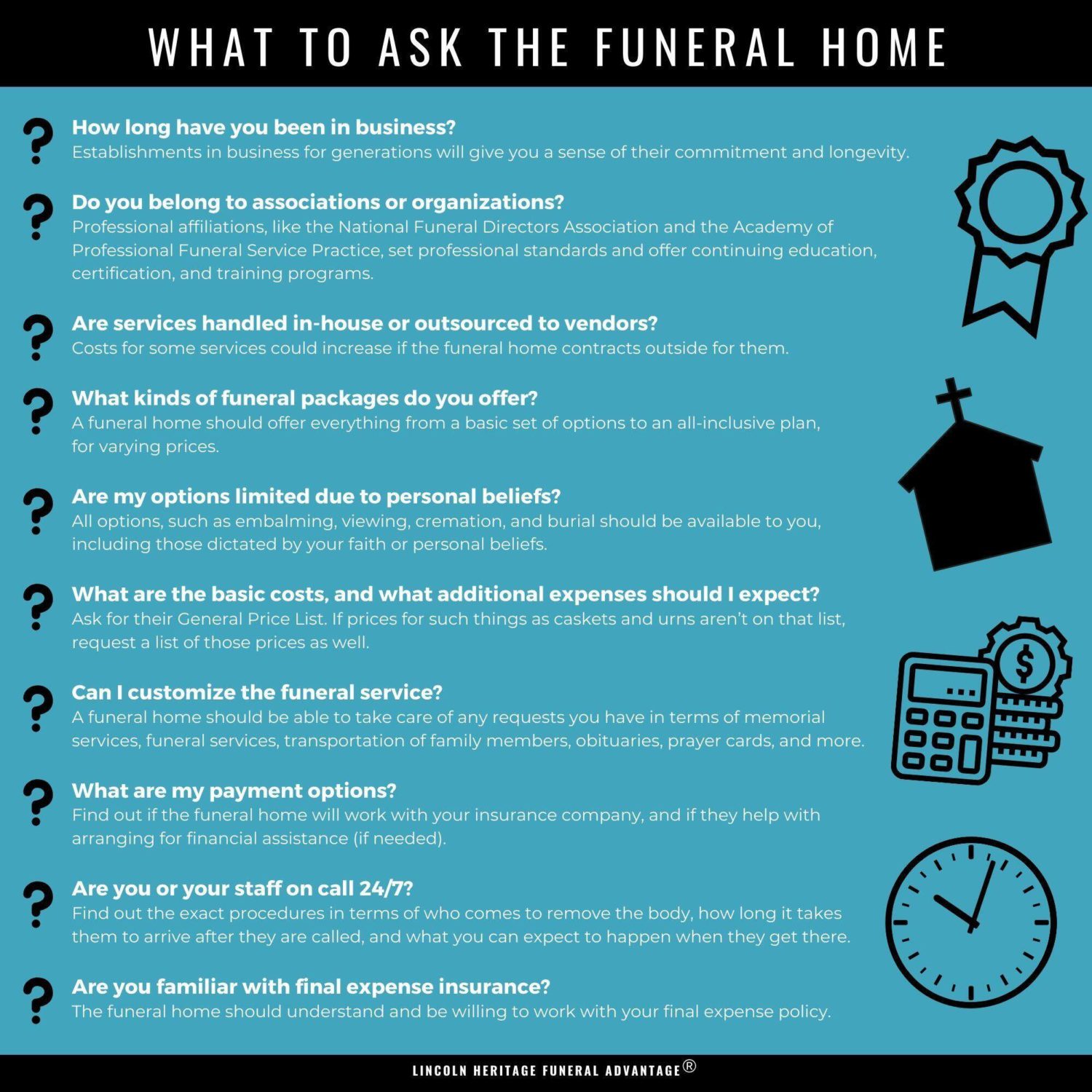

Source: lhlic.com

Source: lhlic.com

The general rule is no, applicants for medicaid may not transfer assets during the five years prior to application without triggering a waiting period for benefits. The irs also has a stipulation about the “incidents of ownership”. However, if there is a significant difference between the policy’s cash value and the death benefit, it can make sense to eliminate the cash value by borrowing against it and spending down the. In our opinion, a funeral trust is really the simplest way to protect your final expense life insurance assets from nursing homes. When you review your policy, make sure it is “assignable.”.

Source: childforallseasons.com

Source: childforallseasons.com

You can breathe easier knowing that final expenses will be paid through your insurance policy, but many people ask if there is a way to cut to the chase and have the funeral home listed as the beneficiary. Though many types of life insurance policies and coverage exist, in general, a life insurance policy obligates an insurance company to pay the beneficiaries of the policy a certain amount of money when the policyholder dies or becomes terminally ill. You must be able to assign the benefits to go to a third party who will file the claim for you (the funeral home, or an assignment company). However, if there is a significant difference between the policy’s cash value and the death benefit, it can make sense to eliminate the cash value by borrowing against it and spending down the. A life insurance assignment is a document that allows a beneficiary to transfer the ownership rights of a policy to a third party such as a funeral home or funeral assignment funding company.

Source: slideshare.net

Source: slideshare.net

By assigning the policy to the trust, the insured is effectively transferring ownership of the life insurance policy to the funeral trust and as a. This reduces the cash value and the death benefit, but keeps the policy in place. You may, however, withdraw the cash value in excess of $1,500 and spend it down, perhaps prepaying for your mother’s funeral if you haven’t done that already. In our opinion, a funeral trust is really the simplest way to protect your final expense life insurance assets from nursing homes. How can i change the owner of my life insurance policy?

Source: formsbank.com

Source: formsbank.com

A life insurance company may provide an individual with the option of irrevocably transferring ownership of a revocable life insurance policy that funds a burial contract to a trust established by the funeral company. By assigning the policy to the trust, the insured is effectively transferring ownership of the life insurance policy to the funeral trust and as a. No, the cash value of the policy is a countable asset and any transfer would cause a period of ineligibility for benefits based on that cash value. You may, however, withdraw the cash value in excess of $1,500 and spend it down, perhaps prepaying for your mother’s funeral if you haven’t done that already. This reduces the cash value and the death benefit, but keeps the policy in place.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title transfer ownership of life insurance policy to funeral home by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information