Types of life insurance products pdf information

Home » Trending » Types of life insurance products pdf informationYour Types of life insurance products pdf images are available in this site. Types of life insurance products pdf are a topic that is being searched for and liked by netizens today. You can Download the Types of life insurance products pdf files here. Download all free vectors.

If you’re looking for types of life insurance products pdf pictures information connected with to the types of life insurance products pdf keyword, you have come to the right blog. Our site frequently gives you hints for viewing the maximum quality video and image content, please kindly search and find more informative video articles and images that match your interests.

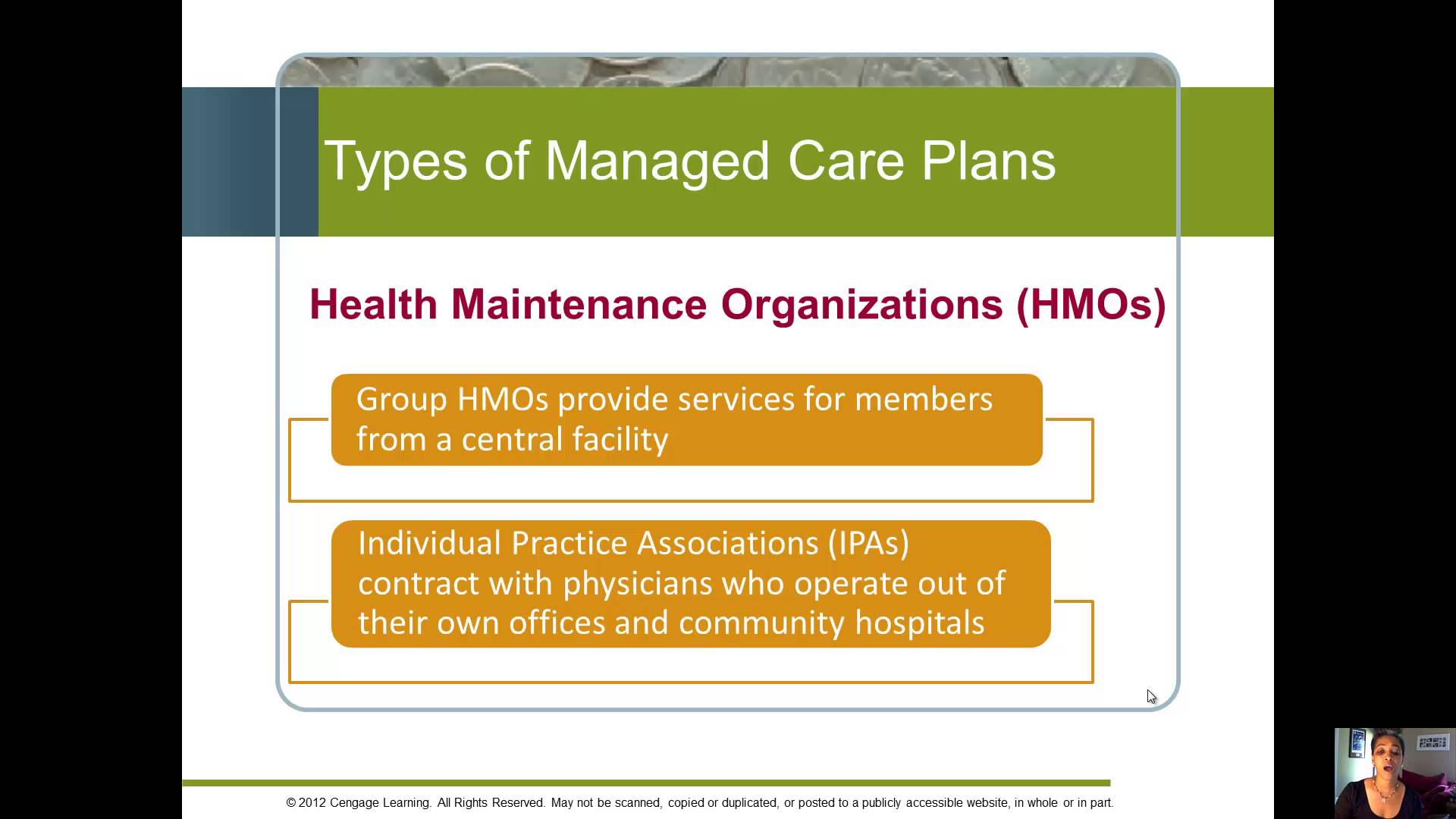

Types Of Life Insurance Products Pdf. Life insurance policy characteristics types term life whole life universal life variable life variable universal life coverage for life may be renewable premiums fixed fixed flexible fixed flexible low monthly premium higher premiums higher premiums higher premiums higher premiums variable death benefit fixed guaranteed flexible not guaranteed Types of life insurance products pdf consult your tax, legal and insurance representatives to determine which type of life insurance policy is right for you based on your current situation and your current needs. Term life insurance provides death. Insurance can be classified into 4 categories from the risk point of view.

Private placement life insurance pdf From casaruraldavina.com

Private placement life insurance pdf From casaruraldavina.com

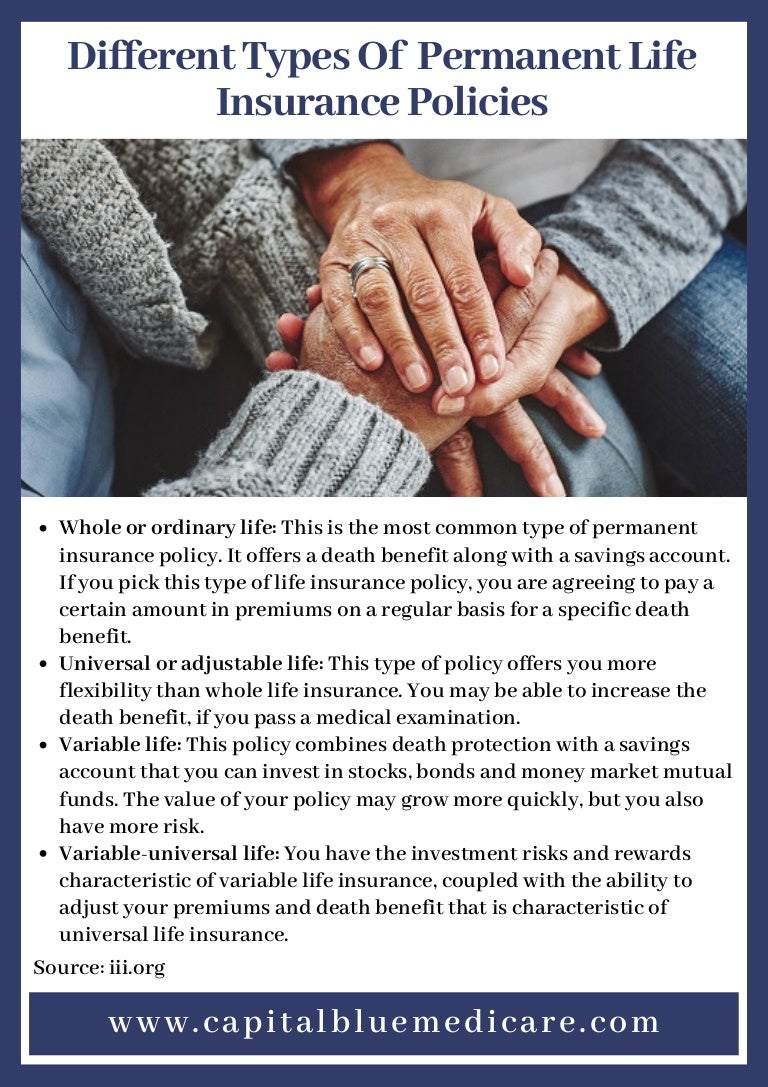

Motor, theft, loyalty and machine insurance involve a certain extent of liability insurance. Health insurance is offered by private health insurance companies The different versions of life insurance plans include: Whole life insurance pays out a death benefit so you can be assured that your family is protected against financial loss that can happen after your death. Whole life insurance with whole life insurance, you are guaranteed lifelong protection. Term life or “temporary” insurance:

Provides coverage for a defined time period, generally five, 10, or 20 years;

Sbi life insurance is an iso 22301 certified insurance company for its business continuity management system (bcms). Page 2 of 9, see disclaimer on final page. Many life insurance policies build up a cash value Simply knowing the various insurance policies does not help. Whole life is sometimes called permanent life insurance, and it encompasses several subcategories, including traditional whole life, universal life, variable life and variable universal life. Permanent life insurance typically comes with a cash value and has higher premiums.

Source: oracle.com

Source: oracle.com

Download to pdf there are two major types of life insurance—term and whole life. Health insurance motor insurance travel insurance home insurance fire insurance 2. Sbi life insurance is an iso 22301 certified insurance company for its business continuity management system (bcms). You can also convert it to permanent life insurance without having to answer questions about your health. Types of life insurance policies the two basic types of life insurance are term proper life insurance coverage should provide you with peace of mind, since you know that those you care about will be financially protected after you die.

Source: insureye.com

Source: insureye.com

Whole life is sometimes called permanent life insurance, and it encompasses several subcategories, including traditional whole life, universal life, variable life and variable universal life. Benefits are paid to the beneficiaries when the policyholder dies. Term life insurance and whole life insurance. Broadly, there are 8 types of insurance, namely: By premium term and premium frequency ______ _______________ ________________ ___ 3

Source: lifeinsurance411.org

Source: lifeinsurance411.org

Motor, theft, loyalty and machine insurance involve a certain extent of liability insurance. Covers the insured for their whole life; Provides full risk cover against any type of eventuality. Pension plans, disability benefits, unemployment benefits, sickness insurance, and industrial insurance are the various forms of social insurance. There are three main insurance sectors:

Source: researchgate.net

Source: researchgate.net

Download to pdf there are two major types of life insurance—term and whole life. Whole, universal, indexed universal, variable, and final expense are all types of permanent life insurance. Term life insurance and whole life insurance. Whole life is sometimes called permanent life insurance, and it encompasses several subcategories, including traditional whole life, universal life, variable life and variable universal life. Offers life insurance coverage till 100 years of age.

Source: layoutready.com

Source: layoutready.com

Pays cash benefits to a named beneficiary if the insured dies during the term of the policy. Our bcms addresses the safety of our employees and enables the company to restore critical business operations to the. Provides the combined benefit of life insurance cum saving. Broadly, there are 8 types of insurance, namely: Types of life insurance products pdf consult your tax, legal and insurance representatives to determine which type of life insurance policy is right for you based on your current situation and your current needs.

Source: casaruraldavina.com

Source: casaruraldavina.com

It can be used as a savings program. Broadly, there are 8 types of insurance, namely: If death or the contingent event does not happen during the tenure of the It is also an ideal way of creating an estate for your heirs as an inheritance. Download to pdf there are two major types of life insurance—term and whole life.

The different versions of life insurance plans include: Health insurance is offered by private health insurance companies Types of life insurance products pdf consult your tax, legal and insurance representatives to determine which type of life insurance policy is right for you based on your current situation and your current needs. It is also an ideal way of creating an estate for your heirs as an inheritance. By premium term and premium frequency ______ _______________ ________________ ___ 3

Source: visual.ly

Source: visual.ly

Covers the insured for their whole life; Term life insurance and whole life insurance. Many life insurance policies build up a cash value The different versions of life insurance plans include: There are three main insurance sectors:

Source: pinterest.com

Source: pinterest.com

The main two categories of life insurance are term life insurance (which lasts for a set term) and permanent life insurance (which never expires). Whole life insurance with whole life insurance, you are guaranteed lifelong protection. Property/casualty, life/health and health insurance. Types of life insurance products pdf consult your tax, legal and insurance representatives to determine which type of life insurance policy is right for you based on your current situation and your current needs. The different versions of life insurance plans include:

Source: researchgate.net

Source: researchgate.net

Whole life insurance and universal life insurance are two types of permanent life insurance that not only can cover you indefinitely, but also accumulate a. Permanent life insurance typically comes with a cash value and has higher premiums. Provides full risk cover against any type of eventuality. The main two categories of life insurance are term life insurance (which lasts for a set term) and permanent life insurance (which never expires). Benefits are paid to the beneficiaries when the policyholder dies.

Source: bestinsurancecenter.com

Source: bestinsurancecenter.com

Types of life insurance policies the two basic types of life insurance are term proper life insurance coverage should provide you with peace of mind, since you know that those you care about will be financially protected after you die. Types of life insurance products the common types of life insurance may include the following: Property/casualty, life/health and health insurance. When it comes down to it, there are essentially two kinds of policies: Whole life insurance pays out a death benefit so you can be assured that your family is protected against financial loss that can happen after your death.

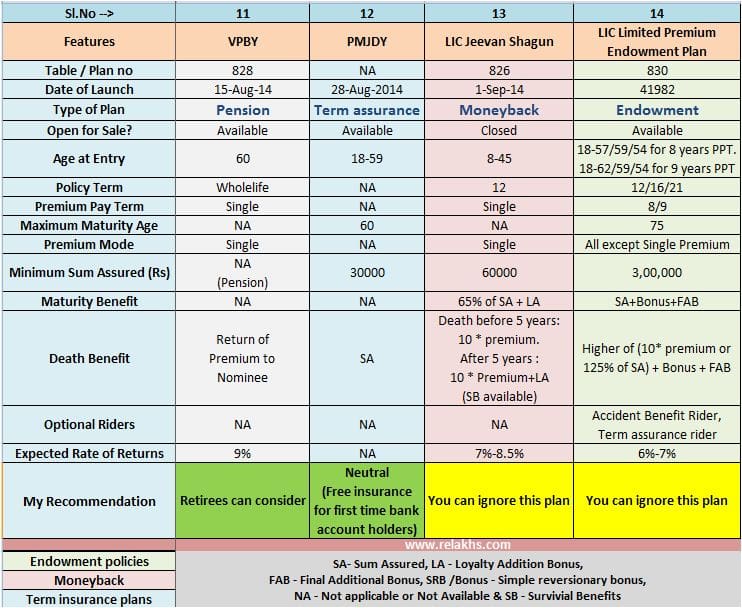

Source: relakhs.com

Source: relakhs.com

There is a second reason some workers have for purchasing life insurance. Property/casualty, life/health and health insurance. Simply knowing the various insurance policies does not help. Life insurance provides the money needed to pay funeral and burial expenses, and it can provide money for our families to replace the money we would have earned, if we were still alive. Health insurance is offered by private health insurance companies

Instead, you must know how each of these plans work. Provides full risk cover against any type of eventuality. Health insurance is offered by private health insurance companies Term life insurance term life insurance is a simple life insurance product that offers to pay benefits in case of death during the tenure of the policy. Term life or “temporary” insurance:

Source: es.slideshare.net

Source: es.slideshare.net

By premium term and premium frequency ______ _______________ ________________ ___ 3 Offers life insurance coverage till 100 years of age. It can be used as a savings program. Health insurance motor insurance travel insurance home insurance fire insurance 2. Provides coverage for a defined time period, generally five, 10, or 20 years;

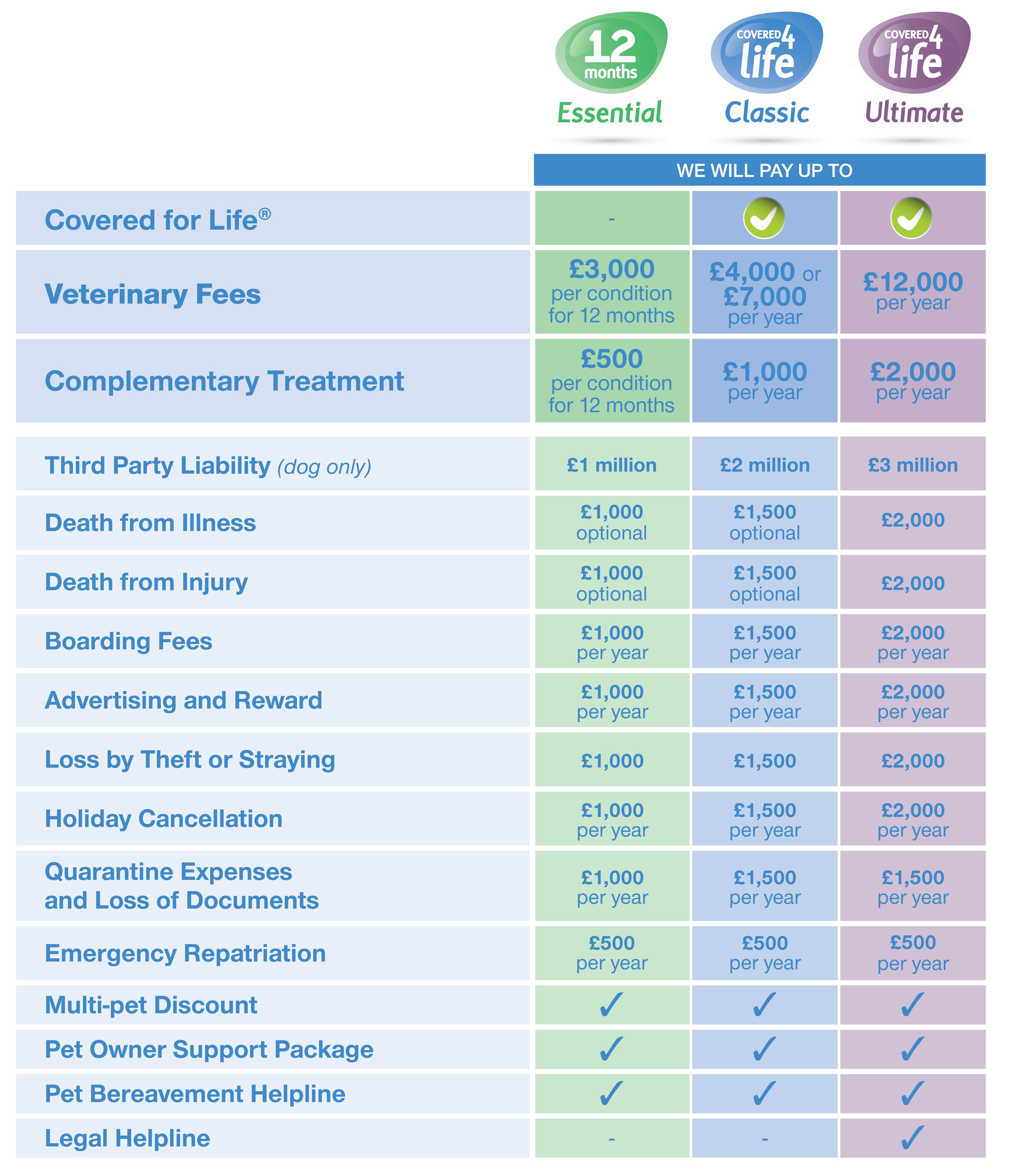

Source: pressreleases.responsesource.com

Source: pressreleases.responsesource.com

The different versions of life insurance plans include: Page 2 of 9, see disclaimer on final page. Whole life insurance with whole life insurance, you are guaranteed lifelong protection. Pension plans, disability benefits, unemployment benefits, sickness insurance, and industrial insurance are the various forms of social insurance. Permanent life insurance is life insurance that covers you for your entire life rather than a limited period, as with term life insurance.

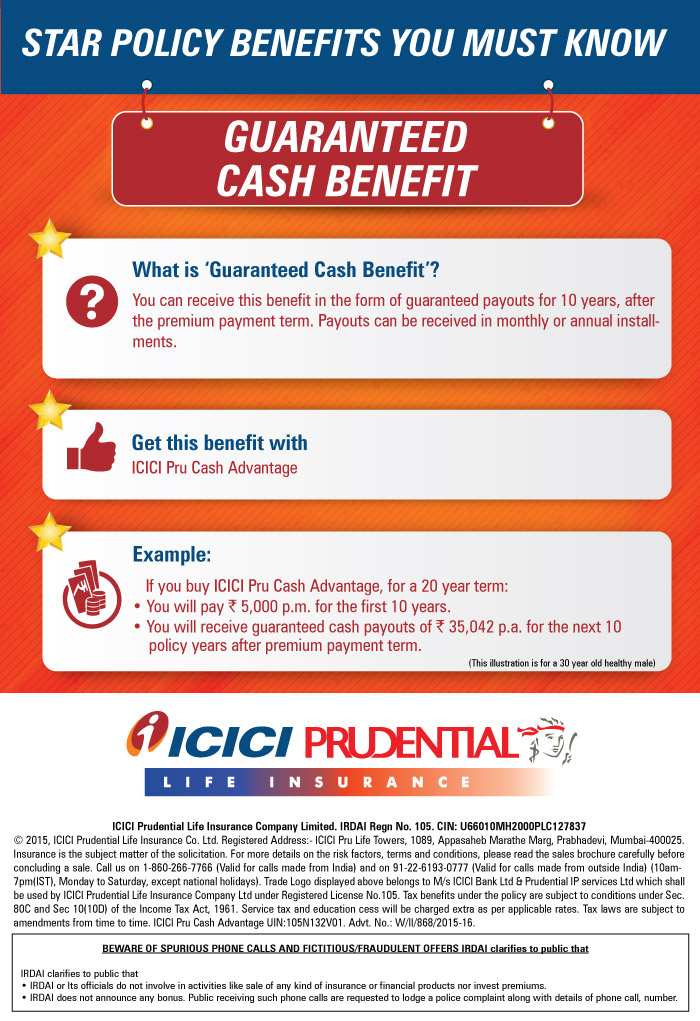

Source: iciciprulife.com

Source: iciciprulife.com

You can also convert it to permanent life insurance without having to answer questions about your health. There is a second reason some workers have for purchasing life insurance. Provides coverage for a defined time period, generally five, 10, or 20 years; Whole life is sometimes called permanent life insurance, and it encompasses several subcategories, including traditional whole life, universal life, variable life and variable universal life. Term life insurance term life vs whole life permanent life insurance return of premium life insurance universal life insurance guaranteed universal life insurance variable life insurance no exam life insurance simplified issue life insurance mortgage protection life insurance

Source: researchgate.net

Source: researchgate.net

Instead, you must know how each of these plans work. Term life or “temporary” insurance: When it comes down to it, there are essentially two kinds of policies: Life insurance policy characteristics types term life whole life universal life variable life variable universal life coverage for life may be renewable premiums fixed fixed flexible fixed flexible low monthly premium higher premiums higher premiums higher premiums higher premiums variable death benefit fixed guaranteed flexible not guaranteed There is a second reason some workers have for purchasing life insurance.

Source: flexcoaching.com

Source: flexcoaching.com

Whole life is sometimes called permanent life insurance, and it encompasses several subcategories, including traditional whole life, universal life, variable life and variable universal life. Permanent life insurance is life insurance that covers you for your entire life rather than a limited period, as with term life insurance. Property/casualty, life/health and health insurance. Sbi life insurance is an iso 22301 certified insurance company for its business continuity management system (bcms). Motor, theft, loyalty and machine insurance involve a certain extent of liability insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title types of life insurance products pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information