Vendor liability insurance Idea

Home » Trend » Vendor liability insurance IdeaYour Vendor liability insurance images are available. Vendor liability insurance are a topic that is being searched for and liked by netizens now. You can Download the Vendor liability insurance files here. Find and Download all free photos and vectors.

If you’re searching for vendor liability insurance pictures information connected with to the vendor liability insurance interest, you have come to the ideal blog. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

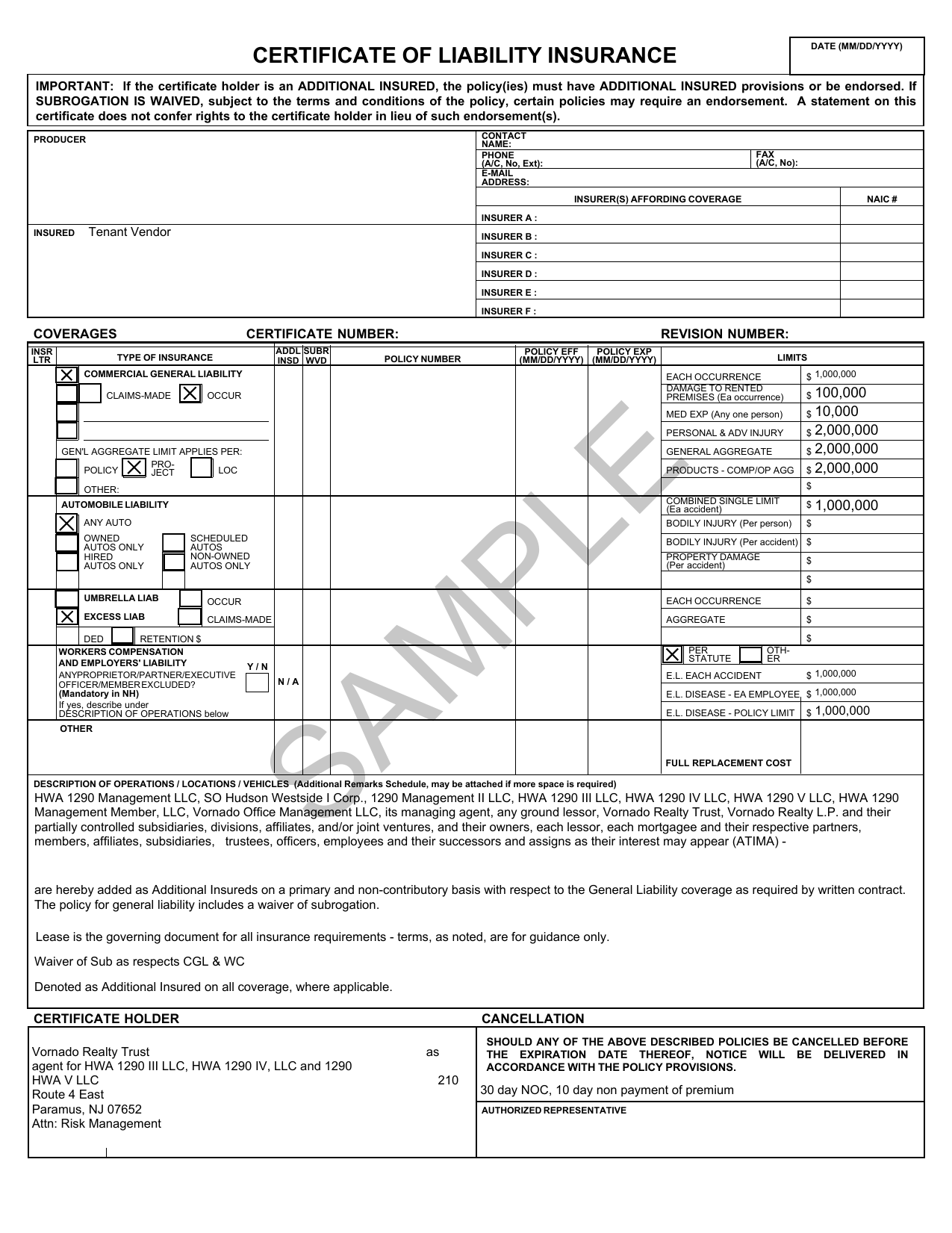

Vendor Liability Insurance. Issuance of a “certificate of additional insurance” guaranteed to meet the venue’s liability insurance requirements. Product liability is required by some fairs in ca, id, ks, ny, pa, tx, and wa. You’ve made some sales and connections, and you’re feeling great. What does a vendors extension under a product liability section cover as a manufacturer of a product you will have a standard products liability insurance cover, this covers the policyholder against any loss, damage or injury that a product may cause, it will provide the finances to cover defence in litigation, court costs and any compensation should the case be awarded against you.

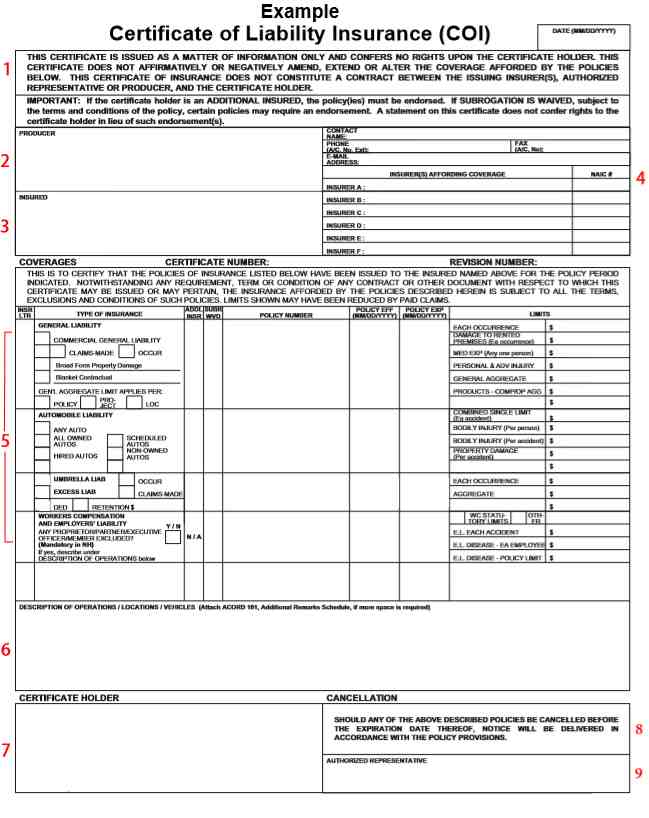

Collect Certificates of Insurance from Vendors From slideshare.net

Collect Certificates of Insurance from Vendors From slideshare.net

Even if what you sell is done as a hobby, you never know what could happen at an event and you need to be prepared for the worst. Get a free estimate on vendor and event liability insurance. Vendor liability insurance provides protection against claims of bodily injury and property damage liability for work performed by selected vendors and contractors who are under contract with the regents of the university of california, and the litigation costs to defend against such claims. Our venue preferred special event liability insurance protects vendors for lawsuits involving injuries and damage to property. Exhibitors and vendor liability insurance. It’s often required by venues where vendors sell or display their goods.

In addition, miscellaneous errors and omissions coverage.

Get a free estimate on vendor and event liability insurance. Even if what you sell is done as a hobby, you never know what could happen at an event and you need to be prepared for the worst. Exhibitors and vendor liability insurance. A standard general liability insurance policy may not match the exact risks that come with participating as a vendor in an event. As a concessionaire, exhibitor or vendor, specialty vendor insurance can help protect you against lawsuits. The rug is not skid proof, and someone slips and falls.

Source: slideshare.net

Source: slideshare.net

Vendor’s insurance is a liability policy providing protection should a vendor or exhibitor have to defend against claims or lawsuits for bodily injury or property damage. Our liability insurance comes with host liquor liability and free, unlimited certificates of insurance required by venues. As a vendor at an event you need to make sure you are covered if something goes wrong. Our venue preferred special event liability insurance protects vendors for lawsuits involving injuries and damage to property. You’ll want a hold harmless clause which includes requirements that any subcontractor must defend, indemnify and provide additional insured coverage under a general liability policy for all.

Source: products-liability-insurance.com

Source: products-liability-insurance.com

Our venue preferred special event liability insurance protects vendors for lawsuits involving injuries and damage to property. Vendor liability insurance is a type of insurance that is used to cover vendors, concessionaires, and exhibitors alike. Your business will be protected against bodily injury and property damage claims that may arise from operations, premises, products, completed operations, advertising or. You’ll want a hold harmless clause which includes requirements that any subcontractor must defend, indemnify and provide additional insured coverage under a general liability policy for all. Vendors can avoid expensive settlement fees and legal costs by having vendor liability insurance with general liability coverage.

Source: sadlersports.com

Source: sadlersports.com

An example of bodily injury would be if someone tripped over cords in your both and needed medical attention. General liability coverage applies when a customer experiences an injury and the vendor is at fault. Exhibitors and vendor liability insurance. Our venue preferred special event liability insurance protects vendors for lawsuits involving injuries and damage to property. Get a free estimate on vendor and event liability insurance.

Source: slideshare.net

Source: slideshare.net

General liability coverage applies when a customer experiences an injury and the vendor is at fault. Our liability insurance comes with host liquor liability and free, unlimited certificates of insurance required by venues. Exhibitors and vendor liability insurance. An example of bodily injury would be if someone tripped over cords in your both and needed medical attention. If you’re sued for bodily injury or property damage , the policy will cover your defense costs and.

Source: slideshare.net

Source: slideshare.net

Act’s show policy starts at just $49 while our annual policy starts at $265. Issuance of a “certificate of additional insurance” guaranteed to meet the venue’s liability insurance requirements. As a concessionaire, exhibitor or vendor, specialty vendor insurance can help protect you against lawsuits. Our liability insurance comes with host liquor liability and free, unlimited certificates of insurance required by venues. Vendors can avoid expensive settlement fees and legal costs by having vendor liability insurance with general liability coverage.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Vendor liability insurance provides protection against claims of bodily injury and property damage liability for work performed by selected vendors and contractors who are under contract with the regents of the university of california, and the litigation costs to defend against such claims. Product liability is required by some fairs in ca, id, ks, ny, pa, tx, and wa. Up to $1,000,000 per occurrence and $2,000,000 total for bodily injury and property damage. Property damage is a risk you face during every job. The product liability coverage covers the resulting damage for the vendor�s products.

Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

Vendor event liability insurance coverage includes: Were you looking for information on liability insurance for farmers markets instead? Vendors can avoid expensive settlement fees and legal costs by having vendor liability insurance with general liability coverage. Issuance of a “certificate of additional insurance” guaranteed to meet the venue’s liability insurance requirements. You’ve made some sales and connections, and you’re feeling great.

Source: marineagency.com

Source: marineagency.com

Vendors can avoid expensive settlement fees and legal costs by having vendor liability insurance with general liability coverage. The product liability coverage covers the resulting damage for the vendor�s products. Let’s take a look at the two most common types of insurance policies for food and craft market vendors. Vendor liability insurance protects you from claims that can arise from property damage, bodily injury, and foodborne illnesses. It’s often required by venues where vendors sell or display their goods.

Vendor’s insurance is a liability policy providing protection should a vendor or exhibitor have to defend against claims or lawsuits for bodily injury or property damage. Let’s take a look at the two most common types of insurance policies for food and craft market vendors. Vendor liability insurance is a type of insurance that is used to cover vendors, concessionaires, and exhibitors alike. As a concessionaire, exhibitor or vendor, specialty vendor insurance can help protect you against lawsuits. Adding a vendor’s endorsement to your products liability policy provides your vendor additional insured status on your policy and gives your vendor added confidence to sell and distribute your product without fear of having a claim adversely affect their.

Source: slideshare.net

Source: slideshare.net

What does a vendors extension under a product liability section cover as a manufacturer of a product you will have a standard products liability insurance cover, this covers the policyholder against any loss, damage or injury that a product may cause, it will provide the finances to cover defence in litigation, court costs and any compensation should the case be awarded against you. Were you looking for information on liability insurance for farmers markets instead? You’ll want a hold harmless clause which includes requirements that any subcontractor must defend, indemnify and provide additional insured coverage under a general liability policy for all. Up to $1,000,000 per occurrence and $2,000,000 total for bodily injury and property damage. Our venue preferred special event liability insurance protects vendors for lawsuits involving injuries and damage to property.

Source: pinterest.com

Source: pinterest.com

As a vendor at an event you need to make sure you are covered if something goes wrong. Vendors can avoid expensive settlement fees and legal costs by having vendor liability insurance with general liability coverage. Until somebody trips and knocks over your entire display, breaking merchandise and demos. As a concessionaire, exhibitor or vendor, specialty vendor insurance can help protect you against lawsuits. Even if what you sell is done as a hobby, you never know what could happen at an event and you need to be prepared for the worst.

Source: slideshare.net

Source: slideshare.net

As a vendor at an event you need to make sure you are covered if something goes wrong. Vendor liability insurance protects you from claims that can arise from property damage, bodily injury, and foodborne illnesses. As a concessionaire, exhibitor or vendor, specialty vendor insurance can help protect you against lawsuits. You’re a vendor or an exhibitor at an important event, and everything is going well. Vendor liability insurance is a type of insurance that is used to cover vendors, concessionaires, and exhibitors alike.

Source: products-liability-insurance.com

Source: products-liability-insurance.com

Until somebody trips and knocks over your entire display, breaking merchandise and demos. Up to $1,000,000 per occurrence and $2,000,000 total for bodily injury and property damage. Product liability is required by some fairs in ca, id, ks, ny, pa, tx, and wa. Issuance of a “certificate of additional insurance” guaranteed to meet the venue’s liability insurance requirements. The cost can be detrimental for any small business owner and can ruin your bottom line.

Source: slideshare.net

Source: slideshare.net

Up to $1,000,000 per occurrence and $2,000,000 total for bodily injury and property damage. More fairs and other states will likely adopt this requirement as well. An example of bodily injury would be if someone tripped over cords in your both and needed medical attention. A standard general liability insurance policy may not match the exact risks that come with participating as a vendor in an event. Issuance of a “certificate of additional insurance” guaranteed to meet the venue’s liability insurance requirements.

Source: slideshare.net

Source: slideshare.net

Liability insurance can protect vendors, exhibitors, and concessionaires from a variety of common business risks such as injuries, property damage, (4). Your business will be protected against bodily injury and property damage claims that may arise from operations, premises, products, completed operations, advertising or. Every contract should include the insurance requirements for that vendor for the work the vendor is undertaking on your organization’s behalf, also known as your subcontractor. Vendor liability insurance protects you from claims that can arise from property damage, bodily injury, and foodborne illnesses. The product liability coverage covers the resulting damage for the vendor�s products.

Source: dftgrstrt5ryt.blogspot.com

Source: dftgrstrt5ryt.blogspot.com

This policy is best for those artisans, crafters, apparel vendors, and more who do not hand make their products, only plan on attending one or two shows, or who only sell at events seasonally. With vendor liability insurance you meet show requirements, can list additional insureds, and you show your true investment in your business. General liability coverage applies when a customer experiences an injury and the vendor is at fault. Property damage is a risk you face during every job. Vendor liability insurance protects you from claims that can arise from property damage, bodily injury, and foodborne illnesses.

Source: studylib.net

Source: studylib.net

Your business will be protected against bodily injury and property damage claims that may arise from operations, premises, products, completed operations, advertising or. With vendor liability insurance you meet show requirements, can list additional insureds, and you show your true investment in your business. The rug is not skid proof, and someone slips and falls. Let’s take a look at the two most common types of insurance policies for food and craft market vendors. An example of bodily injury would be if someone tripped over cords in your both and needed medical attention.

Source: issuu.com

Source: issuu.com

In addition, miscellaneous errors and omissions coverage. The rug is not skid proof, and someone slips and falls. Act’s show policy starts at just $49 while our annual policy starts at $265. Let’s take a look at the two most common types of insurance policies for food and craft market vendors. With vendor liability insurance you meet show requirements, can list additional insureds, and you show your true investment in your business.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title vendor liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information