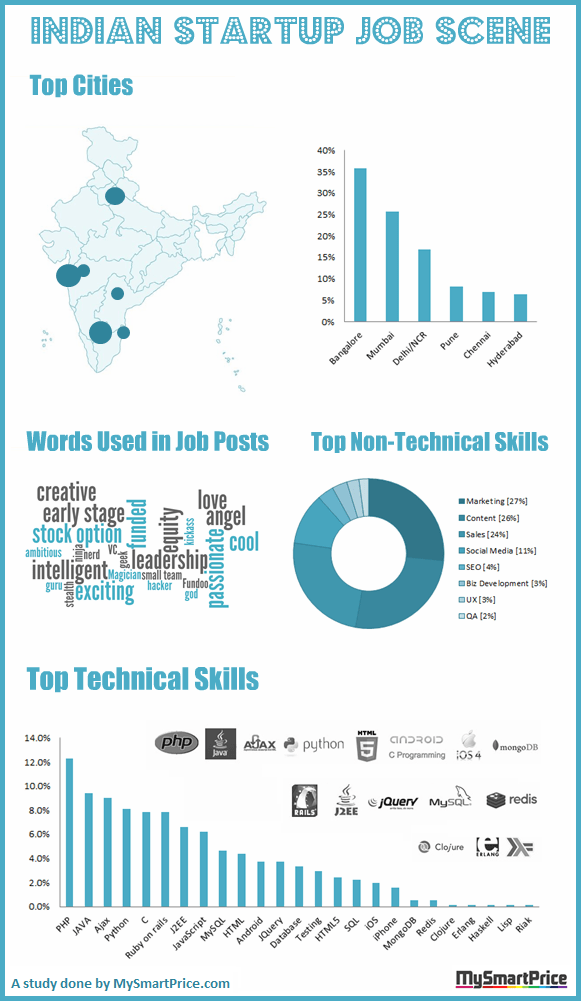

Transit insurance percentage in india information

Home » Trend » Transit insurance percentage in india informationYour Transit insurance percentage in india images are ready in this website. Transit insurance percentage in india are a topic that is being searched for and liked by netizens today. You can Find and Download the Transit insurance percentage in india files here. Find and Download all royalty-free photos and vectors.

If you’re looking for transit insurance percentage in india images information connected with to the transit insurance percentage in india keyword, you have pay a visit to the right site. Our site frequently gives you hints for viewing the maximum quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

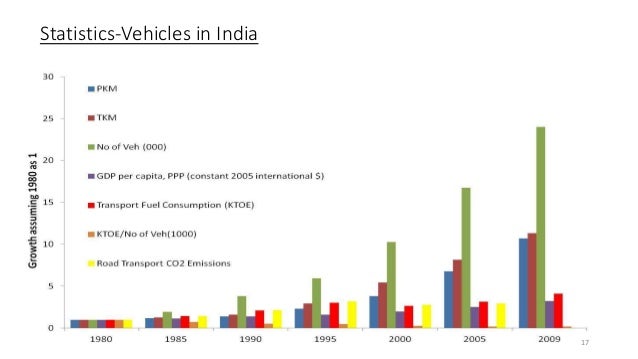

Transit Insurance Percentage In India. Transportation industry contributed roughly 6.3% of gdp and is majorly dominated by road sector. We offer specially curated plans for covering the risk of theft, malicious. Lancier224@yahoo.com or call lanre on 08033054437. Once we receive the above information, we will determine the rate and compute premium payable.

INSURANCE PERCENTAGE IN INDIA CoverNest Blog From covernest.com

INSURANCE PERCENTAGE IN INDIA CoverNest Blog From covernest.com

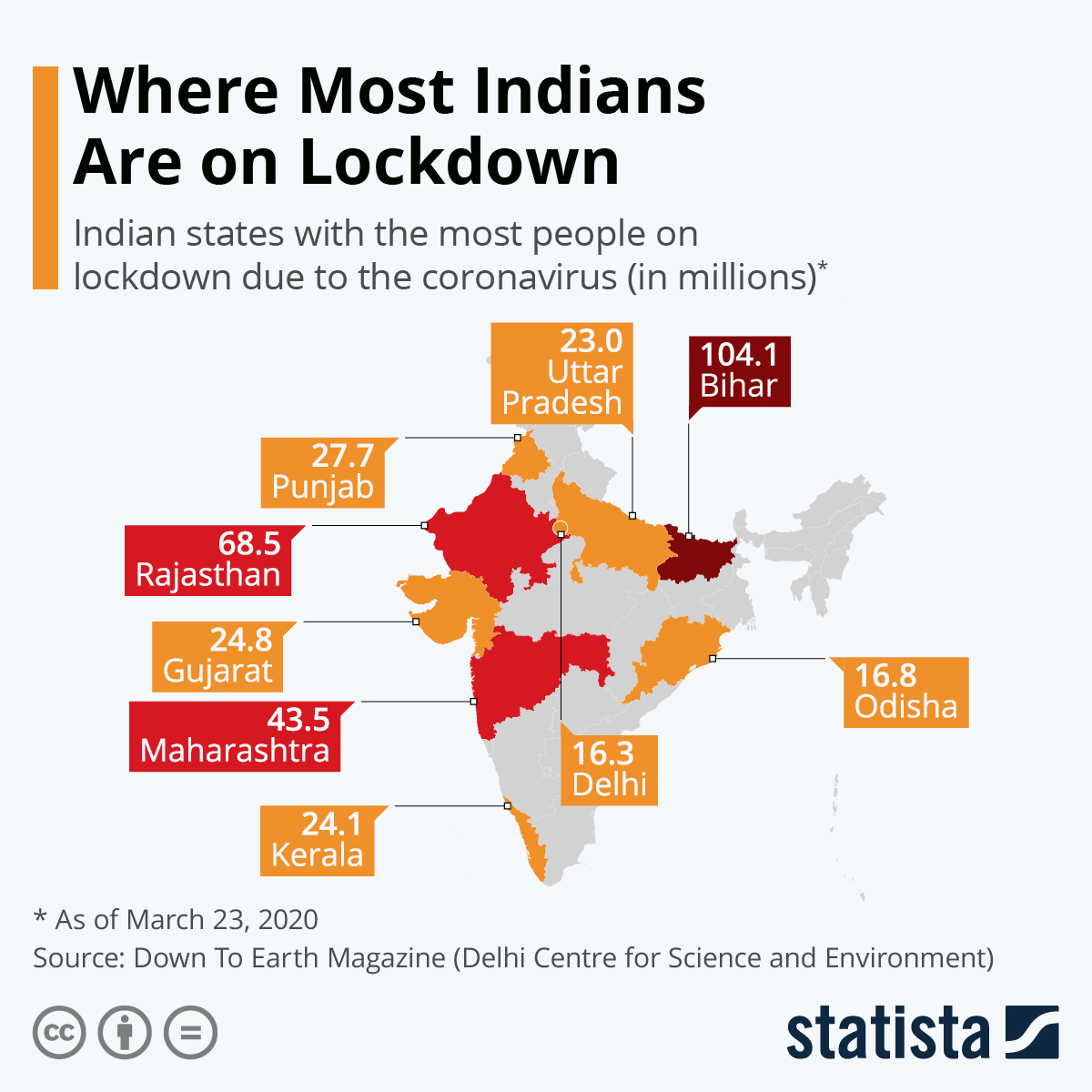

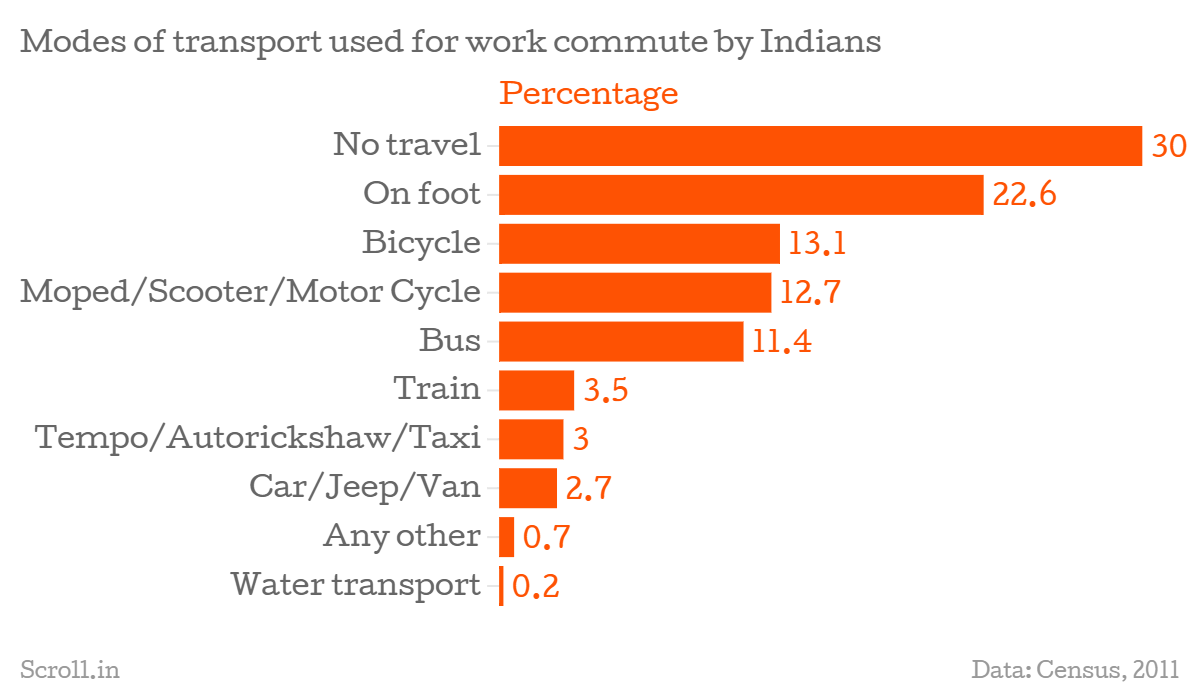

Cost of transit insurance @ 1.5% = rs. If you are using your vehicle for transporting your goods, then this insurance will cover the goods against damages. 5.36% (0.61 and 0.62 m) duronto express is the fastest train in india (known as restless in bengali) railways in india is divided. Started at ₹425 no financial losses due to damage of goods in transit. 4) value of goods per annum. The share of public transport is just 18.1% of work trips.

According to the survey more than 50% of the workforce (excluding domestic and agriculture) continue to work at home or travel to their workplace by foot in the absence of adequate transport facilities.

According to the survey more than 50% of the workforce (excluding domestic and agriculture) continue to work at home or travel to their workplace by foot in the absence of adequate transport facilities. Practitioners of marine insurance must familiarize themselves. If you are using multiple vessels for transporting your goods, then you should take an insurance plan of this kind as it will cover the goods that are transported through more than one vehicle. Royal sundaram marine insurance covers loss or damage of goods in transit and all other risks. If you are using your vehicle for transporting your goods, then this insurance will cover the goods against damages. Marine cargo insurance policy provides commercial indemnity and it is customary to issue policies on agreed value basis.

Source: bemoneyaware.com

Source: bemoneyaware.com

Marine cargo insurance primarily covers loss during transit caused due to fire, explosion, hijacks, accidents, collisions, and overturning. 3360 + taxes over to you moving insurance is very important to protect the safety of your goods. Our expertise is trucking so we know what coverage’s you need to protect your assets and keep your Gst rates on packers and movers is 18% for complete packing and moving services. According to the survey more than 50% of the workforce (excluding domestic and agriculture) continue to work at home or travel to their workplace by foot in the absence of adequate transport facilities.

Source: ticsyformacion.com

Source: ticsyformacion.com

- number of trips per annum. If you are using multiple vessels for transporting your goods, then you should take an insurance plan of this kind as it will cover the goods that are transported through more than one vehicle. Marine insurance policy provides coverage for all means of transportation example road, railway, air, sea, couriers and postal service. 6) limit per carriage per one loss. Cost of transit insurance @ 1.5% = rs.

Source: slideshare.net

Source: slideshare.net

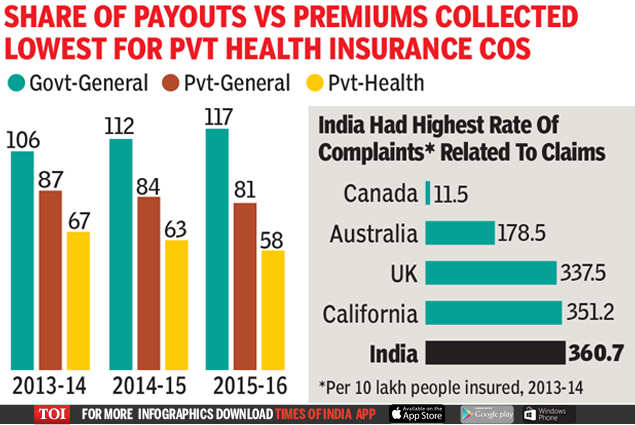

The system of insuring import goods against the payment of import duty accruing from the loss and pilferage of transit cargo while in transit in india, is called duty insurance. The insurance company generally agrees to the sum insured up to 10% to 15% higher value than total cif value mentioned in the invoice. It also covers situations like jettison and washing overboard. Marine cargo insurance primarily covers loss during transit caused due to fire, explosion, hijacks, accidents, collisions, and overturning. 5.36% (0.61 and 0.62 m) duronto express is the fastest train in india (known as restless in bengali) railways in india is divided.

Source: emarketer.com

Source: emarketer.com

Marine cargo insurance policy provides commercial indemnity and it is customary to issue policies on agreed value basis. 1860 258 0000, 1860 425 0000 Coverage for general average sacrifice salvages charges. Marine cargo insurance primarily covers loss during transit caused due to fire, explosion, hijacks, accidents, collisions, and overturning. The system of insuring import goods against the payment of import duty accruing from the loss and pilferage of transit cargo while in transit in india, is called duty insurance.

![Webinar Why India�s [draft] Road Transport and Safety Webinar Why India�s [draft] Road Transport and Safety](https://image.slidesharecdn.com/webinarroadtransportsafetybill-141020053751-conversion-gate02/95/webinar-why-indias-draft-road-transport-and-safety-bill-2014-matters-for-citizens-13-638.jpg?cb=1413783604) Source: slideshare.net

Source: slideshare.net

Has specialized in commercial truck insurance for over 30 years. 094444 48899 | customer service: Imagine if anything goes wrong, you will be completely lost and it hardly cost anything. Protection against any natural calamities such as an earthquake or lightning. Insurance for transit of goods provides cover under the 3 types of inland transit clauses as mentioned below:

Source: timesofindia.indiatimes.com

Source: timesofindia.indiatimes.com

1680 + taxes cost of all inclusive insurance @ 3% = rs. Sum insured in a marine cargo policy is normally based on actual invoice value plus expenses incidental to transit (generally not. Protection against any natural calamities such as an earthquake or lightning. ‘duty’ policies to cover duty payable on the imported. 4) value of goods per annum.

Source: fashionstance.blogspot.com

Source: fashionstance.blogspot.com

The insurance company generally agrees to the sum insured up to 10% to 15% higher value than total cif value mentioned in the invoice. Marine cargo insurance policy provides commercial indemnity and it is customary to issue policies on agreed value basis. Railways in india are found in three gauges: It’s not a good idea to ignore moving insurance. Under the treaty of transit, three types of duty insurance policy coverage depending on the means and ownership of transport are required as follows:

Source: slideshare.net

Source: slideshare.net

1680 + taxes cost of all inclusive insurance @ 3% = rs. 5.36% (0.61 and 0.62 m) duronto express is the fastest train in india (known as restless in bengali) railways in india is divided. Sum insured in a marine cargo policy is normally based on actual invoice value plus expenses incidental to transit (generally not. Cost of transit insurance @ 1.5% = rs. Gst rates for domestic shifting

Source: investindia.gov.in

Source: investindia.gov.in

We offer specially curated plans for covering the risk of theft, malicious. 5) number of trips per annum. The system of insuring import goods against the payment of import duty accruing from the loss and pilferage of transit cargo while in transit in india, is called duty insurance. You could either email the details of the above requirements to: We pride ourselves on our exceptional knowledge of the industry and the excellent customer service we provide to our clients.

Source: slideshare.net

Source: slideshare.net

The system of insuring import goods against the payment of import duty accruing from the loss and pilferage of transit cargo while in transit in india, is called duty insurance. 3360 + taxes over to you moving insurance is very important to protect the safety of your goods. Imagine if anything goes wrong, you will be completely lost and it hardly cost anything. The amount of loss payable on marine insurance policy is based on cif value of goods plus an agreed percentage. 4) value of goods per annum.

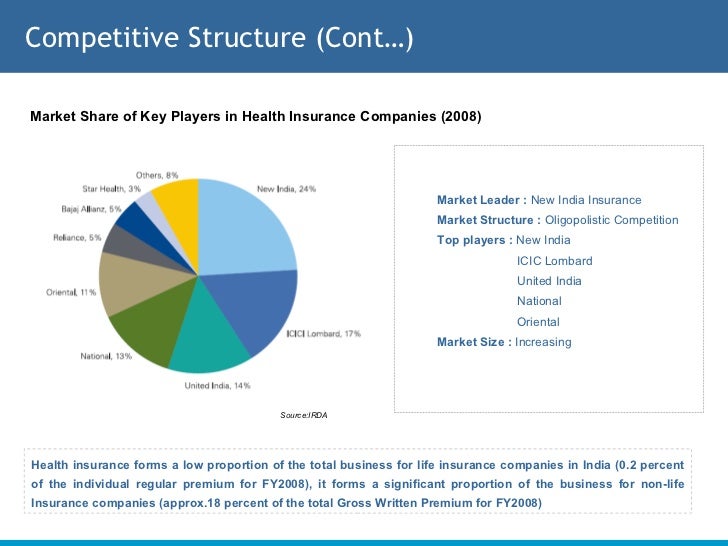

Source: worldbank.org

Has specialized in commercial truck insurance for over 30 years. 5) number of trips per annum. In the fiscal year of 2021, nearly 514 million people across india were covered under health insurance schemes. Once we receive the above information, we will determine the rate and compute premium payable. 5.36% (0.61 and 0.62 m) duronto express is the fastest train in india (known as restless in bengali) railways in india is divided.

Source: covernest.com

Source: covernest.com

Marine insurance policy provides coverage for all means of transportation example road, railway, air, sea, couriers and postal service. 6) limit per carriage per one loss. Cost of transit insurance @ 1.5% = rs. It covers expenses such as survey fees, forwarding expenses, costs of reconditioning and charges of sue. Marine insurance policy provides coverage for all means of transportation example road, railway, air, sea, couriers and postal service.

Source: gso.gov.vn

Source: gso.gov.vn

If you are using your vehicle for transporting your goods, then this insurance will cover the goods against damages. Practitioners of marine insurance must familiarize themselves. Our expertise is trucking so we know what coverage’s you need to protect your assets and keep your 4) value of goods per annum. Gst rates for domestic shifting

Source: slideshare.net

Source: slideshare.net

Lancier224@yahoo.com or call lanre on 08033054437. Has specialized in commercial truck insurance for over 30 years. While renewal premium accounted for 54.75 percent of the total premium received by the life insurers, new business contributed the remaining 45.25 percent. Imagine if anything goes wrong, you will be completely lost and it hardly cost anything. In the fiscal year of 2021, nearly 514 million people across india were covered under health insurance schemes.

Source: revisi.net

Source: revisi.net

In the fiscal year of 2021, nearly 514 million people across india were covered under health insurance schemes. ‘duty’ policies to cover duty payable on the imported. Marine cargo insurance policy provides commercial indemnity and it is customary to issue policies on agreed value basis. Gst on transit insurance is also 18% table of contents [ hide] a complete guide on packers and movers gst rates in india what is gst? The fundamental principles of marine insurance are drawn from the marine insurance act, 1963* as in all contracts of insurance on property, the contract of marine insurance is based on the fundamental principles of indemnity, insurable interest, utmost good faith, proximate cause, subrogation and contribution.

Source: statista.com

Source: statista.com

We offer specially curated plans for covering the risk of theft, malicious. We pride ourselves on our exceptional knowledge of the industry and the excellent customer service we provide to our clients. Started at ₹425 no financial losses due to damage of goods in transit. 4) value of goods per annum. Cost of transit insurance @ 1.5% = rs.

Source: slideshare.net

Source: slideshare.net

The amount of loss payable on marine insurance policy is based on cif value of goods plus an agreed percentage. Marine cargo insurance primarily covers loss during transit caused due to fire, explosion, hijacks, accidents, collisions, and overturning. Cover your goods in transit with marine cargo insurance policy! Started at ₹425 no financial losses due to damage of goods in transit. It covers expenses such as survey fees, forwarding expenses, costs of reconditioning and charges of sue.

Source: scroll.in

Source: scroll.in

Citizens are largely dependent on private transport. Marine insurance policy provides coverage for all means of transportation example road, railway, air, sea, couriers and postal service. Practitioners of marine insurance must familiarize themselves. Railways in india are found in three gauges: It also covers situations like jettison and washing overboard.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title transit insurance percentage in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information