Types of non insurable risk Idea

Home » Trend » Types of non insurable risk IdeaYour Types of non insurable risk images are available in this site. Types of non insurable risk are a topic that is being searched for and liked by netizens now. You can Download the Types of non insurable risk files here. Download all royalty-free photos and vectors.

If you’re looking for types of non insurable risk pictures information related to the types of non insurable risk topic, you have visit the ideal site. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

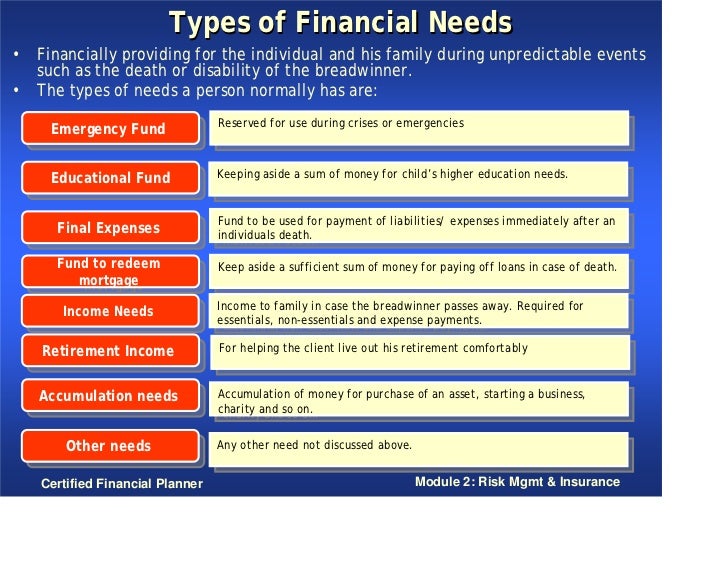

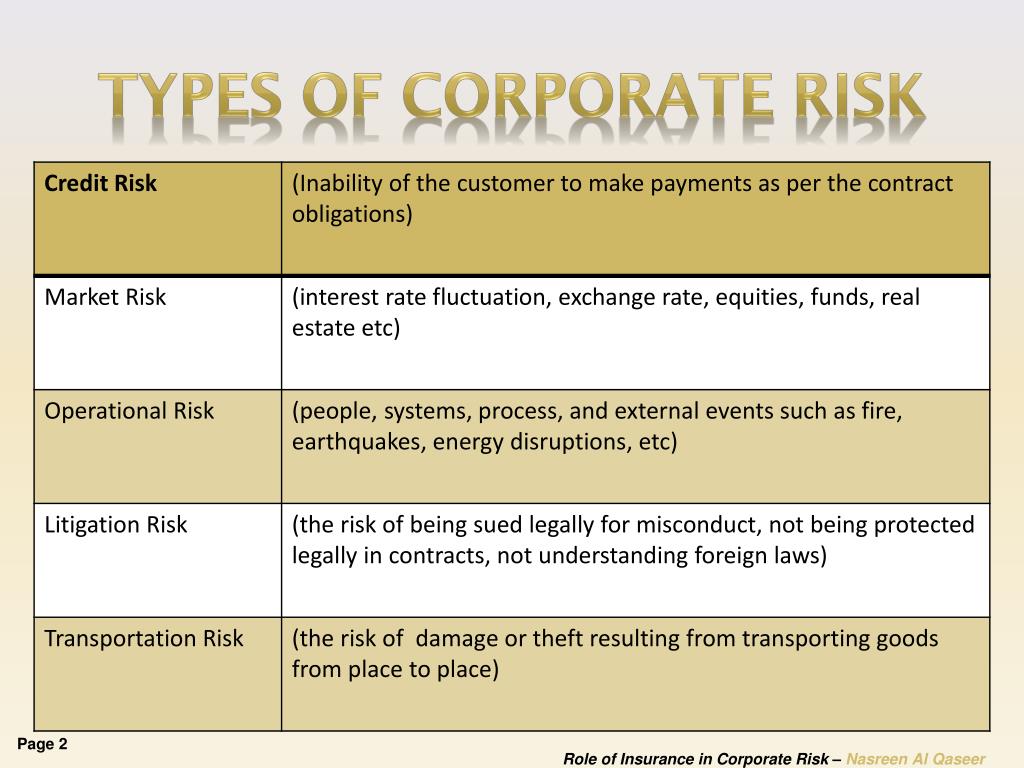

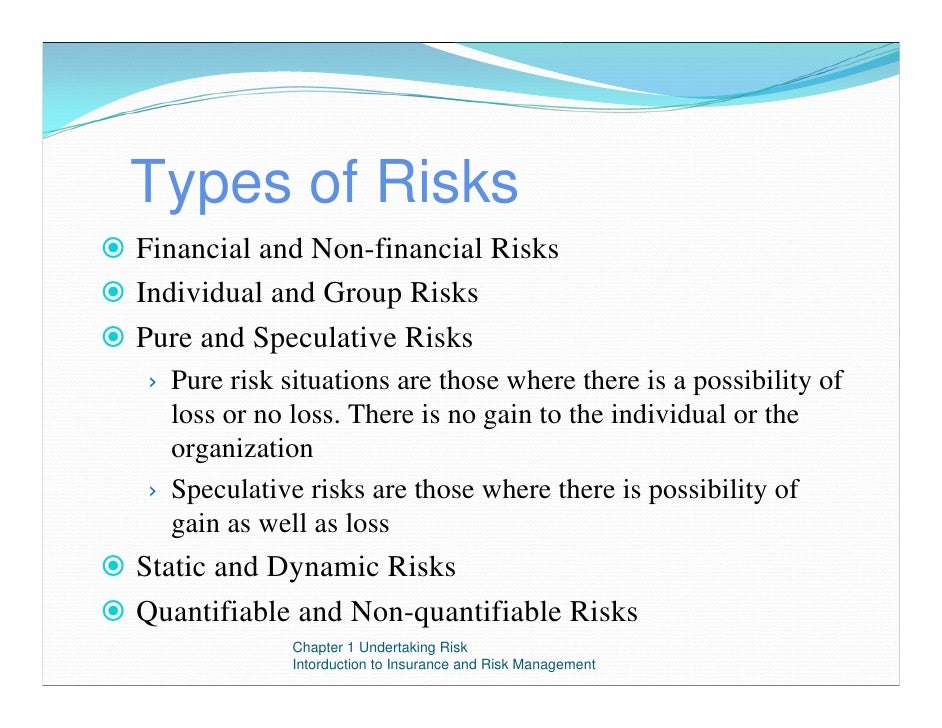

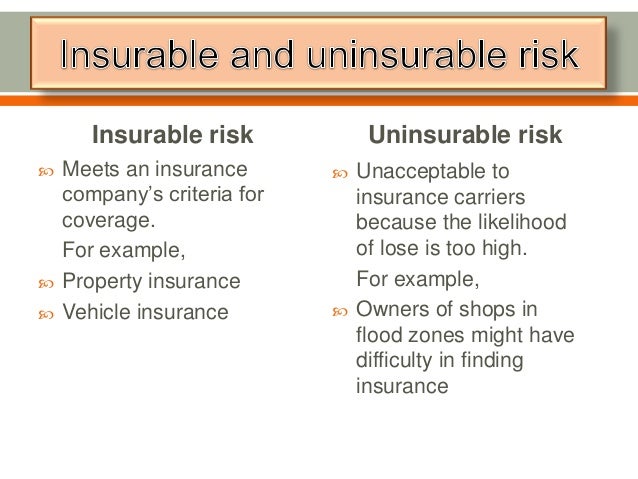

Types Of Non Insurable Risk. The risk cannot be forecast and measured. Insurable risks are the type of risks in which the insurer makes provision for or insures against because it is possible to collect, calculate and estimate the likely future losses. Reputational risk, regulatory risk, trade secret risk, political risk and pandemic risk. This technique is applied when the risk is known or loss is already known and it is not serious in nature.

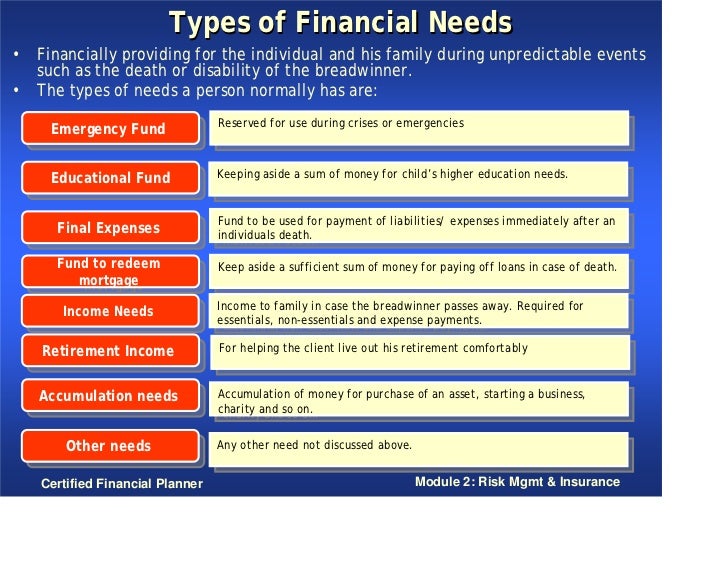

Risk Management and Insurance From slideshare.net

Risk Management and Insurance From slideshare.net

Some examples of insurable risk include loss of life, health, fraud and damage or loss of the property from fire, water, weather and theft. So, this will fall under the pure risk, and these risks are insurable. Generally, a firm will abandon the activities or assets that will lead to loss. In addition, other types of business risks are deemed uninsurable based on the potential that a loss will occur outweighing the potential that it won’t. The risk cannot be forecast and measured. However, while some risks can be insured (i.e.

The risk cannot be forecast and measured.

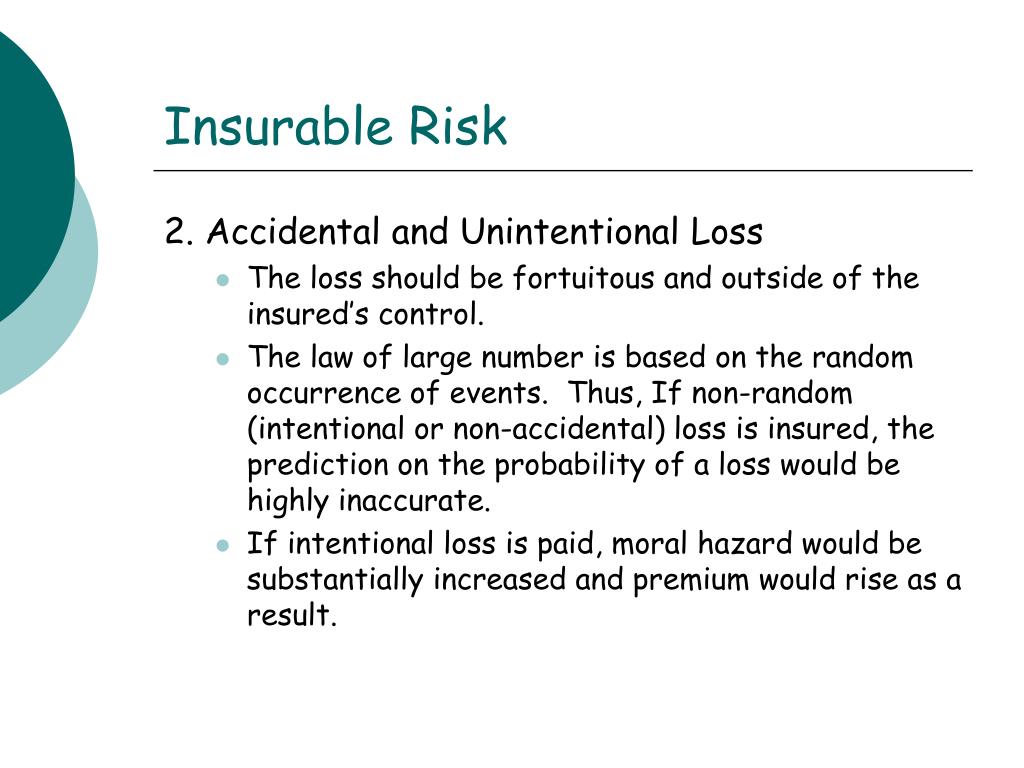

The risk cannot be forecast and measured. E an uninsurable risk, is a risk that no one will sell you insurance for. Reputational risk, regulatory risk, trade secret risk, political risk and pandemic risk. This technique is applied when the risk is known or loss is already known and it is not serious in nature. The risk cannot be forecast and measured. And, of course, any allegation related to a criminal act or intentional wrongdoing on your part is generally uninsurable.

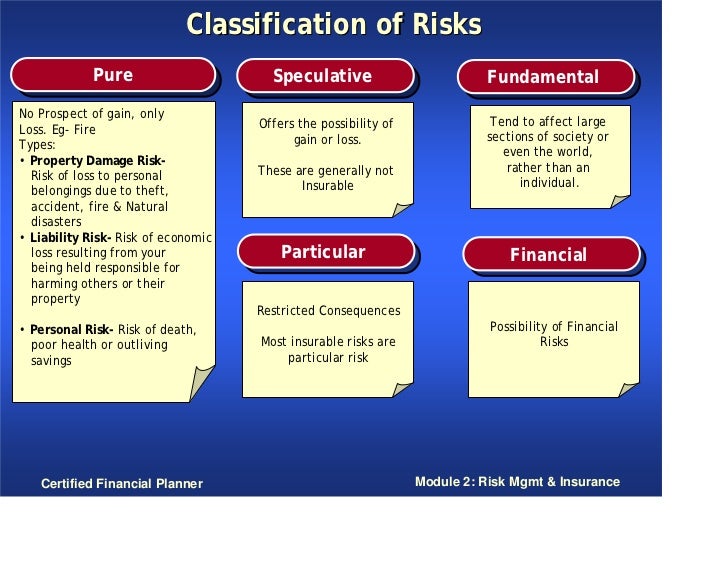

Source: slideshare.net

Source: slideshare.net

An example for hoas is sinkholes. All these types of risks can be categorized into two types: These risks are generally not insurable. Are all pure risks insurable by insurance companies? Risk management practice aligns with all federal and state legislation.

Source: iedunote.com

Source: iedunote.com

All risks involving natural disasters are referred to as acts of god. E an uninsurable risk, is a risk that no one will sell you insurance for. These risks are generally not insurable. That is why most insurance policies exclude coverage for this type of event. It means, avoiding the activities where the risk in involved.

Source: slideserve.com

Source: slideserve.com

Reputational risk, regulatory risk, trade secret risk, political risk and pandemic risk. So we ask this question. The answer in effect, insurance is not always available as a method of handling risk. These risks are generally not insurable. For example, deterioration of property caused by wear and tear (because a decision was made to not maintain the property in question) or income loss due to market changes are typically not insurable.

Source: slideshare.net

Source: slideshare.net

It holds the prospect of gain as well as loss. It means, avoiding the activities where the risk in involved. Furthermore, what is insurable risk and examples? These are typically risks that are commercially uninsurable, illegal for the insurance company to insure, or hold the potential for catastrophic loss. What is insurable risk and non insurable risk?

Source: slideshare.net

Source: slideshare.net

For example, deterioration of property caused by wear and tear (because a decision was made to not maintain the property in question) or income loss due to market changes are typically not insurable. Furthermore, what is insurable risk and examples? However, some pure risks are not insurable. All these types of risks can be categorized into two types: While some coverage is available, these five threats are considered mostly uninsurable:

Source: slideshare.net

Source: slideshare.net

All risks involving natural disasters are referred to as acts of god. And, of course, any allegation related to a criminal act or intentional wrongdoing on your part is generally uninsurable. E an uninsurable risk, is a risk that no one will sell you insurance for. Are all pure risks insurable by insurance companies? All risks involving natural disasters are referred to as acts of god.

Source: slideshare.net

Source: slideshare.net

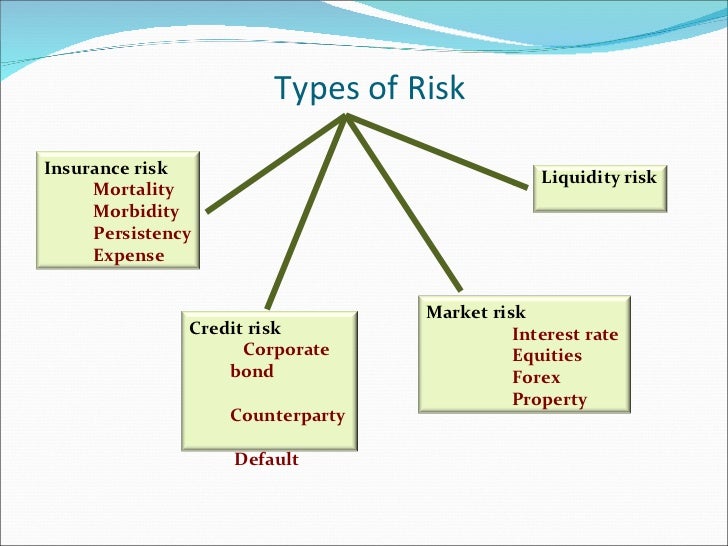

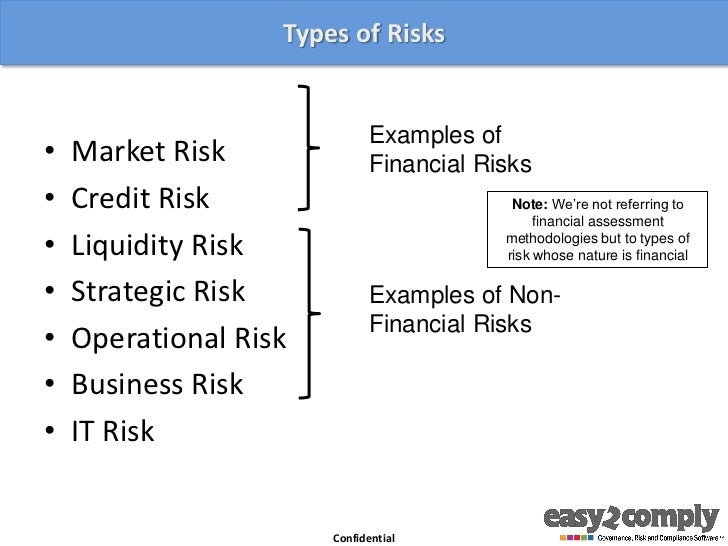

The following are the different types of risk in insurance: The answer in effect, insurance is not always available as a method of handling risk. For example, deterioration of property caused by wear and tear (because a decision was made to not maintain the property in question) or income loss due to market changes are typically not insurable. These are known as uninsurable risks. These risks are generally not insurable.

Source: slideserve.com

Source: slideserve.com

Furthermore, what is insurable risk and examples? However, some pure risks are not insurable. Furthermore, what is insurable risk and examples? In addition, other types of business risks are deemed uninsurable based on the potential that a loss will occur outweighing the potential that it won’t. This technique is applied when the risk is known or loss is already known and it is not serious in nature.

Source: slideserve.com

Source: slideserve.com

The risk cannot be forecast and measured. These risks are generally not insurable. The answer in effect, insurance is not always available as a method of handling risk. That is why most insurance policies exclude coverage for this type of event. These are typically risks that are commercially uninsurable, illegal for the insurance company to insure, or hold the potential for catastrophic loss.

Source: deloitte.wsj.com

Source: deloitte.wsj.com

So, this will fall under the pure risk, and these risks are insurable. These risks are generally not insurable. Reputational risk, regulatory risk, trade secret risk, political risk and pandemic risk. Speculative risks are those that might produce a profit or loss, namely business ventures or gambling transactions. These are known as uninsurable risks.

Source: slideshare.net

Source: slideshare.net

These are typically risks that are commercially uninsurable, illegal for the insurance company to insure, or hold the potential for catastrophic loss. So, this will fall under the pure risk, and these risks are insurable. The following are the different types of risk in insurance: For example, deterioration of property caused by wear and tear (because a decision was made to not maintain the property in question) or income loss due to market changes are typically not insurable. These are typically risks that are commercially uninsurable, illegal for the insurance company to insure, or hold the potential for catastrophic loss.

Source: researchgate.net

Source: researchgate.net

While some coverage is available, these five threats are considered mostly uninsurable: Risk management practice aligns with all federal and state legislation. It means, avoiding the activities where the risk in involved. Speculative risks are those that might produce a profit or loss, namely business ventures or gambling transactions. Reputational risk, regulatory risk, trade secret risk, political risk and pandemic risk.

Source: finansialku.com

Source: finansialku.com

Premium should be economically feasible. Insurable risks), some cannot be insured according to their nature (i.e. It holds the prospect of gain as well as loss. For example, deterioration of property caused by wear and tear (because a decision was made to not maintain the property in question) or income loss due to market changes are typically not insurable. The answer in effect, insurance is not always available as a method of handling risk.

Source: researchgate.net

Source: researchgate.net

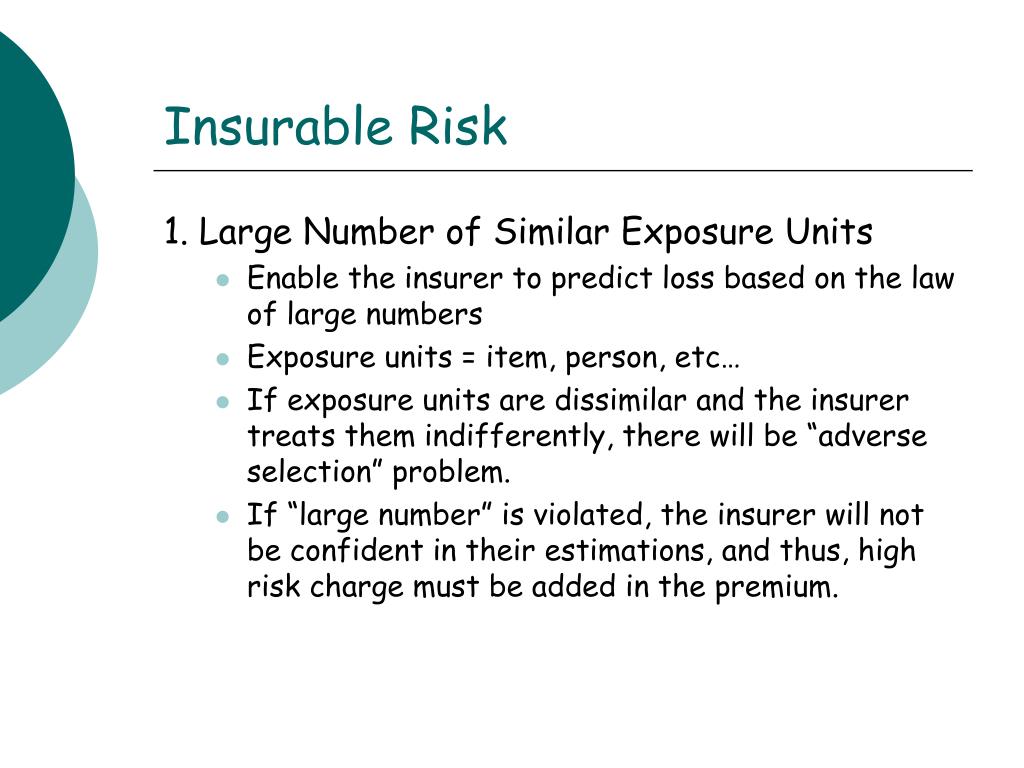

An example of speculative risk includes the purchase of the shares of a company by a person. Large numbers of exposure units. Furthermore, what is insurable risk and examples? The answer in effect, insurance is not always available as a method of handling risk. Insurable risks are the type of risks in which the insurer makes provision for or insures against because it is possible to collect, calculate and estimate the likely future losses.

Source: slideshare.net

Source: slideshare.net

All these types of risks can be categorized into two types: These are typically risks that are commercially uninsurable, illegal for the insurance company to insure, or hold the potential for catastrophic loss. Large numbers of exposure units. For example, most errors and omissions insurance policies won�t cover you if a client sues you for not paying a bill or for stealing a customer or employee. Insurable risks), some cannot be insured according to their nature (i.e.

Source: researchgate.net

Source: researchgate.net

Furthermore, what is insurable risk and examples? So we ask this question. What is insurable risk and non insurable risk? It holds the prospect of gain as well as loss. An example for hoas is sinkholes.

Source: slideserve.com

Source: slideserve.com

It holds the prospect of gain as well as loss. And, of course, any allegation related to a criminal act or intentional wrongdoing on your part is generally uninsurable. The risk cannot be forecast and measured. So we ask this question. Generally, a firm will abandon the activities or assets that will lead to loss.

Source: wcedeportal.co.za

Furthermore, what is insurable risk and examples? However, some pure risks are not insurable. The risk cannot be forecast and measured. Generally, a firm will abandon the activities or assets that will lead to loss. Furthermore, what is insurable risk and examples?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title types of non insurable risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information