Vandalism covered by home insurance information

Home » Trend » Vandalism covered by home insurance informationYour Vandalism covered by home insurance images are ready in this website. Vandalism covered by home insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Vandalism covered by home insurance files here. Download all free photos.

If you’re looking for vandalism covered by home insurance images information related to the vandalism covered by home insurance keyword, you have visit the right blog. Our site always provides you with suggestions for seeing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

Vandalism Covered By Home Insurance. Vandalism is covered only for damage to parts of the property you’re responsible for, as well as to your personal property. However, it is not considered vandalism because it was not done purposefully. There are a couple of conditions, though, where your home insurance policy might not cover an act of vandalism. Hopefully vandalism is something you never have to face, but in the event that you do, your homeowners insurance can help you pay for resulting damages.

Does home insurance cover damage to your roof caused by From economicalgroup.com

Any standard insurance policy covers damage to your home or commercial property. From broken lights to a smashed in mailbox, let’s take a closer look at how your home insurance helps financially protect you. Vandalism and malicious mischief insurance is insurance coverage that protects against losses sustained as a result of vandals. This type of insurance is included in most basic commercial and. Hopefully vandalism is something you never have to face, but in the event that you do, your homeowners insurance can help you pay for resulting damages. Yes, your homeowners insurance should cover most instances of vandalism.

However, since specific coverages vary from insurer to insurer, one should not assume that you’re fully covered.

One of the most overlooked homeowners’ claims is often vandalism. However, there may be some circumstances in which you may not be in coverage. Does homeowners insurance cover vandalism? If the damage affects the structure of your home, then it. Beside above, what is not covered by homeowners insurance? If your home is the target of an act of vandalism, your homeowners insurance policy will cover it just as it would cover any other covered peril, like a.

Source: thebalance.com

Source: thebalance.com

It is always best to talk to your insurance professional and discuss the specific terms and conditions of your policy, but in general, commonly vandalism is a covered peril in today�s homeowners� insurance policies. One of these named perils is vandalism, although insurers may have limits on how much they reimburse you for. Vandalism is a covered damage usually for parts of your property that you are directly responsible for including your personal property. Even basic named perils policies typically include coverage for vandalism. Refer to your home insurance policy to learn more about your coverage.

Source: equity-insider.com

Source: equity-insider.com

Specifically, it’s essential to determine if the cost of repairs will be greater than the deductible. Well, every insurance policy is different, so every case would be as well. However, it is not considered vandalism because it was not done purposefully. It’s best to contact your provider to verify that you are fully covered. Does homeowners insurance cover vandalism?

Source: economicalgroup.com

Your deductible may also differ for those losses. The most common form of homeowners insurance, known as the ho3 form, covers a list of over a dozen named perils you’re financially protected from. Furthermore, if the property damage is so severe that you aren’t able to reside in your home, additional living expenses (ale) coverage will kick in to cover lodging and other expenses until your home is. For instance, homes vacant more than 30 to 60 days may not be in coverage. This will cover both the primary dwelling as well as your personal property.

Source: proinsgrp.com

Source: proinsgrp.com

Damage to your cottage or seasonal dwelling we offer a range of insurance products to meet our clients’ individual needs. If the cost of vandalism repairs is higher than your car insurance deductible, it may make sense to file a comprehensive claim for vehicle damage caused by vandalism. The most common form of homeowners insurance, known as the ho3 form, covers a list of over a dozen named perils you’re financially protected from. From broken lights to a smashed in mailbox, let’s take a closer look at how your home insurance helps financially protect you. Deductible options for comprehensive coverage range from $0 to $2,000, depending on your insurer and state.

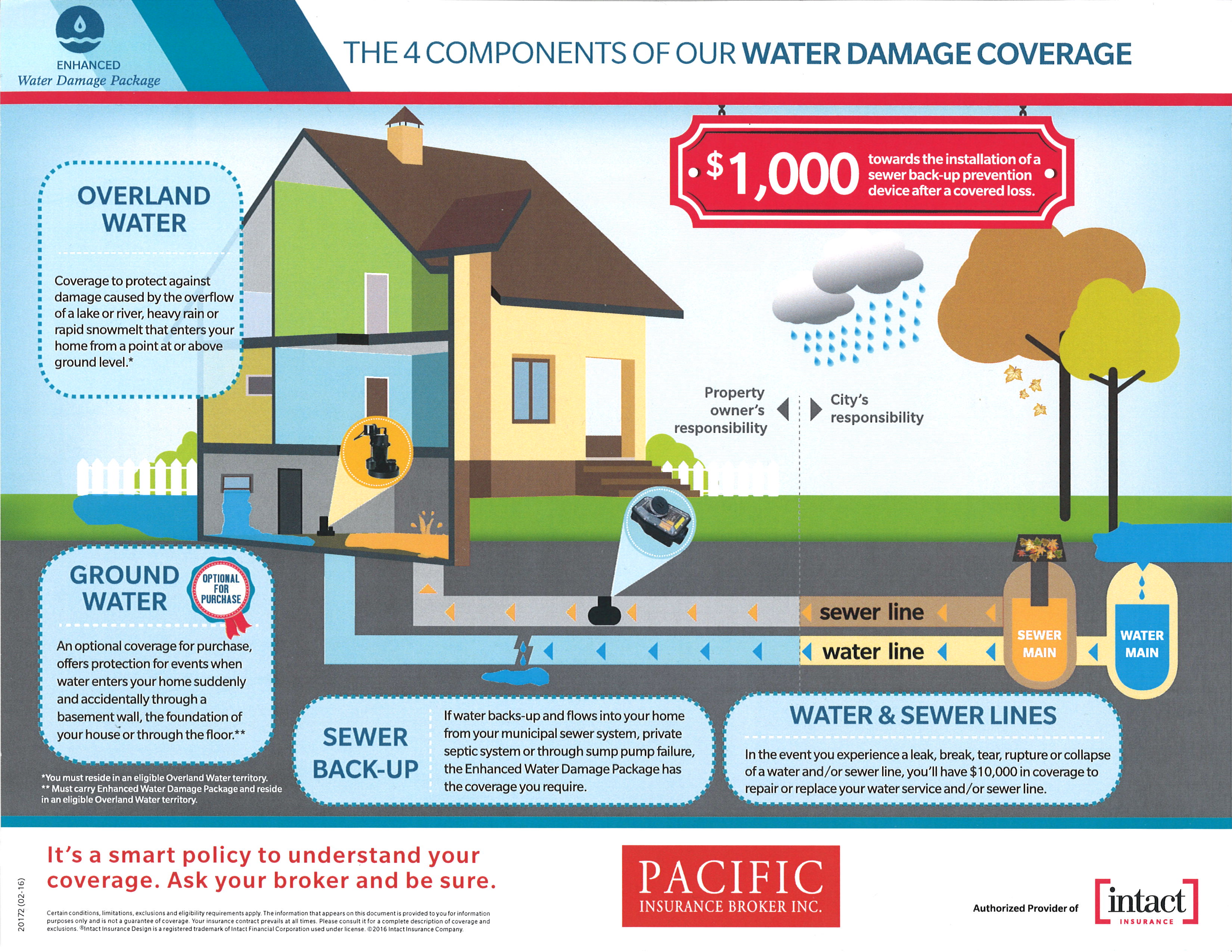

Source: pacins.ca

Source: pacins.ca

Besides, does homeowners insurance cover car vandalism? Yes, your homeowners insurance should cover most instances of vandalism. However, it is not considered vandalism because it was not done purposefully. This will cover both the primary dwelling as well as your personal property. Luckily, a standard insurance policy also covers most incidents of vandalism.

Source: octagonrestoration.com

Source: octagonrestoration.com

Well, every insurance policy is different, so every case would be as well. What about my contractor’s tools? Vandalism is covered only for damage to parts of the property you’re responsible for, as well as to your personal property. Hopefully vandalism is something you never have to face, but in the event that you do, your homeowners insurance can help you pay for resulting damages. That’s what homeowner’s insurance is for and why most homeowner’s insurance policies include coverage for acts of vandalism.

Source: smrsi.com

Source: smrsi.com

Hopefully vandalism is something you never have to face, but in the event that you do, your homeowners insurance can help you pay for resulting damages. Vandalism is one of the standard perils covered by most homeowners insurance policies. Damage to your cottage or seasonal dwelling we offer a range of insurance products to meet our clients’ individual needs. In general, home insurance policies provide coverage for vandalism. Does homeowners insurance cover vandalism?

Source: rismedia.com

Source: rismedia.com

If your home is the target of an act of vandalism, your homeowners insurance policy will cover it just as it would cover any other covered peril, like a. Hopefully vandalism is something you never have to face, but in the event that you do, your homeowners insurance can help you pay for resulting damages. For instance, homes vacant more than 30 to 60 days may not be in coverage. Vandalism is one of the standard perils covered by most homeowners insurance policies. Comprehensive car insurance is the only standard policy type that covers vandalism.

Source: everquote.com

Source: everquote.com

First, the vandalized property must be something that you’re responsible for. If the damage affects the structure of your home, then it. But even when you have comprehensive car insurance, there are some key things to know. Besides, does homeowners insurance cover car vandalism? Does full coverage car insurance cover vandalism?

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

One of the most overlooked homeowners’ claims is often vandalism. Hopefully vandalism is something you never have to face, but in the event that you do, your homeowners insurance can help you pay for resulting damages. Damage to your cottage or seasonal dwelling we offer a range of insurance products to meet our clients’ individual needs. Vandalism is a covered damage usually for parts of your property that you are directly responsible for including your personal property. Furthermore, if the property damage is so severe that you aren’t able to reside in your home, additional living expenses (ale) coverage will kick in to cover lodging and other expenses until your home is.

Source: eberstlaw.com

Source: eberstlaw.com

There are many limits to this. Home insurance almost always covers vandalism and malicious acts. Any standard insurance policy covers damage to your home or commercial property. For example, if the neighborhood kid hits a baseball into a window, you may be able to file a claim against your property insurance. One of the most overlooked homeowners’ claims is often vandalism.

Source: phoenixprotectiongroup.com

Source: phoenixprotectiongroup.com

First, the vandalized property must be something that you’re responsible for. This will cover both the primary dwelling as well as your personal property. Specifically, it’s essential to determine if the cost of repairs will be greater than the deductible. Vandalism is one of the standard perils covered by most homeowners insurance policies. There are a couple of conditions, though, where your home insurance policy might not cover an act of vandalism.

Source: theinsurancebuzz.com

Source: theinsurancebuzz.com

First, the vandalized property must be something that you’re responsible for. Does full coverage car insurance cover vandalism? Vandalism is a covered damage usually for parts of your property that you are directly responsible for including your personal property. Yes, your homeowners insurance should cover most instances of vandalism. Even if it covers items stolen from or damaged while in your car, your homeowners insurance won�t cover the damage to the car itself.

Source: eaglewatchroofing.com

Source: eaglewatchroofing.com

One of the most overlooked homeowners’ claims is often vandalism. Does full coverage car insurance cover vandalism? What about my contractor’s tools? Check your policy for specific details or contact your agent if you have questions. Many homeowners are not even aware that they can file a vandalism claim and even those that do are too overwhelmed to properly do an accurate.

Source: realtor.com

Source: realtor.com

There are a couple of conditions, though, where your home insurance policy might not cover an act of vandalism. Fortunately, vandalism itself is usually covered under your comprehensive car insurance. Refer to your home insurance policy to learn more about your coverage. One of these named perils is vandalism, although insurers may have limits on how much they reimburse you for. One of the most overlooked homeowners’ claims is often vandalism.

Source: npa1.org

Source: npa1.org

Does homeowners insurance cover vandalism? Check your policy for specific details or contact your agent if you have questions. Well, every insurance policy is different, so every case would be as well. Vandalism is covered only for damage to parts of the property you’re responsible for, as well as to your personal property. So, while you may have insured your property for $100,000, you may only have $30,000 worth of coverage for theft, vandalism (vmm) or burglary, for example.

Source: altezains.com

Source: altezains.com

Say you’re a condo owner and have an insurance policy on your place. The most common form of homeowners insurance, known as the ho3 form, covers a list of over a dozen named perils you’re financially protected from. There are many limits to this. There are a couple of conditions, though, where your home insurance policy might not cover an act of vandalism. This will cover both the primary dwelling as well as your personal property.

Source: coastalinsurancesolution.com

Source: coastalinsurancesolution.com

Fortunately, vandalism itself is usually covered under your comprehensive car insurance. Comprehensive coverage can cover any vehicle damage beyond your control. Vandalism and malicious mischief insurance is insurance coverage that protects against losses sustained as a result of vandals. Damage to your cottage or seasonal dwelling we offer a range of insurance products to meet our clients’ individual needs. Vandalism is covered only for damage to parts of the property you’re responsible for, as well as to your personal property.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title vandalism covered by home insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information