Vicarious liability insurance Idea

Home » Trend » Vicarious liability insurance IdeaYour Vicarious liability insurance images are ready. Vicarious liability insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Vicarious liability insurance files here. Get all free vectors.

If you’re searching for vicarious liability insurance pictures information related to the vicarious liability insurance keyword, you have come to the ideal blog. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

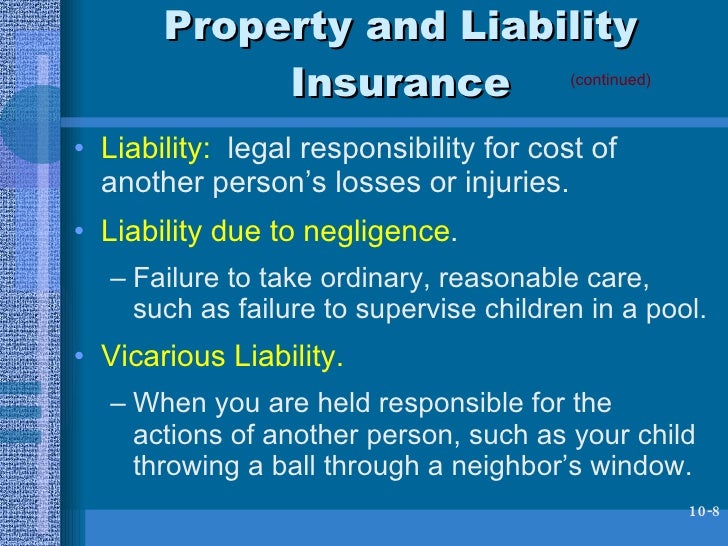

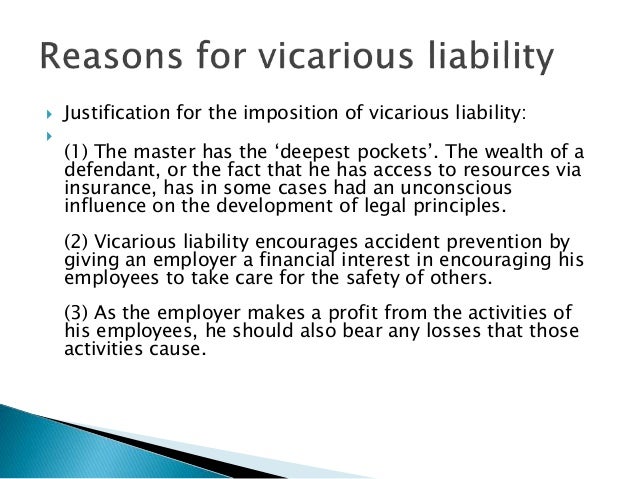

Vicarious Liability Insurance. Vicarious liability refers to a situation where someone is held responsible for the actions or omissions of another person. Vicarious liability exists when one person or organisation is held legally responsible for the acts or omissions of another person or party. From a practical perspective, the employer is usually seen as a better target defendant to sue, due its turnover and availability of insurance, whether the risk is covered by specific vicarious liability insurance or not. In the context of insurance, employers or other parties at risk of vicarious liability may need.

Vicarious Liability From investopedia.com

Vicarious Liability From investopedia.com

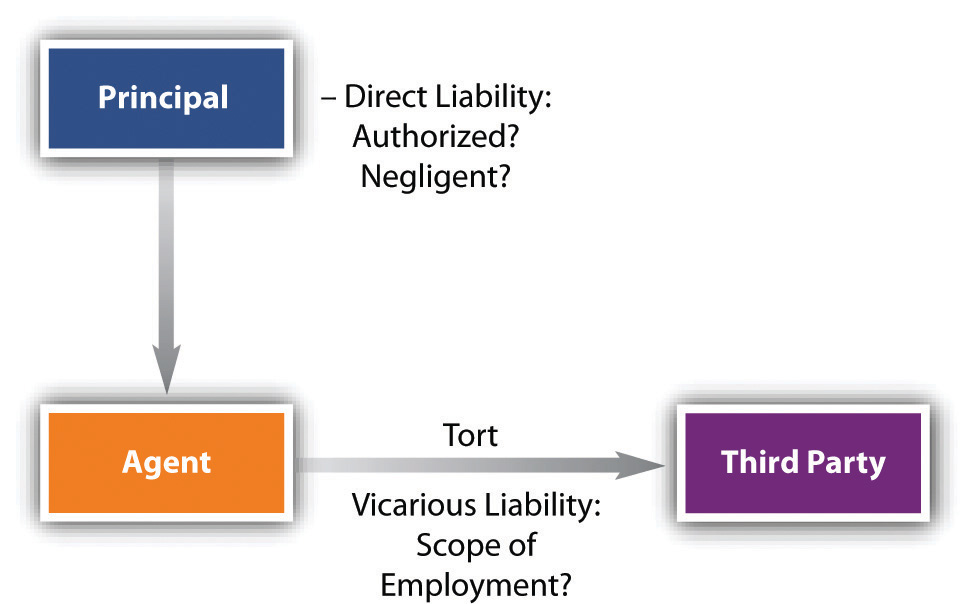

A principal, such as an employer; Vicarious liability — the liability of a principal for the acts of its agents. Get your instant quote now! Vicarious liability insurance protects you and your business from lawsuits resulting from mistakes caused by your employees, the independent contractors you’ve hired or agents that act on behalf of your small business. Is liable for the acts of; Get your instant quote now!

Vicarious liability is legal principle that states that a party can be held liable for the negligent actions of another party with whom they have a special relationship, such as parent and child, employer and employee, and vehicle owner and driver.

For example, an employer could be deemed vicariously liable if a superior sexually harassed his secretary. Is liable for the acts of; The reason most people haven’t heard of the term is because these judgments are much more common in business settings. But is negligent in carrying out that responsibility and exercising. Various types of insurance policies can help cover the expense of defending yourself against a vicarious liability claim. What is vicarious liability insurance.

Source: bloomsbury.com

Source: bloomsbury.com

What is vicarious liability insurance. It’s important to understand how your company could be held liable for the actions of others, including employees, volunteers, contractors, partners, and others. In general, vicarious liability is the liability of being deemed partly at fault even by an act caused by a third party. But is negligent in carrying out that responsibility and exercising. An agent, such as an employee.

Source: apollocover.com

Source: apollocover.com

The third party also carries their own share of the liability. Epli will also mitigate your liability for harassment claims. Vicarious liability insurance protects you and your business from lawsuits resulting from mistakes caused by your employees, the independent contractors you’ve hired or agents that act on behalf of your small business. Vicarious liability is a legal term used to explain the legal responsibility one party may hold for actions that cause harm, even if they aren’t the party that directly caused the harm. It’s important to understand how your company could be held liable for the actions of others, including employees, volunteers, contractors, partners, and others.

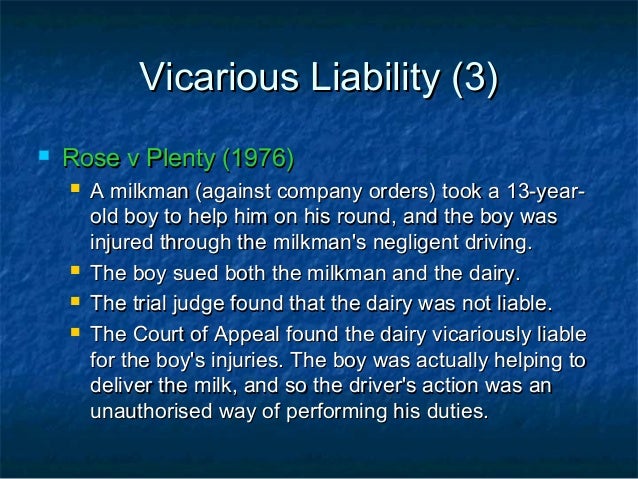

Source: slideshare.net

Source: slideshare.net

Links for irmi online subscribers only:. Let’s explore what the issue of vicarious liability really means for healthcare companies, and how it can be prepared for. Employment practices liability insurance (epli) is a crucial insurance designed to protect against employment discrimination issues where your business might be vicariously liable. Also sometimes referred to as imputed liability, vicarious liability states that any party who is in an authoritative legal relationship with another party is legally responsible if their actions cause. A principal, such as an employer;

Source: slideshare.net

Source: slideshare.net

Vicarious liability refers to a situation where someone is held responsible for the actions or omissions of another person. A principal, such as an employer; Vicarious liability insurance definition in any situation where you have someone else representing you or your business interests in any sort of official capacity, it creates an environment where you could be found to have vicarious liability. Links for irmi online subscribers only:. Vicarious liability is legal principle that states that a party can be held liable for the negligent actions of another party with whom they have a special relationship, such as parent and child, employer and employee, and vehicle owner and driver.

Source: npa1.org

Source: npa1.org

Free, unlimited and instant certificates of insurance online. In general, vicarious liability is the liability of being deemed partly at fault even by an act caused by a third party. Get your instant quote now! It’s important to understand how your company could be held liable for the actions of others, including employees, volunteers, contractors, partners, and others. Is liable for the acts of;

Source: brokerininsurance.com

Source: brokerininsurance.com

But is negligent in carrying out that responsibility and exercising. Employment practices liability insurance (epli) is a crucial insurance designed to protect against employment discrimination issues where your business might be vicariously liable. Get your instant quote now! Vicarious liability is relevant to employers’ liability insurance, which is included in most workers’ compensation policies. Vicarious liability is a legal doctrine that assigns.

Source: vinsonlawoffice.com

Source: vinsonlawoffice.com

Vicarious liability — the liability of a principal for the acts of its agents. Vicarious liability is a common insurance concept that applies in many situations where companies could be sued. Is liable for the acts of; Vicarious liability, sometimes referred to as “imputed liability,” is a legal concept that assigns liability to an individual who did not actually cause the harm, but who has a specific superior legal relationship to the person who did cause the harm.vicarious liability most commonly comes into play when an employee has acted in a negligent manner for which the. Vicarious liability can arise when one party suppose to be responsible for the third party;

Source: slideshare.net

Source: slideshare.net

Let’s explore what the issue of vicarious liability really means for healthcare companies, and how it can be prepared for. Most commonly, this is the legal framework at play when you are sued over mistakes made by your contractors, employees, or agents. This is most commonly found within the business and commercial environment when things although previous unsuccessful attempts have been made in the uk to place the responsibility for the actions of minors upon the parents. Various types of insurance policies can help cover the expense of defending yourself against a vicarious liability claim. The tort doctrine that imposes responsibility upon one person for the failure of another, with whom the person has a special relationship (such as parent and child, employer and employee, or owner of vehicle and driver), to exercise such care as a reasonably prudent person would use under similar circumstances.

Source: clydeco.com

Employment practices liability insurance (epli) is a crucial insurance designed to protect against employment discrimination issues where your business might be vicariously liable. Vicarious liability insurance protects you and your business from lawsuits resulting from mistakes caused by your employees, the independent contractors you’ve hired or agents that act on behalf of your small business. Get your instant quote now! Vicarious liability can result from the acts of independent agents, partners, independent contractors, employees, and children. Vicarious liability is when you or your business are held financially responsible for the actions of another person or party.

Source: webberinsurance.com.au

Source: webberinsurance.com.au

Free, unlimited and instant certificates of insurance online. Vicarious liability is a legal doctrine that assigns. Vicarious liability insurance protects you and your business from lawsuits resulting from mistakes caused by your employees, the independent contractors you’ve hired or agents that act on behalf of your small business. Vicarious liability is legal principle that states that a party can be held liable for the negligent actions of another party with whom they have a special relationship, such as parent and child, employer and employee, and vehicle owner and driver. The reason most people haven’t heard of the term is because these judgments are much more common in business settings.

Source: legalraj.com

Vicarious liability can result from the acts of independent agents, partners, independent contractors, employees, and children. Links for irmi online subscribers only:. Vicarious liability can arise when one party suppose to be responsible for the third party; The reason most people haven’t heard of the term is because these judgments are much more common in business settings. Employers� liability insurance covers (among other things) suits against employers by workers who are injured on the job but aren’t eligible for workers’ comp benefits.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

Vicarious liability refers to a situation where someone is held responsible for the actions or omissions of another person. If an employee, independent contractor, or business agent acts in a negligent manner or causes an injury by acting recklessly in the workplace, that person’s employer must answer for their actions in court. It’s important to understand how your company could be held liable for the actions of others, including employees, volunteers, contractors, partners, and others. Vicarious liability is relevant to employers’ liability insurance, which is included in most workers’ compensation policies. The third party also carries their own share of the liability.

Source: embroker.com

Source: embroker.com

Vicarious liability is legal principle that states that a party can be held liable for the negligent actions of another party with whom they have a special relationship, such as parent and child, employer and employee, and vehicle owner and driver. Vicarious liability is a legal term used to explain the legal responsibility one party may hold for actions that cause harm, even if they aren’t the party that directly caused the harm. Ad small business general liability insurance that�s affordable & tailored for you! Vicarious liability is a situation in which one party is held partly responsible for the unlawful actions of a third party. The tort doctrine that imposes responsibility upon one person for the failure of another, with whom the person has a special relationship (such as parent and child, employer and employee, or owner of vehicle and driver), to exercise such care as a reasonably prudent person would use under similar circumstances.

Source: npa1.org

Source: npa1.org

Vicarious liability exists when one person or organisation is held legally responsible for the acts or omissions of another person or party. Vicarious liability can arise when one party suppose to be responsible for the third party; In general, vicarious liability is the liability of being deemed partly at fault even by an act caused by a third party. Links for irmi online subscribers only:. Vicarious liability refers to a situation where someone is held responsible for the actions or omissions of another person.

Source: hoffmaier.com

Source: hoffmaier.com

It’s important to understand how your company could be held liable for the actions of others, including employees, volunteers, contractors, partners, and others. The tort doctrine that imposes responsibility upon one person for the failure of another, with whom the person has a special relationship (such as parent and child, employer and employee, or owner of vehicle and driver), to exercise such care as a reasonably prudent person would use under similar circumstances. Vicarious liability is a legal term used to explain the legal responsibility one party may hold for actions that cause harm, even if they aren’t the party that directly caused the harm. Vicarious liability, sometimes referred to as “imputed liability,” is a legal concept that assigns liability to an individual who did not actually cause the harm, but who has a specific superior legal relationship to the person who did cause the harm.vicarious liability most commonly comes into play when an employee has acted in a negligent manner for which the. Employers� liability insurance covers (among other things) suits against employers by workers who are injured on the job but aren’t eligible for workers’ comp benefits.

Source: ioshmagazine.com

Source: ioshmagazine.com

Vicarious liability assigns your company responsibility for your employees� professional conduct and workplace safety. A principal, such as an employer; When insurance is provided as a contingent only basis, this means that cover applies only when that of the individual healthcare practitioner’s own indemnity insurance would not. Vicarious liability insurance protects you and your business from lawsuits resulting from mistakes caused by your employees, the independent contractors you’ve hired or agents that act on behalf of your small business. In the context of insurance, employers or other parties at risk of vicarious liability may need.

Source: cfcunderwriting.com

Source: cfcunderwriting.com

This is most commonly found within the business and commercial environment when things although previous unsuccessful attempts have been made in the uk to place the responsibility for the actions of minors upon the parents. Vicarious liability can result from the acts of independent agents, partners, independent contractors, employees, and children. Vicarious liability exists when one person or organisation is held legally responsible for the acts or omissions of another person or party. Vicarious liability can arise when one party suppose to be responsible for the third party; From a practical perspective, the employer is usually seen as a better target defendant to sue, due its turnover and availability of insurance, whether the risk is covered by specific vicarious liability insurance or not.

Source: aop.org.uk

Source: aop.org.uk

Vicarious liability is legal principle that states that a party can be held liable for the negligent actions of another party with whom they have a special relationship, such as parent and child, employer and employee, and vehicle owner and driver. In the context of insurance, employers or other parties at risk of vicarious liability may need. From a practical perspective, the employer is usually seen as a better target defendant to sue, due its turnover and availability of insurance, whether the risk is covered by specific vicarious liability insurance or not. Free, unlimited and instant certificates of insurance online. A principal, such as an employer;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title vicarious liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information