Unilateral insurance Idea

Home » Trend » Unilateral insurance IdeaYour Unilateral insurance images are available. Unilateral insurance are a topic that is being searched for and liked by netizens now. You can Download the Unilateral insurance files here. Find and Download all free photos.

If you’re searching for unilateral insurance images information linked to the unilateral insurance interest, you have visit the ideal site. Our site always gives you hints for seeking the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

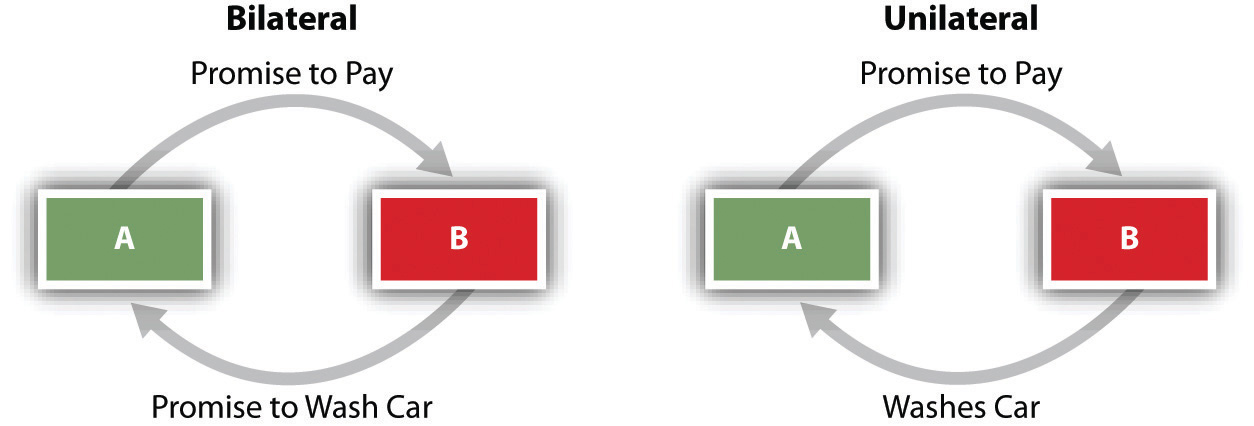

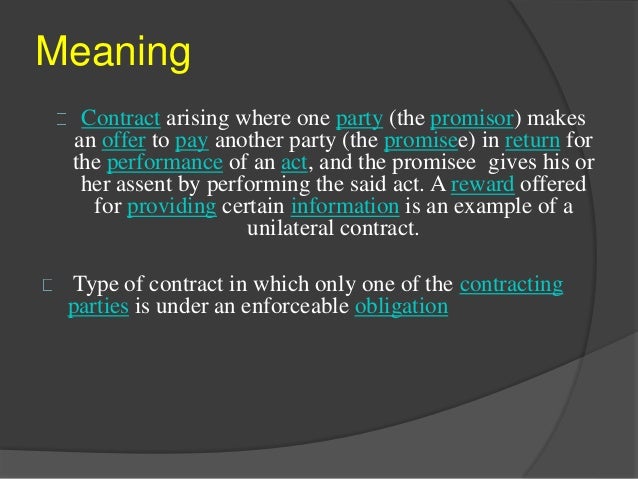

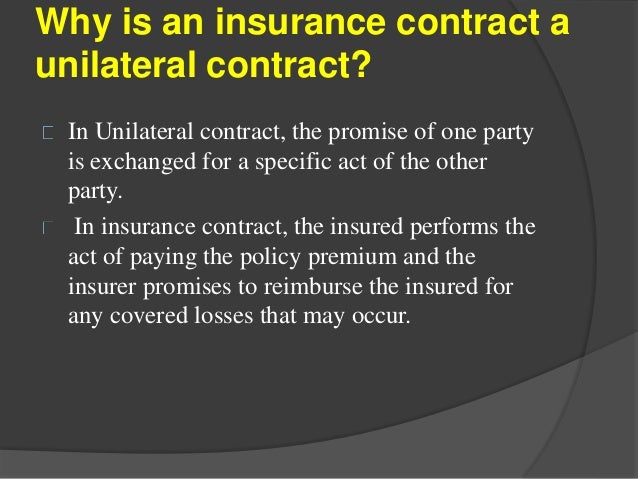

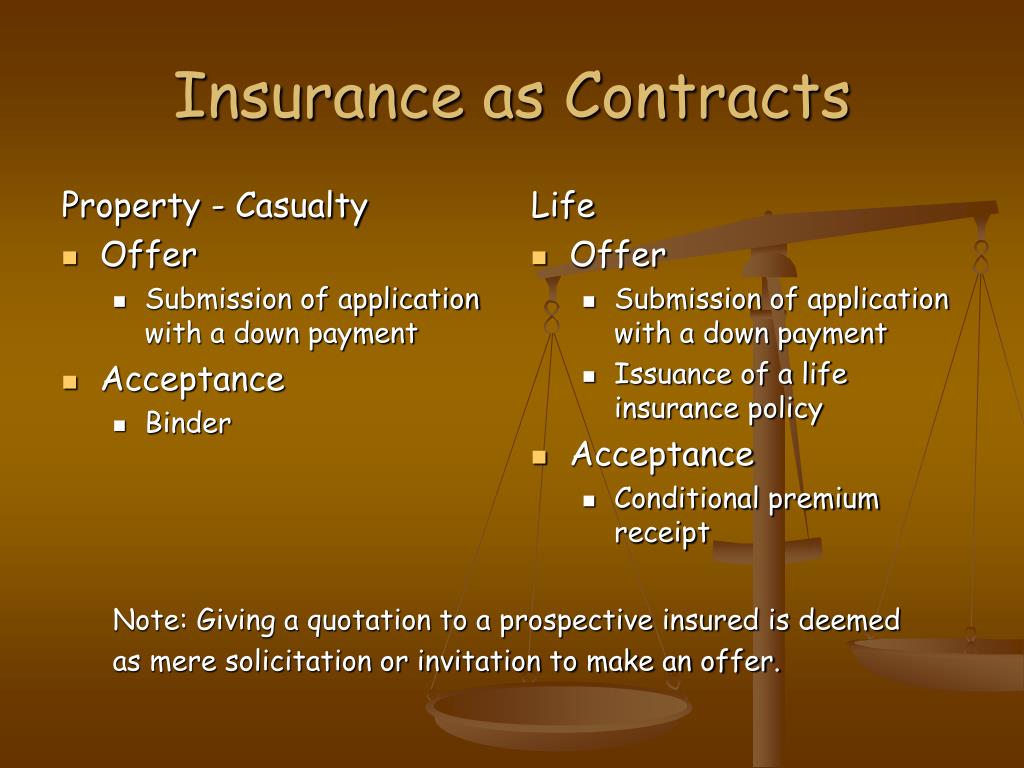

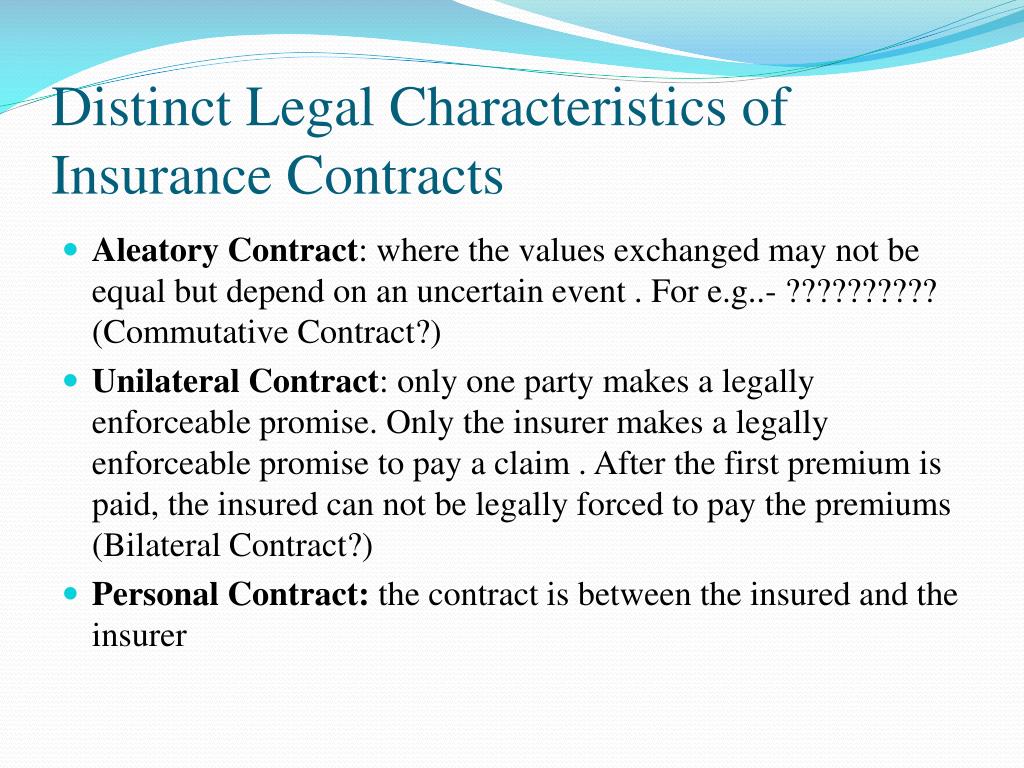

Unilateral Insurance. What makes it a unilateral contract is the company deciding alone all the conditions. When you consult insurance services, the company promises to pay you a certain amount if a certain event occurs. Insurance contracts are another example of unilateral contracts. In fact, the applicant does not even promise to pay premiums.

Unilateral Contract Definition Example Business From businesspromotionstore.com

Unilateral Contract Definition Example Business From businesspromotionstore.com

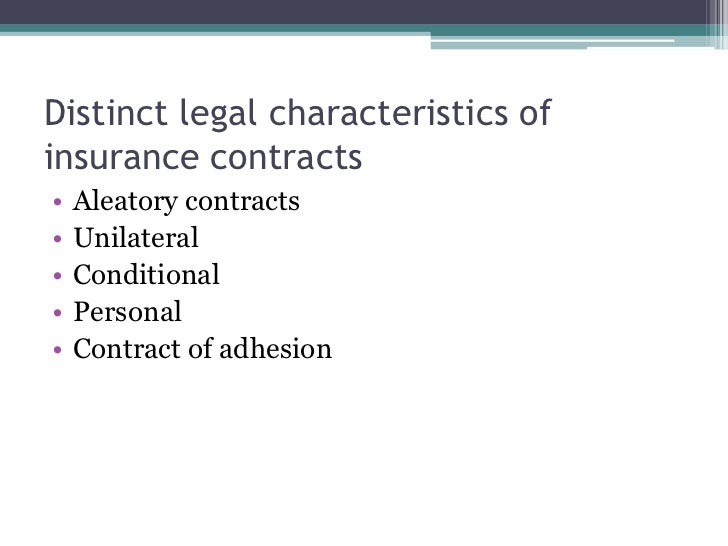

Standard form contracts also present a unique set of interpretation challenges to judges. This is a unilateral agreement, and the insurance company will not have to pay if the events never happen. Distinguishing characteristic of an insurance contract in that it is only the insurance company that pledges anything. Car owners in rwanda woke up one morning in january 2018 to learn that insurance companies had suddenly increased motor vehicle premiums by up to 73 per cent. In a standard insurance contract, the insurance company promises to provide coverage against losses while the insured does not make any promises. A unilateral contract is commonly formed in a number of cases.

Unilateral contract refers to a promise of one party to another that is legally binding.

In a standard insurance contract, the insurance company promises to provide coverage against losses while the insured does not make any promises. In this case, the company only pays the insurance if specific occurrences happen. Insurers promise to pay benefits upon the occurrence of a specific event, such as death or disability. Distinguishing characteristic of an insurance contract in that it is only the insurance company that pledges anything. What makes an insurance policy a unilateral contract? If the event doesn�t happen, the company won�t have to pay.

Source: businesspromotionstore.com

Source: businesspromotionstore.com

In a standard insurance contract, the insurance company promises to provide coverage against losses while the insured does not make any promises. Since it is a unilateral contract, the insurer is not obligated to make a payment to the insured if the event does not occur. In an insurance contract, the insurance firm promises to indemnify or pay the insured individual a specific amount of money if a certain event happens. Unilateral extended reporting period provision: An insurance contract provision that allows the insured to extend the period of time in which coverage is.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

Besides open requests, insurance companies also use unilateral contracts. The applicant makes no such promise. The promise itself must be an express promise. An insurance company makes a promise to pay for damages if an accident occurs, as long as the insurance premiums have been paid. An insurance agreement is a legal contract between an insurance company and insurance agreements are also considered unilateral contracts because only.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

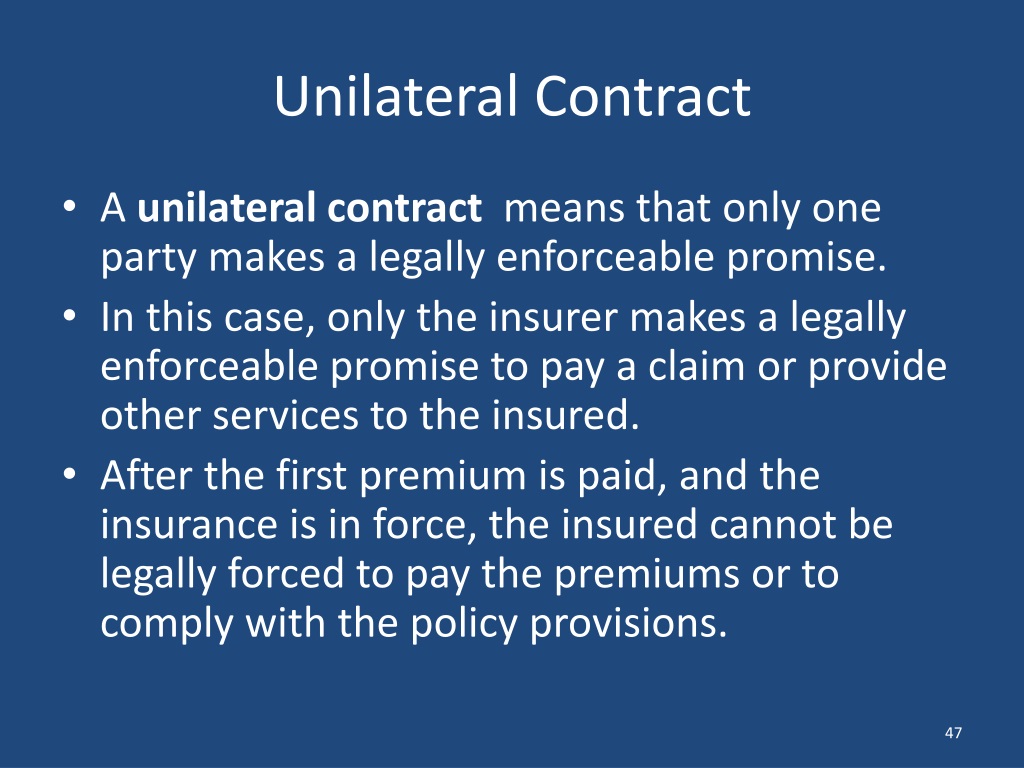

Consider the term �breach� synonymous with �break.� When you consult insurance services, the company promises to pay you a certain amount if a certain event occurs. Unilateral extended reporting period provision: In fact, the applicant does not even promise to pay premiums. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

However, if that event doesn’t happen, the company is not obliged to pay you any money. In a standard insurance contract, the insurance company promises to provide coverage against losses while the insured does not make any promises. Note that not all promises can create a unilateral agreement. In fact, the applicant does not even promise to pay premiums. An insurance agreement is a legal contract between an insurance company and insurance agreements are also considered unilateral contracts because only.

Source: slideshare.net

Source: slideshare.net

Insurance policies are usually unilateral agreements. At the time, the central bank, the sector’s regulator, backed the move although it admitted the increment could have been done gradually. In a standard insurance contract, the insurance company promises to provide coverage against losses while the insured does not make any promises. Note that not all promises can create a unilateral agreement. In fact, the applicant does not even promise to pay premiums.

Source: slideshare.net

Source: slideshare.net

Unilateral contract — a contract in which only one party makes an enforceable promise. A prime example of a unilateral contract is that of insurance. In fact, the applicant does not even promise to pay premiums. Insurance contracts are another example of unilateral contracts. Since it is a unilateral contract, the insurer is not obligated to make a payment to the insured if the event does not occur.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

What makes it a unilateral contract is the company deciding alone all the conditions. Car owners in rwanda woke up one morning in january 2018 to learn that insurance companies had suddenly increased motor vehicle premiums by up to 73 per cent. This means that only one party (the insurer) makes any kind of enforceable promise. At the time, the central bank, the sector’s regulator, backed the move although it admitted the increment could have been done gradually. An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder.

Source: camerahaiphong.org

Source: camerahaiphong.org

If the event doesn�t happen, the company won�t have to pay. In this case, the company only pays the insurance if specific occurrences happen. An insurance agreement is a legal contract between an insurance company and insurance agreements are also considered unilateral contracts because only. In an insurance contract, the insurance firm promises to indemnify or pay the insured individual a specific amount of money if a certain event happens. The promise itself must be an express promise.

Source: camerahaiphong.org

Source: camerahaiphong.org

Car owners in rwanda woke up one morning in january 2018 to learn that insurance companies had suddenly increased motor vehicle premiums by up to 73 per cent. We hope the you have a better understanding of. Unilateral extended reporting period provision: The insurance company promises it will pay the insured person a specific amount of money in case a certain event happens. Insurance contracts are another example of unilateral contracts.

Source: slideserve.com

Source: slideserve.com

Unilateral contract — a contract in which only one party makes an enforceable promise. An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder. In a standard insurance contract, the insurance company promises to provide coverage against losses while the insured does not make any promises. Insurance is a contractual agreement between two parties in which one party promise to protect another party from uncertainties and losses. The applicant makes no such promise.

Source: mymissiontodoinlife.blogspot.com

Source: mymissiontodoinlife.blogspot.com

The promise itself must be an express promise. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. Insurance contracts are another example of unilateral contracts. Insurance is a contractual agreement between two parties in which one party promise to protect another party from uncertainties and losses. Unilateral contract insurance policies.an annuity contract is a contract between an individual investor and an insurance business in which the investor pays the annuity provider a flat payment or a series of premiums.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

The insurance company promises it will pay the insured person a specific amount of money in case a certain event happens. An insurance company makes a promise to pay for damages if an accident occurs, as long as the insurance premiums have been paid. Insurance is a means of protection from any unforeseen losses and contingencies. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. Insurance contracts are another example of unilateral contracts.

Source: fdvnlawfirm.vn

The insured does not have to pay unless they want to take advantage of the service, at which point paying the premium would constitute acting on the contract. What makes an insurance policy a unilateral contract? Avoid sudden, unilateral decisions in insurance sector. How to revoke a unilateral contract? Standard form contracts also present a unique set of interpretation challenges to judges.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

By contrast, the insured makes few,. Insurance is a means of protection from any unforeseen losses and contingencies. Since it is a unilateral contract, the insurer is not obligated to make a payment to the insured if the event does not occur. By contrast, the insured makes few,. This is a unilateral agreement, and the insurance company will not have to pay if the events never happen.

Source: slideserve.com

Source: slideserve.com

At the time, the central bank, the sector’s regulator, backed the move although it admitted the increment could have been done gradually. Unilateral contract — a contract in which only one party makes an enforceable promise. Unilateral contract refers to a promise of one party to another that is legally binding. Unilateral contract refers to a promise of one party to another that is legally binding. Insurance contracts are another example of unilateral contracts.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

Besides open requests, insurance companies also use unilateral contracts. An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder. However, if that event doesn’t happen, the company is not obliged to pay you any money. Unilateral extended reporting period provision: The insurance company promises it will pay the insured person a specific amount of money in case a certain event happens.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

In a bilateral contract, all of the parties assume the obligations under the contract. Also, an insurance company can agree to pay an insured person money if certain events occur. Distinguishing characteristic of an insurance contract in that it is only the insurance company that pledges anything. The other party doesn�t have the same legal restrictions under the contract. In an insurance contract, the insurance firm promises to indemnify or pay the insured individual a specific amount of money if a certain event happens.

Source: slideserve.com

Source: slideserve.com

We hope the you have a better understanding of. How to revoke a unilateral contract? An insurance contract provision that allows the insured to extend the period of time in which coverage is. Insurance contracts are another example of unilateral contracts. Also, an insurance company can agree to pay an insured person money if certain events occur.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title unilateral insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information