Waiting period in health insurance policy information

Home » Trend » Waiting period in health insurance policy informationYour Waiting period in health insurance policy images are ready. Waiting period in health insurance policy are a topic that is being searched for and liked by netizens today. You can Find and Download the Waiting period in health insurance policy files here. Find and Download all royalty-free photos.

If you’re searching for waiting period in health insurance policy images information linked to the waiting period in health insurance policy keyword, you have pay a visit to the ideal blog. Our website always provides you with hints for viewing the highest quality video and image content, please kindly search and find more enlightening video content and images that match your interests.

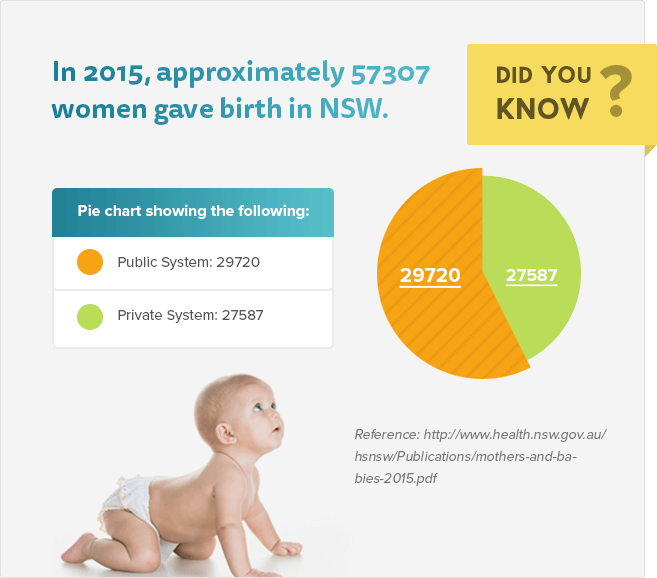

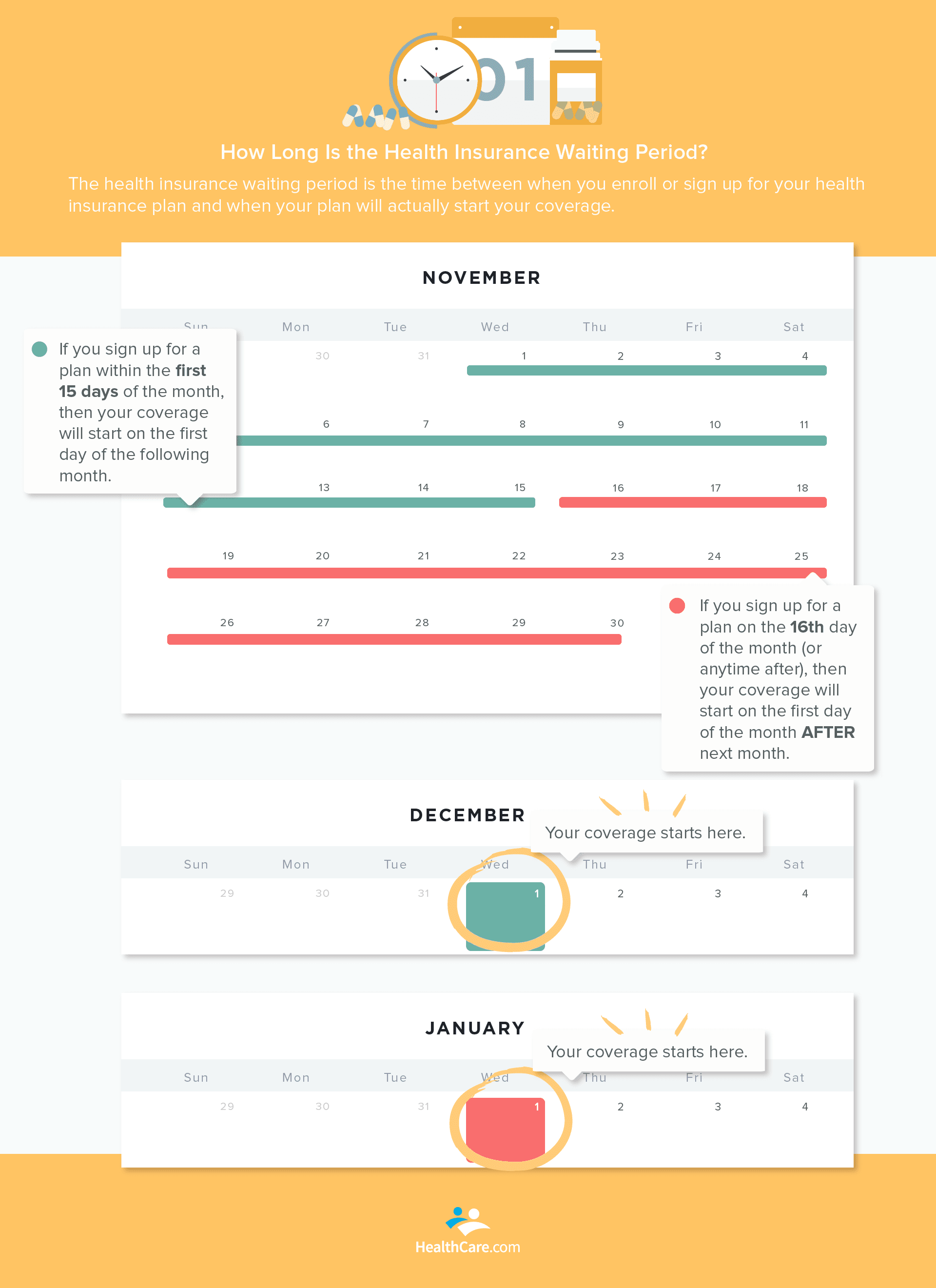

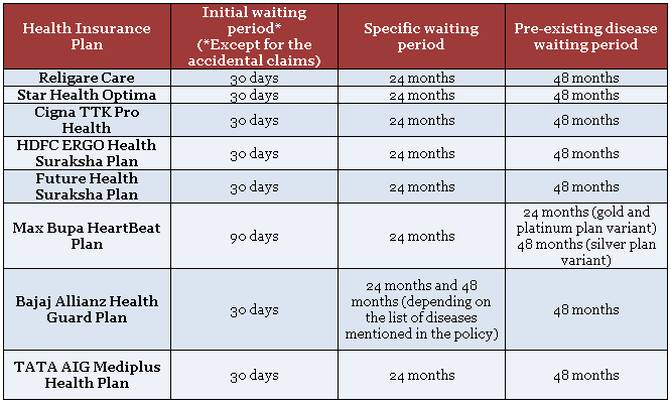

Waiting Period In Health Insurance Policy. An initial waiting period of 30 days is applicable in every health insurance policy. The waiting period is associated with certain illnesses as well as specific health conditions. Other types of waiting periods: An initial waiting period, also known as the cooling period in health insurance, refers to.

Waiting Period in Health Insurance Simplified Symbo From symboinsurance.com

Waiting Period in Health Insurance Simplified Symbo From symboinsurance.com

There are mostly 3 types of waiting period in a standard health insurance policy: The waiting period varies as per the. 6 rows the waiting period is a specific time period before a certain list of illnesses starts getting. Different conditions and coverage have different waiting periods and have different rules for the same. Generally speaking, many policies come with long waiting periods for the following types of coverage: Typically, when you buy a health insurance policy, you will be asked.

Depending on your chosen plan type, the level of coverage, and the insurer, waiting periods can also vary.

The waiting period is a specific time period before a certain list of ailments start getting covered under the intended health insurance policy. An initial waiting period of 30 days is applicable in every health insurance policy. The only exception to the initial waiting period is accidental claims wherein the claims are approved only when the insured is involved in an accident and requires immediate hospitalisation. There are mostly 3 types of waiting period in a standard health insurance policy: This 30 day period specifies the amount of time you have to wait from the date of issuance of policy to actively start using your health insurance policy. A waiting period is the duration wherein you are not eligible for any claim, even if it’s a medical emergency.

Source: lsminsurance.ca

Source: lsminsurance.ca

This duration can range from 90 days to four years, depending on the terms and conditions of your policy. With series of new and old health cover plans in this category from basic to elite health plans, health insurance companies design the health covers keeping in mind the cost it needs to bear the risk. There will be a waiting period of 2 to 5 years to cover the maternity benefit. The government sets the maximum waiting periods that insurers can impose for hospital treatment: Other types of waiting periods:

Source: healthinsurancecomparison.com.au

Source: healthinsurancecomparison.com.au

There is an initial waiting period that needs to get over if you want to receive the benefits under your health insurance plan. An initial waiting period this refers to the waiting period of 30 days (90 days in certain cases) from the date of commencement of the. Hence, this is the period during which claim is not admitted. In past i have written about top 10 common exclusions in health insurance policies, in this post i would like to bring to your notice about the #waiting #period in any health insurance policy. Types of waiting periods in health insurance 1.

Source: navi.com

Source: navi.com

Normally, the waiting periods are different for each disease/ailment/treatment and also depend on the specific benefits of the policy. The government sets the maximum waiting periods that insurers can impose for hospital treatment: Typically, when you buy a health insurance policy, you will be asked. The concept of waiting period in a health insurance policy is defined as the period of time specified which must pass before some or all of your health care coverage can begin. An initial waiting period this refers to the waiting period of 30 days (90 days in certain cases) from the date of commencement of the.

Source: peoplekeep.com

Source: peoplekeep.com

The terms & conditions and duration of a waiting period differ from one insurer to another. Generally, there are three key “waiting periods” that constitute a decisive measure of any health insurance. 30 days waiting period at inception. At the time of buying a health. With series of new and old health cover plans in this category from basic to elite health plans, health insurance companies design the health covers keeping in mind the cost it needs to bear the risk.

Source: iselect.com.au

Source: iselect.com.au

Some insurance companies offer this as an add on cover, while some make it a part of their basic health policy. The insurance will come into effect after the initial waiting period. Waiting period in health insurance is the time period during which the policyholder can not raise a claim for some or all benefits of the policy from the insurer i.e. This 30 day period specifies the amount of time you have to wait from the date of issuance of policy to actively start using your health insurance policy. Generally, there are three key “waiting periods” that constitute a decisive measure of any health insurance.

Source: myinsuranceclub.com

Source: myinsuranceclub.com

At the time of buying a health. This type of health insurance waiting period can last for up to 18 months.the solution to remove this waiting period from your health insurance is to prove that you have had insurance benefits without interruptions before your existing plan. The only exception to the initial waiting period is accidental claims wherein the claims are approved only when the insured is involved in an accident and requires immediate hospitalisation. As a standard in the health insurance industry, all health insurance plans come with a waiting period of at least 1 month and a maximum of 90 days. There are mostly 3 types of waiting period in a standard health insurance policy:

Source: symboinsurance.com

Source: symboinsurance.com

The insurance will come into effect after the initial waiting period. This waiting period is based on several factors such as the type of policy you hold, medical history, age, etc. There are mostly 3 types of waiting period in a standard health insurance policy: The insurance will come into effect after the initial waiting period. Types of waiting periods in health insurance 1.

Source: putuv.com

Source: putuv.com

Waiting period in health insurance is the time period during which the policyholder can not raise a claim for some or all benefits of the policy from the insurer i.e. Different conditions and coverage have different waiting periods and have different rules for the same. The terms & conditions and duration of a waiting period differ from one insurer to another. The waiting period in health insurance refers to the duration or period that one has to wait before claiming health insurance benefits. There will be a waiting period of 2 to 5 years to cover the maternity benefit.

Source: healthinsurancecomparison.com.au

Source: healthinsurancecomparison.com.au

You need to wait out the period of time, from the time you buy the health policy before you can make a claim. Waiting period in health insurance. The concept of waiting period in a health insurance policy is defined as the period of time specified which must pass before some or all of your health care coverage can begin. An initial waiting period this refers to the waiting period of 30 days (90 days in certain cases) from the date of commencement of the. The terms & conditions and duration of a waiting period differ from one insurer to another.

Source: gurpreetsaluja.com

Source: gurpreetsaluja.com

Some insurance companies offer this as an add on cover, while some make it a part of their basic health policy. There is an initial waiting period that needs to get over if you want to receive the benefits under your health insurance plan. Some insurance companies offer this as an add on cover, while some make it a part of their basic health policy. This type of health insurance waiting period can last for up to 18 months.the solution to remove this waiting period from your health insurance is to prove that you have had insurance benefits without interruptions before your existing plan. Typically, when you buy a health insurance policy, you will be asked.

Source: dnaindia.com

Source: dnaindia.com

This duration can range from 90 days to four years, depending on the terms and conditions of your policy. Depending on your chosen plan type, the level of coverage, and the insurer, waiting periods can also vary. There are mostly 3 types of waiting period in a standard health insurance policy: Waiting period in health insurance. Types of waiting periods in health insurance 1.

Source: healthcare.com

Source: healthcare.com

This period is also called as “cooling period” in health insurance. Typically, when you buy a health insurance policy, you will be asked. There will be a waiting period of 2 to 5 years to cover the maternity benefit. With series of new and old health cover plans in this category from basic to elite health plans, health insurance companies design the health covers keeping in mind the cost it needs to bear the risk. The insurance will come into effect after the initial waiting period.

Source: rediff.com

Source: rediff.com

In past i have written about top 10 common exclusions in health insurance policies, in this post i would like to bring to your notice about the #waiting #period in any health insurance policy. This 30 day period specifies the amount of time you have to wait from the date of issuance of policy to actively start using your health insurance policy. The waiting period is a specific time period before a certain list of ailments start getting covered under the intended health insurance policy. Other types of waiting periods: The government sets the maximum waiting periods that insurers can impose for hospital treatment:

Source: compareclub.com.au

Source: compareclub.com.au

You need to wait out the period of time, from the time you buy the health policy before you can make a claim. The concept of waiting period in a health insurance policy is defined as the period of time specified which must pass before some or all of your health care coverage can begin. This 30 day period specifies the amount of time you have to wait from the date of issuance of policy to actively start using your health insurance policy. The waiting period in health insurance refers to the duration or period that one has to wait before claiming health insurance benefits. At the time of buying a health.

Source: niveshmarket.com

Source: niveshmarket.com

Depending on your chosen plan type, the level of coverage, and the insurer, waiting periods can also vary. Insurance providers do not offer any coverage to any claims within that period. The waiting period is a specific time period before a certain list of ailments start getting covered under the intended health insurance policy. With series of new and old health cover plans in this category from basic to elite health plans, health insurance companies design the health covers keeping in mind the cost it needs to bear the risk. Waiting period in health insurance is the time period during which the policyholder can not raise a claim for some or all benefits of the policy from the insurer i.e.

Source: tryupdates.com

Source: tryupdates.com

Types of waiting periods in health insurance 1. In past i have written about top 10 common exclusions in health insurance policies, in this post i would like to bring to your notice about the #waiting #period in any health insurance policy. An initial waiting period, also known as the cooling period in health insurance, refers to. An initial waiting period of 30 days is applicable in every health insurance policy. Generally, there are three key “waiting periods” that constitute a decisive measure of any health insurance.

Source: avbob.funeralcoverme.co.za

Source: avbob.funeralcoverme.co.za

The waiting period varies as per the. There is an initial waiting period that needs to get over if you want to receive the benefits under your health insurance plan. Hence, this is the period during which claim is not admitted. The waiting period is associated with certain illnesses as well as specific health conditions. The waiting period varies as per the.

Source: iselect.com.au

Source: iselect.com.au

2 years waiting period for some specified illnesses like cataract. This period is also called as “cooling period” in health insurance. This type of health insurance waiting period can last for up to 18 months.the solution to remove this waiting period from your health insurance is to prove that you have had insurance benefits without interruptions before your existing plan. Some insurance companies offer this as an add on cover, while some make it a part of their basic health policy. With series of new and old health cover plans in this category from basic to elite health plans, health insurance companies design the health covers keeping in mind the cost it needs to bear the risk.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title waiting period in health insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information