Universal life insurance pros and cons information

Home » Trend » Universal life insurance pros and cons informationYour Universal life insurance pros and cons images are available. Universal life insurance pros and cons are a topic that is being searched for and liked by netizens today. You can Download the Universal life insurance pros and cons files here. Find and Download all free photos.

If you’re searching for universal life insurance pros and cons images information linked to the universal life insurance pros and cons keyword, you have come to the ideal site. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly search and find more informative video content and images that fit your interests.

Universal Life Insurance Pros And Cons. We here at i&e hope that this list will help provide just a little insight into this unique insurance and investment product. Below are some of the benefits of indexed universal life insurance. While universal life insurance is a type of permanent life insurance and carries a cash value, the premium is divided into a savings portion and an investment portion. Pros and cons of indexed universal life insurance.

Indexed Universal Life Insurance Pros and Cons From theinsuranceproblog.com

Indexed Universal Life Insurance Pros and Cons From theinsuranceproblog.com

Pros and cons of indexed universal life insurance. Unlike other types of permanent life policies, universal life can adjust to fit your financial needs when your cash flow is up or when your budget is tight. The interest rate applied to the cash value never drops below 0%. One challenge of universal life insurance policies is that some policyholders aren’t able to handle the freedom. It’s permanent life insurance that lasts a person’s lifetime. Pros of universal life insurance.

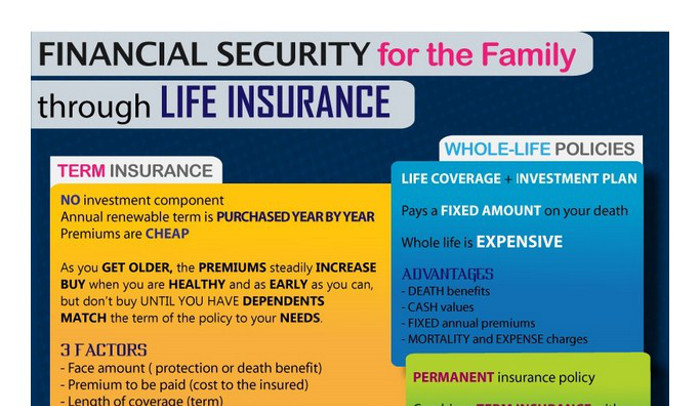

The reason universal life insurance is more expensive than term insurance, for instance, is that universal life insurance is guaranteed to be there when you die as long as your premiums are paid.

The pros and cons of universal life insurance are essential to review because this product is not the best option for every financial situation. What are the pros and cons of universal life insurance? Unlike other types of permanent life policies, universal life can adjust to fit your financial needs when your cash flow is up or when your budget is tight. Pros and cons of indexed universal life insurance. A universal life policy is a flexible form of cash value life insurance. Although the flexibility of universal life insurance can be attractive, there are some downsides.

Source: youtube.com

Source: youtube.com

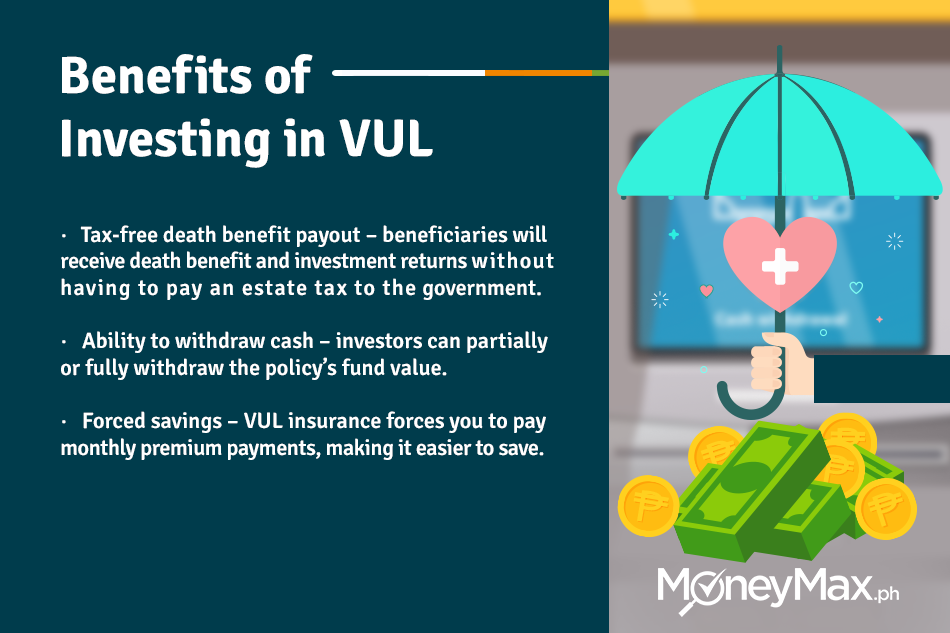

With the benefit of having lower premiums in light of the fact that you pay for the unadulterated protection comes to the disservice of your recipient just getting a payout that is equivalent to the presumptive worth. Universal life insurance cons freedom requires responsibility. Let’s go over universal life insurance pros and cons when it comes to changing how you pay premiums. We’ll explore some of the most important aspects of universal life insurance below. The vul is both an investment product and a life insurance product.

Source: youtube.com

Source: youtube.com

With it, you can change premium payments and invest more (or less) into your cash value for potential growth. Universal life insurance can be a good alternative to whole life or term life. The vul is both an investment product and a life insurance product. Pros of universal life insurance. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: brandongaille.com

Source: brandongaille.com

If you like a life insurance policy that maximizes both the coverage amount and retirement income through cash value growth, indexed universal life insurance is the right one for you. Let’s go over universal life insurance pros and cons when it comes to changing how you pay premiums. What are the pros and cons of purchasing universal life insurance? While many people benefit from owning a universal life insurance policy, it’s not the best type of protection for others. Unlike other types of permanent life policies, universal life can adjust to fit your financial needs when your cash flow is up or when your budget is tight.

Source: infoforinvestors.com

Source: infoforinvestors.com

But there are pros and cons to these features. Life insurance pros and cons when deciding on the right life insurance coverage to help protect your loved ones, weighing the pros and cons can help you narrow down your needs. Higher rate of return potential; What are the pros and cons of purchasing universal life insurance? Although the flexibility of universal life insurance can be attractive, there are some downsides.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Deciphering how it all works and its pros and cons are vital before deciding to move forward with an indexed universal life policy. One challenge of universal life insurance policies is that some policyholders aren’t able to handle the freedom. Compared to the returns earned by your universal policy premiums, you may be shortchanging yourself. Deciphering how it all works and its pros and cons are vital before deciding to move forward with an indexed universal life policy. But with this flexibility also comes some drawbacks.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

Universal life insurance can be a good alternative to whole life or term life. Before purchasing a universal life insurance policy, it’s important to consider these disadvantages carefully, as some of them could result in the lapse of your policy or a reduction in benefits. Deciphering how it all works and its pros and cons are vital before deciding to move forward with an indexed universal life policy. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. With it, you can change premium payments and invest more (or less) into your cash value for potential growth.

Source: insuranceandestates.com

Source: insuranceandestates.com

We here at i&e hope that this list will help provide just a little insight into this unique insurance and investment product. Life insurance pros and cons when deciding on the right life insurance coverage to help protect your loved ones, weighing the pros and cons can help you narrow down your needs. With the benefit of having lower premiums in light of the fact that you pay for the unadulterated protection comes to the disservice of your recipient just getting a payout that is equivalent to the presumptive worth. We here at i&e hope that this list will help provide just a little insight into this unique insurance and investment product. Universal life insurance cons freedom requires responsibility.

Source: findependencehub.com

Source: findependencehub.com

Universal life insurance gives the policyholder the ability to choose a higher death benefit or a higher cash value depending on what makes sense for each stage of life. The following is a list of the popular pros and cons of the variable universal life insurance policy. We’ll explore some of the most important aspects of universal life insurance below. Higher rate of return potential; Cons of universal life insurance.

Source: thismylife-ing.blogspot.com

Source: thismylife-ing.blogspot.com

Let’s go over universal life insurance pros and cons when it comes to changing how you pay premiums. Let’s look at the pros and cons. But there are pros and cons to these features. While universal life insurance is a type of permanent life insurance and carries a cash value, the premium is divided into a savings portion and an investment portion. Many types of universal life insurance, like indexed universal life insurance and variable universal life insurance, give you a good deal of flexibility in premiums paid and being able to adjust the death benefit.

Source: healthresearchfunding.org

Source: healthresearchfunding.org

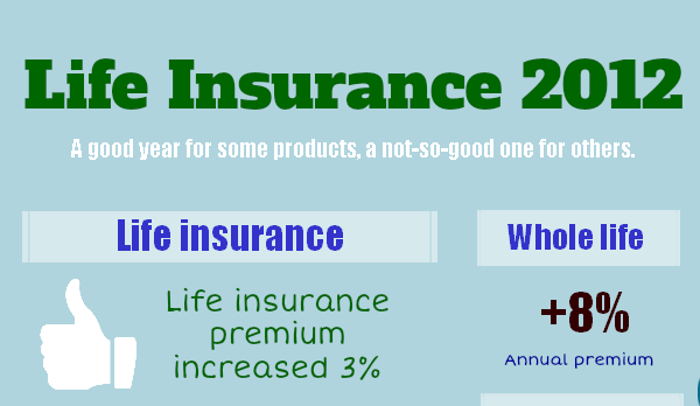

Term life insurance and whole life insurance are the two most common types of life insurance. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. It provides lifelong coverage with flexible payments and an investment account. Let’s go over universal life insurance pros and cons when it comes to changing how you pay premiums. Investments into stocks and money markets carry risk, and universal life insurance policies have advantages and disadvantages based on your needs.

Source: moneyunder30.com

Source: moneyunder30.com

Universal life insurance can be a good alternative to whole life or term life. Many types of universal life insurance, like indexed universal life insurance and variable universal life insurance, give you a good deal of flexibility in premiums paid and being able to adjust the death benefit. Investments into stocks and money markets carry risk, and universal life insurance policies have advantages and disadvantages based on your needs. Indexed universal life insurance offers greater control over the performance of your policy’s cash value growth since you’re not relying on a figure determined by the insurer and their performance. Term life insurance and whole life insurance are the two most common types of life insurance.

Source: termlifeadvice.com

Source: termlifeadvice.com

The disadvantages of universal life insurance. Pros of variable universal life. While the savings component of a universal policy sounds great in theory, it may not be so wonderful. A quick list of pros of indexed universal life insurance: Universal life insurance gives the policyholder the ability to choose a higher death benefit or a higher cash value depending on what makes sense for each stage of life.

Source: healthresearchfunding.org

Source: healthresearchfunding.org

The cons of universal life insurance high fees. The cons of universal life insurance high fees. Variable universal life insurance could offer cash value accumulation and consistent returns over time. Cons of universal life insurance level death policy. We’ll explore some of the most important aspects of universal life insurance below.

Source: billwells3.wordpress.com

Source: billwells3.wordpress.com

Universal life insurance cons freedom requires responsibility. A universal life policy is a flexible form of cash value life insurance. Compared to the returns earned by your universal policy premiums, you may be shortchanging yourself. Investments into stocks and money markets carry risk, and universal life insurance policies have advantages and disadvantages based on your needs. Cons of universal life insurance level death policy.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

Let’s go over universal life insurance pros and cons when it comes to changing how you pay premiums. Higher rate of return potential; But there are pros and cons to these features. Cons of universal life insurance. Cons of universal life insurance level death policy.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Universal life insurance cons freedom requires responsibility. Compared to the returns earned by your universal policy premiums, you may be shortchanging yourself. The following is a list of the popular pros and cons of the variable universal life insurance policy. It’s permanent life insurance that lasts a person’s lifetime. Cons of universal life insurance.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

It’s permanent life insurance that lasts a person’s lifetime. Although the flexibility of universal life insurance can be attractive, there are some downsides. Universal life insurance can be a good alternative to whole life or term life. A universal life policy is a flexible form of cash value life insurance. Pros and cons of indexed universal life insurance.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title universal life insurance pros and cons by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information