Transunion auto insurance score Idea

Home » Trending » Transunion auto insurance score IdeaYour Transunion auto insurance score images are available in this site. Transunion auto insurance score are a topic that is being searched for and liked by netizens today. You can Find and Download the Transunion auto insurance score files here. Find and Download all free photos and vectors.

If you’re looking for transunion auto insurance score pictures information linked to the transunion auto insurance score keyword, you have visit the right blog. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly search and find more informative video content and images that match your interests.

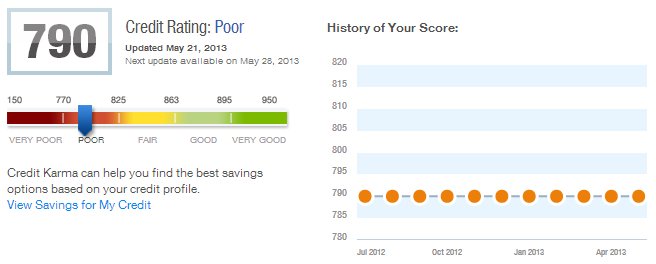

Transunion Auto Insurance Score. Transunion auto insurance scores, also known as transunion truerisk scores or transunion insurance risk scores, range from 150 to 950, unlike typical credit scores. Vehicle history score, a more accurate way to score a vehicle’s risk, could save acceptance customers money on their auto insurance. If your insurance score is low, that means that you’re potentially a higher insurance risk, and that you may end up paying a higher premium each month. Better identify consumers who meet your risk levels.

Armed with these innovative tools, you can better target and retain customers, improve. An auto insurance score (ais) assigns a level of insurance risk to each individual. Tru) revealed that 21.7% of consumers were shopping for personal auto insurance in 2018, up from 20% the previous year. How do i get my insurance score? Vehicle history score, a more accurate way to score a vehicle’s risk, could save acceptance customers money on their auto insurance. (acceptance) received approval from the california department of insurance on february 19, 2021, to use the transunion vehicle history score powered by carfax ® to help set auto insurance rates.

A good score is usually around 770 or higher.

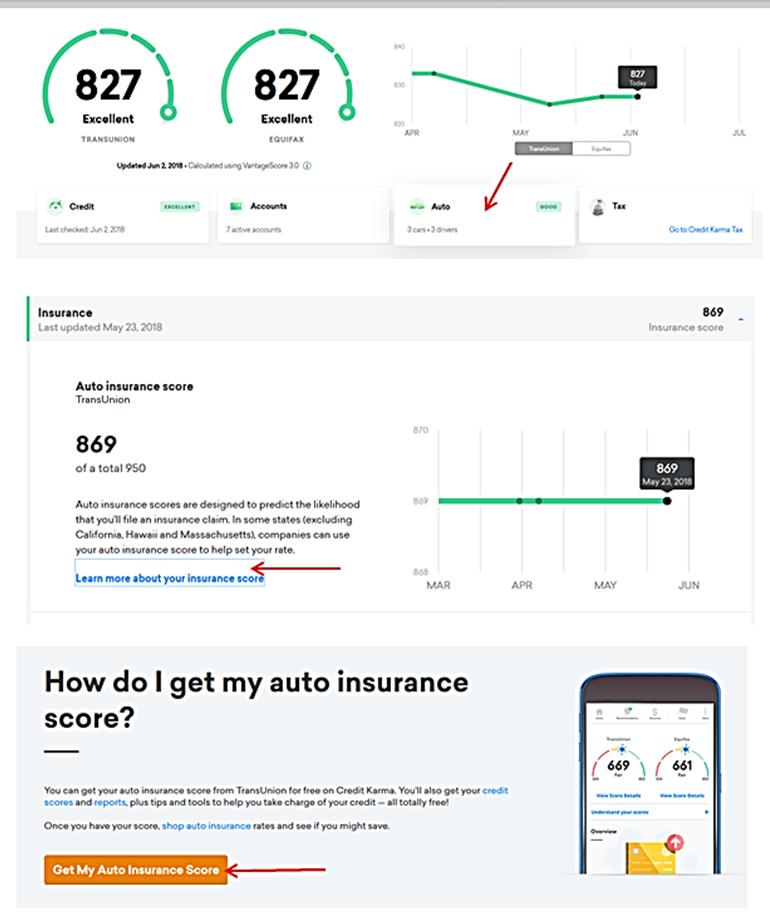

When you get an auto quote, you can opt to see your insurance score for free. Doing so helps us keep our platform safe and affordable for everyone. Acceptance to use transunion vehicle history score to underwrite auto insurance. Transunion�s insurance scores allow you to see both your auto and property scores and the factors that impact each. The credit score you receive is based on the vantagescore 3.0 model and may not be the credit score model used by your lender. Tailor offers to consumer based on anticipated need and behavior.

On the other hand, lexisnexis insurance scores range from 200. Transunion auto insurance scores, also known as transunion truerisk scores or transunion insurance risk scores, range from 150 to 950, unlike typical credit scores. On the other hand, lexisnexis insurance scores range from 200. Transunion solutions can help you protect your book against fraud, identify and verify consumers, and market effectively with timely offers. In partnership with transunion, auto insurance valuescore enables marketers to target new auto insurance prospects who are most likely to resemble their most valuable existing customers.

A good score is usually around 770 or higher. A good score is usually around 770 or higher. Tru) revealed that 21.7% of consumers were shopping for personal auto insurance in 2018, up from 20% the previous year. Doing so helps us keep our platform safe and affordable for everyone. Transunion�s insurance scores allow you to see both your auto and property scores and the factors that impact each.

Source: newsroom.transunion.com

Source: newsroom.transunion.com

A good score is usually around 770 or higher. First acceptance insurance company, inc. On the other hand, lexisnexis insurance scores range from 200. Millennial and gen z consumers played a large role in. Once you�re a say driver, you can access your insurance score at anytime through your mysay dashboard.

One of the unique features of transunion scores is transparency, meaning that the consumer and the insurance agent can see how the score was calculated. It has been consistently reporting my score as 795 for as long as i can remember. On the other hand, lexisnexis insurance scores range from 200. Fico personal finance score 95. Transunion auto insurance scores, also known as transunion truerisk scores or transunion insurance risk scores, range from 150 to 950, unlike typical credit scores.

Fico personal finance score 95. With say, there are two ways. A good score is usually around 770 or higher. While most rating plans on the market classify vehicles into groups. If you only want to see your insurance score, you can use our insurance score quote (also free).

Transunion solutions can help you protect your book against fraud, identify and verify consumers, and market effectively with timely offers. In partnership with transunion, auto insurance valuescore enables marketers to target new auto insurance prospects who are most likely to resemble their most valuable existing customers. If you only want to see your insurance score, you can use our insurance score quote (also free). Vehicle history score, a more accurate way to score a vehicle’s risk, could save acceptance customers money on their auto insurance. First acceptance insurance company received approval from the california department of insurance on february 19, 2021, to use the transunion vehicle history score powered by carfax ® to help set auto insurance rates.

A good score is usually around 770 or higher. In partnership with transunion, auto insurance valuescore enables marketers to target new auto insurance prospects who are most likely to resemble their most valuable existing customers. A good score is usually around 770 or higher. If you only want to see your insurance score, you can use our insurance score quote (also free). Fico personal finance score 95.

Source: travelwithgrant.boardingarea.com

Source: travelwithgrant.boardingarea.com

Transunion insurance risk scores the insurance risk scores developed at transunion are predictive scoring models that use credit information to assist insurance carriers inevaluating risk. How does my insurance score impact my insurance. A good score is usually around 770 or higher. The number of consumers shopping for personal auto insurance is on the rise, driven largely by the youngest generations. You can monitor your transunion auto insurance score for free on credit karma, along with your free credit reports and vantagescore 3.0 scores from transunion and equifax.

Typical insurance scores range from 200 to 997; It has been consistently reporting my score as 795 for as long as i can remember. A household marketing indicator that solely ranks prospects into categories of preferred, standard and nonstandard segments, auto insurance valuescore can be used in any marketing. Transunion insurance risk scores the insurance risk scores developed at transunion are predictive scoring models that use credit information to assist insurance carriers inevaluating risk. How do i get my insurance score?

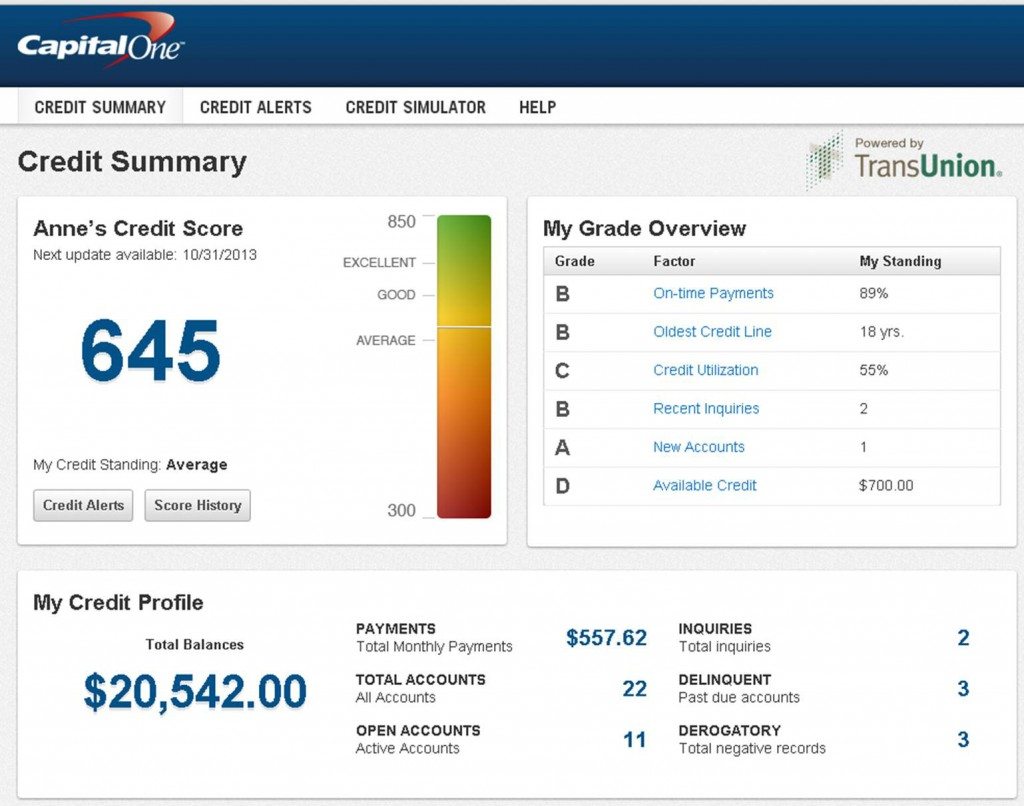

How does my insurance score impact my insurance. According to the zebra’s “the state of auto insurance report for 2020,” drivers with poor credit scores (300 to 579) pay more than twice as much for their auto insurance compared to people with exceptional credit scores (800 to 850). One of the unique features of transunion scores is transparency, meaning that the consumer and the insurance agent can see how the score was calculated. Better identify consumers who meet your risk levels. Transunion�s insurance scores allow you to see both your auto and property scores and the factors that impact each.

Tru) revealed that 21.7% of consumers were shopping for personal auto insurance in 2018, up from 20% the previous year. Once you�re a say driver, you can access your insurance score at anytime through your mysay dashboard. While most rating plans on the market classify vehicles into groups. An auto insurance score (ais) assigns a level of insurance risk to each individual. A household marketing indicator that solely ranks prospects into categories of preferred, standard and nonstandard segments, auto insurance valuescore can be used in any marketing.

Transunion auto insurance scores, also known as transunion truerisk scores or transunion insurance risk scores, range from 150 to 950, unlike typical credit scores. It has been consistently reporting my score as 795 for as long as i can remember. How do i get my insurance score? The newly released auto insurance shopping index from transunion (nyse: Last week, i dropped progressive and went back to usaa.

Source: mybanktracker.com

Source: mybanktracker.com

Transunion auto insurance scores, also known as transunion truerisk scores or transunion insurance risk scores, range from 150 to 950, unlike typical credit scores. Transunion�s insurance scores allow you to see both your auto and property scores and the factors that impact each. Last week, i dropped progressive and went back to usaa. Transunion insurance risk scores the insurance risk scores developed at transunion are predictive scoring models that use credit information to assist insurance carriers inevaluating risk. Doing so helps us keep our platform safe and affordable for everyone.

Doing so helps us keep our platform safe and affordable for everyone. A good score is usually around 770 or higher. We receive ais from the credit reporting agency transunion. Millennial and gen z consumers played a large role in. When you get an auto quote, you can opt to see your insurance score for free.

Source: insurancecomswa.blogspot.com

Fico personal finance score 95. Once you�re a say driver, you can access your insurance score at anytime through your mysay dashboard. (acceptance) received approval from the california department of insurance on february 19, 2021, to use the transunion vehicle history score powered by carfax ® to help set auto insurance rates. If your score is high, then it’s. Transunion auto insurance scores, also known as transunion truerisk scores or transunion insurance risk scores, range from 150 to 950, unlike typical credit scores.

A household marketing indicator that solely ranks prospects into categories of preferred, standard and nonstandard segments, auto insurance valuescore can be used in any marketing. The number of consumers shopping for personal auto insurance is on the rise, driven largely by the youngest generations. Use trended data for a more accurate risk score , incorporating how an individual has changed their credit usage and payment behaviors over time. Transunion auto insurance scores, also known as transunion truerisk scores or transunion insurance risk scores, range from 150 to 950, unlike typical credit scores. The newly released auto insurance shopping index from transunion (nyse:

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

Armed with these innovative tools, you can better target and retain customers, improve. The credit score you receive is based on the vantagescore 3.0 model and may not be the credit score model used by your lender. Transunion solutions can help you protect your book against fraud, identify and verify consumers, and market effectively with timely offers. On the other hand, lexisnexis insurance scores range from 200. Once you�re a say driver, you can access your insurance score at anytime through your mysay dashboard.

Source: creditsesame.com

Source: creditsesame.com

The credit score you receive is based on the vantagescore 3.0 model and may not be the credit score model used by your lender. An auto insurance score (ais) assigns a level of insurance risk to each individual. In partnership with transunion, auto insurance valuescore enables marketers to target new auto insurance prospects who are most likely to resemble their most valuable existing customers. Last week, i dropped progressive and went back to usaa. Fico personal finance score 95.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title transunion auto insurance score by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information