Types of portfolio insurance information

Home » Trending » Types of portfolio insurance informationYour Types of portfolio insurance images are ready. Types of portfolio insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Types of portfolio insurance files here. Download all royalty-free photos and vectors.

If you’re searching for types of portfolio insurance pictures information related to the types of portfolio insurance keyword, you have visit the ideal blog. Our site frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

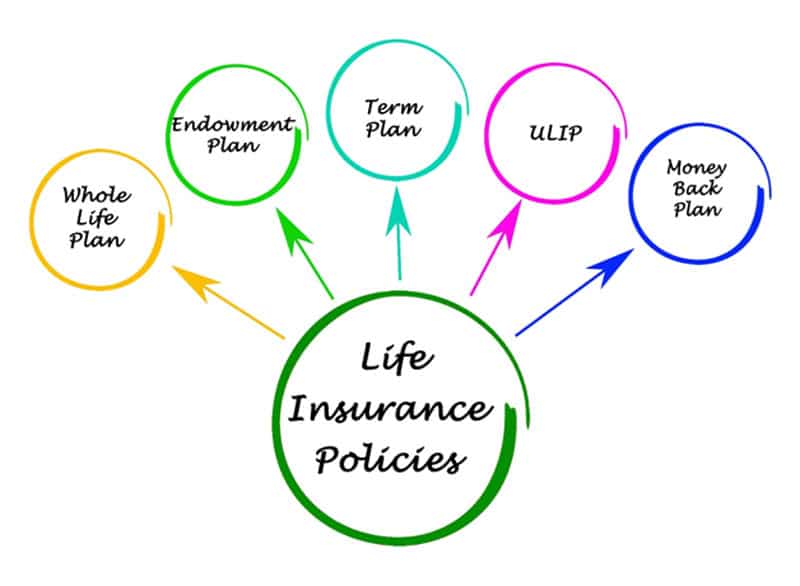

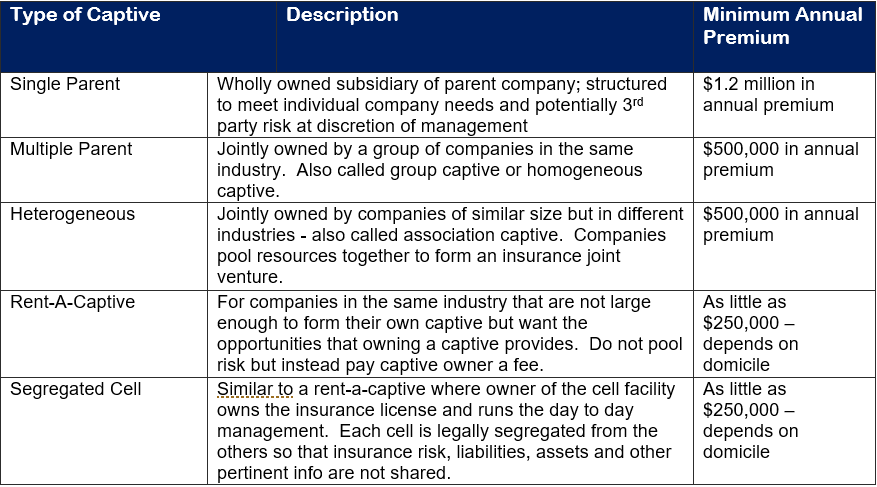

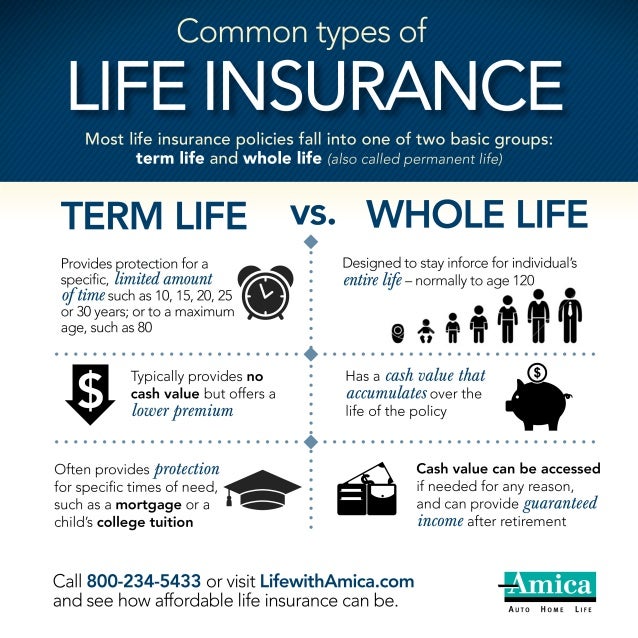

Types Of Portfolio Insurance. Another proportional treaty is known as surplus share a proportional reinsurance treaty that is common in commercial property insurance. You can purchase liability insurance for the physical property as well as for your actual business. Hazard and fire insurance is always needed. Liability insurance is always needed.

EDUCATIONAL PORTFOLIO MUTUAL FUNDS & INSURANCE COMPANIES From youtube.com

EDUCATIONAL PORTFOLIO MUTUAL FUNDS & INSURANCE COMPANIES From youtube.com

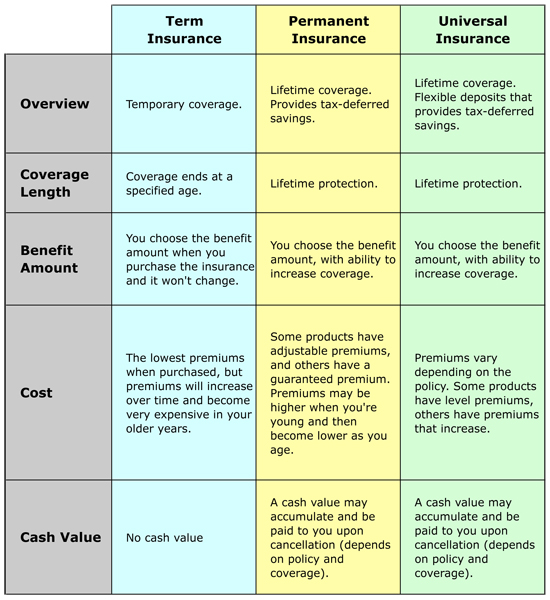

Here are ten different insurance broker roles and responsibilities: Conservative (income) portfolios balanced portfolios growth portfolios what is a conservative investment portfolio? After that, another key area in creating a solid foundation for your financial plan is to look at life insurance. Consequently, when claims are made, the reinsurer will also bear a portion of the losses. Creating a manageable and profitable portfolio of insured risks. You can purchase liability insurance for the physical property as well as for your actual business.

It’s on that basis that investment portfolios are broadly categorized into:

Securities (including mutual funds) are not fdic insured, not bank. A surplus share treaty allows the reinsured to limit its exposure on any one risk to a given amount (the retained line). The figure above shows the cumulative performance of the spy portfolio, basic cppi portfolio, dynamic multiplier cppi portfolio and the changing floor. Of course, one of its most valuable components is should also cover the costs associated with your property investment portfolio. He or she brings the clients and insurance companies together. Active income, passive income and portfolio income.

Source: entrepreneurshipsecret.com

Source: entrepreneurshipsecret.com

As we can once again see, the drawdowns of the dynamic multiplier cppi portfolio are much lower compared to the spy’s drawdowns. As we can once again see, the drawdowns of the dynamic multiplier cppi portfolio are much lower compared to the spy’s drawdowns. The reason for such uncertainty is market forces represented in two markets, viz “ bull market and bear market “ 2. C60, d51, d90, g11, g12. Hazard and fire insurance is always needed.

Source: dragonflycap.com

Source: dragonflycap.com

Conservative (income) portfolios balanced portfolios growth portfolios what is a conservative investment portfolio? Offered by an employer to its employee 6) maternity health insurance: Under this type of coverage, the reinsurer will receive a prorated share of the premiums of all the policies sold by the insurance company being covered. Beyond disability insurance, you may need other types of insurance to help protect your portfolio, too. This would make its results more predictable on a net basis (i.e.

Source: fbfinancial.ca

Source: fbfinancial.ca

He or she brings the clients and insurance companies together. Another proportional treaty is known as surplus share a proportional reinsurance treaty that is common in commercial property insurance. The term of insurance in fire insurance does not exceed generally more than one year but in life insurance, it lasts for a very long period. Offered by an employer to its employee 6) maternity health insurance: The reinsurer assumes a part of the risk in proportion to the amount that the insured value exceeds the retained line, up to a given.

Source: wikifinancepedia.com

Source: wikifinancepedia.com

Consequently, when claims are made, the reinsurer will also bear a portion of the losses. Hazard and fire insurance for the physical property: This is better illustrated in the figure below. The term of insurance in fire insurance does not exceed generally more than one year but in life insurance, it lasts for a very long period. Linking new clients and insurance companies.

Source: afterinc.com

Source: afterinc.com

Income for which services have been performed. Your risk profile and income needs determine how much risk you can afford to take, and what your portfolio holdings should look like. Conservative (income) portfolios balanced portfolios growth portfolios what is a conservative investment portfolio? An index put option is one way to establish portfolio insurance. Liability insurance is always needed.

Source: pinterest.pt

Source: pinterest.pt

Linking new clients and insurance companies. It is an insurance broker’s responsibility to represent an insurance company or companies, mostly in an independent capacity. Under this type of coverage, the reinsurer will receive a prorated share of the premiums of all the policies sold by the insurance company being covered. While income protection insurance doesn’t replace all of your income, it goes a long way to buying you some financial breathing room until you get back on your financial feet once again. There are 3 types of income:

Source: pimlicodental.com

Source: pimlicodental.com

Income for which services have been performed. Your risk profile and income needs determine how much risk you can afford to take, and what your portfolio holdings should look like. Types of insurance for real estate investors and landlords: Securities (including mutual funds) are not fdic insured, not bank. The figure above shows the cumulative performance of the spy portfolio, basic cppi portfolio, dynamic multiplier cppi portfolio and the changing floor.

Source: youtube.com

Source: youtube.com

Stocks for this kind of. This includes wages, tips, salaries, commissions, and income from businesses in which there is material participation. Of course, one of its most valuable components is should also cover the costs associated with your property investment portfolio. Good auto, home or renter’s insurance may prevent one bad accident from possibly draining your investments. Types of insurance for real estate investors and landlords:

Source: comparepolicy.com

Source: comparepolicy.com

Here are ten different insurance broker roles and responsibilities: It is an insurance broker’s responsibility to represent an insurance company or companies, mostly in an independent capacity. Factors such as children, age, lifestyle, and employment benefits play a role when you�re building your insurance portfolio. Of course, one of its most valuable components is should also cover the costs associated with your property investment portfolio. This includes wages, tips, salaries, commissions, and income from businesses in which there is material participation.

Source: vinzite.com

Source: vinzite.com

It is an insurance broker’s responsibility to represent an insurance company or companies, mostly in an independent capacity. This includes wages, tips, salaries, commissions, and income from businesses in which there is material participation. Market risk is the risk that the value of an investment will decrease due to movements in market factors. Creating a manageable and profitable portfolio of insured risks. These types of insurance plans cater to all individuals above 60 years of age 5) group health insurance :

Source: dreamstime.com

Source: dreamstime.com

Types of insurance for real estate investors and landlords: Beyond disability insurance, you may need other types of insurance to help protect your portfolio, too. Under this type of coverage, the reinsurer will receive a prorated share of the premiums of all the policies sold by the insurance company being covered. Consequently, when claims are made, the reinsurer will also bear a portion of the losses. Linking new clients and insurance companies.

Source: insurancefunda.in

Source: insurancefunda.in

A surplus share treaty allows the reinsured to limit its exposure on any one risk to a given amount (the retained line). He or she brings the clients and insurance companies together. Of course, one of its most valuable components is should also cover the costs associated with your property investment portfolio. Active income, passive income and portfolio income. Pays upfront premium fixed % of the gross net premium income (gnpi) minimum and deposit premium is often applicable primary insurer reinsurer:

Source: pinterest.com

Source: pinterest.com

Market risk is the risk that the value of an investment will decrease due to movements in market factors. Another proportional treaty is known as surplus share a proportional reinsurance treaty that is common in commercial property insurance. This is better illustrated in the figure below. Conservative (income) portfolios balanced portfolios growth portfolios what is a conservative investment portfolio? Sector solutions / special concepts;

Source: imoney.my

Source: imoney.my

While income protection insurance doesn’t replace all of your income, it goes a long way to buying you some financial breathing room until you get back on your financial feet once again. While income protection insurance doesn’t replace all of your income, it goes a long way to buying you some financial breathing room until you get back on your financial feet once again. There are, however, four types of insurance that most financial experts. The term of insurance in fire insurance does not exceed generally more than one year but in life insurance, it lasts for a very long period. Of course, one of its most valuable components is should also cover the costs associated with your property investment portfolio.

Source: slideshare.net

Source: slideshare.net

Charges the rate at which they are willing to accept the losses in excess of the client�s retention pays losses in excess of the client�s Another proportional treaty is known as surplus share a proportional reinsurance treaty that is common in commercial property insurance. The reason for such uncertainty is market forces represented in two markets, viz “ bull market and bear market “ 2. Hazard and fire insurance is always needed. You can purchase liability insurance for the physical property as well as for your actual business.

Source: dhanayo.ga

Source: dhanayo.ga

Offered by an employer to its employee 6) maternity health insurance: C60, d51, d90, g11, g12. Here are ten different insurance broker roles and responsibilities: Good auto, home or renter’s insurance may prevent one bad accident from possibly draining your investments. Active income, passive income and portfolio income.

Source: visual.ly

Source: visual.ly

C60, d51, d90, g11, g12. This includes wages, tips, salaries, commissions, and income from businesses in which there is material participation. Here are ten different insurance broker roles and responsibilities: Factors such as children, age, lifestyle, and employment benefits play a role when you�re building your insurance portfolio. You can purchase liability insurance for the physical property as well as for your actual business.

Source: turtlemint.com

Source: turtlemint.com

Types of insurance for real estate investors and landlords: Your risk profile and income needs determine how much risk you can afford to take, and what your portfolio holdings should look like. He or she brings the clients and insurance companies together. You can purchase liability insurance for the physical property as well as for your actual business. As we can once again see, the drawdowns of the dynamic multiplier cppi portfolio are much lower compared to the spy’s drawdowns.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title types of portfolio insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information