W i insurance Idea

Home » Trend » W i insurance IdeaYour W i insurance images are available. W i insurance are a topic that is being searched for and liked by netizens today. You can Get the W i insurance files here. Find and Download all free photos and vectors.

If you’re looking for w i insurance images information linked to the w i insurance interest, you have come to the right site. Our website always gives you hints for seeing the highest quality video and image content, please kindly search and find more informative video content and images that fit your interests.

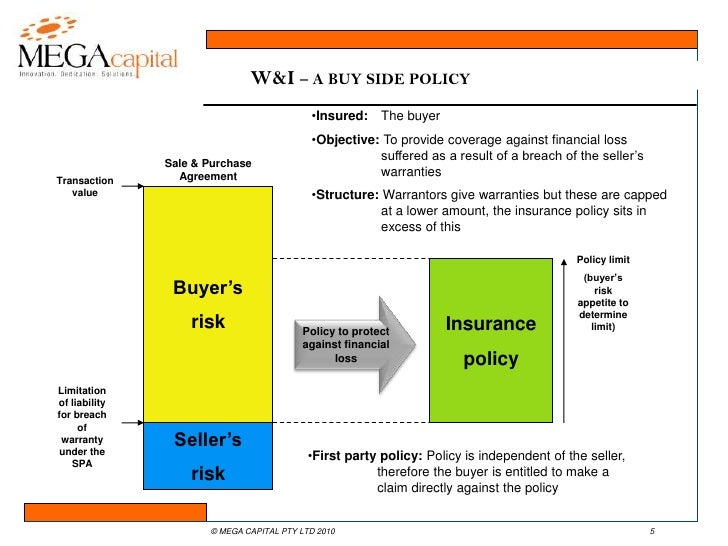

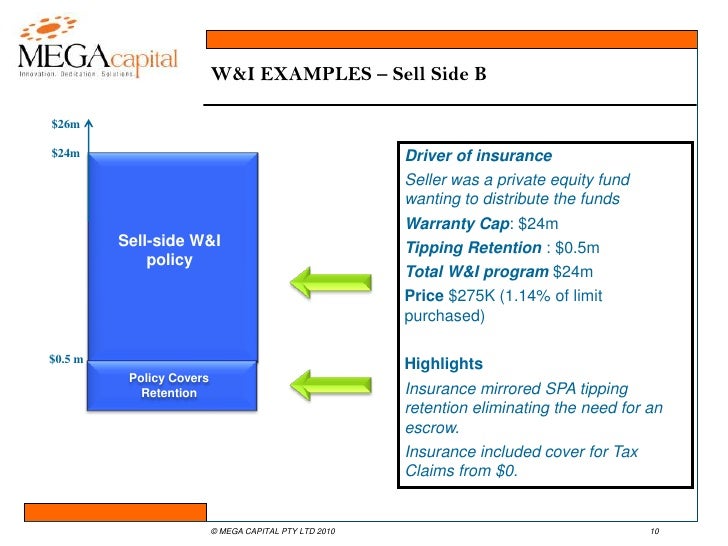

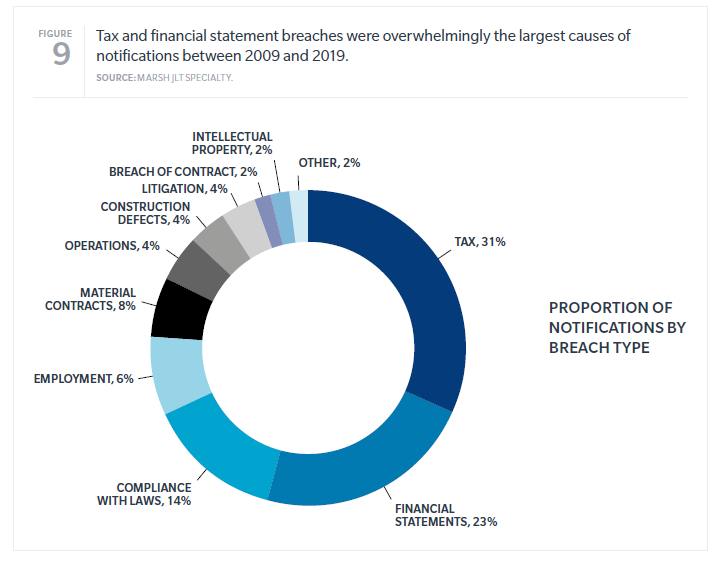

W I Insurance. This may change with more insurers being asked to cover synthetic warranties. In addition to looking at the purpose of these provisions and the key issues to remember when drafting them, the use of w&i insurance and its impact on the transaction is also considered. (w&i) insurance overview w&i insurance provides cover to a buyer or a seller of a company for loss suffered as a result of a breach of a warranty or a claim being made under an indemnity in a sale and purchase agreement (spa). Warranty and indemnity insurance (or representation and warranty insurance as it is known in the us) provides cover for.

W&I Insurance Exclusions and Solutions for Private Equity From jdsupra.com

W&I Insurance Exclusions and Solutions for Private Equity From jdsupra.com

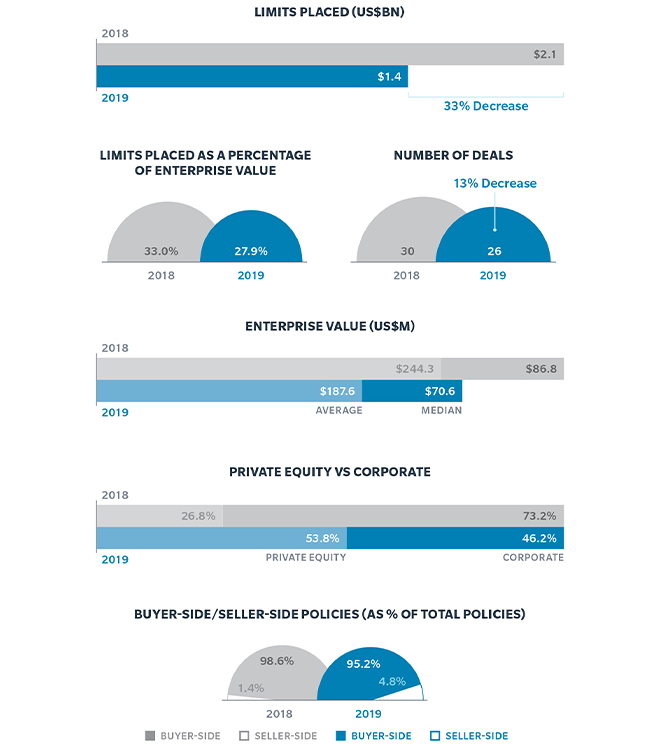

While not appropriate or available in all cases, the question of whether to obtain warranty and indemnity ( w&i ) insurance should be considered at term sheet stage. Participants in mergers and acquisitions (m&a) are also increasingly using. Most w&i policies list the buyer as the insured party, usually allowing the seller a clean exit at completion. Why it has a role to play in secondaries. This may change with more insurers being asked to cover synthetic warranties. 2022 is off to a strong start with a january record 656 r&w/w&i insurance policy submissions, 13% more than january 2021.

2022 is off to a strong start with a january record 656 r&w/w&i insurance policy submissions, 13% more than january 2021.

This may change with more insurers being asked to cover synthetic warranties. Why it has a role to play in secondaries. R&w/w&i insurance policy submission and binding numbers seem to demonstrate the growth and acceptance of transactional insurance during this eventful time for dealmakers. Most w&i policies list the buyer as the insured party, usually allowing the seller a clean exit at completion. We draw from a vast pool of personal, property and commercial insurance policies. W&i insurance benefits both parties as it allows losses to be shifted from a buyer/seller to an insurer.

Source: trendings-today14.blogspot.com

Source: trendings-today14.blogspot.com

Articles , november 25, 2020. Optio group has acquired warranty and indemnity (w&i) focused mga brockwell capital, the underwriting outfit launched by former allied world head of m&a andrew graham and colleagues in 2017. The growing popularity is also a result of declining insurance premiums. R&w/w&i insurance policy submission and binding numbers seem to demonstrate the growth and acceptance of transactional insurance during this eventful time for dealmakers. Have been outstanding in taking care of my insurance needs and always helpful and friendly mike w.

Source: raconteur.net

Source: raconteur.net

Cooley’s m&a lawyers and insurance specialists are knowledgeable and experienced with r&w insurance products and their pros and cons as compared to a traditional indemnity and escrow structure. In addition to looking at the purpose of these provisions and the key issues to remember when drafting them, the use of w&i insurance and its impact on the transaction is also considered. Warranty and indemnity insurance (w&i) brings the insurer into this indemnification arrangement as an interested third party. The growing popularity is also a result of declining insurance premiums. Richard butterwick, catherine campbell, paul davies, michael green, aofie mccabe, harry redford, david walker, amy watkins.

Source: inceconnect.co.za

Source: inceconnect.co.za

The growing popularity is also a result of declining insurance premiums. W&i insurance claims on the rise a current case shows impressively: In europe, they are now around 1 percent of the risk to be insured, or even lower. While not appropriate or available in all cases, the question of whether to obtain warranty and indemnity ( w&i ) insurance should be considered at term sheet stage. We draw from a vast pool of personal, property and commercial insurance policies.

Source: trendings-today14.blogspot.com

Source: trendings-today14.blogspot.com

W&i insurance provides cover for buyers or sellers for breaches of warranties and indemnities made by sellers in sale agreements. It covers damages resulting from breaches of warranties and indemnities given. W&i insurance benefits both parties as it allows losses to be shifted from a buyer/seller to an insurer. W&i insurance is a highly adaptable product designed to cater for unforeseen liabilities arising from a breach of the warranties or claim under the tax indemnity in a sale and purchase agreement (spa). (w&i) insurance overview w&i insurance provides cover to a buyer or a seller of a company for loss suffered as a result of a breach of a warranty or a claim being made under an indemnity in a sale and purchase agreement (spa).

Source: slideshare.net

Source: slideshare.net

We draw from a vast pool of personal, property and commercial insurance policies. Insurance agency helps you find insurance solutions tailored to your individual needs. We bound 49 policies in january, a 14% drop from our record january 2021. Warranty and indemnity insurance (w&i) during sales processes it is common for the seller to provide warranties to the buyer on a broad range of matters about the target such as title to shares, property, employment, tax, intellectual property, and other commercial matters. The growing popularity is also a result of declining insurance premiums.

Source: youtube.com

Source: youtube.com

Warranty and indemnity insurance (w&i) brings the insurer into this indemnification arrangement as an interested third party. Warranty and indemnity insurance (or representation and warranty insurance as it is known in the us) provides cover for. The growing popularity is also a result of declining insurance premiums. We draw from a vast pool of personal, property and commercial insurance policies. R&w/w&i insurance policy submission and binding numbers seem to demonstrate the growth and acceptance of transactional insurance during this eventful time for dealmakers.

Source: portolano.it

Source: portolano.it

The growing popularity is also a result of declining insurance premiums. After m&a transactions, sellers can be confronted with significant claims for damages. Most w&i policies list the buyer as the insured party, usually allowing the seller a clean exit at completion. The growing popularity is also a result of declining insurance premiums. 1 what is w&i insurance?

Source: raconteur.net

Source: raconteur.net

As an independent insurance agency, w.i.m.i. Most w&i policies list the buyer as the insured party, usually allowing the seller a clean exit at completion. Optio group has acquired warranty and indemnity (w&i) focused mga brockwell capital, the underwriting outfit launched by former allied world head of m&a andrew graham and colleagues in 2017. We bound 49 policies in january, a 14% drop from our record january 2021. W&i insurance benefits both parties as it allows losses to be shifted from a buyer/seller to an insurer.

Source: locktoninternational.com

Source: locktoninternational.com

It covers damages resulting from breaches of warranties and indemnities given. Have been outstanding in taking care of my insurance needs and always helpful and friendly mike w. This webinar looks at a key area of negotiation on private m&a transactions, the warranties, indemnities and seller protection provisions. Most w&i policies list the buyer as the insured party, usually allowing the seller a clean exit at completion. We bound 49 policies in january, a 14% drop from our record january 2021.

Source: bespecter.com

Source: bespecter.com

In this instance, there would be no need to purchase the additional title cover, as the w&i policy will cover title risks (contained within the fundamental warranties) up to the full ev. We bound 49 policies in january, a 14% drop from our record january 2021. As an independent insurance agency, w.i.m.i. W&i insurance claims on the rise a current case shows impressively: Warranty and indemnity insurance (w&i) during sales processes it is common for the seller to provide warranties to the buyer on a broad range of matters about the target such as title to shares, property, employment, tax, intellectual property, and other commercial matters.

Source: inceconnect.co.za

Source: inceconnect.co.za

Cooley’s m&a lawyers and insurance specialists are knowledgeable and experienced with r&w insurance products and their pros and cons as compared to a traditional indemnity and escrow structure. Exclusions and solutions for private equity. W&i insurance is especially used for bigger deal sizes. We bound 49 policies in january, a 14% drop from our record january 2021. Cooley’s m&a lawyers and insurance specialists are knowledgeable and experienced with r&w insurance products and their pros and cons as compared to a traditional indemnity and escrow structure.

Source: raconteur.net

Source: raconteur.net

Why it has a role to play in secondaries. This may change with more insurers being asked to cover synthetic warranties. R&w/w&i insurance policy submission and binding numbers seem to demonstrate the growth and acceptance of transactional insurance during this eventful time for dealmakers. Richard butterwick, catherine campbell, paul davies, michael green, aofie mccabe, harry redford, david walker, amy watkins. Warranty and indemnity insurance (or representation and warranty insurance as it is known in the us) provides cover for.

Source: aig.co.uk

Source: aig.co.uk

W&i insurance benefits both parties as it allows losses to be shifted from a buyer/seller to an insurer. Richard butterwick, catherine campbell, paul davies, michael green, aofie mccabe, harry redford, david walker, amy watkins. Why it has a role to play in secondaries. Most w&i policies list the buyer as the insured party, usually allowing the seller a clean exit at completion. In europe, they are now around 1 percent of the risk to be insured, or even lower.

Source: mhc.ie

Source: mhc.ie

In europe, they are now around 1 percent of the risk to be insured, or even lower. As an independent insurance agency, w.i.m.i. We invite you to explore our comprehensive consulting services and get to know our competent and friendly staff. Warranty and indemnity (w&i) insurance has by now been fully embedded in the m&a transaction process, but the coverage provided by the insurance policy is based on the warranty package in a share purchase agreement (spa). 1 what is w&i insurance?

Source: libertygts.com

Source: libertygts.com

Richard butterwick, catherine campbell, paul davies, michael green, aofie mccabe, harry redford, david walker, amy watkins. Why it has a role to play in secondaries. In europe, they are now around 1 percent of the risk to be insured, or even lower. In this instance, there would be no need to purchase the additional title cover, as the w&i policy will cover title risks (contained within the fundamental warranties) up to the full ev. Cooley’s m&a lawyers and insurance specialists are knowledgeable and experienced with r&w insurance products and their pros and cons as compared to a traditional indemnity and escrow structure.

Source: natlawreview.com

Warranty and indemnity (w&i) insurance has by now been fully embedded in the m&a transaction process, but the coverage provided by the insurance policy is based on the warranty package in a share purchase agreement (spa). Have been outstanding in taking care of my insurance needs and always helpful and friendly mike w. R&w/w&i insurance policy submission and binding numbers seem to demonstrate the growth and acceptance of transactional insurance during this eventful time for dealmakers. We invite you to explore our comprehensive consulting services and get to know our competent and friendly staff. Exclusions and solutions for private equity.

Source: aon.com

R&w/w&i insurance policy submission and binding numbers seem to demonstrate the growth and acceptance of transactional insurance during this eventful time for dealmakers. R&w/w&i insurance policy submission and binding numbers seem to demonstrate the growth and acceptance of transactional insurance during this eventful time for dealmakers. Cooley’s m&a lawyers and insurance specialists are knowledgeable and experienced with r&w insurance products and their pros and cons as compared to a traditional indemnity and escrow structure. The growing popularity is also a result of declining insurance premiums. 1 what is w&i insurance?

Source: slideshare.net

Source: slideshare.net

Richard butterwick, catherine campbell, paul davies, michael green, aofie mccabe, harry redford, david walker, amy watkins. As an independent insurance agency, w.i.m.i. R&w/w&i insurance policy submission and binding numbers seem to demonstrate the growth and acceptance of transactional insurance during this eventful time for dealmakers. Optio group has acquired warranty and indemnity (w&i) focused mga brockwell capital, the underwriting outfit launched by former allied world head of m&a andrew graham and colleagues in 2017. 2022 is off to a strong start with a january record 656 r&w/w&i insurance policy submissions, 13% more than january 2021.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title w i insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information