Umpire insurance definition information

Home » Trending » Umpire insurance definition informationYour Umpire insurance definition images are available. Umpire insurance definition are a topic that is being searched for and liked by netizens now. You can Find and Download the Umpire insurance definition files here. Find and Download all free images.

If you’re searching for umpire insurance definition images information related to the umpire insurance definition keyword, you have visit the right blog. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

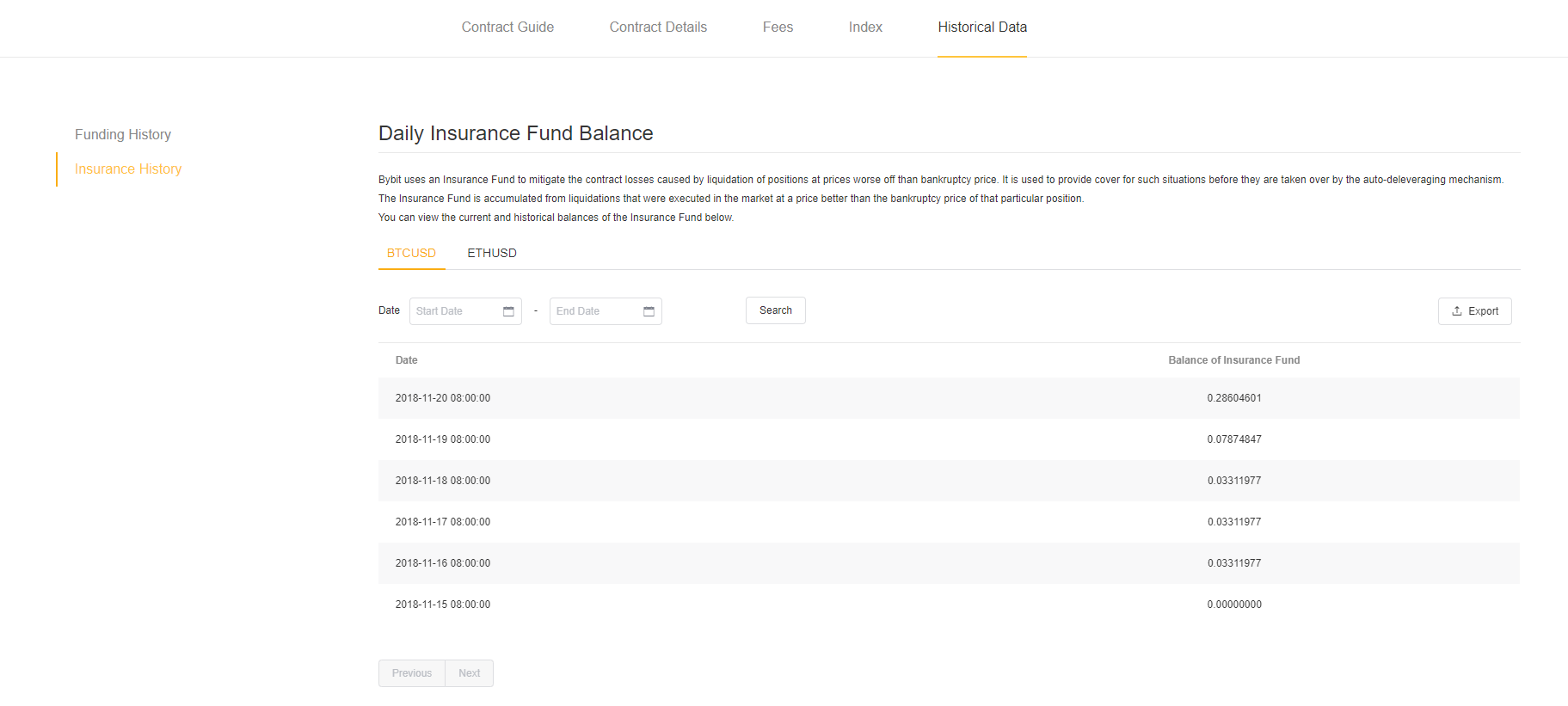

Umpire Insurance Definition. The use of an umpire is usually a requirement within an appraisal clause when the insured appraiser and insurance companies appraiser are unable to reach a settlement. This third appraiser is independent of the parties and makes the final decision. Responsible for assessing the amount of a property loss or value of a property. Then, they both choose a third appraiser to act as umpire.

More Bad News about the Medicare Doc Fix From blog.independent.org

More Bad News about the Medicare Doc Fix From blog.independent.org

During an insurance claim appraisal the umpire is an appointed professional who makes a binding decision after the two parties in an appraisal process fail to agree on a loss. Learn more about general liability insurance coverage here. In the property insurance world an umpire is an appointed professional in an insurance claim dispute who makes a binding decision after. This process, you and the insurance company hire separate damage appraisers. The umpire�s decision is binding on you and the insurance company, but only for the loss amount. An property insurance umpire is a competent, disinterested, impartial individual who is charged with making a decision regarding the value of property or the amount of a property loss.

When an impasse in the determination of the amount of a loss is reached, one party will demand (or request) appraisal and will name an appraiser.

A general liability policy covers legal defense costs and pays. The parties to the dispute agree to make their cases before one or more arbiters and to abide by whatever decision the arbiter or arbiters make, each party forgoing the right to an appeal. Generally in appraisal, conditions provide for the insured, and insurer each to select an appraiser, and for those individuals to select an umpire. If the two appraisers cannot agree upon an umpire, the appraisal provision allows for the court to appoint an umpire. The appraisal panel then will consist of two appraisers, and one umpire. Tasked with making a binding decision if and when two appraisers are unable to agree.

Source: contracteye.co.uk

Source: contracteye.co.uk

Generally in appraisal, conditions provide for the insured, and insurer each to select an appraiser, and for those individuals to select an umpire. When an impasse in the determination of the amount of a loss is reached, one party will demand (or request) appraisal and will name an appraiser. Most policies require that the two appraisers must select and agree upon an appraisal umpire within 15 days of. There are generally three arbiters, but there may be. Instead, under most property insurance forms, the umpire is having differences of loss brought by the two appointed appraisers and then making judgments based on what is brought by the appraisers.

Source: getdohelp.com

Source: getdohelp.com

Rovision in a property insurance policy to the effect that in the event the insured and insurer cannot agree on the amount of a claim settlement, each appoints an appraiser. The parties to the dispute agree to make their cases before one or more arbiters and to abide by whatever decision the arbiter or arbiters make, each party forgoing the right to an appeal. This includes serious injury or death of an official / referee / umpire, property damage to a facility or location rented or occupied by an officiating organization. Most policies require that the two appraisers must select and agree upon an appraisal umpire within 15 days of. Learn more about general liability insurance coverage here.

Source: medium.com

Source: medium.com

This includes serious injury or death of an official / referee / umpire, property damage to a facility or location rented or occupied by an officiating organization. In the event that a policyholder or the insurance company invoke the appraisal clause the two independent appraisers must choose an umpire. Same as term arbitration clause: When an impasse in the determination of the amount of a loss is reached, one party will demand (or request) appraisal and will name an appraiser. The following standards of conduct define the ethical behavior, and shall constitute a code of ethics that shall be binding on all members of the insurance appraisal and umpire association:

Source: associationhealthplans.com

Source: associationhealthplans.com

Responsible for assessing the amount of a property loss or value of a property. The insurance company hires an appraiser for each party. An impartial third party asked to resolve a disagreement without forcing the disputants to go to court. The use of an umpire is usually a requirement within an appraisal clause when the insured appraiser and insurance companies appraiser are unable to reach a settlement. Instead, under most property insurance forms, the umpire is having differences of loss brought by the two appointed appraisers and then making judgments based on what is brought by the appraisers.

Source: forbes.com

Source: forbes.com

Most policies require that the two appraisers must select and agree upon an appraisal umpire within 15 days of. An property insurance umpire is a competent, disinterested, impartial individual who is charged with making a decision regarding the value of property or the amount of a property loss. One appointed to decide between disagreeing arbitrators Most policies require that the two appraisers must select and agree upon an appraisal umpire within 15 days of. Generally in appraisal, conditions provide for the insured, and insurer each to select an appraiser, and for those individuals to select an umpire.

Source: obamacarefacts.com

Source: obamacarefacts.com

Competent in loss adjusting and construction. An impartial third party asked to resolve a disagreement without forcing the disputants to go to court. In the property insurance world an umpire is an appointed professional in an insurance claim dispute who makes a binding decision after. The other party will do so as well. This third appraiser is independent of the parties and makes the final decision.

Source: honestpolicy.com

Source: honestpolicy.com

The parties to the dispute agree to make their cases before one or more arbiters and to abide by whatever decision the arbiter or arbiters make, each party forgoing the right to an appeal. According to the windstorm insurance network, an umpire is a competent, disinterested, impartial individual who is charged with making a decision regarding the value of property or the amount of a property loss. Rovision in a property insurance policy to the effect that in the event the insured and insurer cannot agree on the amount of a claim settlement, each appoints an appraiser. Umpires decide certain types of financial disputes between property owners and insurance companies in particular circumstances. The umpire’s role in the resolution of insurance valuation disputes.

Source: obamacarefacts.com

Source: obamacarefacts.com

The appraisers select a disinterested umpire. N umpire clause refers to language in an insurance policy that provides for a means of resolution by an unbiased third party if an insurer and. The appraisal panel then will consist of two appraisers, and one umpire. When an impasse in the determination of the amount of a loss is reached, one party will demand (or request) appraisal and will name an appraiser. The following standards of conduct define the ethical behavior, and shall constitute a code of ethics that shall be binding on all members of the insurance appraisal and umpire association:

Source: marketbusinessnews.com

Source: marketbusinessnews.com

One appointed to decide between disagreeing arbitrators An impartial third party asked to resolve a disagreement without forcing the disputants to go to court. Same as term arbitration clause: The insured and the insurer each appoint an appraiser and. Insurance policies provide a method of dispute resolution called “appraisal”.

Source: insuranceofficialnews.blogspot.com

Source: insuranceofficialnews.blogspot.com

According to the windstorm insurance network, an umpire is a competent, disinterested, impartial individual who is charged with making a decision regarding the value of property or the amount of a property loss. A third component of a standard auto insurance definition is the appraisal process. The umpire’s role in the resolution of insurance valuation disputes. This third appraiser is independent of the parties and makes the final decision. One appointed to decide between disagreeing arbitrators

Source: slaterinsuranceschool.com

Source: slaterinsuranceschool.com

This process is used when a dispute arises about the amount of a claim. The parties to the dispute agree to make their cases before one or more arbiters and to abide by whatever decision the arbiter or arbiters make, each party forgoing the right to an appeal. A third component of a standard auto insurance definition is the appraisal process. The other party will do so as well. Then, they both choose a third appraiser to act as umpire.

Source: blog.independent.org

Source: blog.independent.org

The umpire’s role in the resolution of insurance valuation disputes. A person having authority to decide finally a controversy or question between parties: This process is used when a dispute arises about the amount of a claim. Generally in appraisal, conditions provide for the insured, and insurer each to select an appraiser, and for those individuals to select an umpire. The following standards of conduct define the ethical behavior, and shall constitute a code of ethics that shall be binding on all members of the insurance appraisal and umpire association:

Source: e2fi2.blogspot.com

Source: e2fi2.blogspot.com

When an impasse in the determination of the amount of a loss is reached, one party will demand (or request) appraisal and will name an appraiser. Umpires decide certain types of financial disputes between property owners and insurance companies in particular circumstances. The appraisers select a disinterested umpire. This process is used when a dispute arises about the amount of a claim. Tasked with making a binding decision if and when two appraisers are unable to agree.

Source: fdean.com

Source: fdean.com

Rovision in a property insurance policy to the effect that in the event the insured and insurer cannot agree on the amount of a claim settlement, each appoints an appraiser. Most policies require that the two appraisers must select and agree upon an appraisal umpire within 15 days of. The insurance company hires an appraiser for each party. Insurance policies provide a method of dispute resolution called “appraisal”. Instead, under most property insurance forms, the umpire is having differences of loss brought by the two appointed appraisers and then making judgments based on what is brought by the appraisers.

Source: reference.com

Source: reference.com

An property insurance umpire is a competent, disinterested, impartial individual who is charged with making a decision regarding the value of property or the amount of a property loss. When an impasse in the determination of the amount of a loss is reached, one party will demand (or request) appraisal and will name an appraiser. The insured and the insurer each appoint an appraiser and. Insurance policies provide a method of dispute resolution called “appraisal”. The standard fire insurance policy, iso policy forms and the national flood insurance forms list no specialized procedures for the appraisal process.

Source: fdic.gov

Source: fdic.gov

Same as term arbitration clause: N umpire clause refers to language in an insurance policy that provides for a means of resolution by an unbiased third party if an insurer and. This third appraiser is independent of the parties and makes the final decision. The other party will do so as well. Generally in appraisal, conditions provide for the insured, and insurer each to select an appraiser, and for those individuals to select an umpire.

Source: northmarkbank.com

This process, you and the insurance company hire separate damage appraisers. Tasked with making a binding decision if and when two appraisers are unable to agree. An property insurance umpire is a competent, disinterested, impartial individual who is charged with making a decision regarding the value of property or the amount of a property loss. In the property insurance world an umpire is an appointed professional in an insurance claim dispute who makes a binding decision after. According to the windstorm insurance network, an umpire is a competent, disinterested, impartial individual who is charged with making a decision regarding the value of property or the amount of a property loss.

Source: inasuran.blogspot.com

The two appraisers choose a third appraiser to act as an umpire. the appraisers then review your claim, and the umpire rules on any disagreements. This process is used when a dispute arises about the amount of a claim. A person having authority to decide finally a controversy or question between parties: The parties to the dispute agree to make their cases before one or more arbiters and to abide by whatever decision the arbiter or arbiters make, each party forgoing the right to an appeal. Most policies require that the two appraisers must select and agree upon an appraisal umpire within 15 days of.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title umpire insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information