W2 health insurance reporting information

Home » Trending » W2 health insurance reporting informationYour W2 health insurance reporting images are available in this site. W2 health insurance reporting are a topic that is being searched for and liked by netizens today. You can Find and Download the W2 health insurance reporting files here. Get all free photos and vectors.

If you’re looking for w2 health insurance reporting pictures information connected with to the w2 health insurance reporting topic, you have pay a visit to the right site. Our site frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

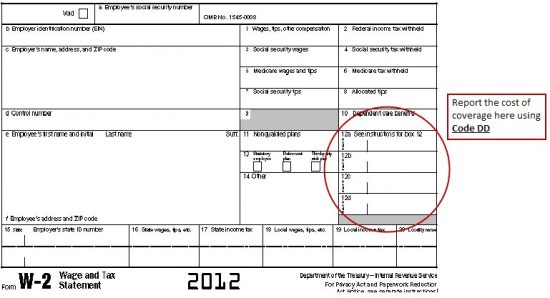

W2 Health Insurance Reporting. This also includes immediate family members of greater than 2% shareholders of an s corporation. Report corporate climate pledges are weaker than they seem from www.news4jax.com. Are employers required to report health insurance on w2? Faqs on w2 health reporting requirements for employer groups.

W2 Reporting Requirements for EmployerProvided Health From peoplekeep.com

W2 Reporting Requirements for EmployerProvided Health From peoplekeep.com

Once you know you require reporting health insurance, here are the steps you will need to follow: What is the 2% shareholder health insurance taxability? Health insurance for s corporation 2% shareholders: Are employers required to report health insurance on w2? S corp health insurance reporting on w2. You don’t have to report healthcare coverage for retirees or former employees.

S corp health insurance reporting on w2.

What is the 2% shareholder health insurance taxability? Since the requirement took effect in 2014, the irs has exempted some businesses. By integrated tax services | dec 1, 2021 | deadlines | 0 comments. The premiums are also additional wages reportable in box 16 (state wages) for some, but not all, states. What is the 2% shareholder health insurance taxability? Health insurance for s corporation 2% shareholders:

Source: herasincometaxschool.com

Source: herasincometaxschool.com

By integrated tax services | dec 1, 2021 | deadlines | 0 comments. Once you know you require reporting health insurance, here are the steps you will need to follow: In general, the amount reported should include both the portion paid by the employer and the portion paid by the employee. Report corporate climate pledges are weaker than they seem from www.news4jax.com. This also includes immediate family members of greater than 2% shareholders of an s corporation.

Source: basusa.com

Source: basusa.com

Which employers must report health insurance on w2? This amount is reported for informational purposes only and is not taxable. The affordable care act (aca) requires virtually all employers that provide group health insurance coverage to report information about the value of these benefits to employees via their w2. Faqs on w2 health reporting requirements for employer groups. Once you know you require reporting health insurance, here are the steps you will need to follow:

Source: aischasworldofphotos.blogspot.com

Source: aischasworldofphotos.blogspot.com

You don’t have to report healthcare coverage for retirees or former employees. Since the requirement took effect in 2014, the irs has exempted some businesses. By integrated tax services | dec 1, 2021 | deadlines | 0 comments. You don’t have to report healthcare coverage for retirees or former employees. W 2 reporting requirements for employer provided health coverage do small employers need to report health insurance on w2.

Source: doctorheck.blogspot.com

Source: doctorheck.blogspot.com

Go to the printable employee copies: Health insurance for s corporation 2% shareholders: In general, the amount reported should include both the portion paid by the employer and the portion paid by the employee. By integrated tax services | dec 1, 2021 | deadlines | 0 comments. W 2 reporting requirements for employer provided health coverage do small employers need to report health insurance on w2.

Source: savingtoinvest.com

Source: savingtoinvest.com

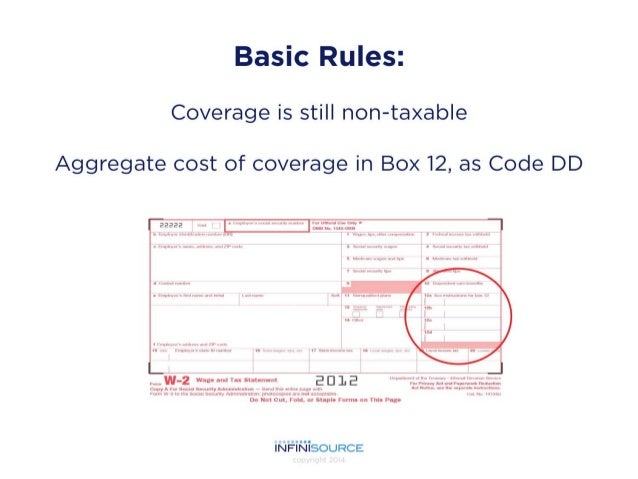

Many employers are eligible for transition relief for tax year 2012 and beyond, until the irs issues final guidance for this reporting requirement. Faqs on w2 health reporting requirements for employer groups. The premiums are also additional wages reportable in box 16 (state wages) for some, but not all, states. How is health insurance reported on w2? Health insurance for s corporation 2% shareholders:

Source: tax-queen.com

Source: tax-queen.com

This also includes immediate family members of greater than 2% shareholders of an s corporation. Are employers required to report health insurance on w2? In general, the amount reported should include both the portion paid by the employer and the portion paid by the employee. This also includes immediate family members of greater than 2% shareholders of an s corporation. What is the 2% shareholder health insurance taxability?

Source: peoplekeep.com

Source: peoplekeep.com

You don’t have to report healthcare coverage for retirees or former employees. This also includes immediate family members of greater than 2% shareholders of an s corporation. W 2 reporting requirements for employer provided health coverage do small employers need to report health insurance on w2. This amount is reported for informational purposes only and is not taxable. You should record both you and your employees’ contribution to healthcare.

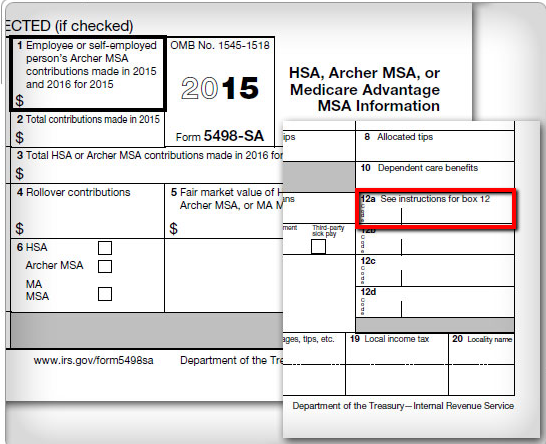

Source: hsaedge.com

Source: hsaedge.com

Are employers required to report health insurance on w2? The premiums are also additional wages reportable in box 16 (state wages) for some, but not all, states. How is health insurance reported on w2? In general, the amount reported should include both the portion paid by the employer and the portion paid by the employee. You don’t have to report healthcare coverage for retirees or former employees.

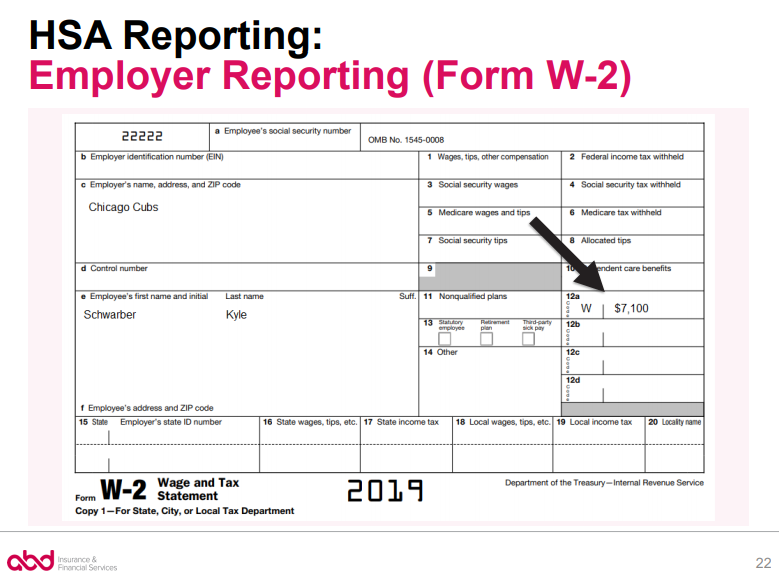

Source: theabdteam.com

Source: theabdteam.com

S corp health insurance reporting on w2. In general, the amount reported should include both the portion paid by the employer and the portion paid by the employee. Report corporate climate pledges are weaker than they seem from www.news4jax.com. Many employers are eligible for transition relief for tax year 2012 and beyond, until the irs issues final guidance for this reporting requirement. Are employers required to report health insurance on w2?

![45 [pdf] W2 FORM HEALTH INSURANCE PRINTABLE HD DOCX 45 [pdf] W2 FORM HEALTH INSURANCE PRINTABLE HD DOCX](https://www.hsaedge.com/wp-content/uploads/2018/04/HSA-employer-contributions-W2-example.png) Source: healthforms-0.blogspot.com

Source: healthforms-0.blogspot.com

W 2 reporting requirements for employer provided health coverage do small employers need to report health insurance on w2. Once you know you require reporting health insurance, here are the steps you will need to follow: This amount is reported for informational purposes only and is not taxable. You don’t have to report healthcare coverage for retirees or former employees. Health insurance for s corporation 2% shareholders:

Source: slideshare.net

Source: slideshare.net

This also includes immediate family members of greater than 2% shareholders of an s corporation. Are employers required to report health insurance on w2? How is health insurance reported on w2? The affordable care act (aca) requires virtually all employers that provide group health insurance coverage to report information about the value of these benefits to employees via their w2. By integrated tax services | dec 1, 2021 | deadlines | 0 comments.

Source: playbestonlinegames.com

Source: playbestonlinegames.com

As an example, you could not deduct your premiums in 2020 if your agi was $60,000 and you paid $4,500 in health insurance premiums over the course of the tax year because 7.5% of your agi works out to $4,500. What is the 2% shareholder health insurance taxability? Health insurance for s corporation 2% shareholders: Ensure auto pay and file option is turned on. The affordable care act (aca) requires virtually all employers that provide group health insurance coverage to report information about the value of these benefits to employees via their w2.

Source: pdfquick.com

Source: pdfquick.com

You don’t have to report healthcare coverage for retirees or former employees. S corp health insurance reporting on w2. If you have auto pay and file turned off (you pay and file electronically or manually) select taxes & forms, then taxes. Which employers must report health insurance on w2? The affordable care act (aca) requires virtually all employers that provide group health insurance coverage to report information about the value of these benefits to employees via their w2.

Source: cpapracticeadvisor.com

Source: cpapracticeadvisor.com

This amount is reported for informational purposes only and is not taxable. Since the requirement took effect in 2014, the irs has exempted some businesses. What is the 2% shareholder health insurance taxability? Faqs on w2 health reporting requirements for employer groups. Which employers must report health insurance on w2?

Source: mycity4her.com

Source: mycity4her.com

Since the requirement took effect in 2014, the irs has exempted some businesses. W 2 reporting requirements for employer provided health coverage do small employers need to report health insurance on w2. Faqs on w2 health reporting requirements for employer groups. Ensure auto pay and file option is turned on. Which employers must report health insurance on w2?

Source: treatsinc.org

Source: treatsinc.org

By integrated tax services | dec 1, 2021 | deadlines | 0 comments. Report corporate climate pledges are weaker than they seem from www.news4jax.com. Which employers must report health insurance on w2? Are employers required to report health insurance on w2? Go to the printable employee copies:

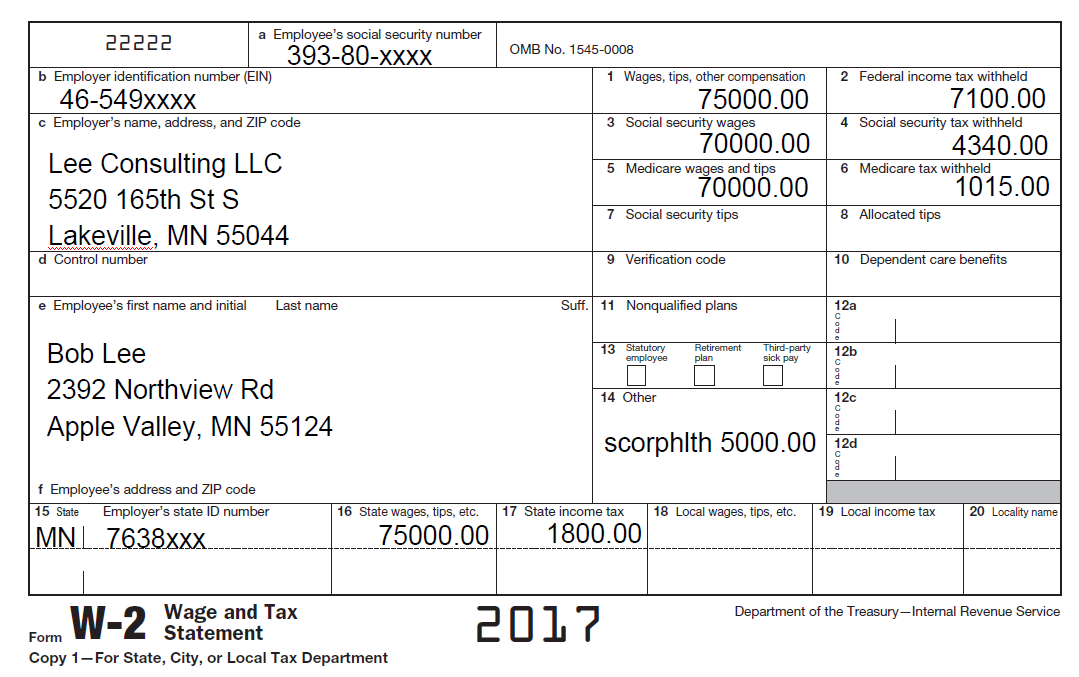

.png?width=1200&name=2017 W-2 FORM (2).png “W2 Reporting Required for Nanny TaxFree Healthcare Benefits”) Source: info.homeworksolutions.com

What is the 2% shareholder health insurance taxability? Go to the printable employee copies: Many employers are eligible for transition relief for tax year 2012 and beyond, until the irs issues final guidance for this reporting requirement. The affordable care act (aca) requires virtually all employers that provide group health insurance coverage to report information about the value of these benefits to employees via their w2. S corp health insurance reporting on w2.

Source: forbes.com

Source: forbes.com

If you have auto pay and file turned off (you pay and file electronically or manually) select taxes & forms, then taxes. Which employers must report health insurance on w2? Health insurance for s corporation 2% shareholders: This also includes immediate family members of greater than 2% shareholders of an s corporation. W 2 reporting requirements for employer provided health coverage do small employers need to report health insurance on w2.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title w2 health insurance reporting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information