Unemployment insurance tax refund information

Home » Trend » Unemployment insurance tax refund informationYour Unemployment insurance tax refund images are ready. Unemployment insurance tax refund are a topic that is being searched for and liked by netizens today. You can Get the Unemployment insurance tax refund files here. Download all free images.

If you’re searching for unemployment insurance tax refund pictures information linked to the unemployment insurance tax refund topic, you have visit the right site. Our site always gives you hints for viewing the maximum quality video and picture content, please kindly surf and find more informative video content and images that fit your interests.

Unemployment Insurance Tax Refund. We received a refund check from sui for $36,000 ( because of the covid) recently. Another thing the american rescue plan did was exempt up to $10,200 of unemployment compensation from taxes for the 2020 tax year. However, a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. The internal revenue service (irs) has started issuing tax refunds to those who received unemployment benefits in 2020, with around 1.5.

DWD Will Collect Unemployment Overpayments From Tax From wboi.org

DWD Will Collect Unemployment Overpayments From Tax From wboi.org

In order to have qualified for the. Contact name, title, phone number, email address. However, a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. Irs will recalculate taxes on 2020 unemployment benefits and start issuing refunds in may. How do i reduce a/p for the balance of 50% and record the refund check. As of march 11, 2021, under the american rescue plan, the first $10,200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax.

Since then, the irs has issued over 8.7 million unemployment compensation refunds totaling over $10 billion.

In the latest batch of refunds announced in november, however, the average was $1,189. This means you may now qualify to receive more money from california tax credits, such as: In order to have qualified for the. To request a refund of overpaid texas unemployment insurance tax, send the following to tax.refund@twc.texas.gov: I have 50% left in a/p. Most taxpayers will receive their unemployment refunds automatically, via direct deposit or paper check.

Source: houayxairiverside.com

Source: houayxairiverside.com

Most taxpayers will receive their unemployment refunds automatically, via direct deposit or paper check. This means you may now qualify to receive more money from california tax credits, such as: For this round, the average refund is $1,686; If you had federal taxes withheld from your unemployment benefits throughout the year, its possible the new $10,200 exemption will make you eligible for a refund. (you can see the article here:

Source: reddit.com

Source: reddit.com

We received an invoice for sui back in 12/20 for about $30,000. For this round, the average refund is $1,686; To request a refund of overpaid texas unemployment insurance tax, send the following to tax.refund@twc.texas.gov: California earned income tax credit (caleitc) young child tax credit (yctc) I have 50% left in a/p.

Source: nj.com

Source: nj.com

How do i reduce a/p for the balance of 50% and record the refund check. And this tax season, you won�t be able to rely on a tax break for unemployment insurance, either. Another thing the american rescue plan did was exempt up to $10,200 of unemployment compensation from taxes for the 2020 tax year. Normally, any unemployment compensation someone receives is taxable. Minnesota department of revenue set to begin processing unemployment insurance and paycheck protection program refunds | minnesota department of revenue (state.mn.us)

Source: businessdailytips.com

Source: businessdailytips.com

Contact name, title, phone number, email address. In late may, the irs started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the american rescue plan went into effect. Check your unemployment refund status using the where’s my refund tool, like tracking your regular tax refund. Minnesota department of revenue set to begin processing unemployment insurance and paycheck protection program refunds | minnesota department of revenue (state.mn.us) If you received unemployment (also known as unemployment insurance), the american rescue plan act of 2021 reduced your federal adjusted gross income (agi) for 2020 tax return.

Source: blog.fiducial.com

Source: blog.fiducial.com

We received an invoice for sui back in 12/20 for about $30,000. Irs will recalculate taxes on 2020 unemployment benefits and start issuing refunds in may. For this round, the average refund is $1,686; To request a refund of overpaid texas unemployment insurance tax, send the following to tax.refund@twc.texas.gov: So far, the refunds have averaged more than $1,600.

Source: taxw.blogspot.com

Source: taxw.blogspot.com

In the latest batch of refunds announced in november, however, the average was $1,189. 50% of that amount was paid in 1/21. The american rescue plan act, a pandemic relief law, waived federal tax on up to $10,200 of unemployment benefits per person collected in 2020, a year in which the unemployment rate spiked to. In late may, the irs started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the american rescue plan went into effect. Most taxpayers will receive their unemployment refunds automatically, via direct deposit or paper check.

Source: yunemplo.blogspot.com

Source: yunemplo.blogspot.com

Direct deposit refunds started going out wednesday, and paper checks today. The $10,200 unemployment tax exemption only applies to 2020. And more unemployment relief is to be expected for the rest of the year. A request for a specific amount or, simply please refund all available credit. The internal revenue service doesn’t have a separate portal for checking the unemployment compensation tax refunds.

While there are 436,000 returns are still stuck in the irs system, americans are looking for ways to track their unemployment tax refund. Check your unemployment refund status by entering the following information to verify your identity. The average refund for those who overpaid taxes on unemployment compensation was $1,265 earlier this year. Direct deposit refunds started going out wednesday, and paper checks today. This means you may now qualify to receive more money from california tax credits, such as:

Source: taxw.blogspot.com

If you had federal taxes withheld from your unemployment benefits throughout the year, its possible the new $10,200 exemption will make you eligible for a refund. I have 50% left in a/p. How do i reduce a/p for the balance of 50% and record the refund check. The refunds are for taxes paid on unemployment insurance before the american rescue plan act became law in march and excluded up to $10,200 in. The american rescue plan act, a pandemic relief law, waived federal tax on up to $10,200 of unemployment benefits per person collected in 2020, a year in which the unemployment rate spiked to.

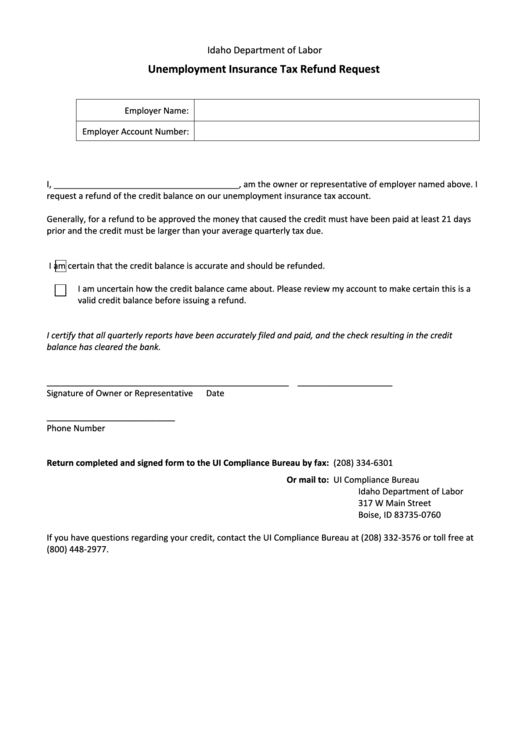

Source: formsbank.com

Source: formsbank.com

In the latest batch of refunds announced in november, however, the average was $1,189. If you received unemployment (also known as unemployment insurance), the american rescue plan act of 2021 reduced your federal adjusted gross income (agi) for 2020 tax return. 50% of that amount was paid in 1/21. Check your unemployment refund status using the where’s my refund tool, like tracking your regular tax refund. Request a refund of the credit balance on our unemployment insurance tax account.

Source: qatax.blogspot.com

(you can see the article here: The internal revenue service doesn’t have a separate portal for checking the unemployment compensation tax refunds. Generally, for a refund to be approved the money that caused the credit must have been paid at least 21 days prior and the credit must be larger than your average quarterly tax due. If you received unemployment (also known as unemployment insurance), the american rescue plan act of 2021 reduced your federal adjusted gross income (agi) for 2020 tax return. The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits.

Source: acropreneur.com

Source: acropreneur.com

We received a refund check from sui for $36,000 ( because of the covid) recently. Generally, for a refund to be approved the money that caused the credit must have been paid at least 21 days prior and the credit must be larger than your average quarterly tax due. In order to have qualified for the. Contact name, title, phone number, email address. 50% of that amount was paid in 1/21.

Source: mlive.com

Source: mlive.com

Since then, the irs has issued over 8.7 million unemployment compensation refunds totaling over $10 billion. This means you may now qualify to receive more money from california tax credits, such as: The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. If you received unemployment (also known as unemployment insurance), the american rescue plan act of 2021 reduced your federal adjusted gross income (agi) for 2020 tax return. The average refund for those who overpaid taxes on unemployment compensation was $1,265 earlier this year.

Source: techmotimes.com

Source: techmotimes.com

And this tax season, you won�t be able to rely on a tax break for unemployment insurance, either. We received a refund check from sui for $36,000 ( because of the covid) recently. 50% of that amount was paid in 1/21. Irs will recalculate taxes on 2020 unemployment benefits and start issuing refunds in may. And this tax season, you won�t be able to rely on a tax break for unemployment insurance, either.

Source: kiplinger.com

Source: kiplinger.com

California earned income tax credit (caleitc) young child tax credit (yctc) That law waived taxes on up to $10,200 in unemployment insurance benefits for individuals earning less than $150,000 a year. To request a refund of overpaid texas unemployment insurance tax, send the following to tax.refund@twc.texas.gov: I have 50% left in a/p. Most taxpayers will receive their unemployment refunds automatically, via direct deposit or paper check.

For this round, the average refund is $1,686; Request a refund of the credit balance on our unemployment insurance tax account. Since then, the irs has issued over 8.7 million unemployment compensation refunds totaling over $10 billion. The $10,200 unemployment tax exemption only applies to 2020. For this round, the average refund is $1,686;

Source: taxf.blogspot.com

Source: taxf.blogspot.com

In late may, the irs started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the american rescue plan went into effect. We received an invoice for sui back in 12/20 for about $30,000. The american rescue plan act, a pandemic relief law, waived federal tax on up to $10,200 of unemployment benefits per person collected in 2020, a year in which the unemployment rate spiked to. So far, the refunds have averaged more than $1,600. The average refund for those who overpaid taxes on unemployment compensation was $1,265 earlier this year.

Source: wboi.org

Source: wboi.org

Normally, any unemployment compensation someone receives is taxable. To request a refund of overpaid texas unemployment insurance tax, send the following to tax.refund@twc.texas.gov: They don�t need to file an amended. The irs will automatically calculate this and give you a refund if necessary. The average refund for those who overpaid taxes on unemployment compensation was $1,265 earlier this year.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title unemployment insurance tax refund by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information