Universal life insurance surrender charges Idea

Home » Trend » Universal life insurance surrender charges IdeaYour Universal life insurance surrender charges images are ready in this website. Universal life insurance surrender charges are a topic that is being searched for and liked by netizens now. You can Download the Universal life insurance surrender charges files here. Find and Download all free photos and vectors.

If you’re looking for universal life insurance surrender charges images information connected with to the universal life insurance surrender charges keyword, you have visit the right site. Our website always provides you with suggestions for downloading the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

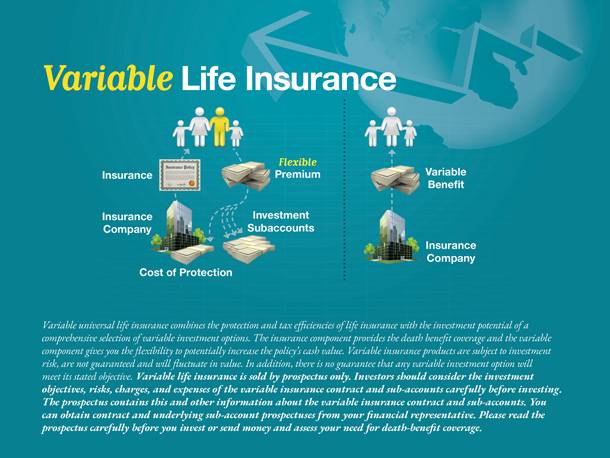

Universal Life Insurance Surrender Charges. It can cover you for the duration of your life, as long as the premiums are. Universal life insurance policies are bundled products, meaning you get insurance protection and an investment return. If you have a $100,000 cash value with a 2% surrender charge, you will have $2,000 taken from the account. Sean drummey contact for a free quote phone:

Universal Life Insurance From integon-life-insurance.blogspot.com

Universal Life Insurance From integon-life-insurance.blogspot.com

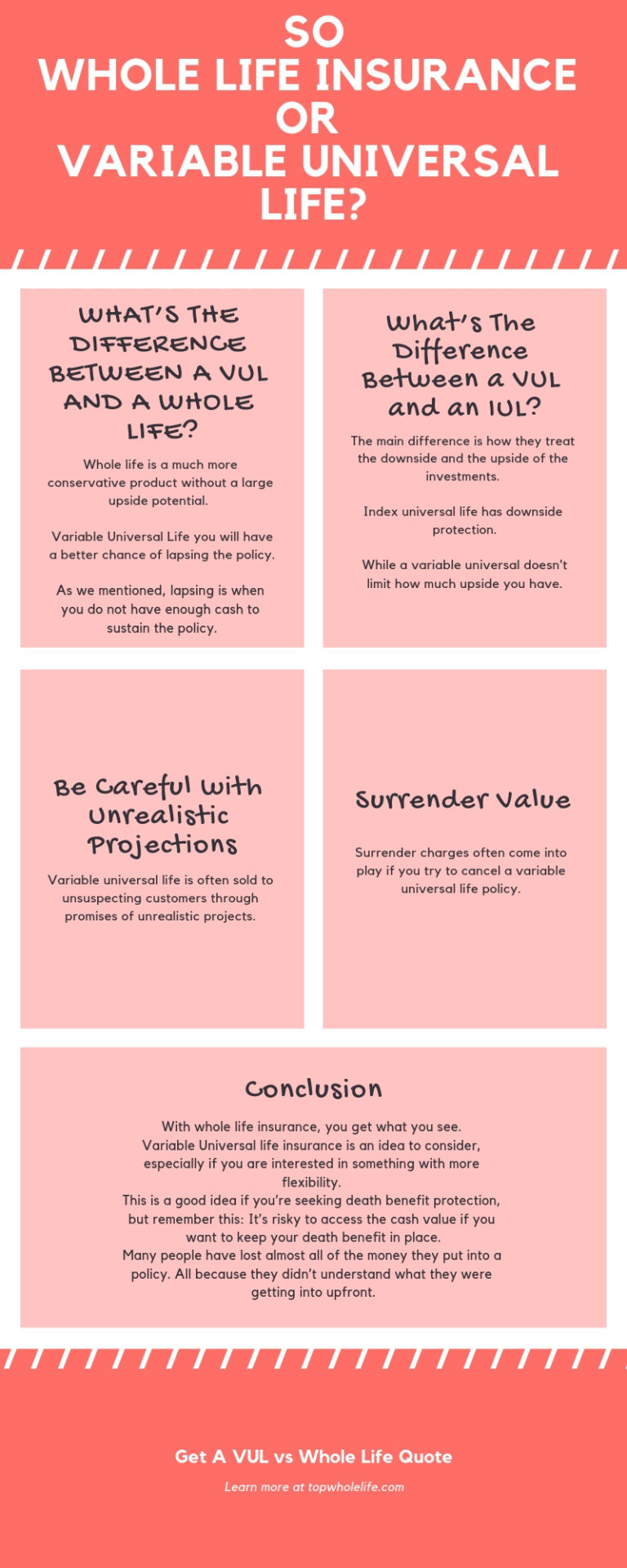

A surrender charge is a charge from the cash value imposed by the insurance company for surrendering the contract early or withdrawing money early. In most cases, the difference between your policy’s cash value and surrender value are the charges associated with early termination. They also depend on levels of A surrender period is a time frame in which you can cancel the policy and take the cash value; However, you�ll be penalized with charges if you do. The universal type of life insurance and variable universal are known to have the highest surrender charges.

You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000.

The universal type of life insurance and variable universal are known to have the highest surrender charges. Sean drummey contact for a free quote phone: This charge is based on your age, gender and underwriting classification. Universal life policies can produce “living benefits” in the form of cash values. Universal life insurance policies are bundled products, meaning you get insurance protection and an investment return. 10 years coverage surrender charges (also applies on face amount reductions):

Source: annuityexpertadvice.com

Source: annuityexpertadvice.com

The least amount of surrender charges in the shortest period of time is a distinct advantage for an indexed universal life in case there is a change in plans. By his math, the yield on the policy (including the surrender. Make a copy of the form and your policy for your records. Surrender charge schedules are difference between insurers and between the ul plans available from each insurer. It can cover you for the duration of your life, as long as the premiums are.

Source: ascendantfinancial.ca

Source: ascendantfinancial.ca

They also depend on levels of And as the surrender schedule extinguished, the cash value would grow faster. The difference between the surrender charge and surrender value is not as clear as one would think. The surrender value is the actual sum of money a policyholder will receive if they try to access the cash value of a policy. Increasing or level death benefit options no surrender charges for level t100 cost of insurance guaranteed annual bonus equal to 1% of the average value of the accumulation fund, from the 6th policy anniversary daily and guaranteed interest investment options of 1, 3, 5 and 10 years

Source: everquote.com

Source: everquote.com

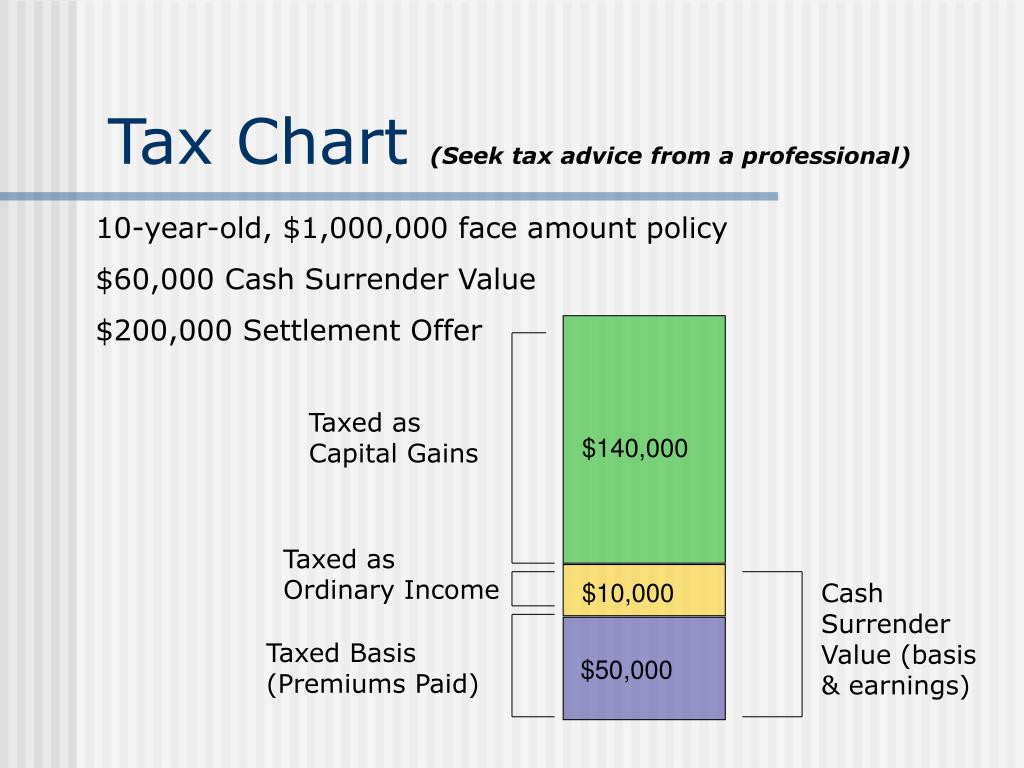

You will pay tax on $2,000 at a rate of 25%. Surrender period and charges most universal life policies charge a penalty if you cancel it. The difference between the surrender charge and surrender value is not as clear as one would think. If you have a $100,000 cash value with a 2% surrender charge, you will have $2,000 taken from the account. In most cases, the difference between your policy’s cash value and surrender value are the charges associated with early termination.

Source: topwholelife.com

Source: topwholelife.com

For example, say that you are in the 25% tax bracket and you paid a total of $10,000 of. The fee is used to cover the costs of keeping the insurance policy on the insurance. Surrender charge this charge is deducted from your cash value if you surrender (terminate) your policy during your surrender charge period. The least amount of surrender charges in the shortest period of time is a distinct advantage for an indexed universal life in case there is a change in plans. The charge then decreases slightly each year up to ten years after the first three years.

Source: integon-life-insurance.blogspot.com

Source: integon-life-insurance.blogspot.com

For example, say that you are in the 25% tax bracket and you paid a total of $10,000 of. Upon surrendering, the insurance company will take anywhere from 10% to 30% in fees. Fill it out and sign it. Sean drummey contact for a free quote phone: Cash values make loans, partial and full surrenders possible.

Source: engage.midlandnational.com

Source: engage.midlandnational.com

Universal life insurance and variable universal life insurance typically have the highest surrender charges, and the charges last for the longest time. Universal life policies can produce “living benefits” in the form of cash values. Your cash value is now worth $13,000, and you decide to surrender your policy. If you surrender a cash value life insurance policy, any gain on the policy over and above your cost basis (premiums paid) will be subject to federal (and possibly state) income tax. A surrender charge, also called a surrender fee, is levied on a life insurance policyholder upon cancellation.

Source: termlifeadvice.com

Source: termlifeadvice.com

A surrender period is a time frame in which you can cancel the policy and take the cash value; Upon surrendering, the insurance company will take anywhere from 10% to 30% in fees. The surrender value is the amount of money one receives after surrendering the policy, which may only be a small amount of the payments on has been making. Submit the surrender form and policy to the insurance company. A surrender charge, also called a surrender fee, is levied on a life insurance policyholder upon cancellation.

Source: uat.metlife.com

Source: uat.metlife.com

The other $10,000 is considered a. What’s left after that is returned directly to the policyholder. For example, say that you are in the 25% tax bracket and you paid a total of $10,000 of. This charge is assessed monthly. A surrender period is a time frame in which you can cancel the policy and take the cash value;

Source: ascendantfinancial.ca

Source: ascendantfinancial.ca

The difference between a surrender charge and surrender value. You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000. They also depend on levels of Universal life insurance is a type of permanent life insurance. You will pay tax on $2,000 at a rate of 25%.

Source: forusfive.blogspot.com

Source: forusfive.blogspot.com

Universal life insurance and variable universal life insurance typically have the highest surrender charges, and the charges last for the longest time. You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000. Surrender period and charges most universal life policies charge a penalty if you cancel it. If you surrender a cash value life insurance policy, any gain on the policy over and above your cost basis (premiums paid) will be subject to federal (and possibly state) income tax. 10 years coverage surrender charges (also applies on face amount reductions):

Source: aspenwealthmgmt.com

Source: aspenwealthmgmt.com

You will pay tax on $2,000 at a rate of 25%. The surrender value is the actual sum of money a policyholder will receive if they try to access the cash value of a policy. Surrender period and charges most universal life policies charge a penalty if you cancel it. Fill it out and sign it. Universal life insurance policies are bundled products, meaning you get insurance protection and an investment return.

Source: wealthmanagement.com

Source: wealthmanagement.com

You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000. Make a copy of the form and your policy for your records. 10 years coverage surrender charges (also applies on face amount reductions): The difference between the surrender charge and surrender value is not as clear as one would think. The other $10,000 is considered a.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

Sean drummey contact for a free quote phone: And as the surrender schedule extinguished, the cash value would grow faster. A surrender period is a time frame in which you can cancel the policy and take the cash value; You�ll also be charged for taking out more than a certain amount of the cash value within a set period. 10 years coverage surrender charges (also applies on face amount reductions):

Source: aws.seniormarketsales.com

Sean drummey contact for a free quote phone: A surrender period is a time frame in which you can cancel the policy and take the cash value; (note that outstanding loans are also counted as part of the gain.) in general, the amount the policy owner has paid for the policy, up to the cost basis, is tax free. Make a copy of the form and your policy for your records. However, you�ll be penalized with charges if you do.

Source: lsminsurance.ca

Source: lsminsurance.ca

This charge is assessed monthly. Upon surrendering, the insurance company will take anywhere from 10% to 30% in fees. Surrender charge schedules are difference between insurers and between the ul plans available from each insurer. Fill it out and sign it. The surrender value is the amount of money one receives after surrendering the policy, which may only be a small amount of the payments on has been making.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

Make a copy of the form and your policy for your records. Investment returns are based on the rates declared periodically by your insurer (known as “crediting rate”) and can be. Surrender charge schedules are difference between insurers and between the ul plans available from each insurer. The surrender penalty arrangement can vary from company to company. Surrender period and charges most universal life policies charge a penalty if you cancel it.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

That amount between $7,918 and $25,000 would not be subject to surrender charges at any time with penn mutual. Make a copy of the form and your policy for your records. By his math, the yield on the policy (including the surrender. The difference between the surrender charge and surrender value is not as clear as one would think. Universal life insurance and variable universal life insurance typically have the highest surrender charges, and the charges last for the longest time.

Source: universallifeinsurancecheck.com

Source: universallifeinsurancecheck.com

The universal type of life insurance and variable universal are known to have the highest surrender charges. The charge then decreases slightly each year up to ten years after the first three years. Surrender period and charges most universal life policies charge a penalty if you cancel it. A surrender period is a time frame in which you can cancel the policy and take the cash value; When a policyowner cash surrenders a universal life insurance policy in it’s early years this may be considered a red flag.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title universal life insurance surrender charges by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information