Us liabilities insurance co Idea

Home » Trending » Us liabilities insurance co IdeaYour Us liabilities insurance co images are available in this site. Us liabilities insurance co are a topic that is being searched for and liked by netizens now. You can Find and Download the Us liabilities insurance co files here. Get all royalty-free photos and vectors.

If you’re looking for us liabilities insurance co images information linked to the us liabilities insurance co keyword, you have pay a visit to the right site. Our website frequently provides you with hints for seeking the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Us Liabilities Insurance Co. General liability insurance, also known as business liability insurance, is a type of insurance policy that helps protect businesses from claims that happen as a result of normal operations. Get free online quotes in 2 minutes! Start your free online quote and save $610! Regulators require insurers to have sufficient surplus to support the policies they issue.

General Liability Insurance R.C. Keller & Company From keller-co.com

General Liability Insurance R.C. Keller & Company From keller-co.com

Given the jump in insolvencies and bankruptcy filings due to the moribund economy, insurance claims again are becoming a focal point for the administration of debtor assets and liabilities. Usli aspires to be the very best insurance company for underwriting insurance for small businesses along with a select group of specialty products. Regulators require insurers to have sufficient surplus to support the policies they issue. Get free online quotes in 2 minutes! Intentional damage and contractual liabilities are not covered by a liabilities insurance policy. Aggregate reserve for life contracts $ less $ included in line 6.3 (including $ modco reserve) 2.

Deferred rent credit deferred lease income derivative instruments and hedges, liabilities

11 rows the company was founded in 1886 and has stood strong to help protect those who. Start your free online quote and save $610! However, claims filed for intentional damages, criminal prosecution, and contractual liabilities are not covered in a liability insurance policy. Liability insurance is a policy that offers cover to businesses/individuals and companies in case of legal hassles and if they are sued due to harm caused to another person by their products and services. United states liability insurance company operates as an insurance company. Intentional damage and contractual liabilities are not covered by a liabilities insurance policy.

Source: welldunninsurance.co.uk

Source: welldunninsurance.co.uk

Liability insurance is a type of insurance policy that. An insurance company’s policyholders’ surplus—its assets minus its liabilities—serves as the company’s financial cushion against catastrophic losses and as a way to fund expansion. The dividend payout is set at a. Start your free online quote and save $610! 11 rows the company was founded in 1886 and has stood strong to help protect those who.

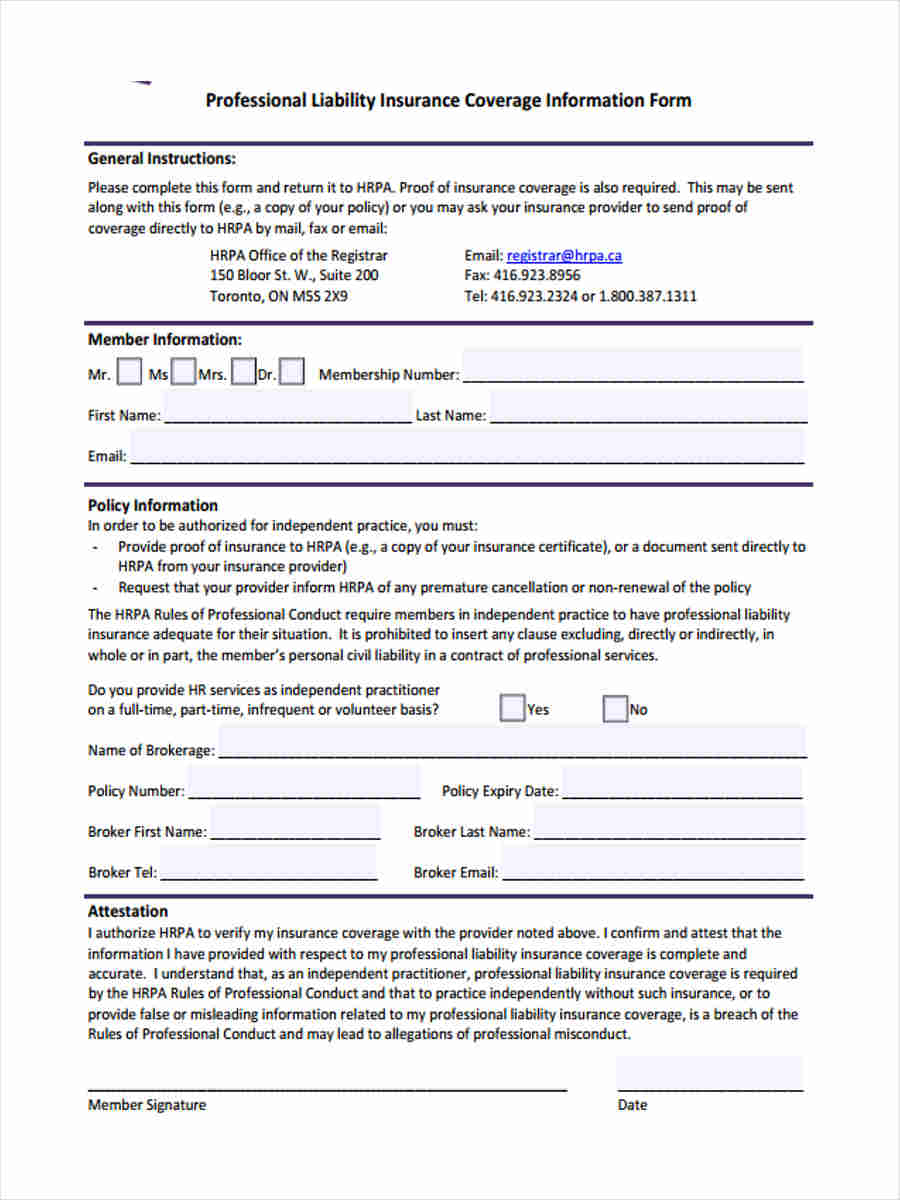

Source: sampleforms.com

Source: sampleforms.com

Accounts payable and other accrued liabilities settlement liabilities : Aggregate reserve for life contracts $ less $ included in line 6.3 (including $ modco reserve) 2. Get free online quotes in 2 minutes! Usli aspires to be the very best insurance company for underwriting insurance for small businesses along with a select group of specialty products. Intentional damage and contractual liabilities are not covered by a liabilities insurance policy.

Source: smallbiztrends.com

Source: smallbiztrends.com

Usli aspires to be the very best insurance company for underwriting insurance for small businesses along with a select group of specialty products. Get cheap usa auto insurance now. However, claims filed for intentional damages, criminal prosecution, and contractual liabilities are not covered in a liability insurance policy. Death of company insurance coverage in bankruptcy. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Get cheap usa auto insurance now. What is not covered under this insurance policy? Ad save $610 on auto insurance today. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. 1.2 what are the insurance company’s obligations the insurer’s obligations under a cgl policy primarily emanates from the “insuring agreement(s)” of the form.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The company offers fire, marine, and casualty insurance. What is not covered under this insurance policy? 1.2 what are the insurance company’s obligations the insurer’s obligations under a cgl policy primarily emanates from the “insuring agreement(s)” of the form. An insurance company’s policyholders’ surplus—its assets minus its liabilities—serves as the company’s financial cushion against catastrophic losses and as a way to fund expansion. Get cheap usa auto insurance now.

Source: kickerinsuresme.com

Source: kickerinsuresme.com

Aggregate reserve for life contracts $ less $ included in line 6.3 (including $ modco reserve) 2. Start your free online quote and save $610! Business liability insurance typically provides coverage to small businesses for bodily injuries, medical payments, advertising injuries and more. Usli aspires to be the very best insurance company for underwriting insurance for small businesses along with a select group of specialty products. Liability insurance policy offers protection to individuals and businesses from legal payouts that the policyholder is liable to pay or is sued for.

Source: businessinsurancequotes.com

Source: businessinsurancequotes.com

Death of company insurance coverage in bankruptcy. Ad save $610 on auto insurance today. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. The dividend payout is set at a. Liability insurance is a policy that offers cover to businesses/individuals and companies in case of legal hassles and if they are sued due to harm caused to another person by their products and services.

Source: kenyachambermines.com

Source: kenyachambermines.com

Get free online quotes in 2 minutes! Interest and dividends payable : An insurance company’s policyholders’ surplus—its assets minus its liabilities—serves as the company’s financial cushion against catastrophic losses and as a way to fund expansion. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. Regulators require insurers to have sufficient surplus to support the policies they issue.

Source: sundirect-heater.com

Source: sundirect-heater.com

1.2 what are the insurance company’s obligations the insurer’s obligations under a cgl policy primarily emanates from the “insuring agreement(s)” of the form. The dividend payout is set at a. Deferred rent credit deferred lease income derivative instruments and hedges, liabilities United states liability insurance company operates as an insurance company. Get cheap usa auto insurance now.

Source: dickeymccay.com

Source: dickeymccay.com

11 rows the company was founded in 1886 and has stood strong to help protect those who. Given the jump in insolvencies and bankruptcy filings due to the moribund economy, insurance claims again are becoming a focal point for the administration of debtor assets and liabilities. Accounts payable and other accrued liabilities settlement liabilities : United states liability insurance company operates as an insurance company. Business liability insurance typically provides coverage to small businesses for bodily injuries, medical payments, advertising injuries and more.

Source: missionbox.com

Source: missionbox.com

General liability insurance, also known as business liability insurance, is a type of insurance policy that helps protect businesses from claims that happen as a result of normal operations. Originally, individual companies that faced a. An insurance company’s policyholders’ surplus—its assets minus its liabilities—serves as the company’s financial cushion against catastrophic losses and as a way to fund expansion. Regulators require insurers to have sufficient surplus to support the policies they issue. 397.59 billion which equates to.

Source: slideshare.net

Source: slideshare.net

The dividend payout is set at a. Death of company insurance coverage in bankruptcy. Start your free online quote and save $610! Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. Get free online quotes in 2 minutes!

Source: issuu.com

Source: issuu.com

An insurance company’s policyholders’ surplus—its assets minus its liabilities—serves as the company’s financial cushion against catastrophic losses and as a way to fund expansion. Start your free online quote and save $610! Interest and dividends payable : Liability insurance policy offers protection to individuals and businesses from legal payouts that the policyholder is liable to pay or is sued for. Given the jump in insolvencies and bankruptcy filings due to the moribund economy, insurance claims again are becoming a focal point for the administration of debtor assets and liabilities.

Source: advisoryhq.com

Source: advisoryhq.com

Liability insurance is a policy that offers cover to businesses/individuals and companies in case of legal hassles and if they are sued due to harm caused to another person by their products and services. Start your free online quote and save $610! Liability insurance is a type of insurance policy that. The dividend payout is set at a. Death of company insurance coverage in bankruptcy.

Source: keller-co.com

Source: keller-co.com

Usli aspires to be the very best insurance company for underwriting insurance for small businesses along with a select group of specialty products. Regulators require insurers to have sufficient surplus to support the policies they issue. 397.59 billion which equates to. Liability insurance policy offers protection to individuals and businesses from legal payouts that the policyholder is liable to pay or is sued for. Deferred rent credit deferred lease income derivative instruments and hedges, liabilities

Source: professionalinforme.blogspot.com

Source: professionalinforme.blogspot.com

What is not covered under this insurance policy? Business liability insurance typically provides coverage to small businesses for bodily injuries, medical payments, advertising injuries and more. 397.59 billion which equates to. Get cheap usa auto insurance now. Given the jump in insolvencies and bankruptcy filings due to the moribund economy, insurance claims again are becoming a focal point for the administration of debtor assets and liabilities.

Source: businessinsurance.co.za

Source: businessinsurance.co.za

Originally, individual companies that faced a. Originally, individual companies that faced a. Get free online quotes in 2 minutes! Death of company insurance coverage in bankruptcy. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence.

Source: bouncy-rentals.com

United states liability insurance company operates as an insurance company. 1.2 what are the insurance company’s obligations the insurer’s obligations under a cgl policy primarily emanates from the “insuring agreement(s)” of the form. Business liability insurance typically provides coverage to small businesses for bodily injuries, medical payments, advertising injuries and more. However, claims filed for intentional damages, criminal prosecution, and contractual liabilities are not covered in a liability insurance policy. An insurance company’s policyholders’ surplus—its assets minus its liabilities—serves as the company’s financial cushion against catastrophic losses and as a way to fund expansion.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title us liabilities insurance co by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information