Types of non insurance transfer Idea

Home » Trending » Types of non insurance transfer IdeaYour Types of non insurance transfer images are available in this site. Types of non insurance transfer are a topic that is being searched for and liked by netizens now. You can Get the Types of non insurance transfer files here. Download all royalty-free vectors.

If you’re looking for types of non insurance transfer images information linked to the types of non insurance transfer keyword, you have come to the right site. Our website always gives you suggestions for downloading the maximum quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

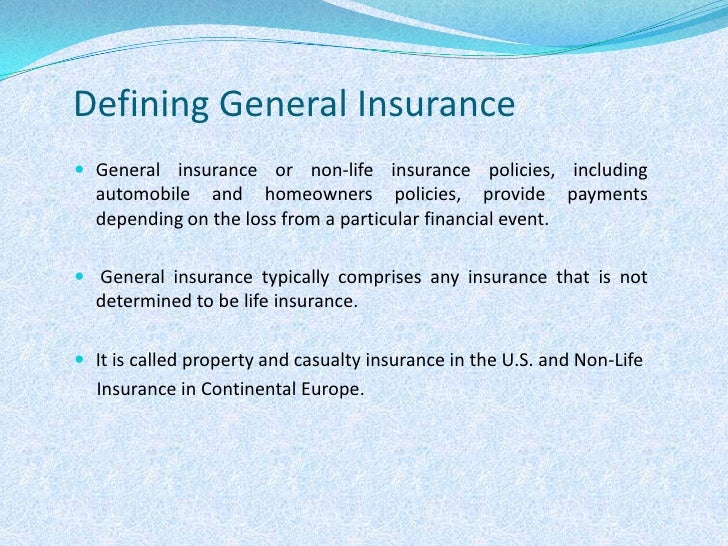

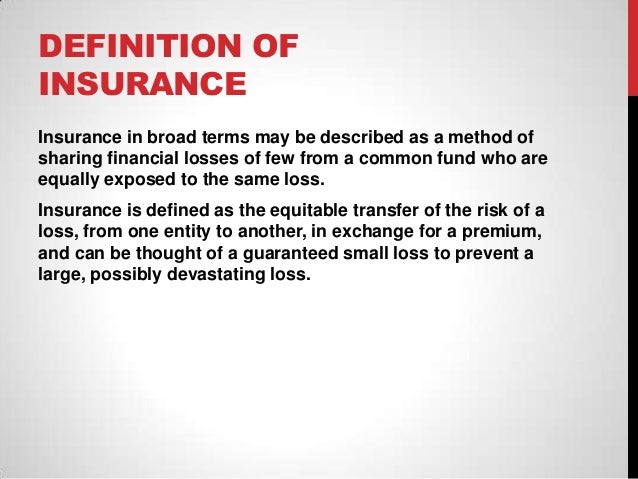

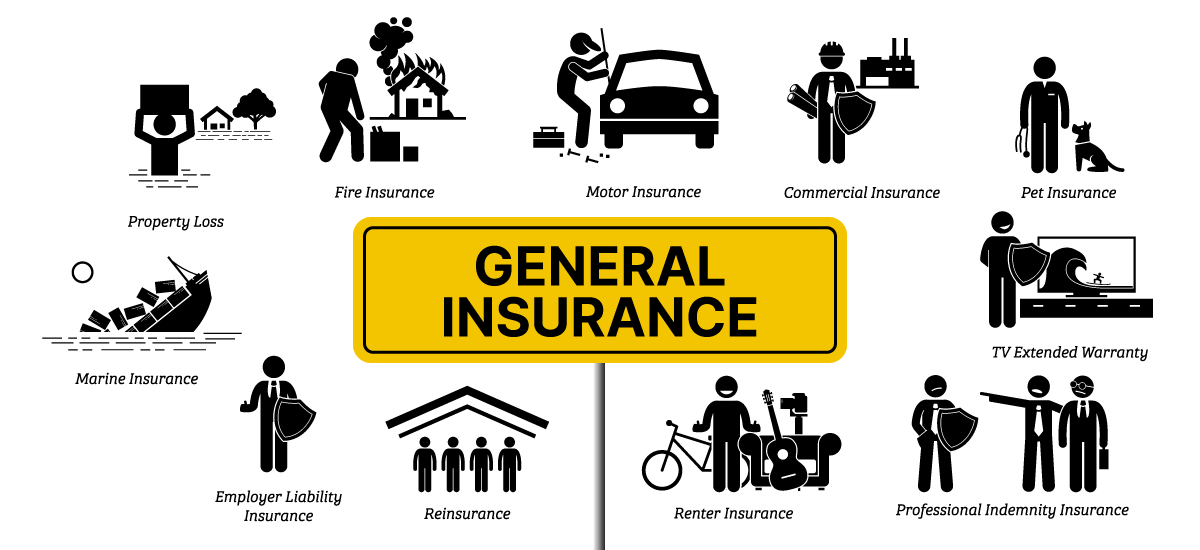

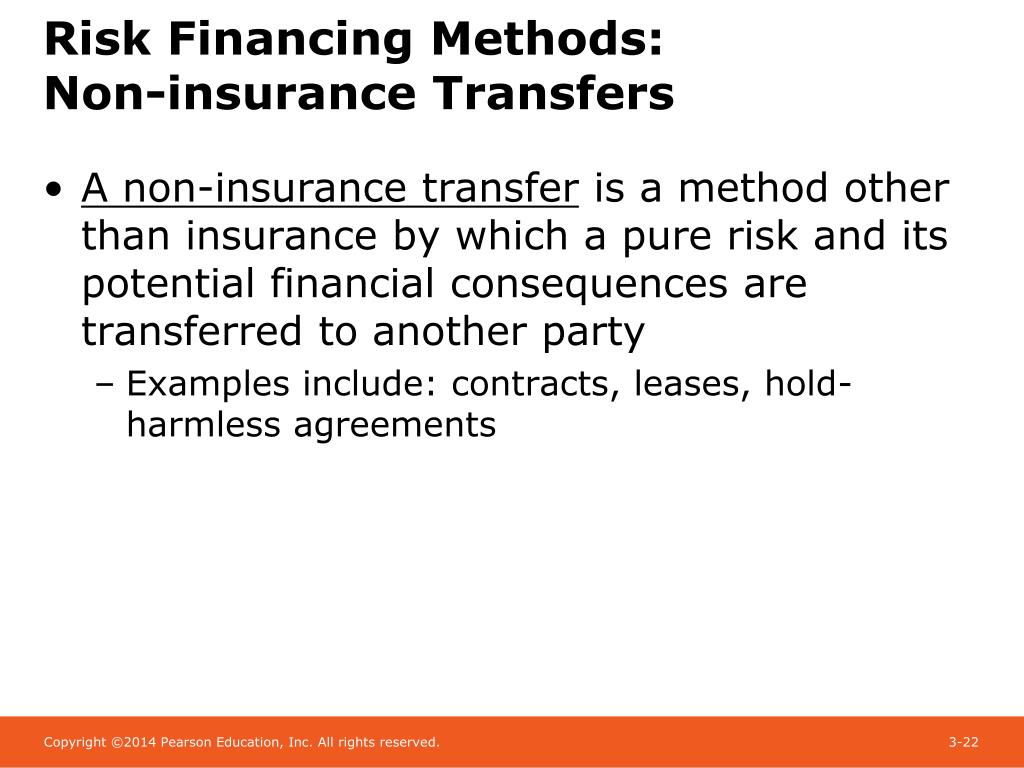

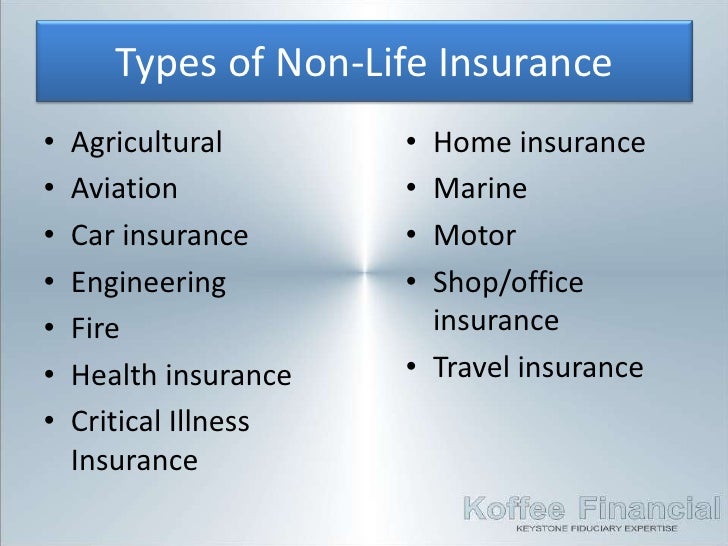

Types Of Non Insurance Transfer. This process of transferring the risk is known as the insurance where the transferor of risk is known as the insured and the transferee party in known as the. This insurance is domestic and coverage is only applicable within the country. Most commonly, the techniques used involve hold harmless agreements, indemnity clauses, leases, hedging, and insurance provisions in contracts that require you to be added as an additional insured, thus. Firm follows both risk retention and risk transfer techniques.

General insurance From slideshare.net

General insurance From slideshare.net

Insurance an insurance policy transfers a specific set of risks such as the fire and flood risk for a particular. But, to understand reinsurance better,. Risk in insurance and its transfer. 7 types of insurance are; Likewise any uncertainty of economic loss is if secured by paying certain sum of amount to an insurance company is transferring of risk. Here the payment of losses is made by insurers.

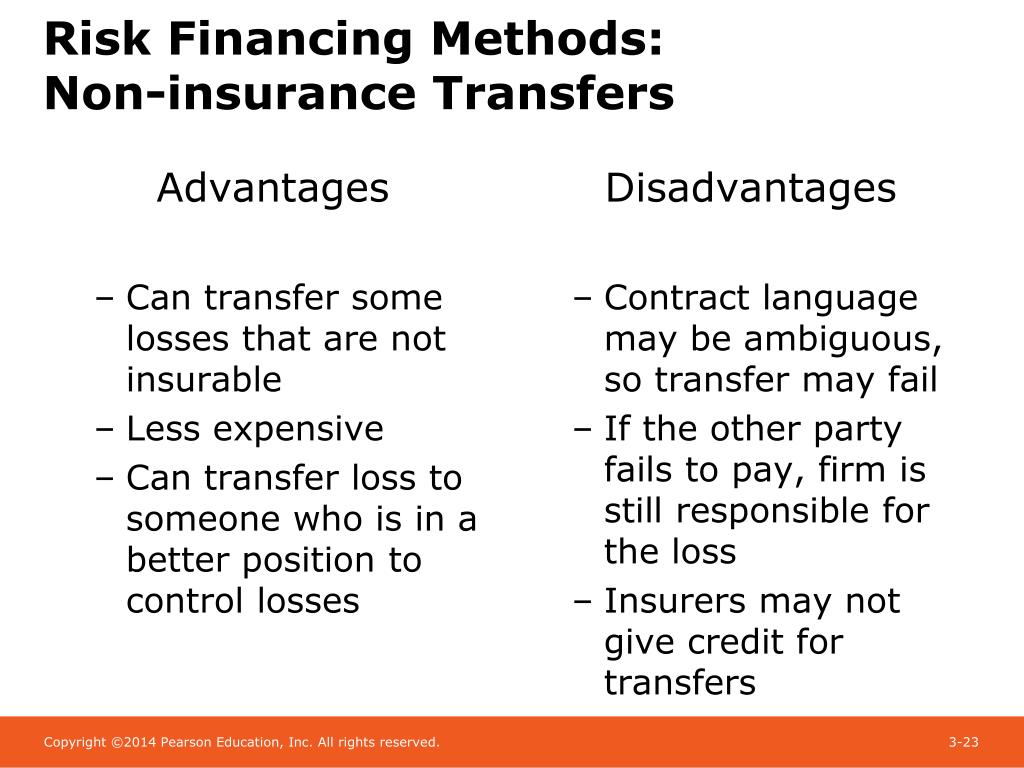

This risk management technique usually involves risk transfers by way of hold harmless, indemnity, and insurance provisions in contracts and is also called contractual risk transfer. links for irmi online subscribers only:

Insurance an insurance policy transfers a specific set of risks such as the fire and flood risk for a particular. However the insurance rate is a factor used to determine the amount to be charged for a certain amount of insurance coverage. Covers the cost of medical care. Life insurance or personal insurance. Insurance an insurance policy transfers a specific set of risks such as the fire and flood risk for a particular. For example, an insurance company may routinely write policies that limit its.

Source: slideshare.net

Source: slideshare.net

But, to understand reinsurance better,. Noninsurance risk transfer — the transfer of risk from one party to another party other than an insurance company. 3 types of risk transfer 1. Land cargo insurance, as its name suggests, covers your shipment when it’s being transported on land. An example for hoas is sinkholes.

Source: slideshare.net

Source: slideshare.net

It’s important to have adequate health insurance coverage that can protect you from financial crisis during medical emergencies. This insurance is domestic and coverage is only applicable within the country. Form 30 (application for intimation and transfer of ownership of a motor vehicle). It is preferred that any risk that an entity or an individual do not want to bear by themselves is to be passed on or transferred to the other entity. Form 29 (notice of transfer of ownership of a motor vehicle).

Source: fourvantage.biz

Source: fourvantage.biz

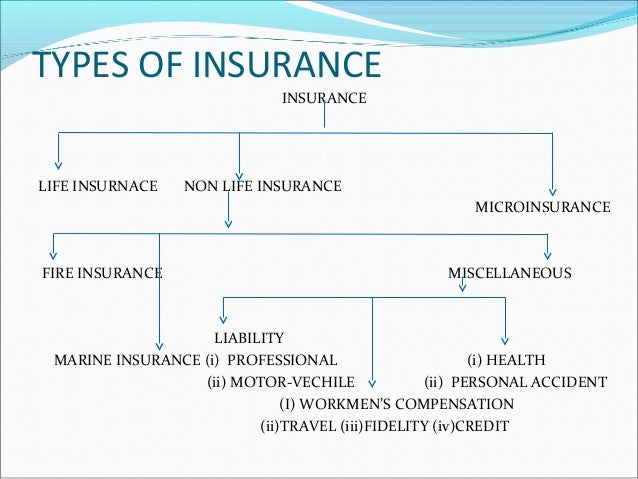

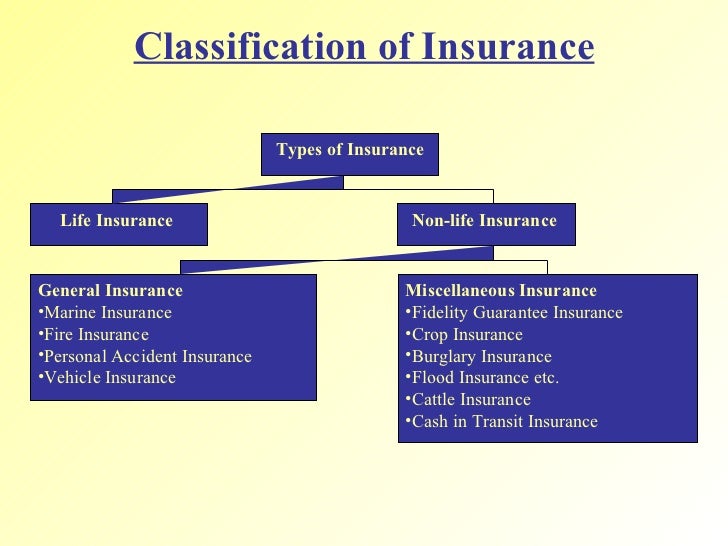

Life insurance or personal insurance, property insurance, marine insurance, fire insurance, liability insurance, guarantee insurance. Find the formats you�re looking for non insurance transfer definition here. That is why most insurance policies exclude coverage for this type of event. An example for hoas is sinkholes. Types of marine insurance policies.

Source: slideshare.net

Source: slideshare.net

Broadly, there are 8 types of insurance, namely: But, to understand reinsurance better,. Under proportional reinsurance, the reinsurer receives a prorated share of. This process of transferring the risk is known as the insurance where the transferor of risk is known as the insured and the transferee party in known as the. Derivatives a derivative is a financial product that derives its value from the value of an underlying entity such as.

Source: donorbox.org

Source: donorbox.org

Floating in marine insurance policy, large exporters may opt for an open policy, also known as a blanket policy, instead of taking insurance separately for each shipment. Life insurance or personal insurance. Covers the cost of medical care. Insurance an insurance policy transfers a specific set of risks such as the fire and flood risk for a particular. 3 types of risk transfer 1.

Source: slideserve.com

Source: slideserve.com

Insurance is categorized based on risk, type, and hazards. Proof of delivery of car to the new owner. But, to understand reinsurance better,. Life insurance or personal insurance. Risk in insurance and its transfer.

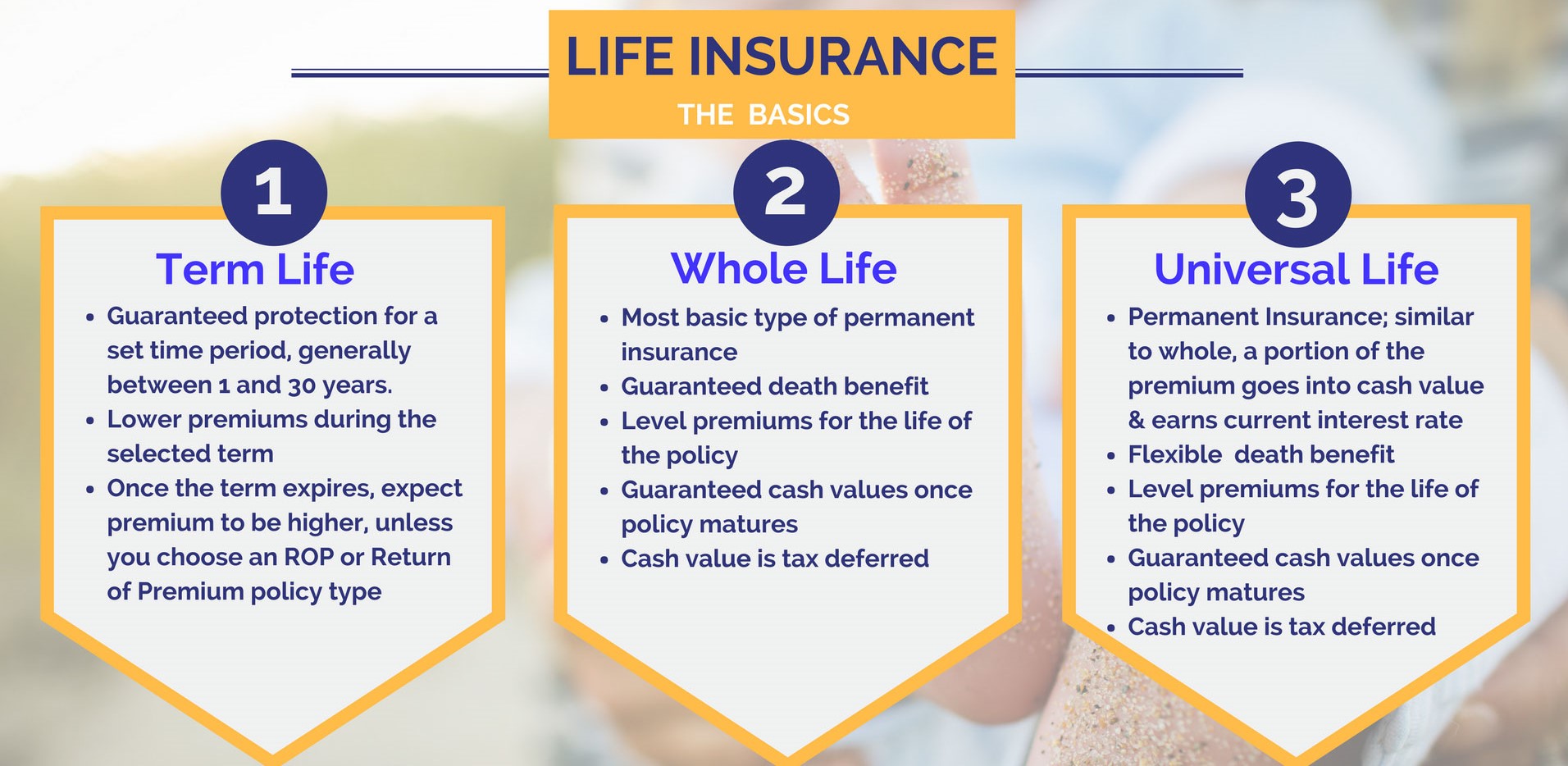

Source: randelltiongson.com

Source: randelltiongson.com

Photocopy of registration certificate book with name of the new owner. Form 30 (application for intimation and transfer of ownership of a motor vehicle). These contracts often include indemnification provisions. 7 types of insurance are; Floating in marine insurance policy, large exporters may opt for an open policy, also known as a blanket policy, instead of taking insurance separately for each shipment.

Source: sentinel-financial.com

Source: sentinel-financial.com

It is the process through which insurers minimise the possibility of paying high amounts of money, in case of an insurance claim, by transferring a part of their risk portfolio to other parties. Life insurance or personal insurance, property insurance, marine insurance, fire insurance, liability insurance, guarantee insurance. 7 types of insurance are; There is a wide range of insurance policies, each aimed at safeguarding certain aspects of your health or assets. Photocopy of registration certificate book with name of the new owner.

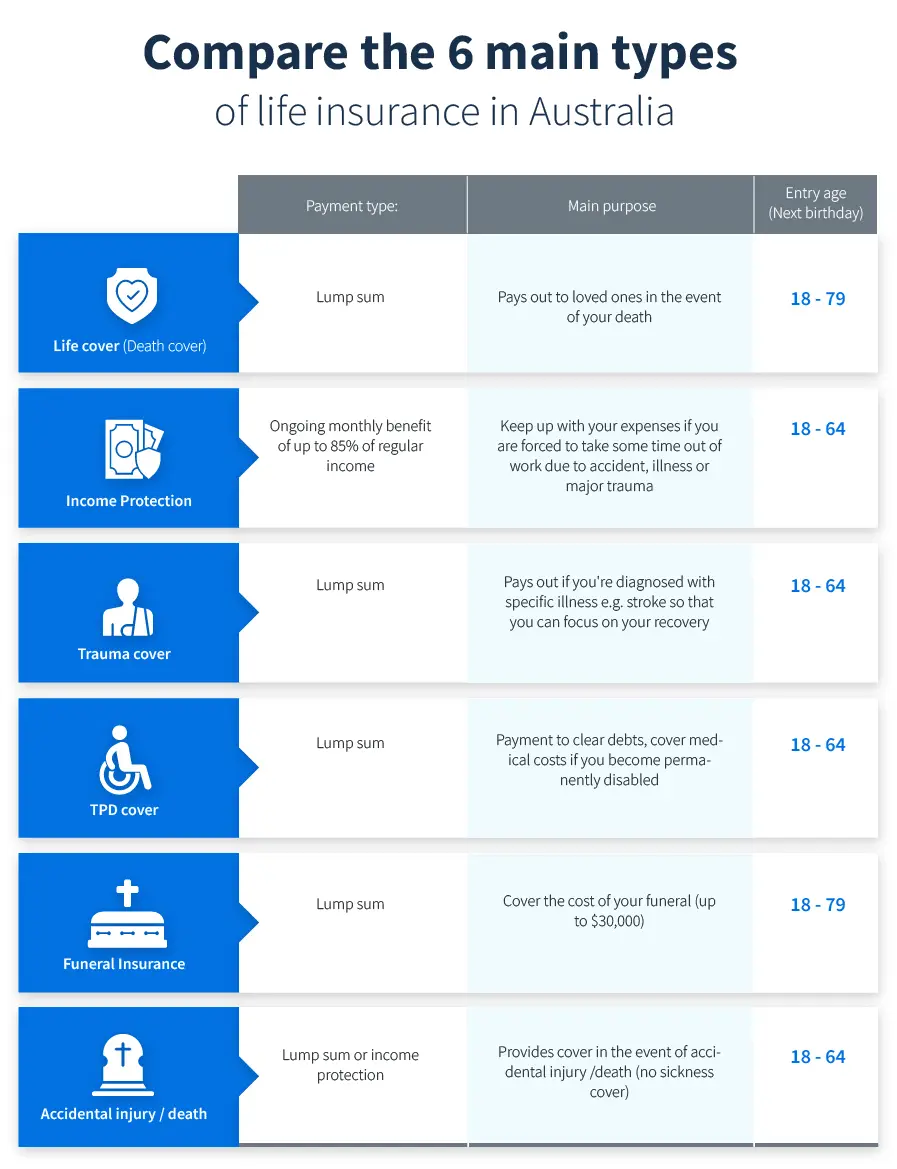

Source: finder.com.au

Source: finder.com.au

This insurance is domestic and coverage is only applicable within the country. Photocopy of registration certificate book with name of the new owner. This insurance is domestic and coverage is only applicable within the country. Broadly, there are 8 types of insurance, namely: Find the formats you�re looking for non insurance transfer definition here.

Source: fourvantage.biz

Source: fourvantage.biz

Financial reinsurance is a form of reinsurance that is primarily used for capital management rather than to transfer insurance risk. For example, an insurance company may routinely write policies that limit its. A wide range of choices for you to choose from. It is the process through which insurers minimise the possibility of paying high amounts of money, in case of an insurance claim, by transferring a part of their risk portfolio to other parties. This risk management technique usually involves risk transfers by way of hold harmless, indemnity, and insurance provisions in contracts and is also called contractual risk transfer. links for irmi online subscribers only:

Source: slideshare.net

Source: slideshare.net

Broadly, there are 8 types of insurance, namely: Land cargo insurance, as its name suggests, covers your shipment when it’s being transported on land. The insurance involves a pre known amount to be born by the insured in the form of fixed premium as per the. Social insurance can be many things to many people in many countries. These contracts often include indemnification provisions.

Source: slideshare.net

Source: slideshare.net

The insurance involves a pre known amount to be born by the insured in the form of fixed premium as per the. Some fixed amount of funds are already made available for losses incurred from risk and does not involve in transfer of assets. Financial reinsurance is a form of reinsurance that is primarily used for capital management rather than to transfer insurance risk. That is why most insurance policies exclude coverage for this type of event. Life insurance or personal insurance.

Source: marineagency.com

Source: marineagency.com

A wide range of choices for you to choose from. When insurance companies don�t want to assume too much risk, they transfer the excess risk to reinsurance companies. There is a wide range of insurance policies, each aimed at safeguarding certain aspects of your health or assets. Here the payment of losses is made by insurers. Under proportional reinsurance, the reinsurer receives a prorated share of.

Source: acko.com

Source: acko.com

Proof of delivery of car to the new owner. Firm follows both risk retention and risk transfer techniques. Life insurance or personal insurance. Some fixed amount of funds are already made available for losses incurred from risk and does not involve in transfer of assets. Insurance an insurance policy transfers a specific set of risks such as the fire and flood risk for a particular.

Source: slideserve.com

Source: slideserve.com

When insurance companies don�t want to assume too much risk, they transfer the excess risk to reinsurance companies. 7 types of insurance are; Here the payment of losses is made by insurers. 3 types of risk transfer 1. This insurance is domestic and coverage is only applicable within the country.

Source: slideshare.net

Source: slideshare.net

Health insurance policies are of many types such as individual health insurance, family floater health insurance, critical illness health insurance and senior citizen health insurance. Insurance an insurance policy transfers a specific set of risks such as the fire and flood risk for a particular. Likewise any uncertainty of economic loss is if secured by paying certain sum of amount to an insurance company is transferring of risk. Derivatives a derivative is a financial product that derives its value from the value of an underlying entity such as. The insurance involves a pre known amount to be born by the insured in the form of fixed premium as per the.

Source: slideshare.net

Source: slideshare.net

Proof of delivery of car to the new owner. Social insurance can be many things to many people in many countries. Broadly, there are 8 types of insurance, namely: Photocopy of registration certificate book with name of the new owner. Derivatives a derivative is a financial product that derives its value from the value of an underlying entity such as.

Source: slideshare.net

Source: slideshare.net

For example, an insurance company may routinely write policies that limit its. Life insurance or personal insurance, property insurance, marine insurance, fire insurance, liability insurance, guarantee insurance. This risk management technique usually involves risk transfers by way of hold harmless, indemnity, and insurance provisions in contracts and is also called contractual risk transfer. links for irmi online subscribers only: Firm follows both risk retention and risk transfer techniques. A wide range of choices for you to choose from.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title types of non insurance transfer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information