Under a health insurance policy benefits other than death information

Home » Trend » Under a health insurance policy benefits other than death informationYour Under a health insurance policy benefits other than death images are available in this site. Under a health insurance policy benefits other than death are a topic that is being searched for and liked by netizens now. You can Download the Under a health insurance policy benefits other than death files here. Get all free vectors.

If you’re looking for under a health insurance policy benefits other than death pictures information related to the under a health insurance policy benefits other than death topic, you have visit the right blog. Our website frequently provides you with hints for refferencing the maximum quality video and image content, please kindly surf and find more informative video content and images that fit your interests.

Under A Health Insurance Policy Benefits Other Than Death. Some insurance policies pay an additional benefit if the accidental death was a common carrier accident. The circumstance around the death, rather than the actual cause of death, can sometimes invalidate a policy. Under a health insurance policy, benefits, other than death benefits, that have not otherwise been assigned, will be paid to a. The type and amount of health care costs that will be covered by the health plan are specified in advance.

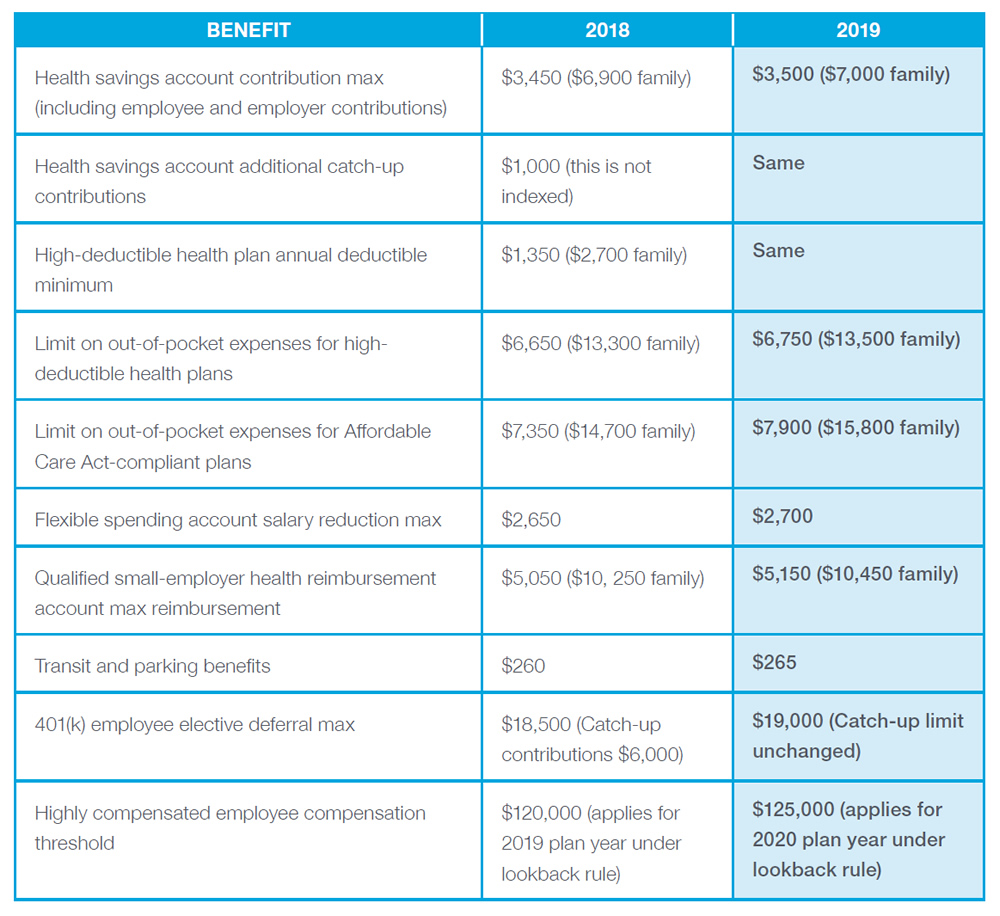

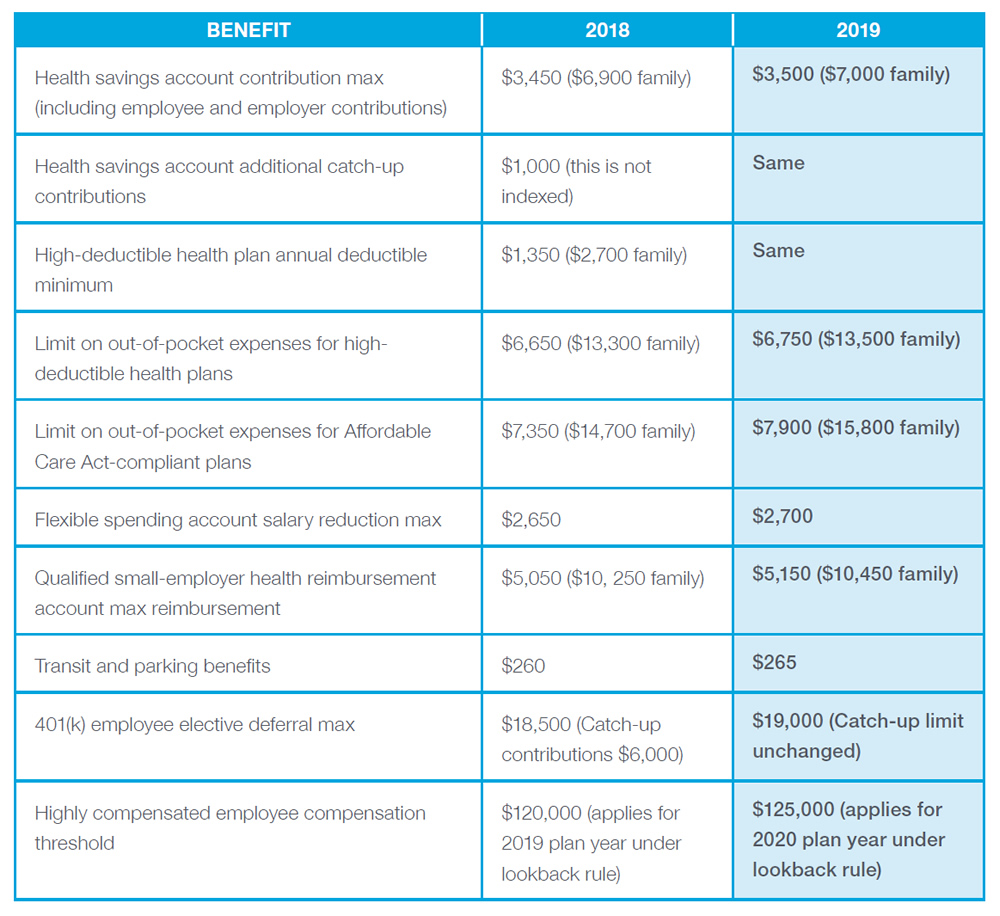

Employee benefits policy year in review Advisories Aflac From aflac.com

Employee benefits policy year in review Advisories Aflac From aflac.com

Beneficiaries must submit to the insurer proof of death and proof. In case the policyholder dies due to any type of critical illness or medical condition, the beneficiary of the policy will get the sum assured as the death benefit. But if the insurance company discovers that you intentionally lied or disclosed false information, it may reduce the death benefit by the amount in premiums that you would have paid had you represented yourself truthfully. Under a health insurance policy, benefits, other than death benefits, that have not otherwise been assigned, will be paid to a. No waiting period is applicable. In this part you can gain knowledge about deductions available to a taxpayer on account of payment of life insurance premium, payment of health insurance premium and expenditure on medical treatment.

Your policy will pay a death benefit to your beneficiary for any cause of death, including natural causes, accidents, and illness.

Most people are unaware of the additional benefits, apart from. A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured or annuitant dies. Death benefit (other than accidental ): If an employer, rather than purchasing a group policy directly, provides coverage to employees by participating in a group policy issued to a trust or an association, continuation rights are generally still available. Group health insurance policy is no longer effective. After expiry of waiting period.

Source: bohatala.com

Source: bohatala.com

For the most part, your life insurance policy’s beneficiaries will receive the total death benefit amount. In such cases, employees may enroll in an individual policy. A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured or annuitant dies. But if the insurance company discovers that you intentionally lied or disclosed false information, it may reduce the death benefit by the amount in premiums that you would have paid had you represented yourself truthfully. No waiting period is applicable.

Source: mutualtrust.com

Source: mutualtrust.com

After expiry of waiting period. Group health insurance policy is no longer effective. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine. Maturity benefits, death benefit and periodic bonuses are some types of assistance from endowment policies. It is essentially a health insurance scheme to cater to the poor, lower section of the society and the vulnerable population.

Source: formsbirds.com

Source: formsbirds.com

A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured or annuitant dies. Health insurance or medical insurance (also known as medical aid in south africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses.as with other types of insurance is risk among many individuals. After expiry of waiting period. But the one defining feature shared by all life insurance policies is a death benefit.it’s the primary reason to get life insurance, and how policies are almost always described: Under a health insurance policy, benefits, other than death benefits, that have not otherwise been assigned, will be paid to a.

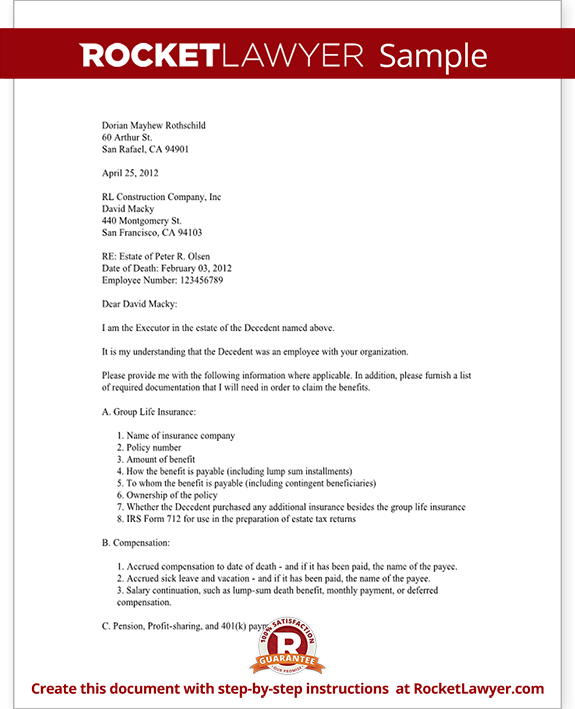

Source: rocketlawyer.com

Source: rocketlawyer.com

Group health insurance policy is no longer effective. No waiting period is applicable. There are a lot of different kinds of life insurance: Your policy will pay a death benefit to your beneficiary for any cause of death, including natural causes, accidents, and illness. Health insurance or medical insurance (also known as medical aid in south africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses.as with other types of insurance is risk among many individuals.

Source: actifithealth.com

Source: actifithealth.com

In this part you can gain knowledge about deductions available to a taxpayer on account of payment of life insurance premium, payment of health insurance premium and expenditure on medical treatment. This happens rarely, in cases of fraud, illegal activity, or when there is a known policy exclusion. Beneficiary of the death benefit b. A health insurance policy and the sum insured help you deal with such unexpected crises without having to worry about the treatment cost. What provisions would prevent an insurance company from paying a reimbursement claim to someone other than the policy owner?

Source: abramsinc.com

Source: abramsinc.com

After expiry of waiting period. In this part you can gain knowledge about deductions available to a taxpayer on account of payment of life insurance premium, payment of health insurance premium and expenditure on medical treatment. But the one defining feature shared by all life insurance policies is a death benefit.it’s the primary reason to get life insurance, and how policies are almost always described: In this case, the policy is included in the divorce decree, the insurance company is notified of the divorce agreement and both parties are clear as to what happens in case of the insured’s death. Health insurance or medical insurance (also known as medical aid in south africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses.as with other types of insurance is risk among many individuals.

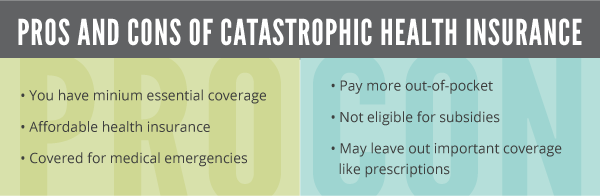

Source: firstquotehealth.com

Source: firstquotehealth.com

The type and amount of health care costs that will be covered by the health plan are specified in advance. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine. In this part you can gain knowledge about deductions available to a taxpayer on account of payment of life insurance premium, payment of health insurance premium and expenditure on medical treatment. The health insurer usually provides either direct payment to hospital (cashless facility) or reimburses the expenses associated with illnesses and injuries or disburses a fixed benefit on occurrence of an illness. In this case, the policy is included in the divorce decree, the insurance company is notified of the divorce agreement and both parties are clear as to what happens in case of the insured’s death.

Source: aflac.com

Source: aflac.com

The health insurer usually provides either direct payment to hospital (cashless facility) or reimburses the expenses associated with illnesses and injuries or disburses a fixed benefit on occurrence of an illness. Equal to ‘sum assured on death’. Maturity benefits, death benefit and periodic bonuses are some types of assistance from endowment policies. Death benefit (other than accidental ): A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured or annuitant dies.

Source: worldclassednews.com

Source: worldclassednews.com

In such cases, employees may enroll in an individual policy. For the most part, your life insurance policy’s beneficiaries will receive the total death benefit amount. But the one defining feature shared by all life insurance policies is a death benefit.it’s the primary reason to get life insurance, and how policies are almost always described: Group health insurance policy is no longer effective. However, if you want a life advantage on an insurance policy, look for a policy with maturity benefits.

Source: ptmlegal.com

Source: ptmlegal.com

In case the policyholder dies due to any type of critical illness or medical condition, the beneficiary of the policy will get the sum assured as the death benefit. In such cases, employees may enroll in an individual policy. It may even cancel your policy. An example of a common carrier accident is one where you are a commercial passenger on a bus, plane or train. What provisions would prevent an insurance company from paying a reimbursement claim to someone other than the policy owner?

Source: blogarama.com

Source: blogarama.com

In this case, the policy is included in the divorce decree, the insurance company is notified of the divorce agreement and both parties are clear as to what happens in case of the insured’s death. Under a health insurance policy, benefits, other than death benefits, that have not otherwise been assigned, will be paid to a. Your policy will pay a death benefit to your beneficiary for any cause of death, including natural causes, accidents, and illness. For the most part, your life insurance policy’s beneficiaries will receive the total death benefit amount. During waiting period (if any) ii.

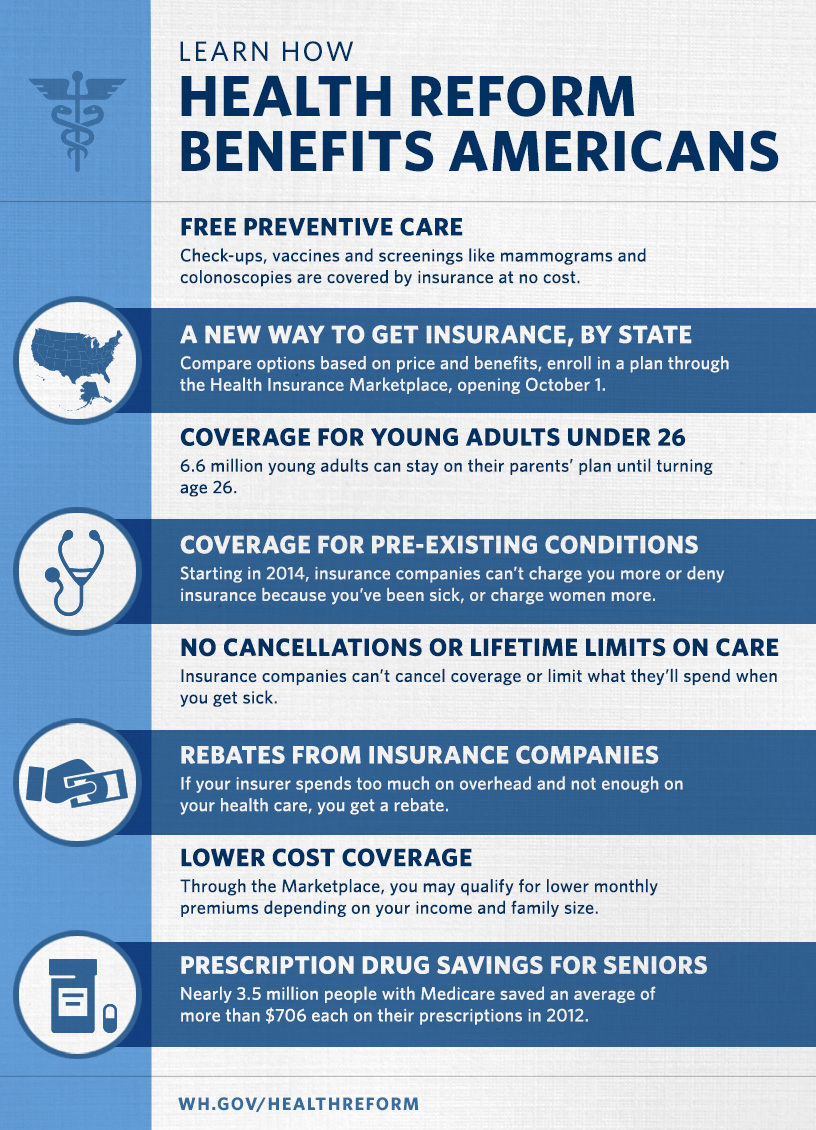

Source: obamacarefacts.com

Source: obamacarefacts.com

If an employer, rather than purchasing a group policy directly, provides coverage to employees by participating in a group policy issued to a trust or an association, continuation rights are generally still available. The circumstance around the death, rather than the actual cause of death, can sometimes invalidate a policy. Most people are unaware of the additional benefits, apart from. This happens rarely, in cases of fraud, illegal activity, or when there is a known policy exclusion. Health insurance or medical insurance (also known as medical aid in south africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses.as with other types of insurance is risk among many individuals.

Source: lafra.org

Source: lafra.org

In this case, the policy is included in the divorce decree, the insurance company is notified of the divorce agreement and both parties are clear as to what happens in case of the insured’s death. This happens rarely, in cases of fraud, illegal activity, or when there is a known policy exclusion. Your policy will pay a death benefit to your beneficiary for any cause of death, including natural causes, accidents, and illness. Health insurance or medical insurance (also known as medical aid in south africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses.as with other types of insurance is risk among many individuals. Under a health insurance policy, benefits, and other deaths benefits, that have not otherwise been assigned, will be paid to?

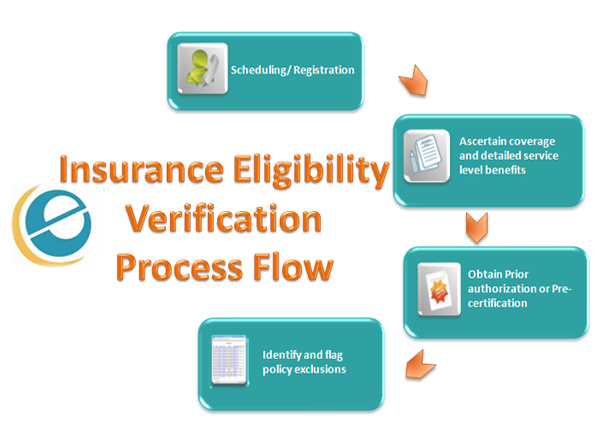

Source: ecareindia.com

Source: ecareindia.com

Usually this is when you buy a ticket for this transportation. Beneficiary of the death benefit b. For the most part, your life insurance policy’s beneficiaries will receive the total death benefit amount. Some insurance policies are only for common carrier accidents. Your policy will pay a death benefit to your beneficiary for any cause of death, including natural causes, accidents, and illness.

Source: revisi.net

Source: revisi.net

After expiry of waiting period. If an employer, rather than purchasing a group policy directly, provides coverage to employees by participating in a group policy issued to a trust or an association, continuation rights are generally still available. It is essentially a health insurance scheme to cater to the poor, lower section of the society and the vulnerable population. But the one defining feature shared by all life insurance policies is a death benefit.it’s the primary reason to get life insurance, and how policies are almost always described: When someone says they have a $100,000 policy, it really means.

Source: obamacarefacts.com

Source: obamacarefacts.com

What provisions would prevent an insurance company from paying a reimbursement claim to someone other than the policy owner? It is essentially a health insurance scheme to cater to the poor, lower section of the society and the vulnerable population. Under a health insurance policy, benefits, and other deaths benefits, that have not otherwise been assigned, will be paid to? However, if you want a life advantage on an insurance policy, look for a policy with maturity benefits. Your policy will pay a death benefit to your beneficiary for any cause of death, including natural causes, accidents, and illness.

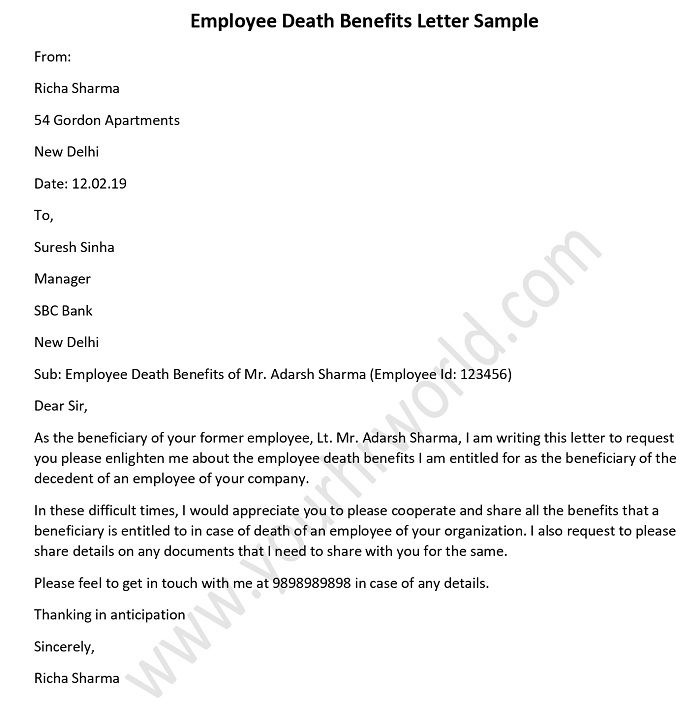

Source: yourhrworld.com

Source: yourhrworld.com

The circumstance around the death, rather than the actual cause of death, can sometimes invalidate a policy. When someone says they have a $100,000 policy, it really means. In this part you can gain knowledge about deductions available to a taxpayer on account of payment of life insurance premium, payment of health insurance premium and expenditure on medical treatment. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine. If an employer, rather than purchasing a group policy directly, provides coverage to employees by participating in a group policy issued to a trust or an association, continuation rights are generally still available.

Source: aflac.com

Source: aflac.com

An example of a common carrier accident is one where you are a commercial passenger on a bus, plane or train. An example of a common carrier accident is one where you are a commercial passenger on a bus, plane or train. In case the policyholder dies due to any type of critical illness or medical condition, the beneficiary of the policy will get the sum assured as the death benefit. Beneficiary of the death benefit b. Group health insurance policy is no longer effective.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title under a health insurance policy benefits other than death by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information