Uk life insurance market 2019 information

Home » Trending » Uk life insurance market 2019 informationYour Uk life insurance market 2019 images are available in this site. Uk life insurance market 2019 are a topic that is being searched for and liked by netizens now. You can Get the Uk life insurance market 2019 files here. Get all free photos and vectors.

If you’re looking for uk life insurance market 2019 pictures information related to the uk life insurance market 2019 interest, you have pay a visit to the right site. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

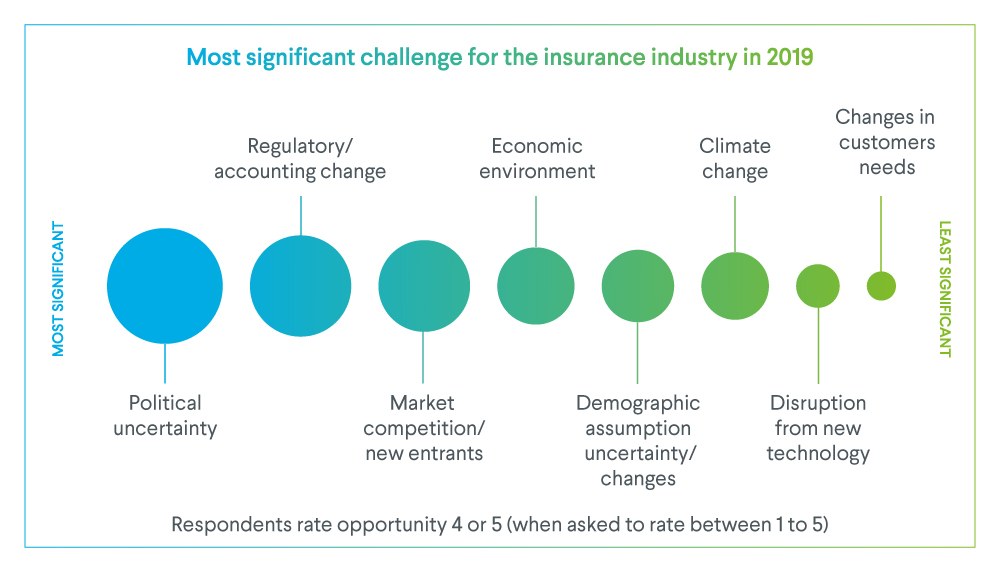

Uk Life Insurance Market 2019. Several insurers are also shifting their focus towards asset management or were taken over by Ey is predicting a 102.5% combined ratio in motor and 101.4% in household. For 2019 the picture is bleaker still: The household insurance market is facing the tougher conditions of the two business lines, according to ekaterina ishchenko, a credit analyst for emea insurance at fitch ratings.

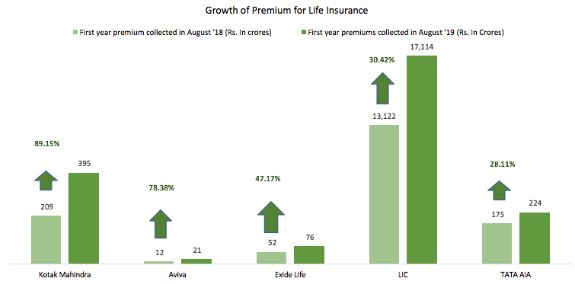

Growth in Insurance Business in August 2019 vs August 2018 From mintpro.in

Growth in Insurance Business in August 2019 vs August 2018 From mintpro.in

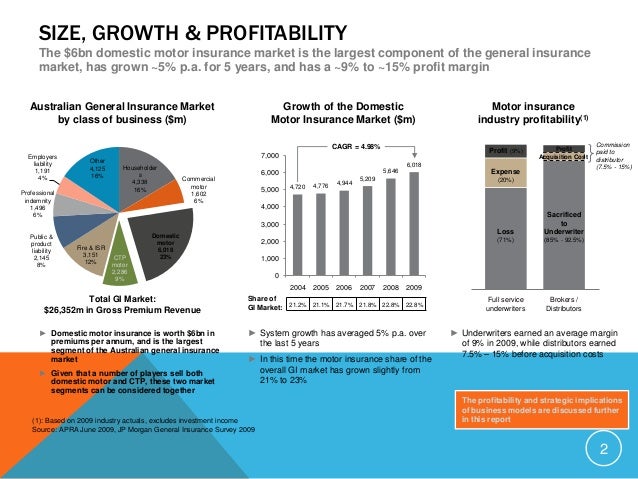

X.x lock purchase this report or a membership to unlock the average company profit margin for this industry. This was lower than the 0% rate expected by the industry and led to modest. Sustained economic growth, rising interest rates, and higher investment income contributed to a strong year for insurers in 2018. Our 2019 analysis of mckinsey’s global insurance pools database offers a detailed look at global insurance trends, with analysis by region and line of business. Growth of the zambian insurance market in 2019 tweet the zambian insurance market recorded an 18.75% turnover increase in 2019. Ey is predicting a 102.5% combined ratio in motor and 101.4% in household.

Ey is predicting a 102.5% combined ratio in motor and 101.4% in household.

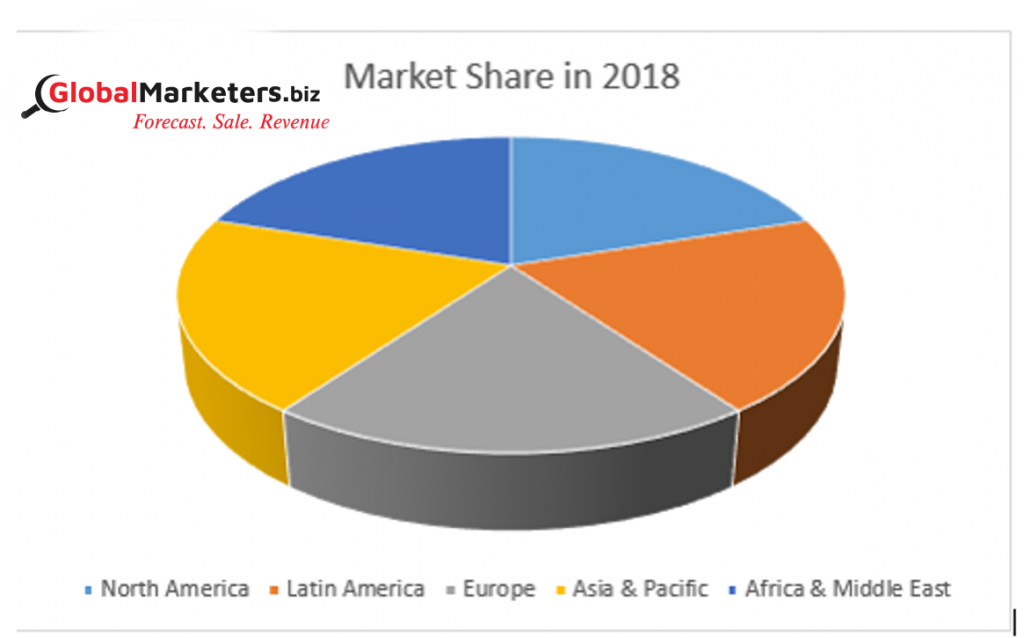

Sales of guaranteed rate products are struggling to grow because yields are low. In a competitive industry like insurance, where product capabilities can be so closely matched by rivals that price is the pivotal difference for customers, the ability to grow through these deals can be the key to climbing the ladder in the. The household insurance market is facing the tougher conditions of the two business lines, according to ekaterina ishchenko, a credit analyst for emea insurance at fitch ratings. Mckinsey global insurance pools 2019 distribution report exhibit 4 of 5 especially in germany and the united kingdom, direct players are increasingly able to outperform their markets. Sustained economic growth, rising interest rates, and higher investment income contributed to a strong year for insurers in 2018. Our 2019 analysis of mckinsey’s global insurance pools database offers a detailed look at global insurance trends, with analysis by region and line of business.

Source: researchandmarkets.com

Source: researchandmarkets.com

Key readings (share of respondents agreeing) 2018 life insurance premiums to grow faster than gdp* 86 % insurance markets to consolidate and experience more m&a* 25 % Total premium income, 2017 ($billion) approximately two thirds of these premiums stem from. The uk insurance market is the fourth largest in the world, and the largest in europe, with an estimated. Sales of guaranteed rate products are struggling to grow because yields are low. £19,500 average price of household bills for a year.

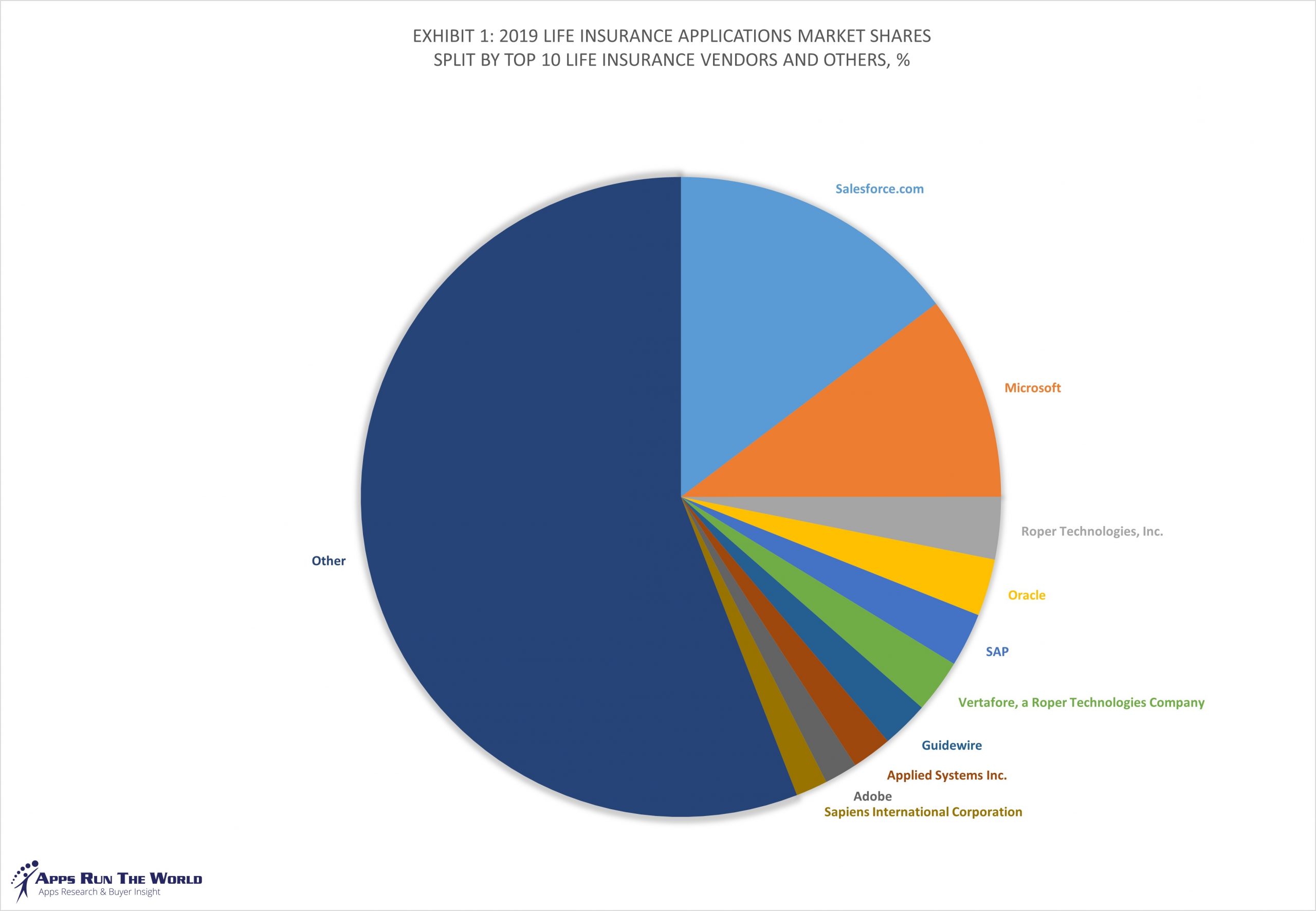

Source: appsruntheworld.com

Source: appsruntheworld.com

This increase is driven by an insurance penetration rate of 2.63% against 2.29% in 2018. The turn of a year is, traditionally, a time for reflection on what’s happened during the year gone by and what the next year may bring. The household insurance market is facing the tougher conditions of the two business lines, according to ekaterina ishchenko, a credit analyst for emea insurance at fitch ratings. Several insurers are also shifting their focus towards asset management or were taken over by Growth of the zambian insurance market in 2019 tweet the zambian insurance market recorded an 18.75% turnover increase in 2019.

Source: llamalife.co.uk

Source: llamalife.co.uk

Sustained economic growth, rising interest rates, and higher investment income contributed to a strong year for insurers in 2018. 2019 relating to advice for the 2020 technical review is an example. X.x lock purchase this report or a membership to unlock the average company profit margin for this industry. The uk life and pensions market continues to undergo tremendous change. The latter went from 3.2 billion zmw (266.48 million usd) in 2018 to 3.8 billion zmw (272.16 million usd) one year later.

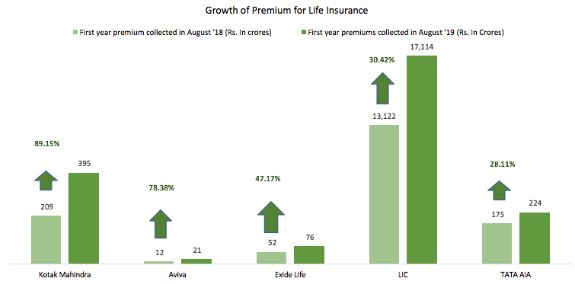

Source: tradonomy.in

Source: tradonomy.in

42% of people with a mortgage have no life insurance in place. The uk hosts the fourth largest insurance market in the world, and the largest in europe, with a total premium volume in 2016 of just under £225 billion13. The latter went from 3.2 billion zmw (266.48 million usd) in 2018 to 3.8 billion zmw (272.16 million usd) one year later. Key readings (share of respondents agreeing) 2018 life insurance premiums to grow faster than gdp* 86 % insurance markets to consolidate and experience more m&a* 25 % So, as an industry that is steeped in tradition but where significant changes are.

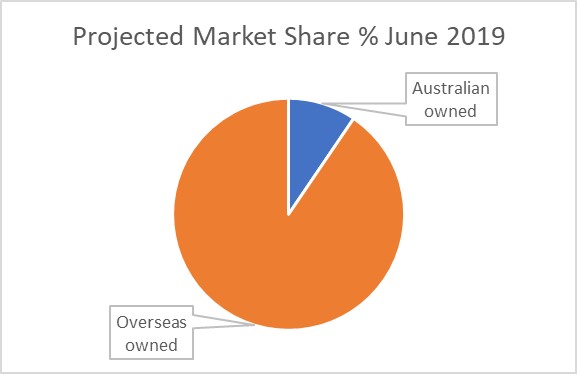

Source: insurancewatch.com.au

Source: insurancewatch.com.au

Key readings (share of respondents agreeing) 2018 life insurance premiums to grow faster than gdp* 86 % insurance markets to consolidate and experience more m&a* 25 % This was lower than the 0% rate expected by the industry and led to modest. Mckinsey global insurance pools 2019 distribution report exhibit 4 of 5 especially in germany and the united kingdom, direct players are increasingly able to outperform their markets. The uk insurance market is the fourth largest in the world, and the largest in europe, with an estimated. £9,493 is the average cost of dying in 2020, 3.1% higher than in 2019 only 50% of households with mortgages have life insurance.

![Top 10 Best Life Insurance Companies Reviews For 2019 [QUOTES] Top 10 Best Life Insurance Companies Reviews For 2019 [QUOTES]](https://www.claybrooke.org.uk/wp-content/uploads/2019/03/whole-of-life-providers-img-1024x768.png) Source: claybrooke.org.uk

Source: claybrooke.org.uk

For 2019 the picture is bleaker still: In a competitive industry like insurance, where product capabilities can be so closely matched by rivals that price is the pivotal difference for customers, the ability to grow through these deals can be the key to climbing the ladder in the. This increase is driven by an insurance penetration rate of 2.63% against 2.29% in 2018. Total premium income, 2017 ($billion) approximately two thirds of these premiums stem from. As of 2019, uk life insurance businesses had a market share of over 70 percent of the total uk insurance market, providing a wide range of.

Source: t4.ai

Source: t4.ai

The uk insurance market is the fourth largest in the world, and the largest in europe, with an estimated. Growth of the zambian insurance market in 2019 tweet the zambian insurance market recorded an 18.75% turnover increase in 2019. Mckinsey global insurance pools 2019 distribution report exhibit 4 of 5 especially in germany and the united kingdom, direct players are increasingly able to outperform their markets. The uk insurance market is the fourth largest in the world, and the largest in europe, with an estimated. With 2019 shaping up to be banner year, longer term challenges like the potential for economic slowdown and ongoing disputes over tariffs and trade rules may cast a shadow on the insurance market outlook.

Source: mintpro.in

Source: mintpro.in

Ey is predicting a 102.5% combined ratio in motor and 101.4% in household. It’s been a busy year for m&a deals in the insurance industry, with the top five agreements worth a total of $18.6bn in 2019. This was lower than the 0% rate expected by the industry and led to modest. In a competitive industry like insurance, where product capabilities can be so closely matched by rivals that price is the pivotal difference for customers, the ability to grow through these deals can be the key to climbing the ladder in the. Sustained economic growth, rising interest rates, and higher investment income contributed to a strong year for insurers in 2018.

Source: insuranceglitz.com

Source: insuranceglitz.com

Sales of guaranteed rate products are struggling to grow because yields are low. The pulse measures current perceptions of the life insurance market in asia’s emerging economies and tracks them over time to monitor changes in attitudes. The turn of a year is, traditionally, a time for reflection on what’s happened during the year gone by and what the next year may bring. Several insurers are also shifting their focus towards asset management or were taken over by For 2019 the picture is bleaker still:

Source: appsruntheworld.com

Source: appsruntheworld.com

Key readings (share of respondents agreeing) 2018 life insurance premiums to grow faster than gdp* 86 % insurance markets to consolidate and experience more m&a* 25 % The pulse measures current perceptions of the life insurance market in asia’s emerging economies and tracks them over time to monitor changes in attitudes. For 2019 the picture is bleaker still: £131,724 average outstanding mortgage debt in november 2019. Growth of the zambian insurance market in 2019 tweet the zambian insurance market recorded an 18.75% turnover increase in 2019.

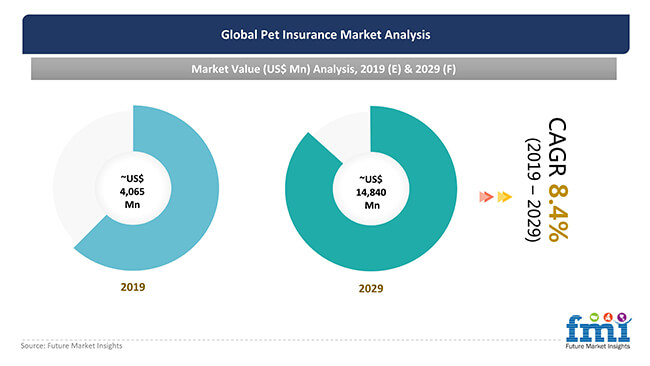

Source: futuremarketinsights.com

Source: futuremarketinsights.com

The company offers term and whole life insurance, home insurance, pet insurance, retirement products, mortgages, investment management and other services. It’s been a busy year for m&a deals in the insurance industry, with the top five agreements worth a total of $18.6bn in 2019. £131,724 average outstanding mortgage debt in november 2019. Automatic enrollment has brought more than 10 million new savers into the pension system, with the number still increasing, as contribution rates have risen to 8%. £9,493 is the average cost of dying in 2020, 3.1% higher than in 2019 only 50% of households with mortgages have life insurance.

Source: keplarllp.com

Source: keplarllp.com

In a competitive industry like insurance, where product capabilities can be so closely matched by rivals that price is the pivotal difference for customers, the ability to grow through these deals can be the key to climbing the ladder in the. The life insurance sector is experiencing several challenges. It’s been a busy year for m&a deals in the insurance industry, with the top five agreements worth a total of $18.6bn in 2019. Ey is predicting a 102.5% combined ratio in motor and 101.4% in household. This was lower than the 0% rate expected by the industry and led to modest.

Source: mordorintelligence.com

Mckinsey global insurance pools 2019 distribution report exhibit 4 of 5 especially in germany and the united kingdom, direct players are increasingly able to outperform their markets. £131,724 average outstanding mortgage debt in november 2019. It’s been a busy year for m&a deals in the insurance industry, with the top five agreements worth a total of $18.6bn in 2019. In a competitive industry like insurance, where product capabilities can be so closely matched by rivals that price is the pivotal difference for customers, the ability to grow through these deals can be the key to climbing the ladder in the. Total premium income, 2017 ($billion) approximately two thirds of these premiums stem from.

Source: openpr.com

Source: openpr.com

2019 relating to advice for the 2020 technical review is an example. The latter went from 3.2 billion zmw (266.48 million usd) in 2018 to 3.8 billion zmw (272.16 million usd) one year later. Ey is predicting a 102.5% combined ratio in motor and 101.4% in household. Sustained economic growth, rising interest rates, and higher investment income contributed to a strong year for insurers in 2018. So, as an industry that is steeped in tradition but where significant changes are.

Source: financialorbit.blogspot.com

Source: financialorbit.blogspot.com

In a competitive industry like insurance, where product capabilities can be so closely matched by rivals that price is the pivotal difference for customers, the ability to grow through these deals can be the key to climbing the ladder in the. Ey is predicting a 102.5% combined ratio in motor and 101.4% in household. £19,500 average price of household bills for a year. As of december 31, 2021, legal & general had a market capitalization of over £18 billion. The household insurance market is facing the tougher conditions of the two business lines, according to ekaterina ishchenko, a credit analyst for emea insurance at fitch ratings.

Source: issuewire.com

Source: issuewire.com

It’s been a busy year for m&a deals in the insurance industry, with the top five agreements worth a total of $18.6bn in 2019. The uk insurance market is the fourth largest in the world, and the largest in europe, with an estimated. £9,493 is the average cost of dying in 2020, 3.1% higher than in 2019 only 50% of households with mortgages have life insurance. Several insurers are also shifting their focus towards asset management or were taken over by Our 2019 analysis of mckinsey’s global insurance pools database offers a detailed look at global insurance trends, with analysis by region and line of business.

Source: hymans.co.uk

Source: hymans.co.uk

Key readings (share of respondents agreeing) 2018 life insurance premiums to grow faster than gdp* 86 % insurance markets to consolidate and experience more m&a* 25 % Key readings (share of respondents agreeing) 2018 life insurance premiums to grow faster than gdp* 86 % insurance markets to consolidate and experience more m&a* 25 % In a competitive industry like insurance, where product capabilities can be so closely matched by rivals that price is the pivotal difference for customers, the ability to grow through these deals can be the key to climbing the ladder in the. Ey is predicting a 102.5% combined ratio in motor and 101.4% in household. The household insurance market is facing the tougher conditions of the two business lines, according to ekaterina ishchenko, a credit analyst for emea insurance at fitch ratings.

Source: hoorayinsurance.co.uk

Source: hoorayinsurance.co.uk

Aviva plc is the leading life and general insurance company in the uk and ireland. Total premium income, 2017 ($billion) approximately two thirds of these premiums stem from. The company offers term and whole life insurance, home insurance, pet insurance, retirement products, mortgages, investment management and other services. The latter went from 3.2 billion zmw (266.48 million usd) in 2018 to 3.8 billion zmw (272.16 million usd) one year later. Automatic enrollment has brought more than 10 million new savers into the pension system, with the number still increasing, as contribution rates have risen to 8%.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title uk life insurance market 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information