Types of life insurance policies pdf information

Home » Trend » Types of life insurance policies pdf informationYour Types of life insurance policies pdf images are ready. Types of life insurance policies pdf are a topic that is being searched for and liked by netizens now. You can Find and Download the Types of life insurance policies pdf files here. Download all royalty-free photos and vectors.

If you’re looking for types of life insurance policies pdf pictures information linked to the types of life insurance policies pdf topic, you have visit the ideal site. Our site frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

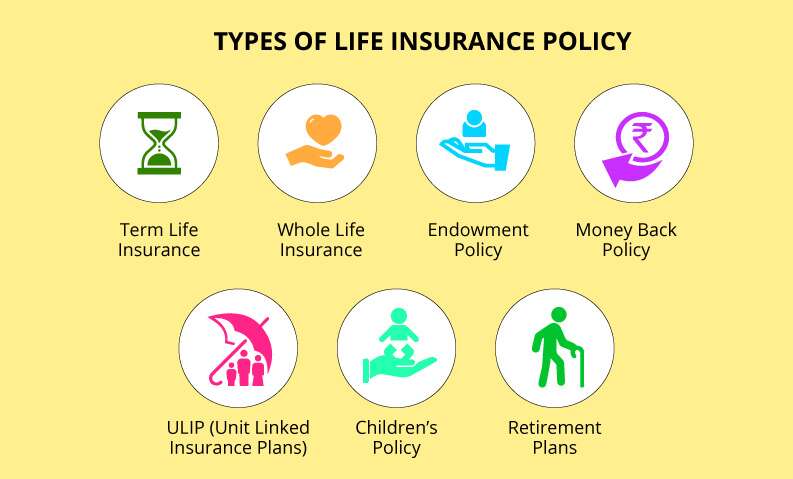

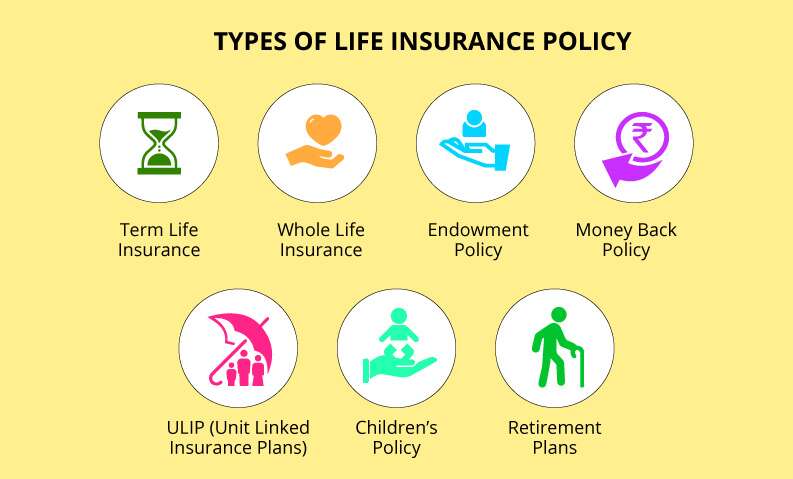

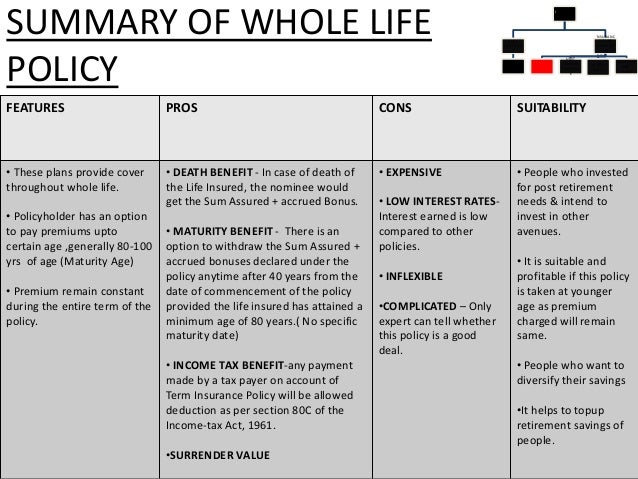

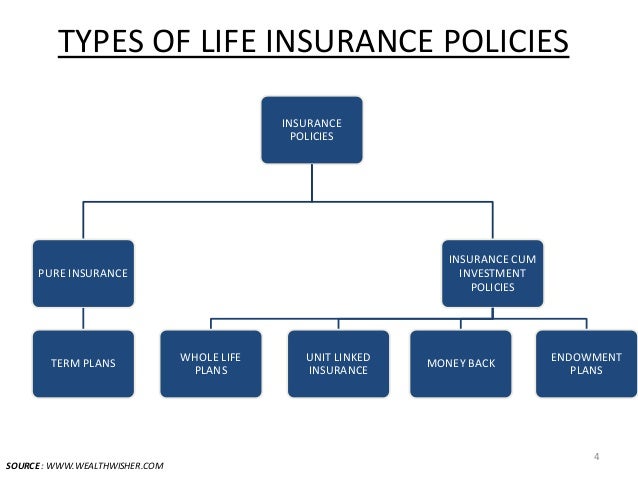

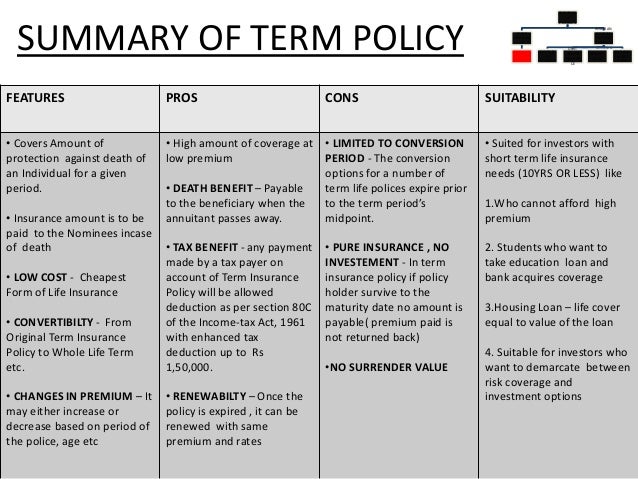

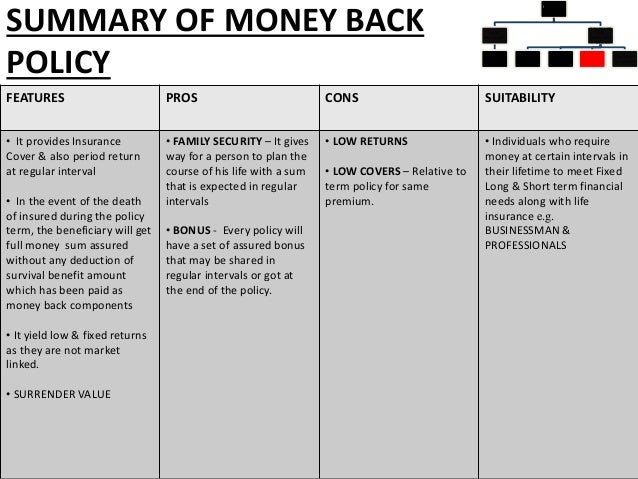

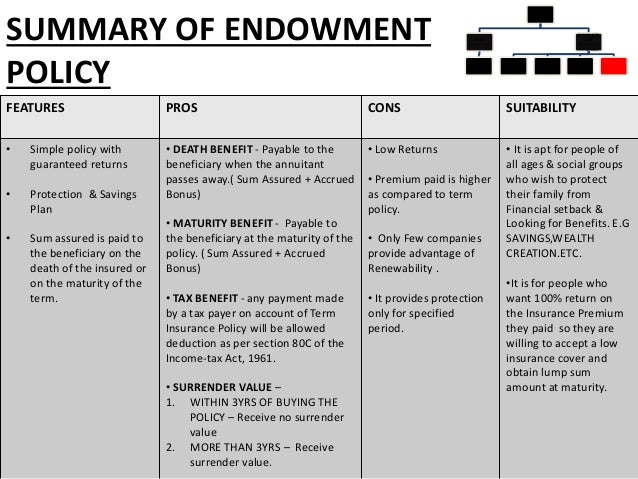

Types Of Life Insurance Policies Pdf. Comparative analysis of unit linked insurance products of different companies. A person has insurable interest in his own life to an unlimited extent. Life insurance policy characteristics types term life whole life universal life variable life variable universal life coverage for life may be renewable premiums fixed fixed flexible fixed flexible low monthly premium higher premiums higher premiums higher premiums higher premiums variable death benefit fixed guaranteed flexible not guaranteed Property/casualty, life/health and health insurance.

Types of the life insurance policy TrendyTarzan From trendytarzan.com

Types of the life insurance policy TrendyTarzan From trendytarzan.com

When a person insures his life he obtains protection against loss to his estate; A person has insurable interest in his own life to an unlimited extent. • part of your premium pays for the expense charges and. If death or the contingent event does not happen during the tenure of the Health insurance motor insurance travel insurance home insurance fire insurance 2. This is the english version of the original publication, which was published originally in hungarian.

Read paper a research on consumer perception about life insurance policies download a research on consumer perception about life insurance policies channa keshava.

Types of life insurance products the common types of life insurance may include the following: Life insurance policy characteristics types term life whole life universal life variable life variable universal life coverage for life may be renewable premiums fixed fixed flexible fixed flexible low monthly premium higher premiums higher premiums higher premiums higher premiums variable death benefit fixed guaranteed flexible not guaranteed Whole life insurance and universal life insurance are two types of permanent life insurance that not only can cover you indefinitely, but also accumulate a. The major documents in vogue in life insurance are premium receipt, insurance policy, endorsements etc. Basis of the corvinus university actuary course. Own life policy so long as the insurance is on one’s own life, the “insurance interest” presents no difficulty.

Source: trendytarzan.com

Source: trendytarzan.com

2.1 objective after going through this lesson you will be able to zrecall the various documents used in life. The major documents in vogue in life insurance are premium receipt, insurance policy, endorsements etc. Covers the insured for their whole life; The documents stand as a proof of the contract between the insurer and the insured. Under pennsylvania law, the deductible is $500.

Source: slideshare.net

Source: slideshare.net

A comprehensive textbook of life insurance. Basis of the corvinus university actuary course. Property/casualty, life/health and health insurance. A basic insurance plan which provides a lump sum amount to the family of the person who is insured in case of his/her unfortunate death. Three basic kinds of life insurance.

Source: slideshare.net

Source: slideshare.net

The absence of a limit in this case is reasonable. Health insurance motor insurance travel insurance home insurance fire insurance 2. Types of life insurance policies the two basic types of life insurance are term proper life insurance coverage should provide you with peace of mind, since you know that those you care about will be financially protected after you die. This is the amount you pay towards the repair of your automobile. In life insurance several documents are in vogue.

Source: insurance-companies.co

Source: insurance-companies.co

Read paper a research on consumer perception about life insurance policies download a research on consumer perception about life insurance policies channa keshava. When a person insures his life he obtains protection against loss to his estate; If death or the contingent event does not happen during the tenure of the A person has insurable interest in his own life to an unlimited extent. Property/casualty, life/health and health insurance.

Source: slideshare.net

Source: slideshare.net

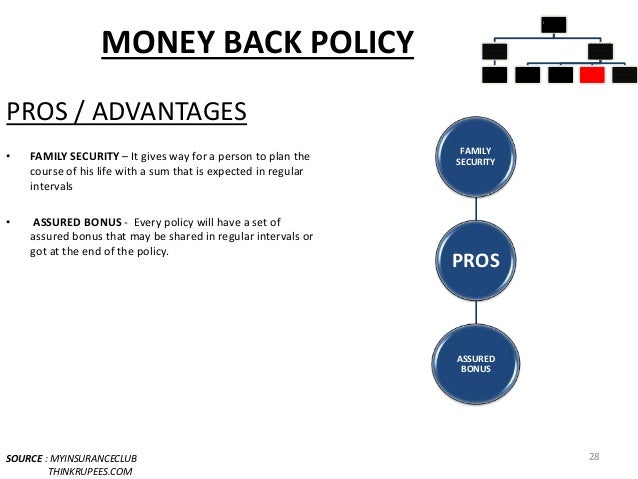

Affordable, flexible term life insurance at your pace. The main two categories of life insurance are term life insurance (which lasts for a set term) and permanent life insurance (which never expires). An insurance policy which provides a lump sum amount on a fixed date i.e. A person has insurable interest in his own life to an unlimited extent. For in the event of

Source: slideshare.net

Source: slideshare.net

Term life or “temporary” insurance: Read paper a research on consumer perception about life insurance policies download a research on consumer perception about life insurance policies channa keshava. Covers the insured for their whole life; Under pennsylvania law, the deductible is $500. A basic insurance plan which provides a lump sum amount to the family of the person who is insured in case of his/her unfortunate death.

Source: slideshare.net

Source: slideshare.net

Final expense and burial insurance are both types of whole life insurance policies that focus on people between the ages of 50 to 85. A person has insurable interest in his own life to an unlimited extent. Term life insurance term life insurance is a simple life insurance product that offers to pay benefits in case of death during the tenure of the policy. 12 full pdfs related to this paper. There is a minimum required premium at issue.

Source: slideshare.net

Source: slideshare.net

Three basic kinds of life insurance. A comprehensive textbook of life insurance. A person has insurable interest in his own life to an unlimited extent. The documents stand as a proof of the contract between the insurer and the insured. Life insurance and non life insurance which is termed as general insurance.

Source: westernsouthern.com

Source: westernsouthern.com

Under pennsylvania law, the deductible is $500. The documents stand as a proof of the contract between the insurer and the insured. Affordable, flexible term life insurance at your pace. A basic insurance plan which provides a lump sum amount to the family of the person who is insured in case of his/her unfortunate death. Health insurance motor insurance travel insurance home insurance fire insurance 2.

Source: flexcoaching.com

Source: flexcoaching.com

The documents stand as a proof of the contract between the insurer and the insured. Provides coverage for a defined time period, generally five, 10, or 20 years; • part of your premium pays for the expense charges and. Permanent life insurance is life insurance that covers you for your entire life rather than a limited period, as with term life insurance. The absence of a limit in this case is reasonable.

Source: lifeinsurance411.org

Source: lifeinsurance411.org

Basis of the corvinus university actuary course. An insurance policy which provides a lump sum amount on a fixed date i.e. Pays cash benefits to a named beneficiary if the insured dies during the term of the policy. A person has insurable interest in his own life to an unlimited extent. There is a minimum required premium at issue.

Source: insureye.com

Source: insureye.com

Final expense and burial insurance are both types of whole life insurance policies that focus on people between the ages of 50 to 85. There is a minimum required premium at issue. Types of insurance insurance in india is mainly of two types viz. Whole life insurance and universal life insurance are two types of permanent life insurance that not only can cover you indefinitely, but also accumulate a. Health insurance is offered by private health insurance companies

Source: slideshare.net

Source: slideshare.net

Own life policy so long as the insurance is on one’s own life, the “insurance interest” presents no difficulty. For in the event of Collision insurance protects your investment in your automobile. Health insurance motor insurance travel insurance home insurance fire insurance 2. The major documents in vogue in life insurance are premium receipt, insurance policy, endorsements etc.

Source: slideshare.net

Source: slideshare.net

The absence of a limit in this case is reasonable. These are described as follows: Health insurance motor insurance travel insurance home insurance fire insurance 2. A comprehensive textbook of life insurance. Permanent life insurance is life insurance that covers you for your entire life rather than a limited period, as with term life insurance.

Source: insureye.com

Source: insureye.com

Three basic kinds of life insurance. Whole life insurance and universal life insurance are two types of permanent life insurance that not only can cover you indefinitely, but also accumulate a. In life insurance several documents are in vogue. All collision insurance policies have a deductible amount. Term life insurance term life insurance is a simple life insurance product that offers to pay benefits in case of death during the tenure of the policy.

Permanent life insurance is life insurance that covers you for your entire life rather than a limited period, as with term life insurance. An insurance policy which provides a lump sum amount on a fixed date i.e. Types of life insurance products the common types of life insurance may include the following: Whole life insurance and universal life insurance are two types of permanent life insurance that not only can cover you indefinitely, but also accumulate a. Permanent life insurance is life insurance that covers you for your entire life rather than a limited period, as with term life insurance.

Source: visual.ly

Source: visual.ly

Read paper a research on consumer perception about life insurance policies download a research on consumer perception about life insurance policies channa keshava. This is the english version of the original publication, which was published originally in hungarian. 12 full pdfs related to this paper. • part of your premium pays for the expense charges and. An insurance policy which provides a lump sum amount on a fixed date i.e.

Source: slideshare.net

Source: slideshare.net

Basis of the corvinus university actuary course. 2.1 objective after going through this lesson you will be able to zrecall the various documents used in life. Health insurance is offered by private health insurance companies Page 2 of 9, see disclaimer on final page Maturity of the policy or on death of the life insured, whichever is earlier.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title types of life insurance policies pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information