Uber visa card travel insurance information

Home » Trending » Uber visa card travel insurance informationYour Uber visa card travel insurance images are ready in this website. Uber visa card travel insurance are a topic that is being searched for and liked by netizens now. You can Download the Uber visa card travel insurance files here. Find and Download all royalty-free vectors.

If you’re searching for uber visa card travel insurance pictures information linked to the uber visa card travel insurance interest, you have come to the right blog. Our website always gives you hints for refferencing the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

Uber Visa Card Travel Insurance. Ultimately he said all visa cards include these perks. May include roadside dispatch, baggage delay, travel and emergency assistance services, and travel accident insurance, depending on card tier. The platinum card provides $15 in uber credits per month for u.s. These benefits make the uber visa card a good bet for both purchasing.

Your guide to DoorDash, Grubhub and Uber Eats promo codes From in.pinterest.com

Your guide to DoorDash, Grubhub and Uber Eats promo codes From in.pinterest.com

You’ll need to ensure that you pay your cellular bill using your uber card in order to take advantage of this offer. Offering 3% back on travel is a shot across the bow at the chase sapphire reserve… except with the uber visa card, there is no annual fee. If you charge your monthly cell phone bill to the card, you�ll get coverage for damage or theft of up. The uber visa credit card offers a pretty cool benefit for cellphone owners. The platinum card provides $15 in uber credits per month for u.s. Green dot bank also operates under the following registered trade names:

Pay for your monthly wireless telephone bill with your uber visa card and your phone will be covered if it’s stolen or damaged.

Although there�s a $550 annual fee, you�ll receive a $300 travel credit each year — automatically applied for flights, hotels and even uber rides. You can have a maximum of two claims a year for a total of $1,200. Here are the key details of the program. While the card offers up to $600 in coverage for stolen and damaged cellphones, as well as involuntary and accidental parting of your cellphone when you pay your monthly phone bill with the card, the card does not come with any other travel insurance options, such as trip delay or baggage loss protections, it’s not the best travel card. There are a few other uber visa benefit changes that you need to know about too. If you pay your cellphone bill with your uber visa credit card, you can get up to $600 of supplemental insurance for damage and theft protection.

Source: financesage.net

Source: financesage.net

This card offers rewards on both uber rides and uber purchases, as you�ll earn 5x points on flights and 10x points on hotels and car rentals through chase ultimate rewards® If you charge your monthly cell phone bill to the card, you�ll get coverage for damage or theft of up. He read some language that sounded like it is included but could not provide any agreement, terms, benefit paperwork to confirm it. Cell phone insurance of up to $600 if you pay your monthly bill with the uber card access to exclusive events no foreign transactions fees visa local offers the uber card comes with cell phone insurance. There are a few other uber visa benefit changes that you need to know about too.

Source: gobankingrates.com

Source: gobankingrates.com

The new uber visa credit card design is one of the uber visa credit card updates. Ultimately he said all visa cards include these perks. While the card offers up to $600 in coverage for stolen and damaged cellphones, as well as involuntary and accidental parting of your cellphone when you pay your monthly phone bill with the card, the card does not come with any other travel insurance options, such as trip delay or baggage loss protections, it’s not the best travel card. This card offers rewards on both uber rides and uber purchases, as you�ll earn 5x points on flights and 10x points on hotels and car rentals through chase ultimate rewards® If you do, you’ll be able to file a damage or theft claim on your device and get up to $600 after a $25 deductible.

Source: money.com

Source: money.com

If you pay your cellphone bill with your uber visa credit card, you can get up to $600 of supplemental insurance for damage and theft protection. Additional rewards, such as purchases made at exxon mobil* gas stations, advance auto parts stores, and carquest auto are excluded. But this card is not available anymore. He read some language that sounded like it is included but could not provide any agreement, terms, benefit paperwork to confirm it. 5% back on uber purchases (including uber eats) 3% back on dining, hotels, and airfare 1% back on all other purchases no annual fee, no foreign transaction fees, and up to $600 in cell phone insurance coverage for damage or theft.

Source: maphappy.org

Source: maphappy.org

Offering 3% back on travel is a shot across the bow at the chase sapphire reserve… except with the uber visa card, there is no annual fee. The uber credit card comes with a perk that can be somewhat hard to find: Go2bank, gobank and bonneville bank. The new uber visa credit card design is one of the uber visa credit card updates. Green dot bank also operates under the following registered trade names:

Source: financesage.net

Source: financesage.net

These benefits make the uber visa card a good bet for both purchasing. The uber credit card’s benefits used to include cellphone insurance, rental car insurance, baggage insurance, travel accident insurance, trip cancellation and interruption insurance, no foreign transaction fees, purchase assurance, free fico score access, and price protection. If you pay your cellphone bill with your uber visa credit card, you can get up to $600 of supplemental insurance for damage and theft protection. 5% back on uber purchases (including uber eats) 3% back on dining, hotels, and airfare 1% back on all other purchases no annual fee, no foreign transaction fees, and up to $600 in cell phone insurance coverage for damage or theft. Starting november 1, 2019, all cardmembers will have access to roadside assistance — at a cost.

Source: thesimpledollar.com

Source: thesimpledollar.com

If you do, you’ll be able to file a damage or theft claim on your device and get up to $600 after a $25 deductible. Rides as well as a $20 credit in december, so you can earn up to $200 per year in annual statement. Ultimately he said all visa cards include these perks. The uber visa credit card offers a pretty cool benefit for cellphone owners. No other consumer credit card offers the same uncapped 5% rewards rate on uber spending.

Source: ecomparemo.com

Source: ecomparemo.com

Additional rewards, such as purchases made at exxon mobil* gas stations, advance auto parts stores, and carquest auto are excluded. 5% back on uber purchases (including uber eats) 3% back on dining, hotels, and airfare 1% back on all other purchases no annual fee, no foreign transaction fees, and up to $600 in cell phone insurance coverage for damage or theft. The uber visa credit card offers a pretty cool benefit for cellphone owners. Use the card for all travel, restaurant and hotel purchases to take advantage of bonus points. You can have a maximum of two claims a year for a total of $1,200.

Source: ednaalves14.blogspot.com

Source: ednaalves14.blogspot.com

The uber credit card’s benefits used to include cellphone insurance, rental car insurance, baggage insurance, travel accident insurance, trip cancellation and interruption insurance, no foreign transaction fees, purchase assurance, free fico score access, and price protection. Use the card for all travel, restaurant and hotel purchases to take advantage of bonus points. If a cardholder uses the uber credit card to pay for their monthly wireless bill, the phones listed are automatically covered beginning the. This card offers rewards on both uber rides and uber purchases, as you�ll earn 5x points on flights and 10x points on hotels and car rentals through chase ultimate rewards® The coverage is up to $600 per claim, subject to a $25 deductible.

Source: pinterest.com

Source: pinterest.com

Cell phone insurance of up to $600 if you pay your monthly bill with the uber card access to exclusive events no foreign transactions fees visa local offers the uber card comes with cell phone insurance. You can have a maximum of two claims a year for a total of $1,200. These benefits make the uber visa card a good bet for both purchasing. While the card offers up to $600 in coverage for stolen and damaged cellphones, as well as involuntary and accidental parting of your cellphone when you pay your monthly phone bill with the card, the card does not come with any other travel insurance options, such as trip delay or baggage loss protections, it’s not the best travel card. If you do, you’ll be able to file a damage or theft claim on your device and get up to $600 after a $25 deductible.

Source: alvia.com

Source: alvia.com

He read some language that sounded like it is included but could not provide any agreement, terms, benefit paperwork to confirm it. Although there�s a $550 annual fee, you�ll receive a $300 travel credit each year — automatically applied for flights, hotels and even uber rides. Rides as well as a $20 credit in december, so you can earn up to $200 per year in annual statement. Use the card for all travel, restaurant and hotel purchases to take advantage of bonus points. Starting november 1, 2019, all cardmembers will have access to roadside assistance — at a cost.

Source: coverager.com

Source: coverager.com

The platinum card from american express one of the few cards to directly offer a statement credit for uber purchases is the platinum card from american express. If you do, you’ll be able to file a damage or theft claim on your device and get up to $600 after a $25 deductible. You have to file a claim within 90 days of the damage or theft to qualify. The uber visa debit card is issued by green dot bank, member fdic. There are a few other uber visa benefit changes that you need to know about too.

Source: financebesties.com

Source: financebesties.com

Ultimately he said all visa cards include these perks. You might qualify for the uber visa signature version of the card, which comes with a robust collection of travel perks, including extended warranty, price protection, purchase assurance, baggage delay insurance, trip cancellation and interruption protection, car rental insurance and more. This card offers rewards on both uber rides and uber purchases, as you�ll earn 5x points on flights and 10x points on hotels and car rentals through chase ultimate rewards® Rides as well as a $20 credit in december, so you can earn up to $200 per year in annual statement. Here are the key details of the program.

He read some language that sounded like it is included but could not provide any agreement, terms, benefit paperwork to confirm it. You might qualify for the uber visa signature version of the card, which comes with a robust collection of travel perks, including extended warranty, price protection, purchase assurance, baggage delay insurance, trip cancellation and interruption protection, car rental insurance and more. Cell phone insurance of up to $600 if you pay your monthly bill with the uber card access to exclusive events no foreign transactions fees visa local offers the uber card comes with cell phone insurance. Check regularly for visa local offers to earn more uber cash. Ultimately he said all visa cards include these perks.

I was told that the card includes travelers insurance and rental car protection but it’s through visa and not through barclays uber. This card offers rewards on both uber rides and uber purchases, as you�ll earn 5x points on flights and 10x points on hotels and car rentals through chase ultimate rewards® You have to file a claim within 90 days of the damage or theft to qualify. You can have a maximum of two claims a year for a total of $1,200. The uber credit card’s benefits used to include cellphone insurance, rental car insurance, baggage insurance, travel accident insurance, trip cancellation and interruption insurance, no foreign transaction fees, purchase assurance, free fico score access, and price protection.

![Amex Platinum Card Maximizing Monthly Uber Credits [2021] Amex Platinum Card Maximizing Monthly Uber Credits [2021]](https://upgradedpoints.com/wp-content/uploads/2021/01/Amex-Platinum-Card-rental-car-1020x472.jpg) Source: upgradedpoints.com

Source: upgradedpoints.com

This card offers rewards on both uber rides and uber purchases, as you�ll earn 5x points on flights and 10x points on hotels and car rentals through chase ultimate rewards® 5% uber cash on uber eats chase sapphire preferred card the chase sapphire preferred® card benefits include unlimited deliveries with a $0 delivery fee and reduced service fees on eligible orders over $12 for a minimum of one year with dashpass, doordash’s subscription service. You have to file a claim within 90 days of the damage or theft to qualify. These benefits make the uber visa card a good bet for both purchasing. Ultimately he said all visa cards include these perks.

Source: prnewswire.com

Source: prnewswire.com

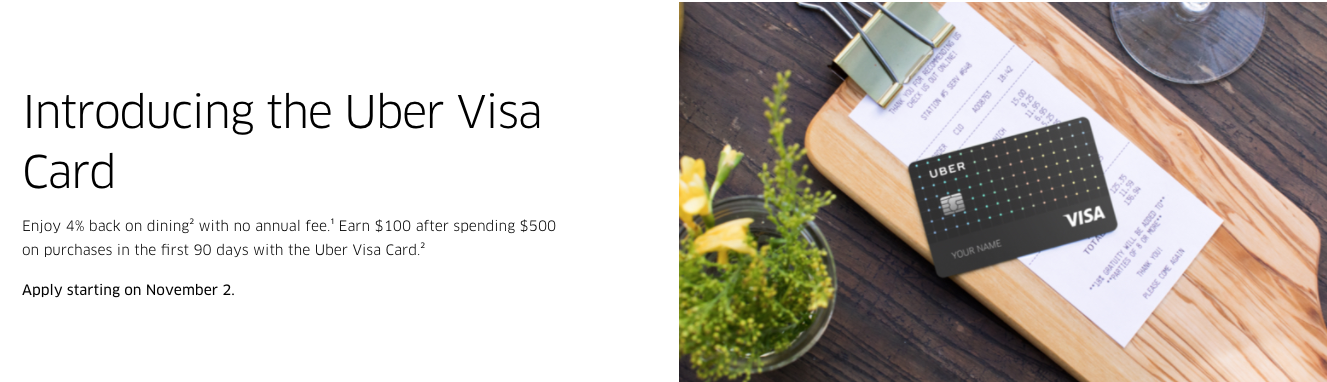

The new uber visa credit card design is one of the uber visa credit card updates. The coverage is up to $600 per claim, subject to a $25 deductible. Ultimately he said all visa cards include these perks. Pay for your monthly wireless telephone bill with your uber visa card and your phone will be covered if it’s stolen or damaged. The terms & fees the uber card can be completely free to use, as long as you avoid accruing interest and fees by paying your balance in full each billing period.

Source: biltwealth.com

Source: biltwealth.com

While the card offers up to $600 in coverage for stolen and damaged cellphones, as well as involuntary and accidental parting of your cellphone when you pay your monthly phone bill with the card, the card does not come with any other travel insurance options, such as trip delay or baggage loss protections, it’s not the best travel card. The uber visa debit card is issued by green dot bank, member fdic. But this card is not available anymore. The platinum card provides $15 in uber credits per month for u.s. Cell phone insurance of up to $600 if you pay your monthly bill with the uber card access to exclusive events no foreign transactions fees visa local offers the uber card comes with cell phone insurance.

Source: standard.co.uk

Source: standard.co.uk

Although there�s a $550 annual fee, you�ll receive a $300 travel credit each year — automatically applied for flights, hotels and even uber rides. Although there�s a $550 annual fee, you�ll receive a $300 travel credit each year — automatically applied for flights, hotels and even uber rides. Offering 3% back on travel is a shot across the bow at the chase sapphire reserve… except with the uber visa card, there is no annual fee. Pay for your monthly wireless telephone bill with your uber visa card and your phone will be covered if it’s stolen or damaged. While the card offers up to $600 in coverage for stolen and damaged cellphones, as well as involuntary and accidental parting of your cellphone when you pay your monthly phone bill with the card, the card does not come with any other travel insurance options, such as trip delay or baggage loss protections, it’s not the best travel card.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title uber visa card travel insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information