Utmost good faith in insurance Idea

Home » Trend » Utmost good faith in insurance IdeaYour Utmost good faith in insurance images are ready in this website. Utmost good faith in insurance are a topic that is being searched for and liked by netizens today. You can Get the Utmost good faith in insurance files here. Get all free images.

If you’re looking for utmost good faith in insurance pictures information connected with to the utmost good faith in insurance keyword, you have pay a visit to the right site. Our site frequently gives you hints for seeing the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

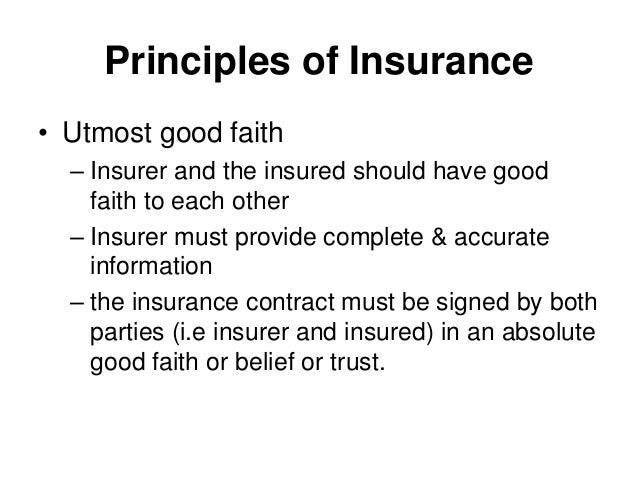

Utmost Good Faith In Insurance. Facts which may enhance the level of risk are called material facts. Unlike the usual contracts in the legal landscape, the law of insurance in england revolves around the principle of uberrimae fidei, latin for the principle of utmost good faith. The principle of utmost good faith, uberrimae fidei, states that the insurer and the insured must disclose all material facts before the policy inception. The duty of utmost good faith.

(PDF) Utmost Good Faith in Insurance Contracts Who bears From researchgate.net

(PDF) Utmost Good Faith in Insurance Contracts Who bears From researchgate.net

The principle of utmost good faith, uberrimae fidei, states that the insurer and the insured must disclose all material facts before the policy inception. Principle of utmost good faith is one of the basic features of an insurance policy. This means it requires complete honesty and full disclosure of all vital facts by both parties (insured and insurer). It means that both the proposer (who wishes to buy the. The duty of utmost good faith applies to all aspects of the relationship between an insurance company and the insured person. The essay’s introduction, body paragraphs and the conclusion are provided below.

The parties to an insurance contract must be honest with each other and must not hide any information relevant to the contract from each other.

What is utmost good faith in insurance? It has long been recognised that insurance contracts are governed by a higher standard of utmost good faith ( uberrimae fidei) which does not apply to other contracts. Unlike the usual contracts in the legal landscape, the law of insurance in england revolves around the principle of uberrimae fidei, latin for the principle of utmost good faith. This essay sample essay on utmost good faith offers an extensive list of facts and arguments related to it. For the former, it means total disclosure about facts that may affect the purchase of the policy or the need for claims in the future. Facts which may enhance the level of risk are called material facts.

Source: slideshare.net

Source: slideshare.net

What is the concept of utmost good faith in insurance coverage legislation? In insurance law, anyone entering into a contract with an insuring firm has an obligation to act with utmost good faith and therefore provide accurate and honest information to the insurance company. The duty of utmost good faith applies to all aspects of the relationship between an insurance company and the insured person. Insurance contract “is conceived in the utmost good faith and incubated in a legal environment which transcends the sharper practices of the world of commerce.” “[t]he parties to a marine insurance policy must accord each other the highest Facts which may enhance the level of risk are called material facts.

Source: es.slideshare.net

Source: es.slideshare.net

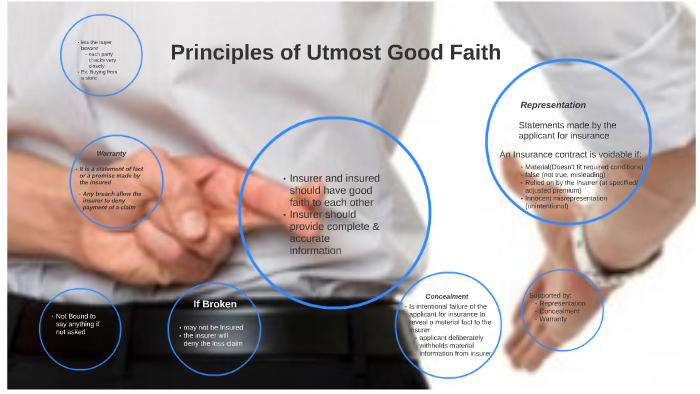

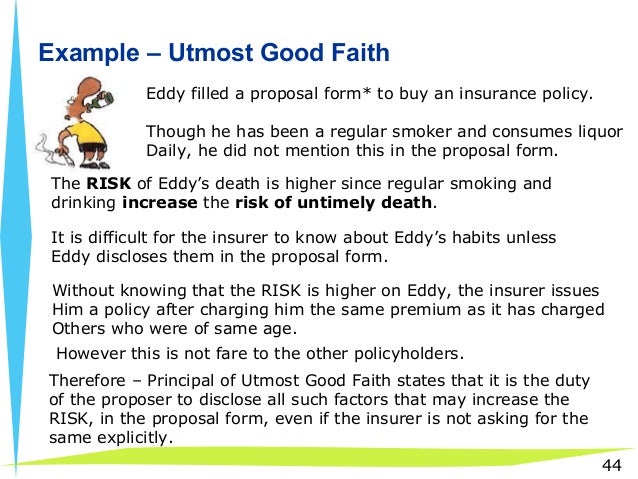

The duty of disclosure and hence the duty of utmost good faith is a requirement on both parties and although it is frequently expected of the insured, the principle is also an obligation on the insurer, who has a duty to inform the prospective policyholder of the exclusions, limitations and restrictions under the insurance policy (to be issued), to fairly assess the. Few months down the line it was discovered by the insurer that the insured is a chain smoker which. A breach committed either innocently or negligently, rather than fraudulently). Greg’s health history upon which some were revealed premised on material fact. This essay sample essay on utmost good faith offers an extensive list of facts and arguments related to it.

Source: slideserve.com

Source: slideserve.com

Utmost good faith or the principle of utmost good faith is one of the most fundamental laws that are applicable in insurance. The principle of utmost good faith states that the insurer and insured both must be transparent and disclose all the essential information required before signing up for an insurance policy. The essay’s introduction, body paragraphs and the conclusion are provided below. A breach of utmost good faith can be in the form of either a misrepresentation (i.e. Facts which may enhance the level of risk are called material facts.

Source: pt.slideshare.net

Source: pt.slideshare.net

The duty of utmost good faith applies to all aspects of the relationship between an insurance company and the insured person. It is also known as ubberimae fidei in latin. The concept of utmost good faith, uberrimae fidei, specifies that the insurance company as well as the guaranteed have to divulge all worldly realities prior to the plan beginning 2. Insurance contract “is conceived in the utmost good faith and incubated in a legal environment which transcends the sharper practices of the world of commerce.” “[t]he parties to a marine insurance policy must accord each other the highest The term “ uberrimae fidei” is a latin term meaning “utmost faith”, hence the doctrine of utmost good faith.

Source: slideshare.net

Source: slideshare.net

Principle of utmost good faith is one of the basic features of an insurance policy. The principle of utmost good faith, uberrimae fidei, states that the insurer and the insured must disclose all material facts before the policy inception. Insurance contracts are agreements made in the utmost good faith , which implies a standard of honesty greater than that usually required in most ordinary commercial contracts. The concept of utmost good faith, uberrimae fidei, specifies that the insurance company as well as the guaranteed have to divulge all worldly realities prior to the plan beginning 2. Insurance contract “is conceived in the utmost good faith and incubated in a legal environment which transcends the sharper practices of the world of commerce.” “[t]he parties to a marine insurance policy must accord each other the highest

Source: kalyan-city.blogspot.com

Source: kalyan-city.blogspot.com

This complete faith is achieved by full disclosure of every. Truths which might improve the degree of threat are called worldly realities. What is utmost good faith in insurance? A breach committed either innocently or negligently, rather than fraudulently). The principle of utmost good faith states that both the insurer and the insured must be transparent with each other, and must reveal all pertinent and valid information to each other before the inception of the policy agreement.

Source: researchgate.net

Source: researchgate.net

Utmost good faith (uberrima fides) indicates both the parties to the insurance contract must disclose all facts material to the risk voluntarily to each other. This essay sample essay on utmost good faith offers an extensive list of facts and arguments related to it. Utmost good faith, uberrimae fedei in latin, refers to the principle of honesty expected from both the insured and the insurer when in the process of transacting a policy. A breach of utmost good faith can be in the form of either a misrepresentation (i.e. The principle of utmost good faith states that the insurer and insured both must be transparent and disclose all the essential information required before signing up for an insurance policy.

Source: prezi.com

Source: prezi.com

It means that both the policyholder and the insurer need to disclose all material and relevant information to each other before commencement of the contract. It is also known as ubberimae fidei in latin. Insurance contract “is conceived in the utmost good faith and incubated in a legal environment which transcends the sharper practices of the world of commerce.” “[t]he parties to a marine insurance policy must accord each other the highest Principle of utmost good faith is one of the basic features of an insurance policy. The term “ uberrimae fidei” is a latin term meaning “utmost faith”, hence the doctrine of utmost good faith.

Source: study.com

Source: study.com

The concept of utmost good faith, uberrimae fidei, specifies that the insurance company as well as the guaranteed have to divulge all worldly realities prior to the plan beginning 2. It has long been recognised that insurance contracts are governed by a higher standard of utmost good faith ( uberrimae fidei) which does not apply to other contracts. In insurance law, anyone entering into a contract with an insuring firm has an obligation to act with utmost good faith and therefore provide accurate and honest information to the insurance company. What is utmost good faith in insurance? A breach committed either innocently or negligently, rather than fraudulently).

Source: carakamulia.com

Source: carakamulia.com

Unlike the usual contracts in the legal landscape, the law of insurance in england revolves around the principle of uberrimae fidei, latin for the principle of utmost good faith. The duty arises when negotiations for the insurance policy commences and does not end until the settlement of any claim. General) utmost good faith is a principle used in insurance contracts that legally obliges all parties to reveal to the others all important information. It also applies to any third party beneficiary to the contract. What is the concept of utmost good faith in insurance coverage legislation?

Source: pottsfinancialservices.com

Source: pottsfinancialservices.com

The duty of utmost good faith. The duty arises when negotiations for the insurance policy commences and does not end until the settlement of any claim. The principle in its ordinary sense means the highest honesty, fair dealing and without any intention to defraud another person. Insurance contracts are agreements made in the utmost good faith , which implies a standard of honesty greater than that usually required in most ordinary commercial contracts. Utmost good faith insurance is a service that involves a promise to pay compensation in the future.

Source: youtube.com

Source: youtube.com

For the former, it means total disclosure about facts that may affect the purchase of the policy or the need for claims in the future. The principle in its ordinary sense means the highest honesty, fair dealing and without any intention to defraud another person. What is the concept of utmost good faith in insurance coverage legislation? Facts which may enhance the level of risk are called material facts. A breach committed either innocently or negligently, rather than fraudulently).

Source: slideshare.net

Source: slideshare.net

What is utmost good faith in insurance? What is utmost good faith in insurance? It means that both the policyholder and the insurer need to disclose all material and relevant information to each other before commencement of the contract. Principle of utmost good faith is one of the basic features of an insurance policy. Insurance contract “is conceived in the utmost good faith and incubated in a legal environment which transcends the sharper practices of the world of commerce.” “[t]he parties to a marine insurance policy must accord each other the highest

Source: slideshare.net

Source: slideshare.net

It is also known as ubberimae fidei in latin. The duty of utmost good faith. Under the english insurance law, the parties to an insurance contract must sign the contract with utmost good faith, and without any intention to deceive each other. Facts which may enhance the level of risk are called material facts. Utmost good faith principle is applied to insurance because of all information regarding the insurance must be disclosed in.

Source: discoverdando.com

Source: discoverdando.com

Insurance contracts are agreements made in the utmost good faith , which implies a standard of honesty greater than that usually required in most ordinary commercial contracts. The principle of utmost good faith states that the insurer and insured both must be transparent and disclose all the essential information required before signing up for an insurance policy. A breach committed either innocently or negligently, rather than fraudulently). Utmost good faith principle is applied to insurance because of all information regarding the insurance must be disclosed in. The duty of utmost good faith applies to all aspects of the relationship between an insurance company and the insured person.

Source: ppt-online.org

Source: ppt-online.org

Greg’s health history upon which some were revealed premised on material fact. The concept of utmost good faith, uberrimae fidei, specifies that the insurance company as well as the guaranteed have to divulge all worldly realities prior to the plan beginning 2. Principle of utmost good faith in insurance. Under the english insurance law, the parties to an insurance contract must sign the contract with utmost good faith, and without any intention to deceive each other. Truths which might improve the degree of threat are called worldly realities.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

The principle of utmost good faith states that both the insurer and the insured must be transparent with each other, and must reveal all pertinent and valid information to each other before the inception of the policy agreement. It is also known as ubberimae fidei in latin. General) utmost good faith is a principle used in insurance contracts that legally obliges all parties to reveal to the others all important information. This essay sample essay on utmost good faith offers an extensive list of facts and arguments related to it. It means that both the policyholder and the insurer need to disclose all material and relevant information to each other before commencement of the contract.

Source: slideshare.net

Source: slideshare.net

Insurance contracts are agreements made in the utmost good faith , which implies a standard of honesty greater than that usually required in most ordinary commercial contracts. The principle of utmost good faith states that the insurer and insured both must be transparent and disclose all the essential information required before signing up for an insurance policy. Few months down the line it was discovered by the insurer that the insured is a chain smoker which. Insurance contract “is conceived in the utmost good faith and incubated in a legal environment which transcends the sharper practices of the world of commerce.” “[t]he parties to a marine insurance policy must accord each other the highest For the former, it means total disclosure about facts that may affect the purchase of the policy or the need for claims in the future.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title utmost good faith in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information