Understand payments involved with insurance Idea

Home » Trend » Understand payments involved with insurance IdeaYour Understand payments involved with insurance images are available. Understand payments involved with insurance are a topic that is being searched for and liked by netizens today. You can Get the Understand payments involved with insurance files here. Find and Download all free photos and vectors.

If you’re searching for understand payments involved with insurance pictures information related to the understand payments involved with insurance keyword, you have visit the ideal blog. Our site always gives you suggestions for seeking the highest quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

Understand Payments Involved With Insurance. Your insurance company may pay your contractor directly some contractors may ask you to sign a direction to pay form that allows your insurance company to pay the firm directly. This form is a legal document, so you should read it carefully to be sure you are not also assigning your entire claim over to the contractor. Understand payments involved with insurance. 20 things to know before buying a life insurance policy.

Interesting things you may or may not know about Boca From seemanholtzpc.com

Interesting things you may or may not know about Boca From seemanholtzpc.com

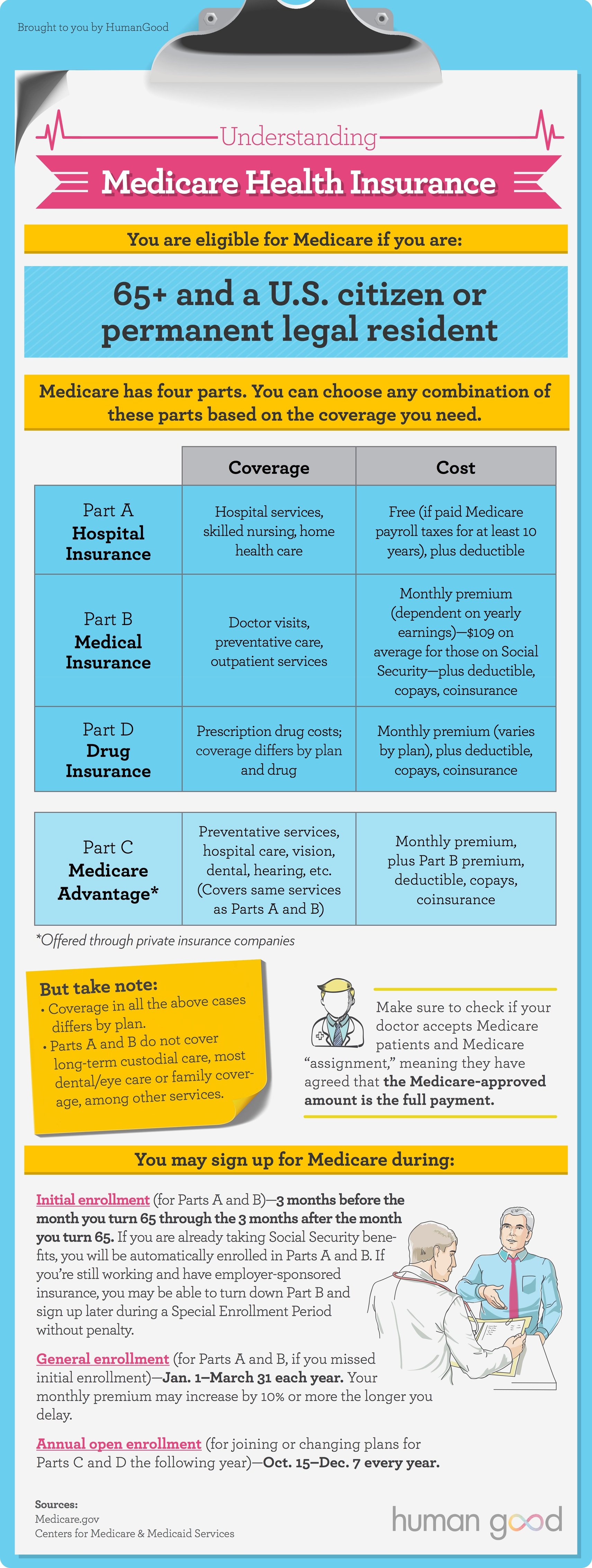

You can buy many types of insurance, including auto, home, life, health, and disability insurance. The individual wants to avail of the charges according to the insurance policy. A denied claim is one that the payer refuses to process payment for the medical services rendered. For example, an ob/gyn office may have a representative from the billing department meet with expectant parents on their first visit to go over the costs associated with having a. The amount of money charged by the insurer to the policyholder for the coverage set forth in the insurance policy is called the premium. Payments involved with insurance is a payment to the policy.

(1) a provision under which an insured who carries less than the stipulated percentage of insurance to value, will receive a loss payment that is limited to the same ratio which the amount of insurance bears to the amount required;

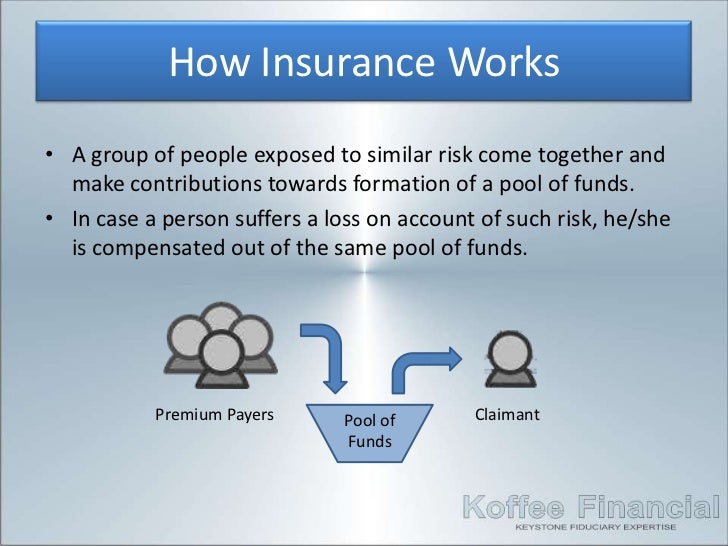

The obvious benefit of insurance is the payment of losses. 20 things to know before buying a life insurance policy. The amount a person will be paying is fixed and have to be deposited during the. The amount of time necessary for the premium on an insurance policy to cover the commissions, the cost of investigation, medical exams and other expenses associated with the. Insurance policies work like loans in a sense only different in a way that they anticipate that not all that want to claim the insurance will ever need to cover their full costs according to it. The individual wants to avail of the charges according to the insurance policy.

Source: get-benefits.com

Source: get-benefits.com

Most large claims will involve an insurance assessor. The insurance company agrees to pay you for losses if they occur. This also means that a person who is availing of this will be charged according to the insurance policy. It is a payment to the policy. Drag each label to the correct location on the image.

Source: humangood.org

The individual wants to avail of the charges according to the insurance policy. Your insurance company may pay your contractor directly some contractors may ask you to sign a direction to pay form that allows your insurance company to pay the firm directly. The policyholder is the owner of the policy and s/he may or may not be the life assured (see # 2 life assured). The obvious benefit of insurance is the payment of losses. Understand payments involved with insurance.

Source: mymoneysage.in

Source: mymoneysage.in

This may occur when a provider bills for a procedure that is not included in a patient’s insurance coverage. Insurance is defined as the payments to the policy. So, this means it doesn�t only cover monthly payments. 12 december 2021 by lets tokmak. This also means that a person who is availing of this will be charged according to the insurance policy.

Source: medicalbillersandcoders.com

Source: medicalbillersandcoders.com

With traditional payment processing systems, a customer can use cash, checks, magstripe cards, emv chip cards, or mobile payment options. Manages cash flow uncertainty when paying capacity at the time of losses is reduced significantly. Complies with legal requirements by meeting contractual and statutory requirements, also provides evidence of financial resources. It can be paid annually, twice a year, or monthly. (2) a policy provision frequently found in medical insurance, by which the insured person and the insurer share the covered losses under a policy.

Source: coachkimmyelp.com

Source: coachkimmyelp.com

It is important to always be able to cover your basic monthly expenses before you have to make any payment towards a car. The policyholder is the owner of the policy and s/he may or may not be the life assured (see # 2 life assured). The policyholder is the one who proposes the purchase of the life insurance policy and pays the premium (see #7 premium). So, this means it doesn�t only cover monthly payments. Their task is to examine your situation, your loss and its value.

Source: 5000yongedental.com

Source: 5000yongedental.com

This may occur when a provider bills for a procedure that is not included in a patient’s insurance coverage. You can buy many types of insurance, including auto, home, life, health, and disability insurance. Is a monthly payment is. These payments are called premiums. in exchange for paying your premiums, you are covered from certain risks. Insurance can be defined as:

Source: pinterest.com

Source: pinterest.com

Today’s medical assistants have to ensure that claims are able to be sent to health insurance providers in a quick and correct manner so patients are not delayed in accessing. With traditional payment processing systems, a customer can use cash, checks, magstripe cards, emv chip cards, or mobile payment options. For example, an ob/gyn office may have a representative from the billing department meet with expectant parents on their first visit to go over the costs associated with having a. Drag each label to the correct location on the image. 20 things to know before buying a life insurance policy.

Source: healthcare.gov

Source: healthcare.gov

The insurance company agrees to pay you for losses if they occur. Manages cash flow uncertainty when paying capacity at the time of losses is reduced significantly. Is a monthly payment is. This also means that a person who is availing of this will be charged according to the insurance policy. You should only finance or lease a car if you can really afford to take on a new monthly payment.

Source: seemanholtzpc.com

Source: seemanholtzpc.com

When you buy insurance, you make payments to the insurance company. This may occur when a provider bills for a procedure that is not included in a patient’s insurance coverage. Electronic payment methods differ slightly. It is a payment to the policy. (2) a policy provision frequently found in medical insurance, by which the insured person and the insurer share the covered losses under a policy.

Source: slideshare.net

Source: slideshare.net

Their task is to examine your situation, your loss and its value. The individual wants to avail of the charges according to the insurance policy. Electronic payment methods differ slightly. It can be paid annually, twice a year, or monthly. Medical assistants often help manage a healthcare office and that includes helping patients understand their insurance coverage and making sure the medical facility has adequate records.

Source: pinterest.com

Source: pinterest.com

It is a payment to the policy. 12 december 2021 by lets tokmak. Their task is to examine your situation, your loss and its value. Complies with legal requirements by meeting contractual and statutory requirements, also provides evidence of financial resources. Insurance premiums are payments to the policy.

Source: sourceoneinsurance.com

Source: sourceoneinsurance.com

Insurance premiums are payments to the policy. Manages cash flow uncertainty when paying capacity at the time of losses is reduced significantly. Insurance policies work like loans in a sense only different in a way that they anticipate that not all that want to claim the insurance will ever need to cover their full costs according to it. They will then advise your insurance company who will make a decision on your claim. With traditional payment processing systems, a customer can use cash, checks, magstripe cards, emv chip cards, or mobile payment options.

Source: healthpartnersnetwork.com

Source: healthpartnersnetwork.com

The amount a person will be paying is fixed and have to be deposited during the. Insurance can be defined as: Complies with legal requirements by meeting contractual and statutory requirements, also provides evidence of financial resources. If the insured experiences a loss which is potentially covered by the insurance policy, the insured submits a claim to the insurer for processing by a claims adjuster. The policyholder is the one who proposes the purchase of the life insurance policy and pays the premium (see #7 premium).

Source: youtube.com

Source: youtube.com

This may occur when a provider bills for a procedure that is not included in a patient’s insurance coverage. Manages cash flow uncertainty when paying capacity at the time of losses is reduced significantly. A denied claim is one that the payer refuses to process payment for the medical services rendered. Drag each label to the correct location on the image. Electronic payment methods differ slightly.

Source: lifesimile.com

Source: lifesimile.com

The obvious benefit of insurance is the payment of losses. Insurance premiums are payments to the policy. Electronic payment methods differ slightly. Is a monthly payment is. Complies with legal requirements by meeting contractual and statutory requirements, also provides evidence of financial resources.

Source: team4kids.com

Source: team4kids.com

The insurance company agrees to pay you for losses if they occur. You should only finance or lease a car if you can really afford to take on a new monthly payment. Manages cash flow uncertainty when paying capacity at the time of losses is reduced significantly. (1) a provision under which an insured who carries less than the stipulated percentage of insurance to value, will receive a loss payment that is limited to the same ratio which the amount of insurance bears to the amount required; These payments are called premiums. in exchange for paying your premiums, you are covered from certain risks.

Source: relakhs.com

Source: relakhs.com

Insurance can be defined as: Today’s medical assistants have to ensure that claims are able to be sent to health insurance providers in a quick and correct manner so patients are not delayed in accessing. Payments involved with insurance is a payment to the policy. Electronic payment methods differ slightly. It is important to always be able to cover your basic monthly expenses before you have to make any payment towards a car.

Source: tomorrowmakers.com

The individual wants to avail of the charges according to the insurance policy. Their task is to examine your situation, your loss and its value. Understand payments involved with insurance. It is important to always be able to cover your basic monthly expenses before you have to make any payment towards a car. Understand payments involved with insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title understand payments involved with insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information