Underlying insurance Idea

Home » Trend » Underlying insurance IdeaYour Underlying insurance images are ready in this website. Underlying insurance are a topic that is being searched for and liked by netizens now. You can Get the Underlying insurance files here. Download all royalty-free images.

If you’re searching for underlying insurance images information linked to the underlying insurance keyword, you have visit the right site. Our website always gives you hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Underlying Insurance. Existing insurer means the insurance company whose policy or contract is or will be changed or affected in a manner described within. When a claim is reported to an insurance company, the first policy that will cover all financial losses and damages is the underlying, or primary, policy. Underlying coverage — with respect to any given policy of excess insurance, the coverage in place on the same risk that will respond to loss before the excess policy is called on to pay any portion of the claim. The primary purpose of excess liability insurance is to close coverage gaps and to offer an added layer of protection in case the underlying insurance is exhausted of all possible resources.

Proof of Underlying Exhaustion From riskybusiness.kcic.com

Proof of Underlying Exhaustion From riskybusiness.kcic.com

If “underlying insurance” does not pay any claim or “suit” for any reason other than exhaustion of their limits of insurance, we will not pay such claim or “suit”. It is absolutely critical that such support exists and is maintained. (b) have paid their total limit “in legal currency”; Underlying refers to the security or asset that must be delivered when a contract or warrant is exercised. Schedule of underlying insurance policies. Required underlying insurance it is a condition of the group personal excess liability plan that you and your family members maintain in full effect primary underlying liability insurance of the types and in at least the amounts shown below.

Existing insurer means the insurance company whose policy or contract is or will be changed or affected in a manner described within.

Thus, such policies variously state that It is absolutely critical that such support exists and is maintained. Links for irmi online subscribers only: Underlying insurance means any policies of insurance listed in the declarations under the schedule of underlying insurance. An underlying policy is insurance that covers a particular risk first. The board also decided to confirm that the amendment to ifrs 17 would only apply when the reinsurance contract held is recognised before, or at the same time as, the loss is recognised on the underlying insurance contracts.

Source: abbreviations.com

Source: abbreviations.com

When we have no duty to defend, we will have the right to defend, or to participate in the defense of the insured against any other “suit” seeking damages to which this insurance may apply. Sums in excess of “underlying insurance” or “other insurance” that any insured becomes legally obligated to pay as damages to which this insurance applies. Without using it properly, most of its ability to provide insurance protection is lost. Existing insurer means the insurance company whose policy or contract is or will be changed or affected in a manner described within. Links for irmi online subscribers only:

Source: navalinstitute.com.au

Source: navalinstitute.com.au

(a) “have paid in cash the full amount of their respective liabilities”; The ceding company assesses risks involved in retaining part of the. (1) if the controlling underlying insurance requires, for a particular claim, that the injury or damage occur during its policy period in order for that coverage to apply, then this insurance will only apply to that injury or damage if it occurs during the policy period of this coverage form. (b) have paid their total limit “in legal currency”; Other insurance covering the same risk will only pay out once this insurance is exhausted.

Source: propertycasualty360.com

Source: propertycasualty360.com

Its primary function, and the reason why another insurance cannot pay the same coverage at the same time, is to negate the possibility of a person gaining profit from insurance in. Underlying insurance contracts to which it relates. In derivatives, the underlying is the security or. (b) have paid their total limit “in legal currency”; The percentage of claims on underlying insurance contracts the entity expects to recover from the reinsurance contract held.

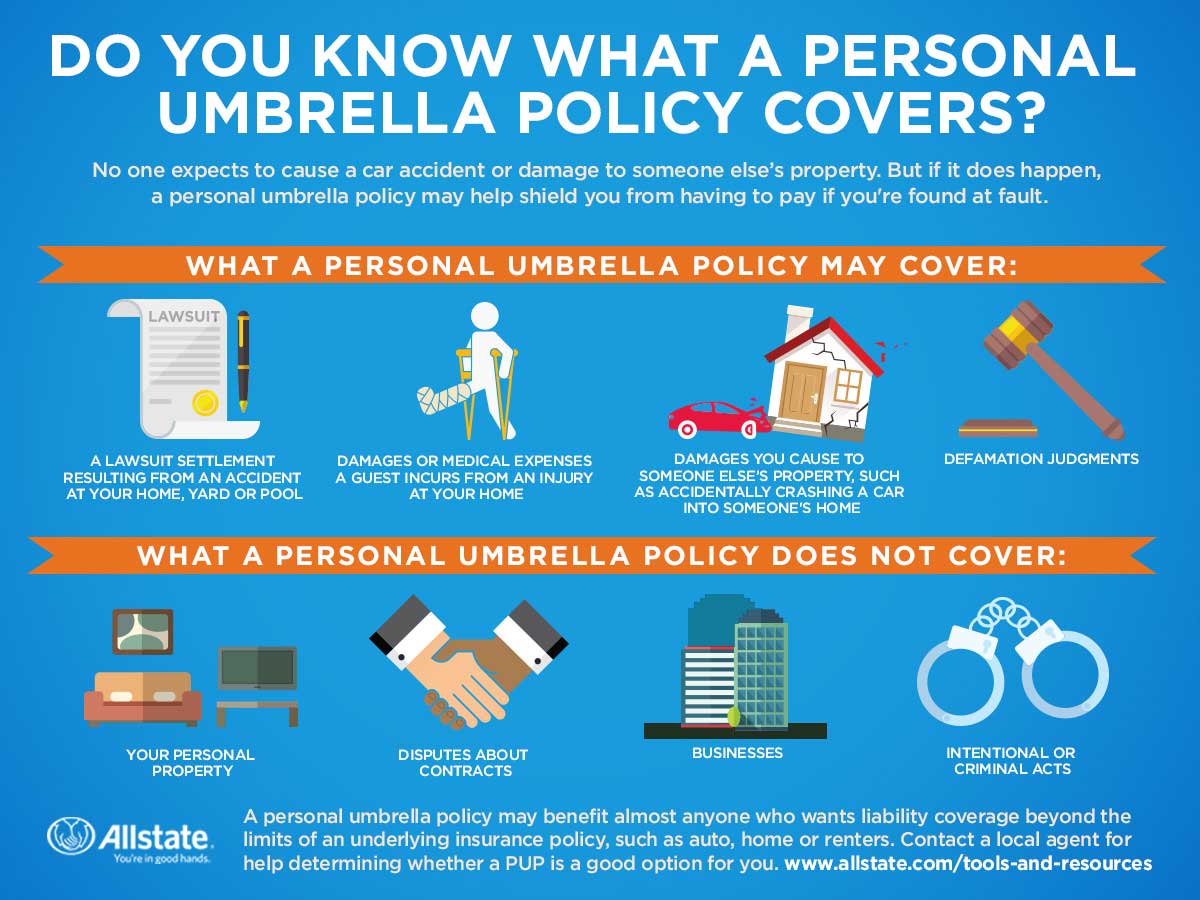

Source: allstate.com

Source: allstate.com

In derivatives, the underlying is the security or. The percentage of claims on underlying insurance contracts the entity expects to recover from the reinsurance contract held. Existing insurer means the insurance company whose policy or contract is or will be changed or affected in a manner described within. Maintaining underlying coverages umbrella insurance works in the same manner as its namesake. Links for irmi online subscribers only:

Source: researchgate.net

Source: researchgate.net

The board also decided to confirm that the amendment to ifrs 17 would only apply when the reinsurance contract held is recognised before, or at the same time as, the loss is recognised on the underlying insurance contracts. Without using it properly, most of its ability to provide insurance protection is lost. An underlying policy is insurance that covers a particular risk first. Required underlying insurance it is a condition of the group personal excess liability plan that you and your family members maintain in full effect primary underlying liability insurance of the types and in at least the amounts shown below. Existing insurer means the insurance company whose policy or contract is or will be changed or affected in a manner described within.

Source: specialtylinesadvisory.com

Source: specialtylinesadvisory.com

And (c) have exhausted their limits “solely as a This is because an entity that holds a reinsurance contract does not normally have a right to reduce the amounts it owes to the underlying policyholder by amounts it expects to receive from the reinsurer. The board also decided to confirm that the amendment to ifrs 17 would only apply when the reinsurance contract held is recognised before, or at the same time as, the loss is recognised on the underlying insurance contracts. Maintaining underlying coverages umbrella insurance works in the same manner as its namesake. An underlying policy is insurance that covers a particular risk first.

Source: simply-easier-acord-forms.blogspot.com

Source: simply-easier-acord-forms.blogspot.com

Underlying insurance contracts to which it relates. In derivatives, the underlying is the security or. The interest on the csm for such contracts is accreted implicitly through adjusting the csm for the Ffx 8000 07 18 page 2 of 7 the amount shown in such schedule of underlying insurance. Simply stated, if the underlying insurer becomes insolvent, the umbrella insurer may be able to escape any obligation to pay damages by its requirement that the underlying limit be exhausted by the payment by the underlying insurer in legal currency.

Source: researchgate.net

Source: researchgate.net

An underlying policy is insurance that covers a particular risk first. “underlying insurance” does not provide coverage or the limits of “underlying insurance” have been exhausted. The ceding company assesses risks involved in retaining part of the. Without using it properly, most of its ability to provide insurance protection is lost. Ffx 8000 07 18 page 2 of 7 the amount shown in such schedule of underlying insurance.

Source: clearbusiness.co.uk

Source: clearbusiness.co.uk

Underlying profit is a calculation made internally by a company to show what it believes is a more accurate reading of its profit position. When we have no duty to defend, we will have the right to defend, or to participate in the defense of the insured against any other “suit” seeking damages to which this insurance may apply. Underlying coverage — with respect to any given policy of excess insurance, the coverage in place on the same risk that will respond to loss before the excess policy is called on to pay any portion of the claim. Other insurance covering the same risk will only pay out once this insurance is exhausted. Existing insurer means the insurance company whose policy or contract is or will be changed or affected in a manner described within.

Source: researchgate.net

The percentage of claims on underlying insurance contracts the entity expects to recover from the reinsurance contract held. Reinsurance contracts often provide coverage for many underlying contracts, and so the Thus, such policies variously state that Its primary function, and the reason why another insurance cannot pay the same coverage at the same time, is to negate the possibility of a person gaining profit from insurance in. An underlying policy is insurance that covers a particular risk first.

Source: vanguardngr.com

Source: vanguardngr.com

Existing insurer means the insurance company whose policy or contract is or will be changed or affected in a manner described within. The interest on the csm for such contracts is accreted implicitly through adjusting the csm for the Simply stated, if the underlying insurer becomes insolvent, the umbrella insurer may be able to escape any obligation to pay damages by its requirement that the underlying limit be exhausted by the payment by the underlying insurer in legal currency. The percentage of claims on underlying insurance contracts the entity expects to recover from the reinsurance contract held. Schedule of underlying insurance policies.

Source: riskandinsurance.com

Source: riskandinsurance.com

(a) “have paid in cash the full amount of their respective liabilities”; “underlying insurance” does not provide coverage or the limits of “underlying insurance” have been exhausted. When a claim is reported to an insurance company, the first policy that will cover all financial losses and damages is the underlying, or primary, policy. Underlying insurance means the primary policy and those policies specified in theschedule as underlying insurance. It is absolutely critical that such support exists and is maintained.

Source: kgchaos.blogspot.com

Source: kgchaos.blogspot.com

If an umbrella or excess insurance policy is evidenced to comply with minimum limits, a copy of the underlyer schedule from the umbrella or excess insurance policy may be required. Underlying insurance means any policies of insurance listed in the declarations under the schedule of underlying insurance. The percentage of claims on underlying insurance contracts the entity expects to recover from the reinsurance contract held. When a claim is reported to an insurance company, the first policy that will cover all financial losses and damages is the underlying, or primary, policy. The ceding company assesses risks involved in retaining part of the.

Source: researchgate.net

It is absolutely critical that such support exists and is maintained. When a claim is reported to an insurance company, the first policy that will cover all financial losses and damages is the underlying, or primary, policy. If “underlying insurance” does not pay any claim or “suit” for any reason other than exhaustion of their limits of insurance, we will not pay such claim or “suit”. The percentage of claims on underlying insurance contracts the entity expects to recover from the reinsurance contract held. If an umbrella or excess insurance policy is evidenced to comply with minimum limits, a copy of the underlyer schedule from the umbrella or excess insurance policy may be required.

Source: testorigen.com

Source: testorigen.com

If “underlying insurance” does not pay any claim or “suit” for any reason other than exhaustion of their limits of insurance, we will not pay such claim or “suit”. Underlying insurance means the primary policy and those policies specified in theschedule as underlying insurance. Existing insurer means the insurance company whose policy or contract is or will be changed or affected in a manner described within. (b) have paid their total limit “in legal currency”; An underlying policy is insurance that covers a particular risk first.

Source: simply-easier-acord-forms.blogspot.com

Source: simply-easier-acord-forms.blogspot.com

And (c) have exhausted their limits “solely as a (b) have paid their total limit “in legal currency”; It is absolutely critical that such support exists and is maintained. Thus, such policies variously state that Its primary function, and the reason why another insurance cannot pay the same coverage at the same time, is to negate the possibility of a person gaining profit from insurance in.

Source: getsafeharbor.com

Source: getsafeharbor.com

An underlying policy is insurance that covers a particular risk first. (a) “have paid in cash the full amount of their respective liabilities”; When a claim is reported to an insurance company, the first policy that will cover all financial losses and damages is the underlying, or primary, policy. When we have no duty to defend, we will have the right to defend, or to participate in the defense of the insured against any other “suit” seeking damages to which this insurance may apply. If an umbrella or excess insurance policy is evidenced to comply with minimum limits, a copy of the underlyer schedule from the umbrella or excess insurance policy may be required.

Source: propertycasualty360.com

Source: propertycasualty360.com

This is because an entity that holds a reinsurance contract does not normally have a right to reduce the amounts it owes to the underlying policyholder by amounts it expects to receive from the reinsurer. Sums in excess of “underlying insurance” or “other insurance” that any insured becomes legally obligated to pay as damages to which this insurance applies. Underlying insurance means the primary policy and those policies specified in theschedule as underlying insurance. A list of the names of the insurance companies providing the insurance underlying an umbrella policy, along with the promised limits and types of insurance. Without using it properly, most of its ability to provide insurance protection is lost.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title underlying insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information