Uk insurance market 2017 Idea

Home » Trending » Uk insurance market 2017 IdeaYour Uk insurance market 2017 images are available. Uk insurance market 2017 are a topic that is being searched for and liked by netizens today. You can Get the Uk insurance market 2017 files here. Get all royalty-free images.

If you’re searching for uk insurance market 2017 images information connected with to the uk insurance market 2017 keyword, you have visit the right blog. Our site always provides you with hints for viewing the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

Uk Insurance Market 2017. Regional stock market indicators contain the advanced and emerging markets. The expansion of alternative capital slowed down in 2019, Potential impact on the motor insurance market, which generates a total annual premium of £15.6 billion. In 2017, the uk introduced legislation to provide for the creation and operation of protected cell companies in the uk so as to foster the growth of the insurance linked securities market in the uk (see question 5).

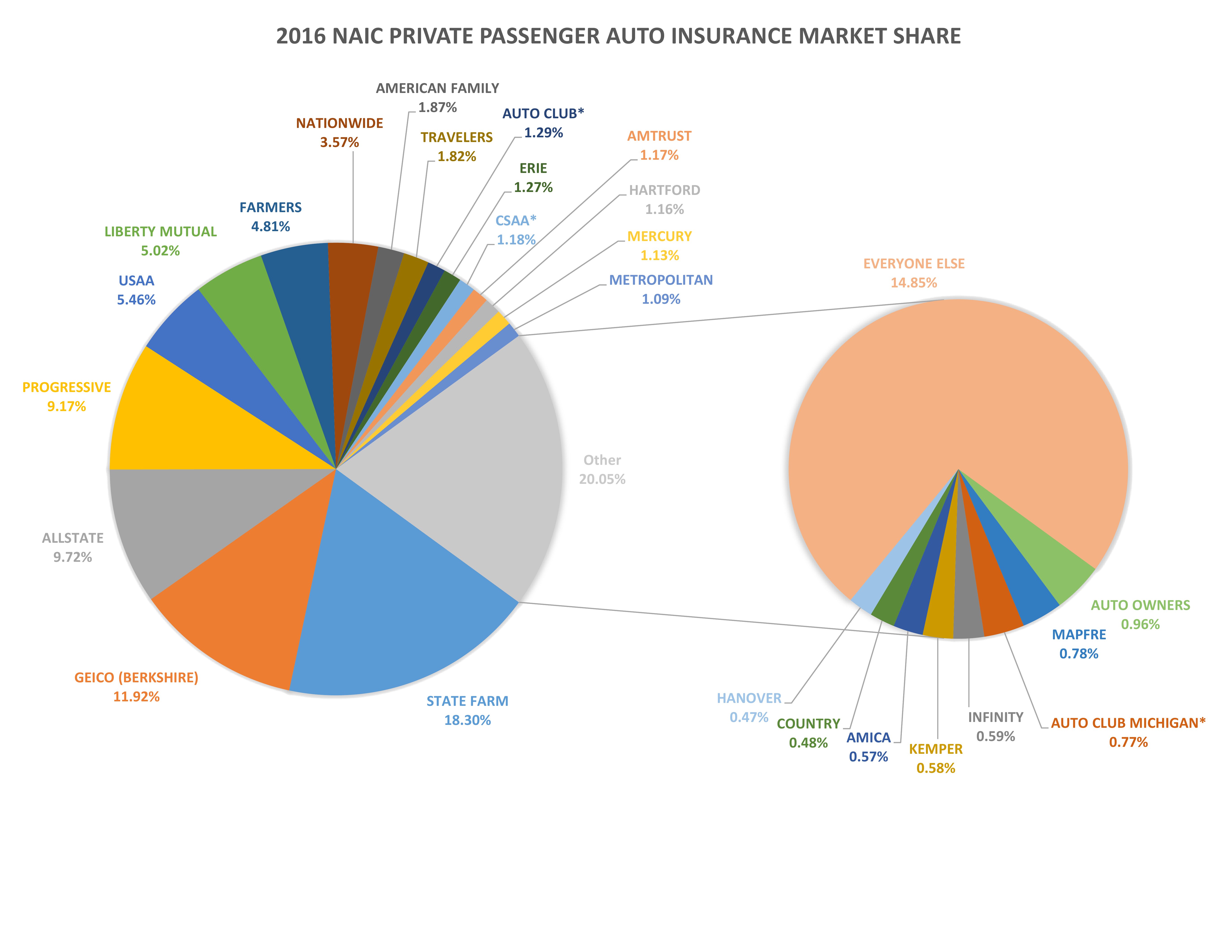

GEICO, Amtrust, Progressive auto insurance market share From repairerdrivennews.com

GEICO, Amtrust, Progressive auto insurance market share From repairerdrivennews.com

The uk insurance market has spoken: 43 maitree christian, “voya financial selling certain annuity businesses to investor group,” s&p global market intelligence, december 21, 2017. But another uk insurance market has also spoken: At the regional level, emea recorded moderate growth in the p&c and health insurance. The market and its profitability remained fairly stable in 2018 compared to previous years. Saw a slowdown in growth of gross written premiums (gwp) from 4.8 percent in 2015 to.

In 2017, the uk introduced legislation to provide for the creation and operation of protected cell companies in the uk so as to foster the growth of the insurance linked securities market in the uk (see question 5).

This one has severe doubts about its efficiency, its diversity, and its cultural and technological fitness to face the future. The uk insurance market has spoken: Life, health, travel, and car insurance are well developed with a range of advantages such as affordable prices, premium opportunities, and much more benefits for individuals and business. The uk pet insurance market report identifies consumer attitudes towards pet insurance, competitive strategies, purchase barriers, and pet insurance industry analysis in the uk. The market and its profitability remained fairly stable in 2018 compared to previous years. X.x lock purchase this report or a membership to unlock the average company profit margin for this industry.

Source: kikavagyok.blogspot.com

To give an indication of scale, in 2017 the uk general insurance market wrote £88.8 billion of premiums and managed worldwide investments totalling £143 billion; Aviva aviva is an international insurance company, headquartered in london. Life insurance, in particular, looks set to return to strong annual premium growth of 5.6% (3.9% in real terms) after a weak 2017. Highest growth rate from 2015 to 2016, at 6 percent followed by p&c at 4.2 percent, while life. In the absence of commercial insurance market coverage, the uk government has therefore confirmed that it would intervene and subject to any eu or uk legal requirements such as state aid, consider arrangements to fill any gap in cover, but on commercial terms.5 accordingly,

Source: appsruntheworld.com

Source: appsruntheworld.com

43 maitree christian, “voya financial selling certain annuity businesses to investor group,” s&p global market intelligence, december 21, 2017. The market and its profitability remained fairly stable in 2018 compared to previous years. This one has severe doubts about its efficiency, its diversity, and its cultural and technological fitness to face the future. Insurers, asset managers and financial advisors all face real pressure to transform. Highest growth rate from 2015 to 2016, at 6 percent followed by p&c at 4.2 percent, while life.

Source: comptia.org

Source: comptia.org

The uk pet insurance market report identifies consumer attitudes towards pet insurance, competitive strategies, purchase barriers, and pet insurance industry analysis in the uk. Highest growth rate from 2015 to 2016, at 6 percent followed by p&c at 4.2 percent, while life. Life insurance, in particular, looks set to return to strong annual premium growth of 5.6% (3.9% in real terms) after a weak 2017. Property rates have increased every quarter since the series of natural catastrophes that took place in 2017. We have used a questionnaire to engage with technology and insurance experts, translating their answers into a model that forecasts this insurance sector.

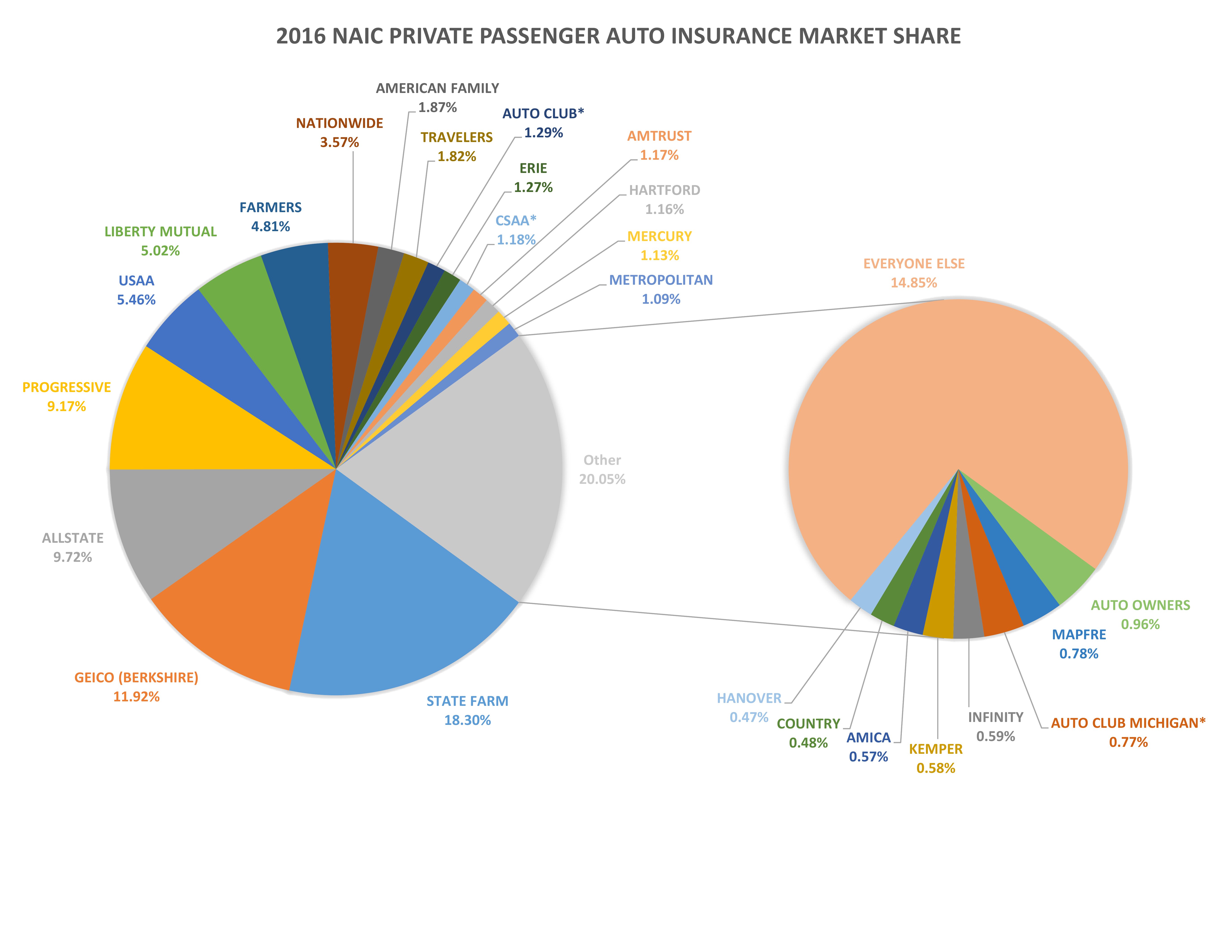

Source: slideshare.net

Source: slideshare.net

In the absence of commercial insurance market coverage, the uk government has therefore confirmed that it would intervene and subject to any eu or uk legal requirements such as state aid, consider arrangements to fill any gap in cover, but on commercial terms.5 accordingly, In this segment, we are expecting annual growth rates of close to 5% (3.3% in real terms). Despite the decrease, italy still represents the third european life market by. The average of questionnaire responses (‘central estimate’), 43 maitree christian, “voya financial selling certain annuity businesses to investor group,” s&p global market intelligence, december 21, 2017.

Source: motorinsuraswa.blogspot.com

Source: motorinsuraswa.blogspot.com

The report uk private motor insurance: Motor insurance companies paid out over 13.4 billion british pounds in claims in 2017, amounting to approximately 29 million pounds per day in domestic payments alone. To give an indication of scale, in 2017 the uk general insurance market wrote £88.8 billion of premiums and managed worldwide investments totalling £143 billion; We conclude that tests should be based on what influences the marginal buyer of an insurance policy, not the average buyer. Stock prices insurance sector cagr 1% 14% l l l stock prices total market cagr 1.6% 12.3% l l l advanced markets * as a % of net premiums earned, cagr = compound average growth rate.

Source: chcf.org

Source: chcf.org

The uk insurance market has spoken: Wholesale insurance broker market study team competition & economics division financial conduct authority 25 the north colonnade canary wharf london e14 5hs email: Losses, especially those stemming from natural catastrophes, are at a period low. The uk insurance market has spoken: Get in touch with us now.

Source: globaldata.com

Source: globaldata.com

Aviva aviva is an international insurance company, headquartered in london. The united kingdom is one of the largest insurance markets in the world, being home to both a very large domestic market, and many multinational insurers. The uk insurance industry is the largest in europe, with its companies managing a total of £1.8tn worth of investments, making it also the third biggest market in the world, according to the association of british insurers (abi). The expansion of alternative capital slowed down in 2019, Losses, especially those stemming from natural catastrophes, are at a period low.

Source: repairerdrivennews.com

Source: repairerdrivennews.com

At the regional level, emea recorded moderate growth in the p&c and health insurance. We note that it has long been recognised that insurance markets are vulnerable to the curse of ‘adverse selection’. Stock prices insurance sector cagr 1% 14% l l l stock prices total market cagr 1.6% 12.3% l l l advanced markets * as a % of net premiums earned, cagr = compound average growth rate. 43 maitree christian, “voya financial selling certain annuity businesses to investor group,” s&p global market intelligence, december 21, 2017. In the absence of commercial insurance market coverage, the uk government has therefore confirmed that it would intervene and subject to any eu or uk legal requirements such as state aid, consider arrangements to fill any gap in cover, but on commercial terms.5 accordingly,

Source: mordorintelligence.com

Losses, especially those stemming from natural catastrophes, are at a period low. The report uk private motor insurance: Saw a slowdown in growth of gross written premiums (gwp) from 4.8 percent in 2015 to. The uk insurance industry is the largest in europe, with its companies managing a total of £1.8tn worth of investments, making it also the third biggest market in the world, according to the association of british insurers (abi). Losses, especially those stemming from natural catastrophes, are at a period low.

Source: thetruthaboutcars.com

Source: thetruthaboutcars.com

Property rates have increased every quarter since the series of natural catastrophes that took place in 2017. Potential impact on the motor insurance market, which generates a total annual premium of £15.6 billion. The united kingdom is one of the largest insurance markets in the world, being home to both a very large domestic market, and many multinational insurers. The uk hosts the fourth largest insurance market in the world, and the largest in europe, with a total premium volume in 2016 of just under £225 billion13. Aviva aviva is an international insurance company, headquartered in london.

Potential impact on the motor insurance market, which generates a total annual premium of £15.6 billion. 43 maitree christian, “voya financial selling certain annuity businesses to investor group,” s&p global market intelligence, december 21, 2017. Stock prices insurance sector cagr 1% 14% l l l stock prices total market cagr 1.6% 12.3% l l l advanced markets * as a % of net premiums earned, cagr = compound average growth rate. At the regional level, emea recorded moderate growth in the p&c and health insurance. We have used a questionnaire to engage with technology and insurance experts, translating their answers into a model that forecasts this insurance sector.

Source: hoffchiro.com

Source: hoffchiro.com

Losses, especially those stemming from natural catastrophes, are at a period low. We have used a questionnaire to engage with technology and insurance experts, translating their answers into a model that forecasts this insurance sector. In 2017, the uk introduced legislation to provide for the creation and operation of protected cell companies in the uk so as to foster the growth of the insurance linked securities market in the uk (see question 5). The expansion of alternative capital slowed down in 2019, We note that it has long been recognised that insurance markets are vulnerable to the curse of ‘adverse selection’.

![Commercial Insurance & Riot Damage [+Best Providers] Commercial Insurance & Riot Damage [+Best Providers]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/expertinsurancereviews-live/2020/06/9118795e-5-largest-insurance-companies-in-the-multiple-peril-insurance-market.jpg) Source: expertinsurancereviews.com

Source: expertinsurancereviews.com

Potential impact on the motor insurance market, which generates a total annual premium of £15.6 billion. Potential impact on the motor insurance market, which generates a total annual premium of £15.6 billion. Highest growth rate from 2015 to 2016, at 6 percent followed by p&c at 4.2 percent, while life. We conclude that tests should be based on what influences the marginal buyer of an insurance policy, not the average buyer. The market and its profitability remained fairly stable in 2018 compared to previous years.

Source: au-group.com

Source: au-group.com

The united kingdom is one of the largest insurance markets in the world, being home to both a very large domestic market, and many multinational insurers. Despite the decrease, italy still represents the third european life market by. Aviva aviva is an international insurance company, headquartered in london. Regional stock market indicators contain the advanced and emerging markets. Highest growth rate from 2015 to 2016, at 6 percent followed by p&c at 4.2 percent, while life.

Source: goodcarbadcar.net

Source: goodcarbadcar.net

Uk insurance market provides a lot of opportunities in different financial areas. Those with the most to gain from buying insurance fall into a particular category. Saw a slowdown in growth of gross written premiums (gwp) from 4.8 percent in 2015 to. Motor insurance companies paid out over 13.4 billion british pounds in claims in 2017, amounting to approximately 29 million pounds per day in domestic payments alone. In this segment, we are expecting annual growth rates of close to 5% (3.3% in real terms).

Source: slideshare.net

Source: slideshare.net

At the regional level, emea recorded moderate growth in the p&c and health insurance. Aviva aviva is an international insurance company, headquartered in london. 43 maitree christian, “voya financial selling certain annuity businesses to investor group,” s&p global market intelligence, december 21, 2017. Regional stock market indicators contain the advanced and emerging markets. The uk pet insurance market report identifies consumer attitudes towards pet insurance, competitive strategies, purchase barriers, and pet insurance industry analysis in the uk.

Source: phocuswright.com

Aviva aviva is an international insurance company, headquartered in london. Motor insurance companies paid out over 13.4 billion british pounds in claims in 2017, amounting to approximately 29 million pounds per day in domestic payments alone. The uk hosts the fourth largest insurance market in the world, and the largest in europe, with a total premium volume in 2016 of just under £225 billion13. Uk insurance market provides a lot of opportunities in different financial areas. The expansion of alternative capital slowed down in 2019,

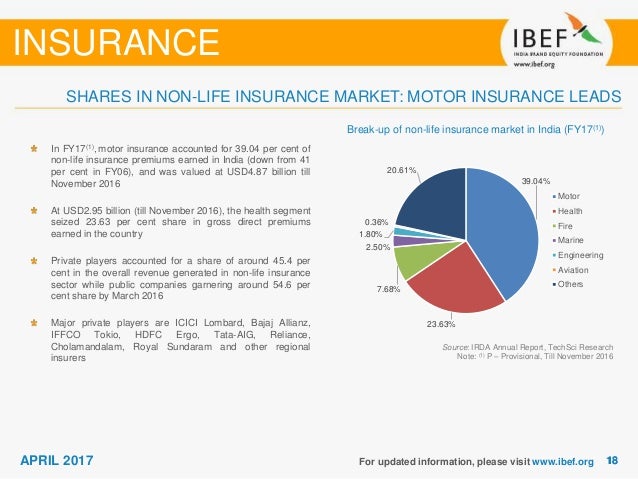

Source: businessinsider.com.au

Source: businessinsider.com.au

The market and its profitability remained fairly stable in 2018 compared to previous years. Potential impact on the motor insurance market, which generates a total annual premium of £15.6 billion. Insurers, asset managers and financial advisors all face real pressure to transform. This one has severe doubts about its efficiency, its diversity, and its cultural and technological fitness to face the future. The expansion of alternative capital slowed down in 2019,

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title uk insurance market 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information