Types of stock insurance Idea

Home » Trend » Types of stock insurance IdeaYour Types of stock insurance images are ready. Types of stock insurance are a topic that is being searched for and liked by netizens today. You can Download the Types of stock insurance files here. Download all royalty-free photos and vectors.

If you’re searching for types of stock insurance pictures information linked to the types of stock insurance interest, you have come to the right site. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

Types Of Stock Insurance. Here are 9 of the most popular types of insurance policies to consider: In this chapter, the major types of insuring organizations are reviewed first. Antm) 3 best car insurance stocks. This is an entity that exists to underwrite the risks of its parent owner.

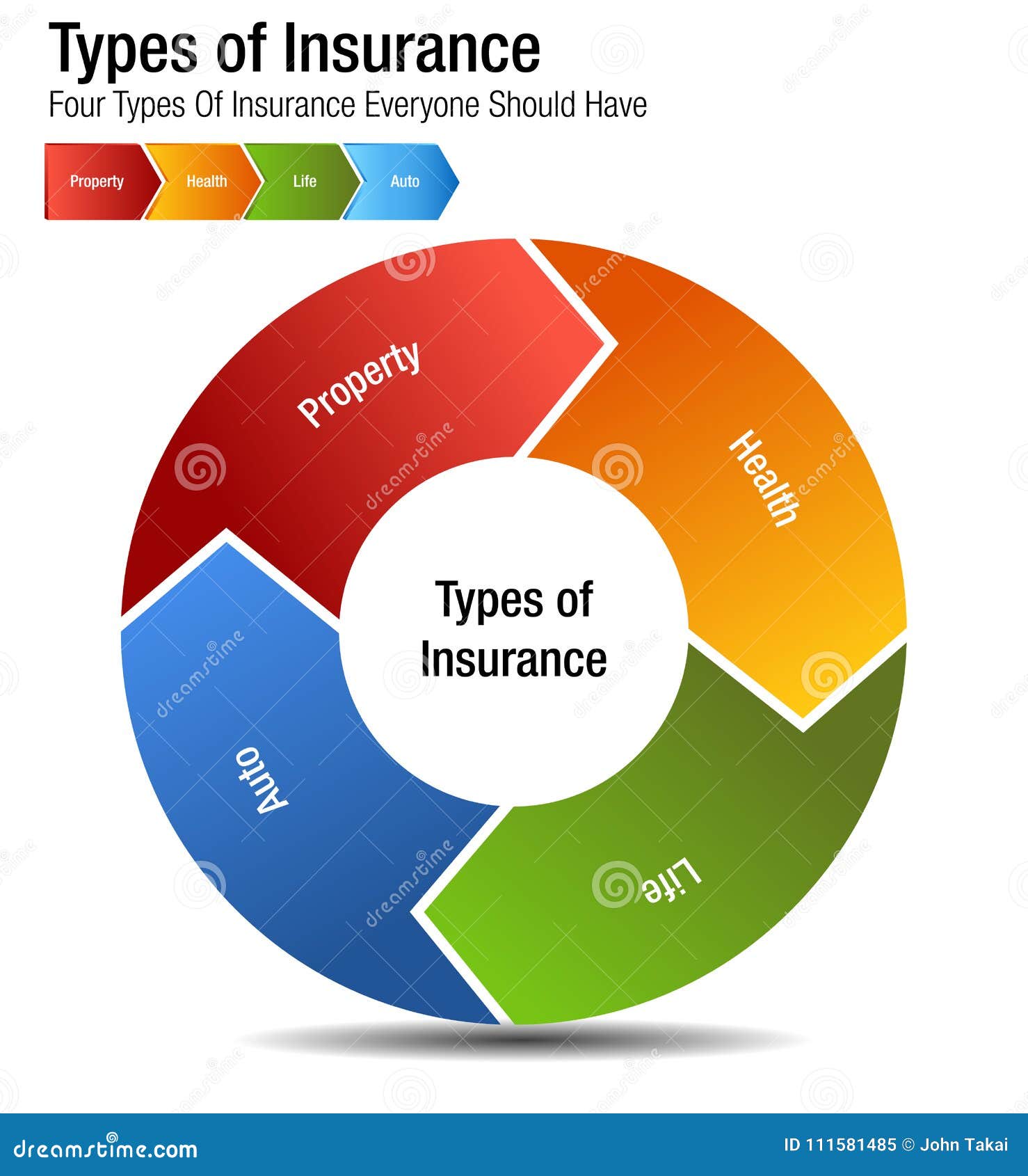

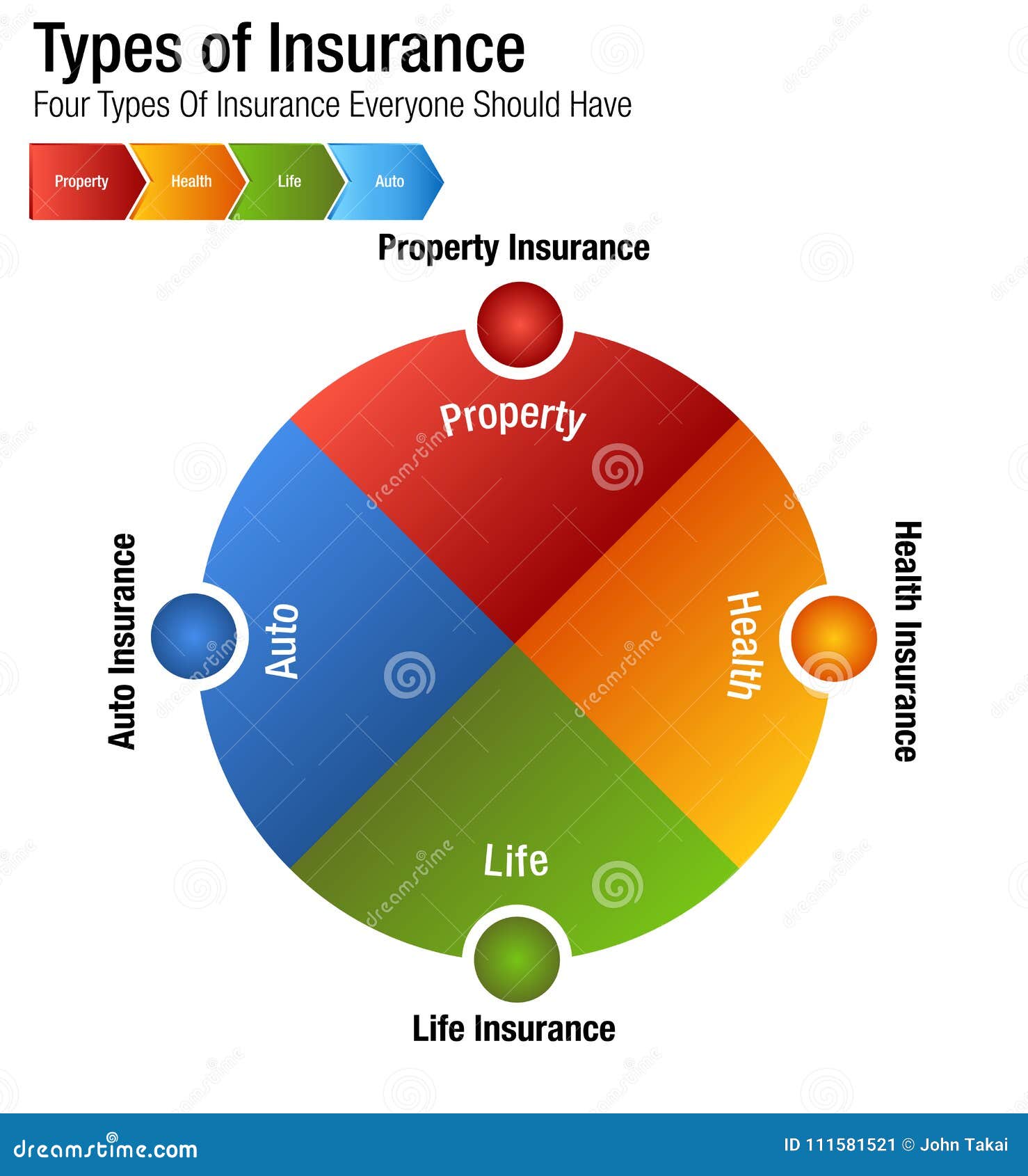

Types of Insurance Property Health Life Auto Chart — Stock From depositphotos.com

Types of Insurance Property Health Life Auto Chart — Stock From depositphotos.com

Risk all asset classes present some risk to investors. This is an entity that exists to underwrite the risks of its parent owner. Standard lines, excess lines, captives, direct sellers, domestic, alien, mutual companies, stock companies, lloyds of london and more. Health insurance motor insurance travel insurance home insurance fire insurance 2. In partial underwriting, securities are underwritten either by single underwriter or by many underwriters who agrees to assume the risk to specified amount. Stock and mutual insurance companies have banded together to form the american nuclear insurers (ani), mutual atomic energy liability underwriters (maelu) and the mutual atomic energy reinsurance pool (maerp).

Types of fire insurance policies;

When that time period is over, you get your principal back, plus a predetermined amount of interest. For your stock brokerage firms business, the most important types of insurance are intended to cover the risks to your business from accidents, from unexpected events, and from mistakes. On the other hand, gic of india (down 1.8%) and icici lombard general insurance (down 1.1%) were among the top losers. The more common categories of insurance company include: Types of private insurers include: Maximum value of discount policy.

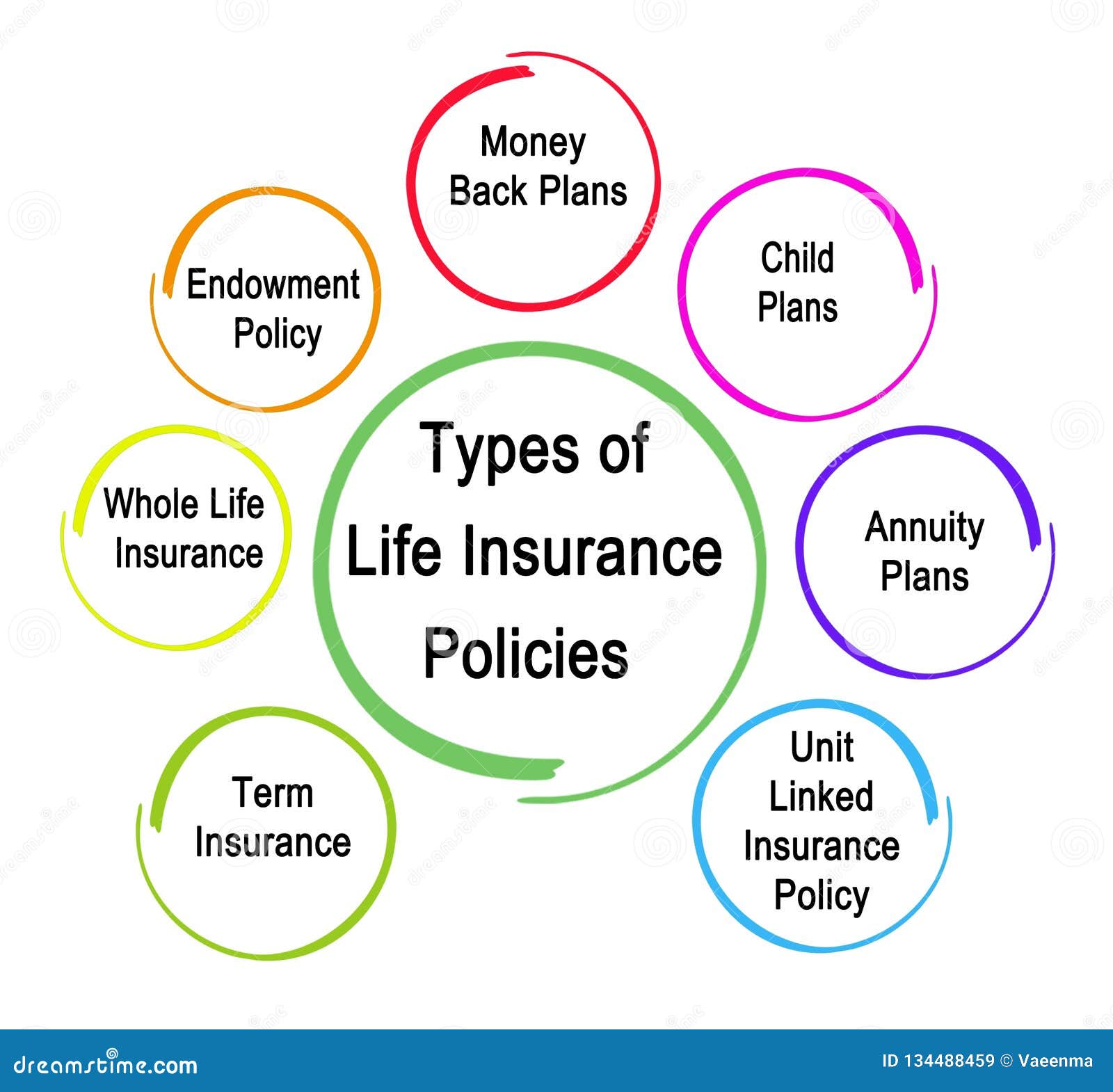

Source: dreamstime.com

Source: dreamstime.com

Auto insurance policies consists of these. Life insurance or personal insurance. Ci) 2.3 anthem inc (nyse: What does stock brokerage firms insurance protect you from? Within the insurance sector, the top gainers were sbi life insurance (up 2.2%) and icici prudential life insurance (up 1.4%).

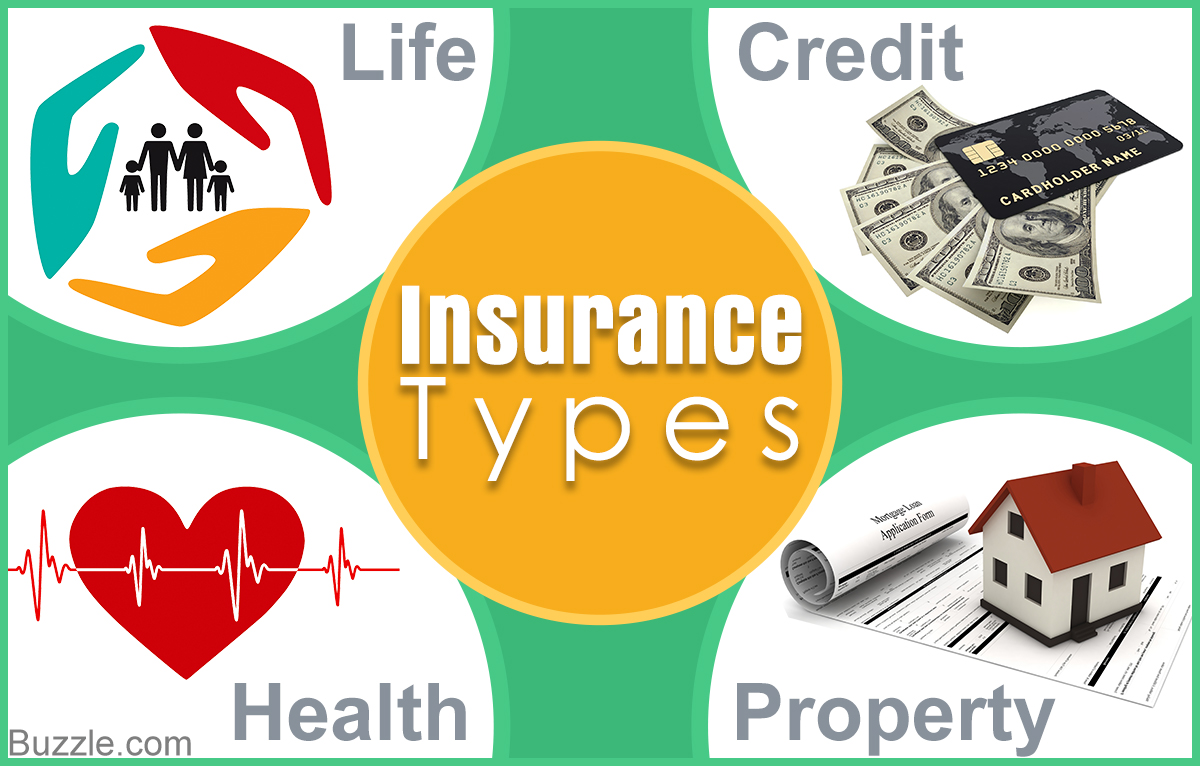

Source: buzznigeria.com

Source: buzznigeria.com

Within the insurance sector, the top gainers were sbi life insurance (up 2.2%) and icici prudential life insurance (up 1.4%). In canada, the nuclear insurance association of canada provides both types of insurance. Maximum value of discount policy. Insurance is categorized based on risk, type, and hazards. When that time period is over, you get your principal back, plus a predetermined amount of interest.

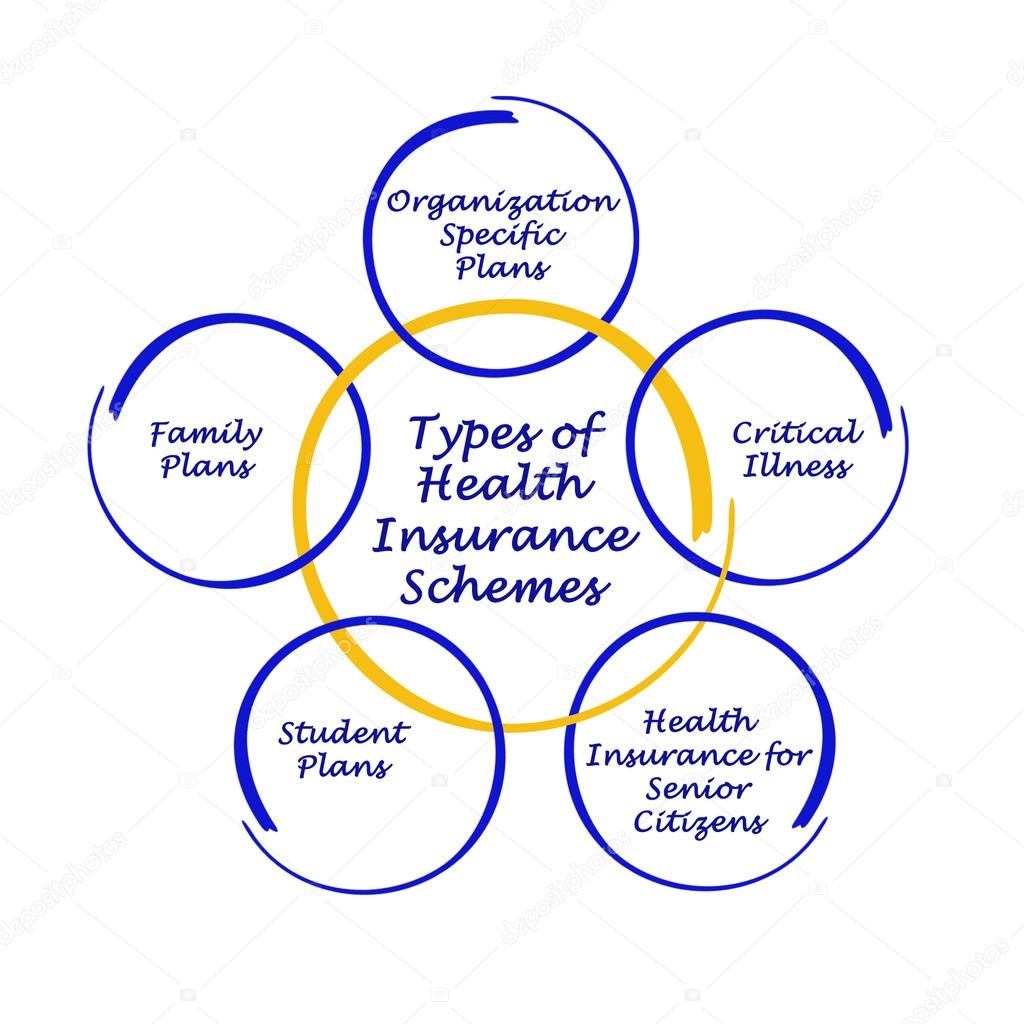

Source: marketbusinessnews.com

Source: marketbusinessnews.com

9 types of insurance you need to consider. In this chapter, the major types of insuring organizations are reviewed first. This is an entity that exists to underwrite the risks of its parent owner. Types of fire insurance policies; Finished goods ready for sale;

Source: dreamstime.com

Source: dreamstime.com

Under such agreement, underwriter underwrites partial amount of shares/debentures issued by companies. When that time period is over, you get your principal back, plus a predetermined amount of interest. In addition to their surplus and reserve accounts, a capital stock insurance. Standard lines, excess lines, captives, direct sellers, domestic, alien, mutual companies, stock companies, lloyds of london and more. Hdfc’s dos policy protects against deterioration, contamination or putrefaction (rotting) of perishable stock as a result of the unexpected rise in temperature brought about by the accidental failure or breakdown of the refrigeration plant.

Source: dreamstime.com

Source: dreamstime.com

What are the types of intermediaries? In partial underwriting, securities are underwritten either by single underwriter or by many underwriters who agrees to assume the risk to specified amount. Maximum value of discount policy. Hdfc’s dos policy protects against deterioration, contamination or putrefaction (rotting) of perishable stock as a result of the unexpected rise in temperature brought about by the accidental failure or breakdown of the refrigeration plant. In canada, the nuclear insurance association of canada provides both types of insurance.

Also there are some legal kinds of insurance that various states require. In partial underwriting, securities are underwritten either by single underwriter or by many underwriters who agrees to assume the risk to specified amount. Insurance is categorized based on risk, type, and hazards. What are the types of intermediaries? This is an entity that exists to underwrite the risks of its parent owner.

Source: dreamstime.com

Source: dreamstime.com

Types of private insurers include: There are no major risks to cds. Ci) 2.3 anthem inc (nyse: Within the insurance sector, the top gainers were sbi life insurance (up 2.2%) and icici prudential life insurance (up 1.4%). Standard lines, excess lines, captives, direct sellers, domestic, alien, mutual companies, stock companies, lloyds of london and more.

Source: dreamstime.com

Source: dreamstime.com

Investors turn to stocks and. Stock and mutual insurance companies have banded together to form the american nuclear insurers (ani), mutual atomic energy liability underwriters (maelu) and the mutual atomic energy reinsurance pool (maerp). Types of fire insurance policies; Insurance is categorized based on risk, type, and hazards. This is an entity that exists to underwrite the risks of its parent owner.

Source: depositphotos.com

Source: depositphotos.com

These are personnel who are directly associated with the organization or stock exchanges. 2.1 unitedhealth group inc (nyse: The more common categories of insurance company include: Standard lines, excess lines, captives, direct sellers, domestic, alien, mutual companies, stock companies, lloyds of london and more. Ci) 2.3 anthem inc (nyse:

Source: dreamstime.com

Source: dreamstime.com

A capital stock insurance company is a type of insurance company that is owned by shareholders instead of policyholders. Under such agreement, underwriter underwrites partial amount of shares/debentures issued by companies. After taxes are paid, the rate of return is often so low that it. Investors turn to stocks and. Hdfc’s dos policy protects against deterioration, contamination or putrefaction (rotting) of perishable stock as a result of the unexpected rise in temperature brought about by the accidental failure or breakdown of the refrigeration plant.

Source: rustycarwallpaper3185.blogspot.com

Source: rustycarwallpaper3185.blogspot.com

Universal life and variable life insurance policies direct a percentage of policy assets into stocks and bonds. In addition to their surplus and reserve accounts, a capital stock insurance. On the other hand, gic of india (down 1.8%) and icici lombard general insurance (down 1.1%) were among the top losers. The concept can also be used to provide insurance for a group of participating entities. Under such agreement, underwriter underwrites partial amount of shares/debentures issued by companies.

Source: onlinejess.com

Source: onlinejess.com

Here is a brief explanation of each of these different types of insurance companies and the specific specialty risks insured and other unique attributes. 1 best insurance stocks to buy. What are the types of intermediaries? February 18, 2022 (close) nse prices: A capital stock insurance company is a type of insurance company that is owned by shareholders instead of policyholders.

Source: depositphotos.com

Source: depositphotos.com

Finished goods ready for sale; The longer the loan period, the higher your interest rate. Also there are some legal kinds of insurance that various states require. 1 best insurance stocks to buy. In this article, we’ll feature some of the best insurance stocks to invest in right now.

Source: rustycarwallpaper3185.blogspot.com

Source: rustycarwallpaper3185.blogspot.com

Top five health insurance stocks in terms of market cap (the size of the company calculated by the shares outstanding multiplied by the share price): The more common categories of insurance company include: In partial underwriting, securities are underwritten either by single underwriter or by many underwriters who agrees to assume the risk to specified amount. This policy will provide you with coverage securing your goods lying at various places. 2.1 unitedhealth group inc (nyse:

They function to link the buyer and sellers. The more common categories of insurance company include: In this article, we’ll feature some of the best insurance stocks to invest in right now. 2.1 unitedhealth group inc (nyse: After taxes are paid, the rate of return is often so low that it.

Source: iedunote.com

Source: iedunote.com

A capital stock insurance company is a type of insurance company that is owned by shareholders instead of policyholders. When that time period is over, you get your principal back, plus a predetermined amount of interest. Everything you use to make your products, provide your services and to run your business is part of your stock. Life insurance or personal insurance. On the other hand, gic of india (down 1.8%) and icici lombard general insurance (down 1.1%) were among the top losers.

Source: rustycarwallpaper3185.blogspot.com

Source: rustycarwallpaper3185.blogspot.com

Antm) 3 best car insurance stocks. The longer the loan period, the higher your interest rate. Standard lines, excess lines, captives, direct sellers, domestic, alien, mutual companies, stock companies, lloyds of london and more. Health insurance motor insurance travel insurance home insurance fire insurance 2. Top five health insurance stocks in terms of market cap (the size of the company calculated by the shares outstanding multiplied by the share price):

Source: dreamstime.com

Source: dreamstime.com

Life insurance or personal insurance, property insurance, marine insurance, fire insurance, liability insurance, guarantee insurance. Everything you use to make your products, provide your services and to run your business is part of your stock. Auto insurance policies consists of these. In this chapter, the major types of insuring organizations are reviewed first. Health insurance motor insurance travel insurance home insurance fire insurance 2.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title types of stock insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information