Types of insurance bonds Idea

Home » Trending » Types of insurance bonds IdeaYour Types of insurance bonds images are ready. Types of insurance bonds are a topic that is being searched for and liked by netizens now. You can Get the Types of insurance bonds files here. Find and Download all free vectors.

If you’re searching for types of insurance bonds pictures information connected with to the types of insurance bonds topic, you have visit the ideal site. Our site always gives you suggestions for downloading the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

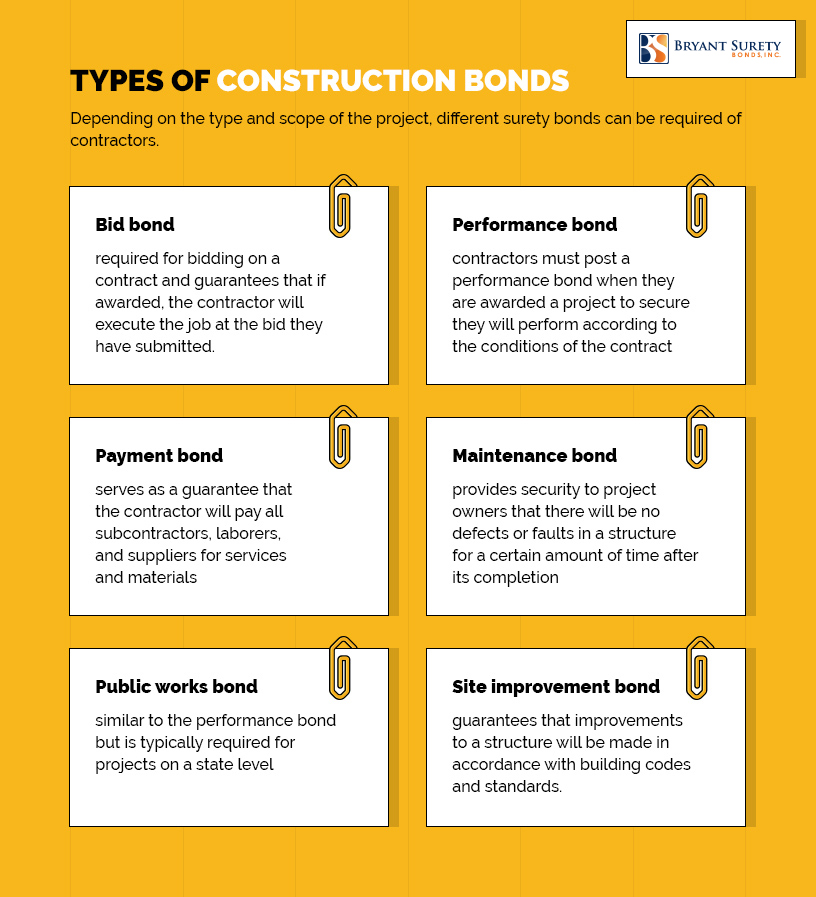

Types Of Insurance Bonds. Typical types of insurance bonds. Project owners can utilise a wide variety of different bond types to protect themselves. Corporate bonds, municipal bonds, government bonds and agency bonds. Business owners policies for professionally driven accounts.

5 Types of Surety Bonds You Might Need Teague Insurance From teagueins.com

5 Types of Surety Bonds You Might Need Teague Insurance From teagueins.com

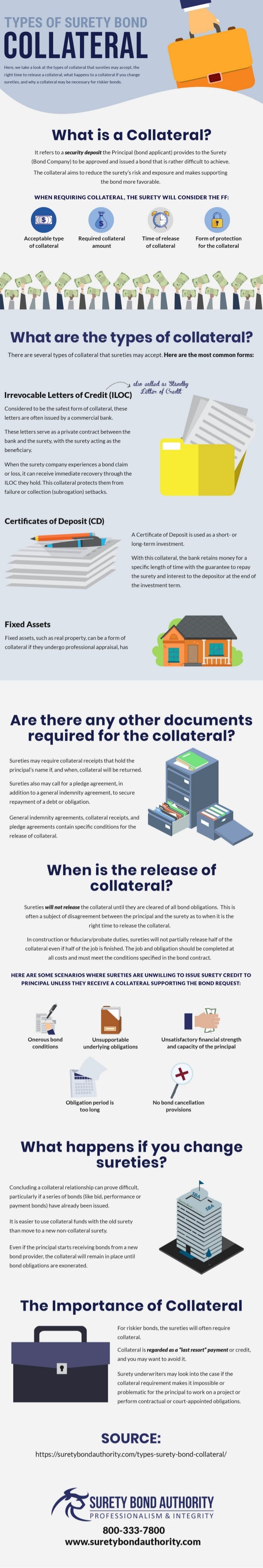

The key types of surety bonds available are: There’s a lot to know here. Most insurance adjuster surety bonds are available for a flat rate (premium), but in some states premiums are variable rates, which can be a s low as 0.5 percent or as high as 10 percent of the. The bonds can be categorised into four variants: The bond prices are inversely proportional to the coupon rate. There are fidelity bonds, performance bonds, contractor bonds, license and permit bonds, auto dealer bonds, there are even payment bonds.

Each has its own durations and risk levels.

They are also the beneficiary in the event of a claim. There are three main types of bonds: Project owners can utilise a wide variety of different bond types to protect themselves. Corporate bonds, municipal bonds, government bonds and agency bonds. Depending on what it covers, life insurance can be classified into various types: Insurance only involves two parties, the insurance carrier and the principal.

Source: swiftbonds.com

Source: swiftbonds.com

The bonds can be categorised into four variants: Typical types of insurance bonds. Although there are many types of insurance bonds, the four most common types needed by business owners are: Commercial auto insurance for professionally driven accounts. When the rate of interest increases the bond prices decrease and rate of interest decreases, the bond price increases.

Source: mgsuretybonds.com

Source: mgsuretybonds.com

Surety bonds are typically provided by a bank or insurance company. The key types of surety bonds available are: Project owners can utilise a wide variety of different bond types to protect themselves. When the rate of interest increases the bond prices decrease and rate of interest decreases, the bond price increases. Corporate bonds are debt securities issued by private and public corporations.

Source: suretybondauthority.com

Source: suretybondauthority.com

Find information on types of bonds at thestreet. Performance bonds help to guarantee that the contractor meets their contractual obligations to the client by performing satisfactory work. Find information on types of bonds at thestreet. The bonds can be categorised into four variants: Depending on what it covers, life insurance can be classified into various types:

Source: suretybondauthority.com

Source: suretybondauthority.com

Such acts include theft, forgery, fraud, and other malicious acts. The premium is a measure of the perceived risk of failure of the issuer. What types of bonds are there? A georgia public adjuster bond, for example, only requires a bond amount of $5,000, while a florida public adjuster bond requires a $50,000 bond amount. The principal is the person or entity required to obtain a bond.

Source: efinancemanagement.com

Source: efinancemanagement.com

The principal is the person or entity required to obtain a bond. Insurance only involves two parties, the insurance carrier and the principal. Each has its own durations and risk levels. A majority of insured securities are municipal bonds issued by states and local governments in the u.s. Project owners can utilise a wide variety of different bond types to protect themselves.

Source: swiftbonds.com

Source: swiftbonds.com

In addition to these four categories, it�s important to understand the basics of what surety bonds are, as well as how to obtain them. This is also referred to as a “contract bond”. Such acts include theft, forgery, fraud, and other malicious acts. Different types of surety bonds. A majority of insured securities are municipal bonds issued by states and local governments in the u.s.

Source: nielsonbonds.com

Source: nielsonbonds.com

The premium is a measure of the perceived risk of failure of the issuer. There’s a lot to know here. The principal is the person or entity required to obtain a bond. The surety is the bonding company backing the bond. They protect companies from employees or clients/customers who intentionally commit deceitful and/or harmful acts that hurt the business and its assets.

Source: businessmagazine.org

Source: businessmagazine.org

Although there are many types of insurance bonds, the four most common types needed by business owners are: The obligee is who is requiring the bond of the principal; A georgia public adjuster bond, for example, only requires a bond amount of $5,000, while a florida public adjuster bond requires a $50,000 bond amount. What types of bonds are there? Project owners can utilise a wide variety of different bond types to protect themselves.

Source: nielsonbonds.com

Source: nielsonbonds.com

They protect companies from employees or clients/customers who intentionally commit deceitful and/or harmful acts that hurt the business and its assets. Each has its own durations and risk levels. We can help with the following types of insurance: The bonds can be categorised into four variants: There’s a lot to know here.

Source: teagueins.com

Source: teagueins.com

The principal is the person or entity required to obtain a bond. Corporate bonds, municipal bonds, government bonds and agency bonds. A georgia public adjuster bond, for example, only requires a bond amount of $5,000, while a florida public adjuster bond requires a $50,000 bond amount. There are just about as many bond types as there are types of insurance policies. The surety is the bonding company backing the bond.

Source: visual.ly

Source: visual.ly

The bond prices are inversely proportional to the coupon rate. The key types of surety bonds available are: Corporate bonds, municipal bonds, government bonds and agency bonds. Business owners policies for professionally driven accounts. These bonds have a lower credit rating, implying higher credit risk.

Source: suretybondsdirect.com

Source: suretybondsdirect.com

A majority of insured securities are municipal bonds issued by states and local governments in the u.s. Find information on types of bonds at thestreet. There are just about as many bond types as there are types of insurance policies. A license and permit bond is a type of surety bond that guarantees businesses will adhere to all laws and regulations enforced by federal, state, local, or other public bodies. The surety is the bonding company backing the bond.

Source: staging.suretybonds.ie

Source: staging.suretybonds.ie

Typical types of insurance bonds. These bonds have a lower credit rating, implying higher credit risk. This is also referred to as a “contract bond”. Depending on what it covers, life insurance can be classified into various types: Such acts include theft, forgery, fraud, and other malicious acts.

![Types of Surety Bonds [Infographic] Types of Surety Bonds [Infographic]](http://cdn2.hubspot.net/hubfs/360382/TYPES_OFSURETYBONDS.jpg) Source: blog.suretysolutionsllc.com

Source: blog.suretysolutionsllc.com

Project owners can utilise a wide variety of different bond types to protect themselves. Each has its own durations and risk levels. The surety is the bonding company backing the bond. However, to understand surety bonds, it may be helpful to break them down into four categories: Business owners policies for professionally driven accounts.

Source: slideshare.net

Source: slideshare.net

There’s a lot to know here. Most insurance adjuster surety bonds are available for a flat rate (premium), but in some states premiums are variable rates, which can be a s low as 0.5 percent or as high as 10 percent of the. This is also referred to as a “contract bond”. When the rate of interest increases the bond prices decrease and rate of interest decreases, the bond price increases. Corporate bonds are debt securities issued by private and public corporations.

Source: bryantsuretybonds.com

Source: bryantsuretybonds.com

Each has its own durations and risk levels. A majority of insured securities are municipal bonds issued by states and local governments in the u.s. There are fidelity bonds, performance bonds, contractor bonds, license and permit bonds, auto dealer bonds, there are even payment bonds. This is also referred to as a “contract bond”. Treasury, savings, agency, municipal, and corporate.

Source: slideshare.net

Source: slideshare.net

Commercial auto insurance for professionally driven accounts. There are five different types of bonds: The bond prices are inversely proportional to the coupon rate. The bonds can be categorised into four variants: Different types of surety bonds.

Source: nielsonbonds.com

Source: nielsonbonds.com

The obligee is who is requiring the bond of the principal; There are four primary types of surety bonds. They protect companies from employees or clients/customers who intentionally commit deceitful and/or harmful acts that hurt the business and its assets. A georgia public adjuster bond, for example, only requires a bond amount of $5,000, while a florida public adjuster bond requires a $50,000 bond amount. Different types of surety bonds.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title types of insurance bonds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information