Use of big data in insurance Idea

Home » Trending » Use of big data in insurance IdeaYour Use of big data in insurance images are available in this site. Use of big data in insurance are a topic that is being searched for and liked by netizens today. You can Download the Use of big data in insurance files here. Download all free photos.

If you’re looking for use of big data in insurance pictures information connected with to the use of big data in insurance topic, you have visit the right site. Our site frequently gives you suggestions for seeing the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

Use Of Big Data In Insurance. 3 examples of using big data in the insurance industry include: 7 ways in which big data is used in the insurance industry 1. Big data and ai in insurance the use of algorithms and big data analytics (bda) is set to profoundly transform the insurance sector. The insurance industry can save time and money on advertising by pinpointing what is important to clients in their respective markets.

How Big data is changing the insurance industry by From chrishtopher-henry-38679.medium.com

How Big data is changing the insurance industry by From chrishtopher-henry-38679.medium.com

Using data from multiple source systems and applying acl and sql to model the process, we identified comparable anomalies. Undoubtedly, the insurance companies benefit from data science application. Big data technologies are applied to predict risks and claims, to monitor and to analyze them in order to develop effective strategies for customers attraction and retention. Big data’s role in the insurance industry customer acquisition. Using big data services helps settle some claims nearly instantaneously. In the insurance industry, big data is the name of the game.

Insurers use big data to improve fraud detection and criminal activity through data management and predictive modeling.

More accurately underwrite, price risk and incentivize risk reduction. Increased data availability to insurers coupled with enhanced processing capabilities will result in increasingly personalised and tailored offers to insurance consumers. Big data constitutes diverse datasets, which can be anything from expanded datasets to social media data. Prudent behaviour can be envisaged through big data, thus new technologies allow the role of insurance to evolve from pure risk protection towards risk prediction and prevention. So far, big data has certainly been advantageous to healthy people and safe drivers, who save on their premiums. And the higher the risk, the greater the cost attached to it.

Source: slideshare.net

Source: slideshare.net

Using big data services helps settle some claims nearly instantaneously. Five ways insurtech companies are using big data in the insurance process pricing and underwriting. Companies spend millions of dollars each year marketing their products and services. Insurance company resources can evaluate the claims history of each customer or all customers insured by the carrier. Estimating the price of an insurance policy based on complex risk assessment procedures is the.

Source: techiexpert.com

Source: techiexpert.com

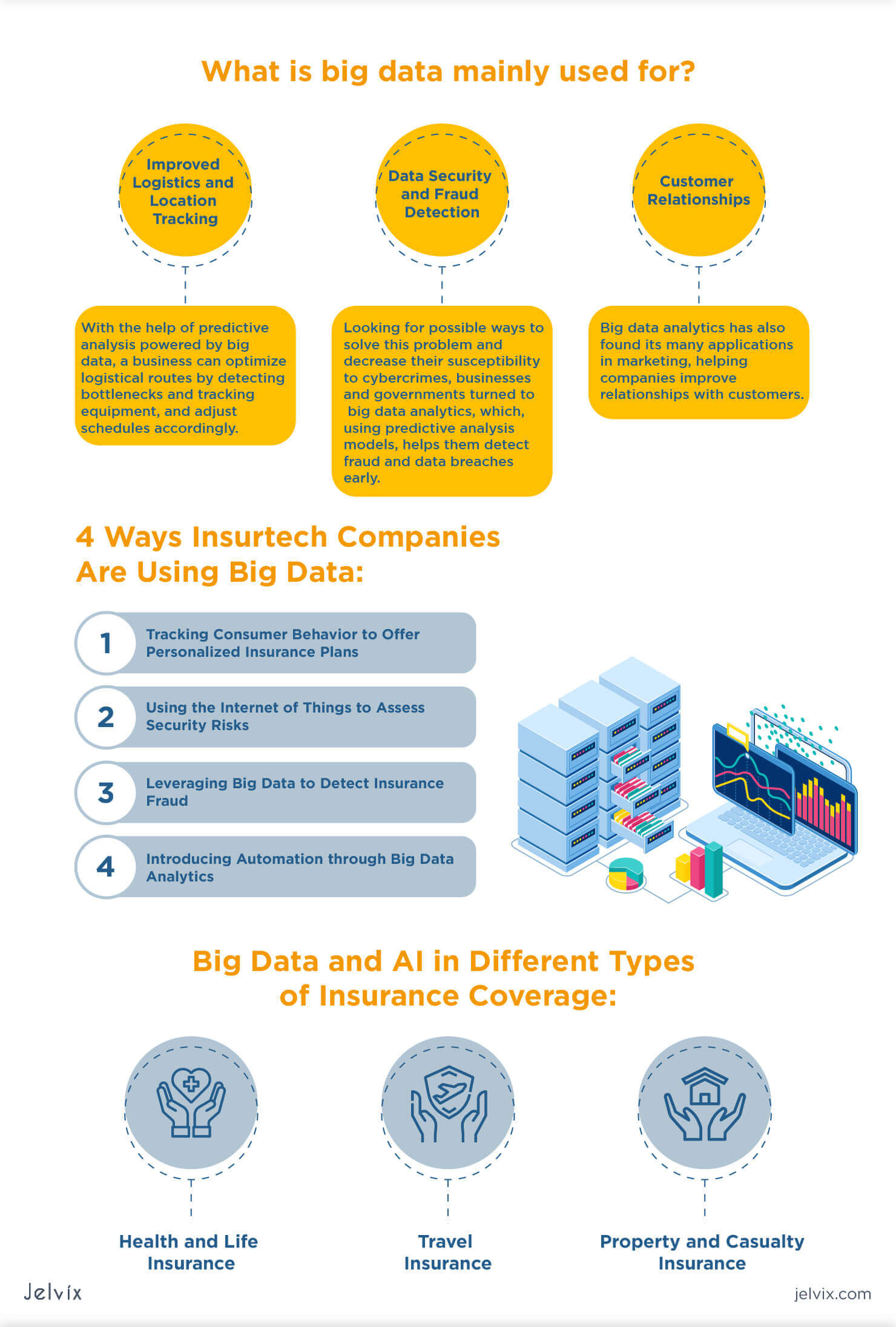

Big data is mainly used for: Another area of insurance that can expect a big impact from big data is advertising. 3 examples of using big data in the insurance industry include: Insurers use big data to improve fraud detection and criminal activity through data management and predictive modeling. Insurers can use it to:

Source: majorel.com

Source: majorel.com

Big data is currently being used to automate backend processes, extend coverage to a wider groups of people and craft insurance policies that cover individuals based on unique needs. A traditional claims journey is typically composed of insurers assessing the loss or. 3 examples of using big data in the insurance industry include: Consumers who agree to let insurance companies track their habits can learn more about themselves, while insurers can use the data to influence behavior and reduce risks. In the insurance industry, big data is the name of the game.

Source: istegroup.com

Source: istegroup.com

Prudent behaviour can be envisaged through big data, thus new technologies allow the role of insurance to evolve from pure risk protection towards risk prediction and prevention. Insurers use big data to tackle fraudulent claims through profiling and predictive modelling. Fraud is a very real. Prudent behaviour can be envisaged through big data, thus new technologies allow the role of insurance to evolve from pure risk protection towards risk prediction and prevention. Using big data services helps settle some claims nearly instantaneously.

Source: pinterest.com

Source: pinterest.com

Every business needs to acquire customers to generate revenue and if the process of acquisition. Insurers can use it to: Using data from multiple source systems and applying acl and sql to model the process, we identified comparable anomalies. Big data technologies are applied to predict risks and claims, to monitor and to analyze them in order to develop effective strategies for customers attraction and retention. Based on customer activity, algorithms can identify early signs of customer dissatisfaction so you.

Source: pinterest.com

Source: pinterest.com

Prudent behaviour can be envisaged through big data, thus new technologies allow the role of insurance to evolve from pure risk protection towards risk prediction and prevention. Companies spend millions of dollars each year marketing their products and services. A traditional claims journey is typically composed of insurers assessing the loss or. Using big data in insurance can be beneficial for all parties involved. Increased data availability to insurers coupled with enhanced processing capabilities will result in increasingly personalised and tailored offers to insurance consumers.

Source: es.slideshare.net

Source: es.slideshare.net

Big data and ai in insurance the use of algorithms and big data analytics (bda) is set to profoundly transform the insurance sector. Big data is currently being used to automate backend processes, extend coverage to a wider groups of people and craft insurance policies that cover individuals based on unique needs. These data lakes were built using commercial hadoop distributions — a flexible number of independent open source compute engines joined in a common platform to effect scale. Insurance company resources can evaluate the claims history of each customer or all customers insured by the carrier. Using data from multiple source systems and applying acl and sql to model the process, we identified comparable anomalies.

Source: jelvix.com

Source: jelvix.com

They match the variables in every claim against the profiles of past claims which were fraudulent so that when there is a match, the claim is pinned for further investigation. Using big data, social media, mobile apps and other tools, insurance companies can combat fraud like never before. Big data in insurance is defined as the structured and/or unstructured data used to influence underwriting, rating, pricing, forms, marketing, and claims handling. Another area of insurance that can expect a big impact from big data is advertising. Big data and risk prediction insurance is mainly about managing risks of all kinds.

Source: chrishtopher-henry-38679.medium.com

Source: chrishtopher-henry-38679.medium.com

Insurance company resources can evaluate the claims history of each customer or all customers insured by the carrier. Insurers can use it to: Companies that want to leverage that information into actionable insights turn to big data analytics. Every individual generates massive amounts of data via social networks, emails, and feedback,. No business likes to lose its customer base.

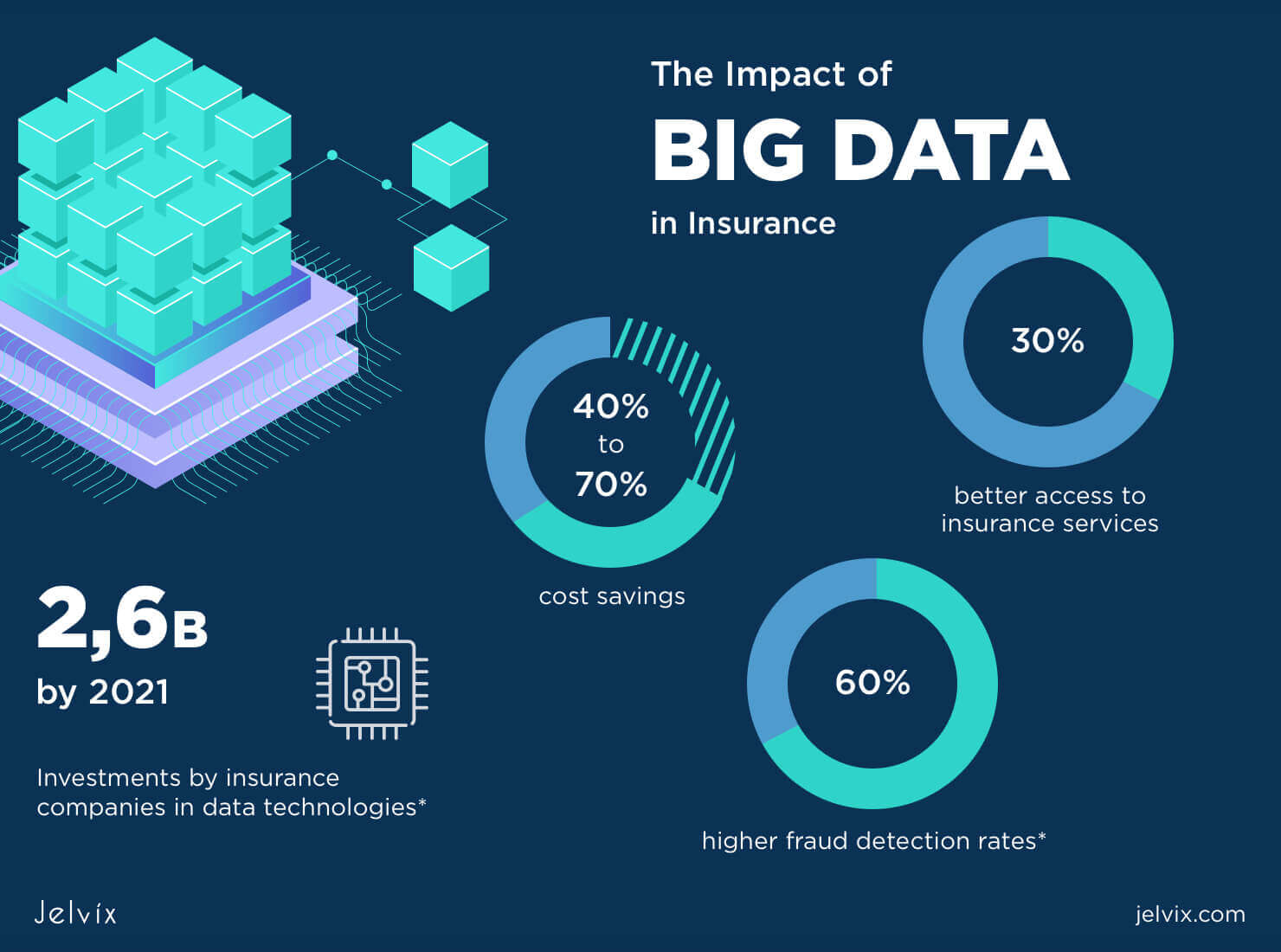

Source: jelvix.com

Source: jelvix.com

7 ways in which big data is used in the insurance industry 1. Fraud is a very real. They match the variables in every claim against the profiles of past claims which were fraudulent so that when there is a match, the claim is pinned for further investigation. Insurers use big data to tackle fraudulent claims through profiling and predictive modelling. Using big data in insurance can be beneficial for all parties involved.

Source: mycustomer.com

Source: mycustomer.com

The insurance industry can save time and money on advertising by pinpointing what is important to clients in their respective markets. They match the variables in every claim against the profiles of past claims which were fraudulent so that when there is a match, the claim is pinned for further investigation. Another area of insurance that can expect a big impact from big data is advertising. Big data technologies are applied to predict risks and claims, to monitor and to analyze them in order to develop effective strategies for customers attraction and retention. Big data is currently being used to automate backend processes, extend coverage to a wider groups of people and craft insurance policies that cover individuals based on unique needs.

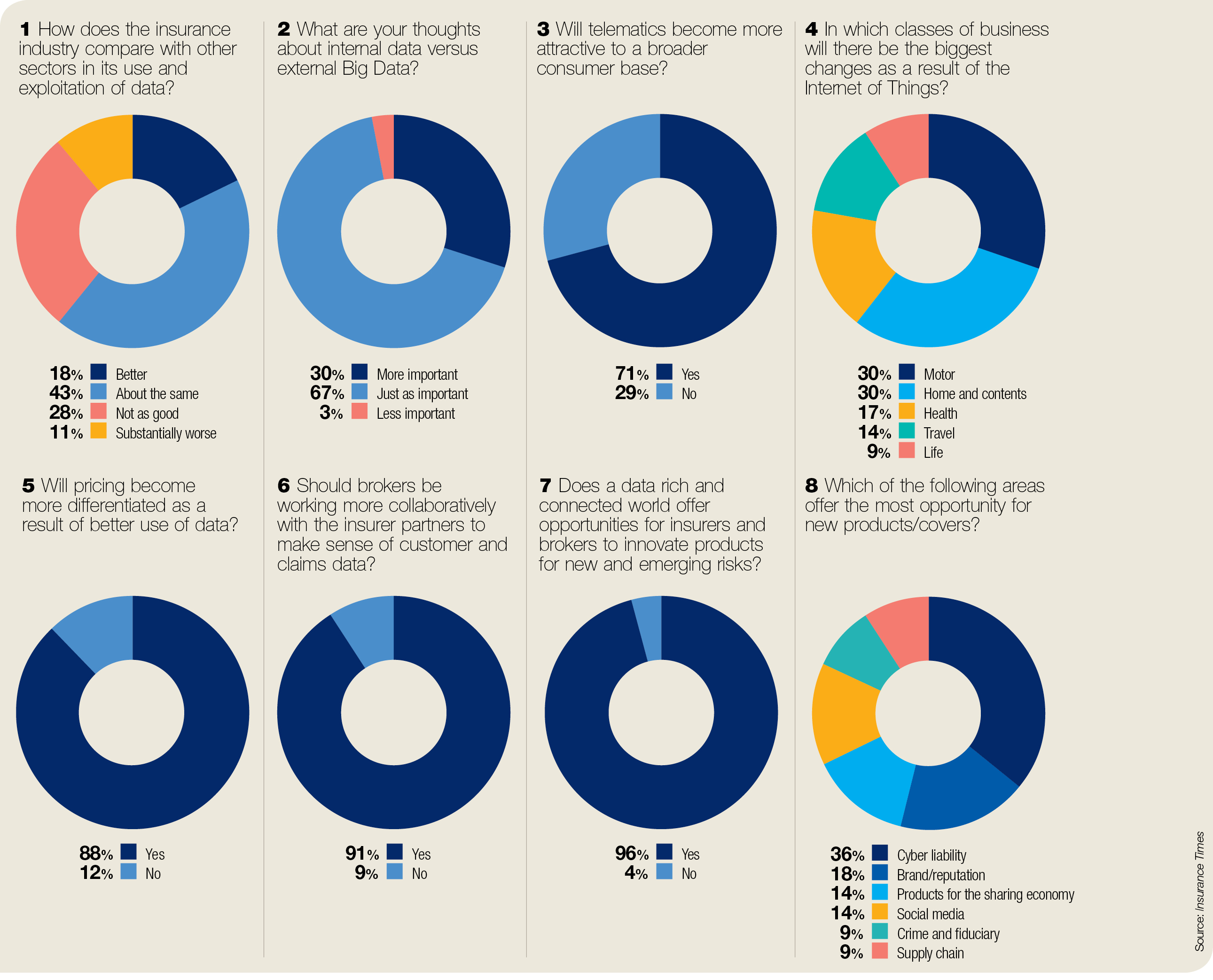

Source: insurancetimes.co.uk

Source: insurancetimes.co.uk

Big data is mainly used for: Undoubtedly, the insurance companies benefit from data science application. Every individual generates massive amounts of data via social networks, emails, and feedback,. Big data is currently being used to automate backend processes, extend coverage to a wider groups of people and craft insurance policies that cover individuals based on unique needs. Insurers can use it to:

Source: aegonlife.com

Source: aegonlife.com

Big data technologies are applied to predict risks and claims, to monitor and to analyze them in order to develop effective strategies for customers attraction and retention. 3 examples of using big data in the insurance industry include: Fraud is a very real. Using big data, social media, mobile apps and other tools, insurance companies can combat fraud like never before. Using data from multiple source systems and applying acl and sql to model the process, we identified comparable anomalies.

Source: analyticsindiamag.com

Source: analyticsindiamag.com

While insurers have had access to this data previously, it is more actionable than ever thanks to advancements in data analytics , machine learning, and iot. Big data technologies are applied to predict risks and claims, to monitor and to analyze them in order to develop effective strategies for customers attraction and retention. Companies that want to leverage that information into actionable insights turn to big data analytics. Insurers use big data in a number of ways. Consumers who agree to let insurance companies track their habits can learn more about themselves, while insurers can use the data to influence behavior and reduce risks.

Source: slideshare.net

Source: slideshare.net

Enrich customer experience by quickly resolving service issues. The analytics are used to process medical information rapidly and efficiently for faster decision making and to detect suspicious or fraudulent claims. Insurance should be fair, objective and able to protect the policy holders while still making a profit for the insurance companies. Consumers who agree to let insurance companies track their habits can learn more about themselves, while insurers can use the data to influence behavior and reduce risks. Big data is mainly used for:

Source: strategymeetsaction.com

Source: strategymeetsaction.com

Big data technologies are applied to predict risks and claims, to monitor and to analyze them in order to develop effective strategies for customers attraction and retention. Companies spend millions of dollars each year marketing their products and services. Insurers use big data to improve fraud detection and criminal activity through data management and predictive modeling. Using big data, social media, mobile apps and other tools, insurance companies can combat fraud like never before. Prudent behaviour can be envisaged through big data, thus new technologies allow the role of insurance to evolve from pure risk protection towards risk prediction and prevention.

Source: reply.com

Source: reply.com

They match the variables in every claim against the profiles of past claims which were fraudulent so that when there is a match, the claim is pinned for further investigation. Companies spend millions of dollars each year marketing their products and services. They match the variables in every claim against the profiles of past claims which were fraudulent so that when there is a match, the claim is pinned for further investigation. Using big data in insurance can be beneficial for all parties involved. No business likes to lose its customer base.

Source: entrepreneurbusinessblog.com

Source: entrepreneurbusinessblog.com

Estimating the price of an insurance policy based on complex risk assessment procedures is the. Insurance company resources can evaluate the claims history of each customer or all customers insured by the carrier. Every individual generates massive amounts of data via social networks, emails, and feedback,. Enrich customer experience by quickly resolving service issues. Insurance should be fair, objective and able to protect the policy holders while still making a profit for the insurance companies.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title use of big data in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information