Utah auto insurance regulations information

Home » Trending » Utah auto insurance regulations informationYour Utah auto insurance regulations images are ready. Utah auto insurance regulations are a topic that is being searched for and liked by netizens today. You can Download the Utah auto insurance regulations files here. Find and Download all royalty-free images.

If you’re searching for utah auto insurance regulations images information linked to the utah auto insurance regulations interest, you have pay a visit to the ideal blog. Our site always provides you with hints for refferencing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Utah Auto Insurance Regulations. Utah minimum car insurance requirements. Your guide to understanding auto insurance in the granite state, page 1.accessed dec. Utah insurance rules — r590 and r592 insurance rules are issued to implement or interpret the utah insurance code or federal mandates and have the effect of law. Proof of current insurance will be required.

Utah car insurance insurance From greatoutdoorsabq.com

Utah car insurance insurance From greatoutdoorsabq.com

The following is a breakdown of minimum liability requirements for utah: The following minimum car insurance coverages are required in utah: In utah, the state minimum coverage requirements are: It was written and legislated to protect the safety of motorists, pedestrians, and property by laying legal ground rules for what is generally considered safe and legal, and what isn�t. $25,000 per person and $65,000 per accident**. Car insurance is required in the state of utah.

All drivers must also carry proof of this coverage while behind the wheel.

In utah, liability car insurance is mandatory for all drivers. A $100.00 reinstatement fee will be assessed, unless you can provide proof that the vehicle was insured on the date that the registration was revoked. 29 this statutory program may not limit or impair the rights, remedies, requirements, or The minimum amount of utah auto insurance coverage is $25,000/$65,000/$15,000. You must have insurance on your vehicle if you are: $25,000 bodily injury per person per accident $65,000 bodily injury for all persons per accident $15,000 property damage liability $3,000 personal injury protection $25,000/$65,000 uninsured/underinsured motorist coverage

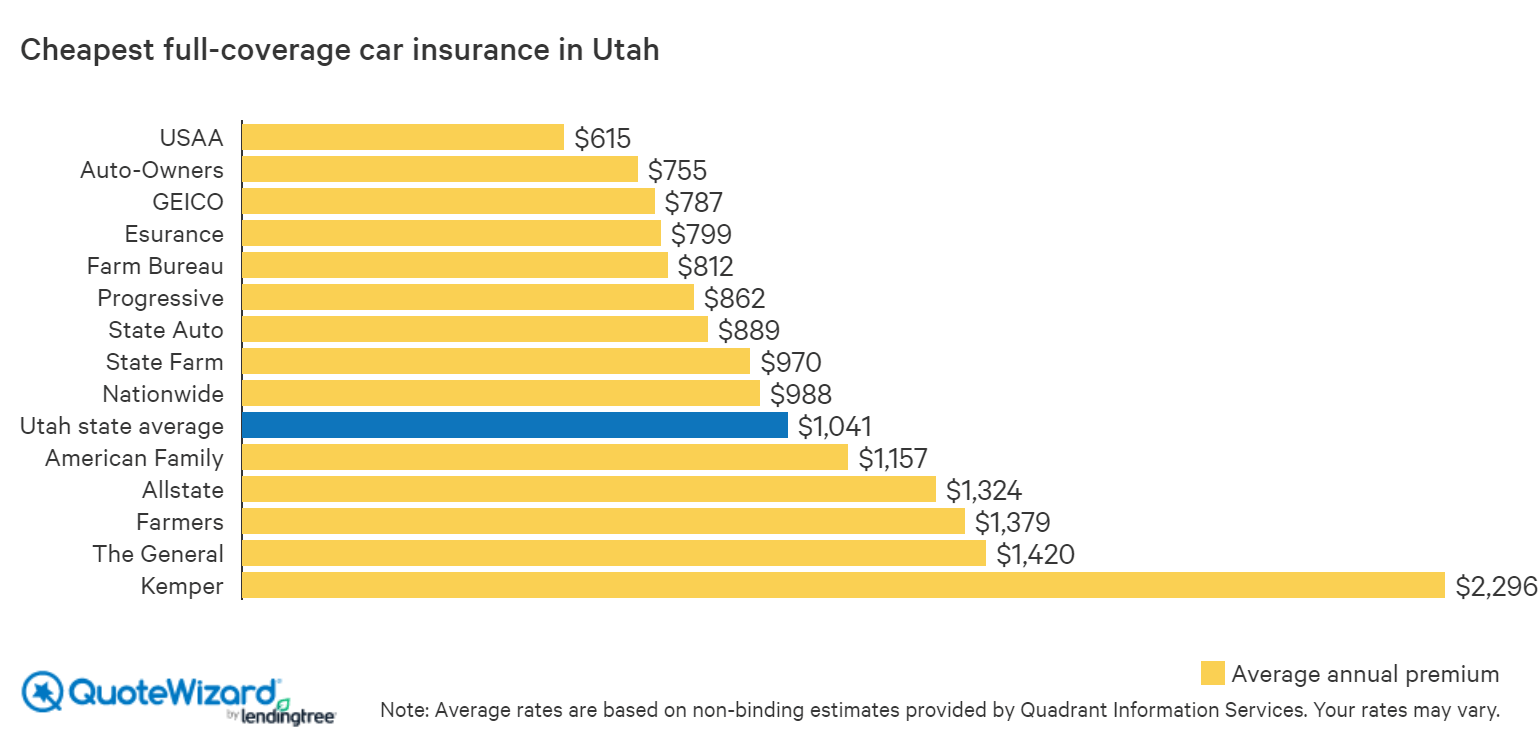

Source: quotewizard.com

Source: quotewizard.com

In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $65,000 per incident. 29 this statutory program may not limit or impair the rights, remedies, requirements, or Utah car insurance laws require that all drivers in the state carry minimum liability coverage of 25/65/15. A $100.00 reinstatement fee will be assessed, unless you can provide proof that the vehicle was insured on the date that the registration was revoked. 26 this chapter is known as the utah automotive repair act. 27 section 2.

Source: lovewordssss.blogspot.com

Liability insurance covers only the other car and/or that car’s driver and passengers when you are found at fault. To drive in utah, you must carry an auto insurance policy that meets the minimum coverage requirements outlined in utah�s financial responsibility laws. Utah insurance rules — r590 and r592 insurance rules are issued to implement or interpret the utah insurance code or federal mandates and have the effect of law. Property damage $15,000 per accident; Optional coverage in utah (varies by carrier):

Source: pinterest.com

Source: pinterest.com

29 this statutory program may not limit or impair the rights, remedies, requirements, or Personal injury protection (pip) $3,000 per person; The following minimum car insurance coverages are required in utah: 26 this chapter is known as the utah automotive repair act. 27 section 2. The owner/operator is a resident;

Source: youtube.com

Source: youtube.com

Personal injury protection (pip) $3,000 per person; Minimum insurance requirements for utah. Liability insurance covers only the other car and/or that car’s driver and passengers when you are found at fault. The utah state legislature has posted utah�s motor vehicle code online. List of current rules petition for rule change follow uidnews on twitter rules being proposed, changed or repealed your written comments are encouraged.

Source: smartfinancial.com

Source: smartfinancial.com

$25,000 per person and $65,000 per accident**. For complete information on reinstating your registration, see insurance requirements. You must have insurance on your vehicle if you are: $25,000 bodily injury per person per accident $65,000 bodily injury for all persons per accident $15,000 property damage liability $3,000 personal injury protection $25,000/$65,000 uninsured/underinsured motorist coverage Liability insurance covers only the other car and/or that car’s driver and passengers when you are found at fault.

Source: everquote.com

Source: everquote.com

It also covers up to $15,000 for damage to another person’s property. Property damage $15,000 per accident; Not carrying the required coverage leaves you at risk and can also lead to some stiff penalties. Yes what are the minimum limits for utah? Utah law mandates that auto insurance policies provide the following:

Source: personalinjury-law.com

Source: personalinjury-law.com

To drive in utah, you must carry an auto insurance policy that meets the minimum coverage requirements outlined in utah�s financial responsibility laws. Bodily injury $65,000 per accident; 26 this chapter is known as the utah automotive repair act. 27 section 2. A $100.00 reinstatement fee will be assessed, unless you can provide proof that the vehicle was insured on the date that the registration was revoked. All drivers must also carry proof of this coverage while behind the wheel.

Source: youtube.com

Source: youtube.com

Utah insurance rules — r590 and r592 insurance rules are issued to implement or interpret the utah insurance code or federal mandates and have the effect of law. Bodily injury $65,000 per accident; In utah, liability car insurance is mandatory for all drivers. $25,000 bodily injury per person per accident $65,000 bodily injury for all persons per accident $15,000 property damage liability $3,000 personal injury protection $25,000/$65,000 uninsured/underinsured motorist coverage Yes what are the minimum limits for utah?

Source: thevivanews.blogspot.com

Source: thevivanews.blogspot.com

The bare minimum car insurance requirement for utah drivers is: $25,000 per person and $65,000 per accident**. Yes what are the minimum limits for utah? Auto insurance requirements in utah. Minimum insurance requirements for utah.

Source: how-do-you-get-car-insurance.blogspot.com

$25,000 per person and $65,000 per accident**. Personal injury protection (pip) $3,000 per person; List of current rules petition for rule change follow uidnews on twitter rules being proposed, changed or repealed your written comments are encouraged. Utah has provisions for liability coverage, personal injury protection (pip) and uninsured or underinsured motorist coverage. In utah, the state minimum coverage requirements are:

Source: detect.ebathroom.my.id

Source: detect.ebathroom.my.id

Property damage $15,000 per accident; A $100.00 reinstatement fee will be assessed, unless you can provide proof that the vehicle was insured on the date that the registration was revoked. The minimum amount of utah auto insurance coverage is $25,000/$65,000/$15,000. State of new hampshire insurance department. Bodily injury $25,000 per person;

Source: quotewizard.com

Source: quotewizard.com

State of new hampshire insurance department. List of current rules petition for rule change follow uidnews on twitter rules being proposed, changed or repealed your written comments are encouraged. Bodily injury $25,000 per person; All drivers must also carry proof of this coverage while behind the wheel. Utah car insurance laws require that all drivers in the state carry minimum liability coverage of 25/65/15.

Source: carinsurancelist.com

Source: carinsurancelist.com

A $100.00 reinstatement fee will be assessed, unless you can provide proof that the vehicle was insured on the date that the registration was revoked. The owner/operator is a resident; Utah insurance rules — r590 and r592 insurance rules are issued to implement or interpret the utah insurance code or federal mandates and have the effect of law. Proof of current insurance will be required. Property damage $15,000 per accident;

Source: clearsurance.com

Source: clearsurance.com

In utah, the state minimum coverage requirements are: The following minimum car insurance coverages are required in utah: Utah car insurance laws require that all drivers in the state carry minimum liability coverage of 25/65/15. Bodily injury $65,000 per accident; Proof of current insurance will be required.

Source: slideshare.net

Source: slideshare.net

In utah, the state minimum coverage requirements are: In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $65,000 per incident. Auto insurance requirements in utah. Bodily injury $25,000 per person; Utah�s auto insurance requirements utah requires vehicle drivers to carry minimum auto insurance coverage if they want to drive legally in the state.

Source: insurance.utah.gov

Source: insurance.utah.gov

$25,000 per person and $65,000 per accident**. As of 2011, utah drivers were required to carry at least the following types and amounts of coverage: $25,000 bodily injury per person $65,000 bodily injury per accident $15,000 property damage per accident —or— 25/65/15 dairyland ® coverage in utah In utah, the state minimum coverage requirements are: Car insurance is required in the state of utah.

Source: everquote.com

Source: everquote.com

The following minimum car insurance coverages are required in utah: Auto insurance requirements in utah. $25,000 bodily injury per person $65,000 bodily injury per accident $15,000 property damage per accident —or— 25/65/15 dairyland ® coverage in utah Bodily injury $65,000 per accident; Is it mandatory to have car insurance in utah?

Source: everquote.com

Source: everquote.com

Car insurance is required in the state of utah. Utah minimum car insurance requirements. It was written and legislated to protect the safety of motorists, pedestrians, and property by laying legal ground rules for what is generally considered safe and legal, and what isn�t. National association of insurance commissioners. The owner/operator is a resident;

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title utah auto insurance regulations by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information