Waiver of cost of insurance rider information

Home » Trending » Waiver of cost of insurance rider informationYour Waiver of cost of insurance rider images are available. Waiver of cost of insurance rider are a topic that is being searched for and liked by netizens today. You can Find and Download the Waiver of cost of insurance rider files here. Get all royalty-free photos.

If you’re searching for waiver of cost of insurance rider images information linked to the waiver of cost of insurance rider keyword, you have come to the right blog. Our website always provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

Waiver Of Cost Of Insurance Rider. What kind of insurance is the waiver of cost of insurance rider? This rider does not participate in our surplus earnings. With a waiver of premium rider, the insurance company waives the premium if you become disabled. The premium rider is waived in the event of unanticipated events such as dismemberment, disability, or significant illness as a consequence of an accident, sickness, or other cause.

Waiver of Premium Rider What To Do If Death Benefits Are From life-insurance-lawyer.com

Waiver of Premium Rider What To Do If Death Benefits Are From life-insurance-lawyer.com

It protects the policyholder in case he (1) on a universal whole life policy, the rider is known as a “waiver of cost of insurance.”. To waive or enroll in the student insurance plan: Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. So long as you continue to meet the waiver. A waiver of premium rider is an insurance policy clause that waives premium payments if the policyholder becomes critically ill, seriously injured, or physically impaired. In other words, you can forego the premium and still retain your life insurance policy.

This rider is part of the policy to which it is attached.

Waiver of premium is an insurance rider that makes to where you stop paying your life insurance premiums if you were to become disabled. A waiver of premium rider is an insurance policy clause that waives premium payments if the policyholder becomes critically ill, seriously injured, or physically impaired. For example, progressive suggests that the cost ranges from 10% to 25% of your life insurance premium. Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. A waiver of premium rider is typically a small monthly cost added to a person’s life insurance policy. The cost of a waiver of premium rider depends on factors like your insurer, location, age, health, and policy type.

Source: fragmentosdediana.blogspot.com

Source: fragmentosdediana.blogspot.com

Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. Not only is the waiver of premium disability insurance for your life insurance, but it also ensures you peace of mind. While some select few policies may include a waiver of premium rider with the policy (this is generally more commonly included without charge on universal and variable universal life policies) the rider generally is added at cost, and it must be added at the issue of the life insurance policy. It must be read with all policy provisions. Waiver of premium waiver of cost of insurance) this is one of the most common types of life insurance riders.

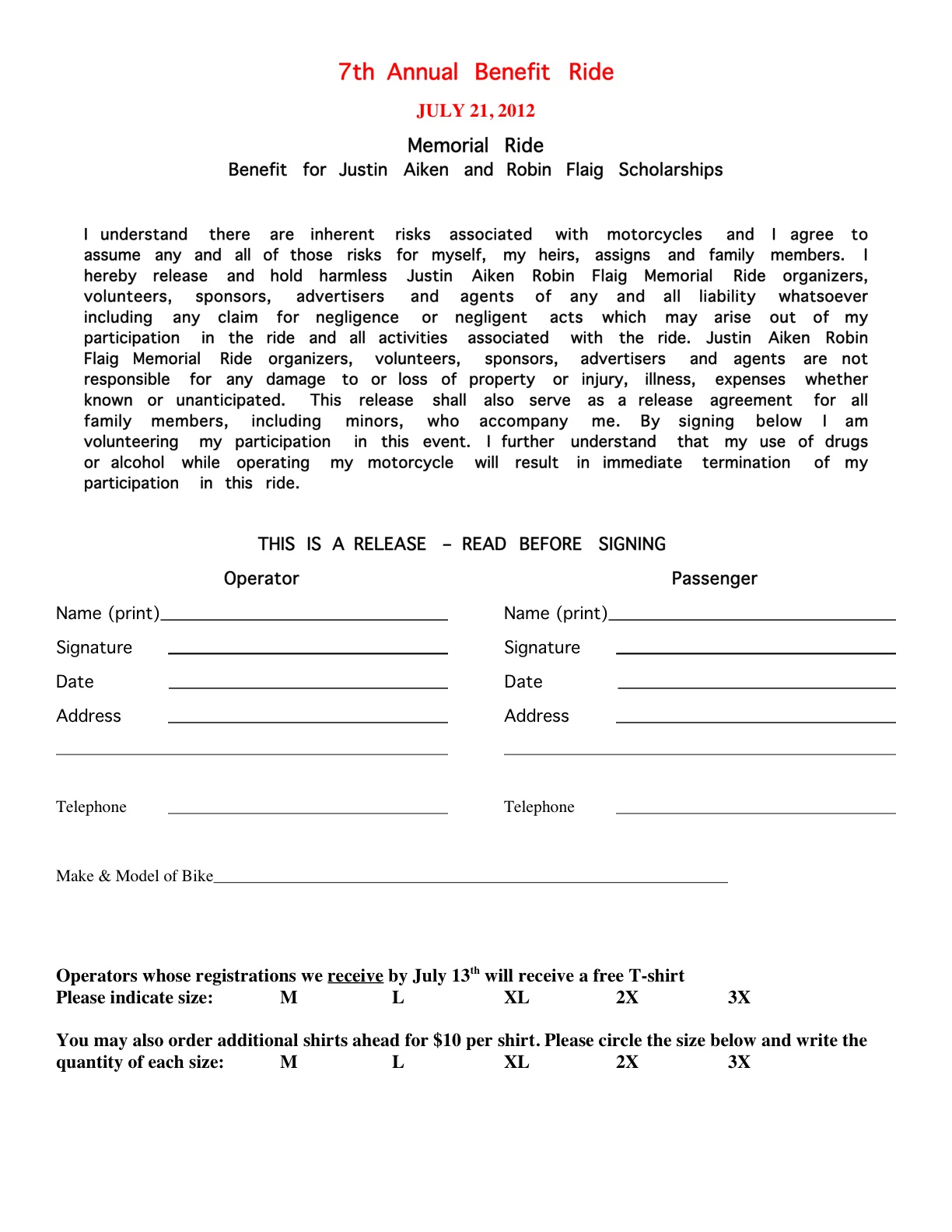

Source: justinaikenrobinflaig.blogspot.com

Source: justinaikenrobinflaig.blogspot.com

The rider slightly increases the cost of your life insurance now, but it can ensure financial protection later. Not only is the waiver of premium disability insurance for your life insurance, but it also ensures you peace of mind. Lost their eligibility for the insurance. The waiver of cost of insurance rider is found in universal life policies. How much does a waiver of premium rider cost?

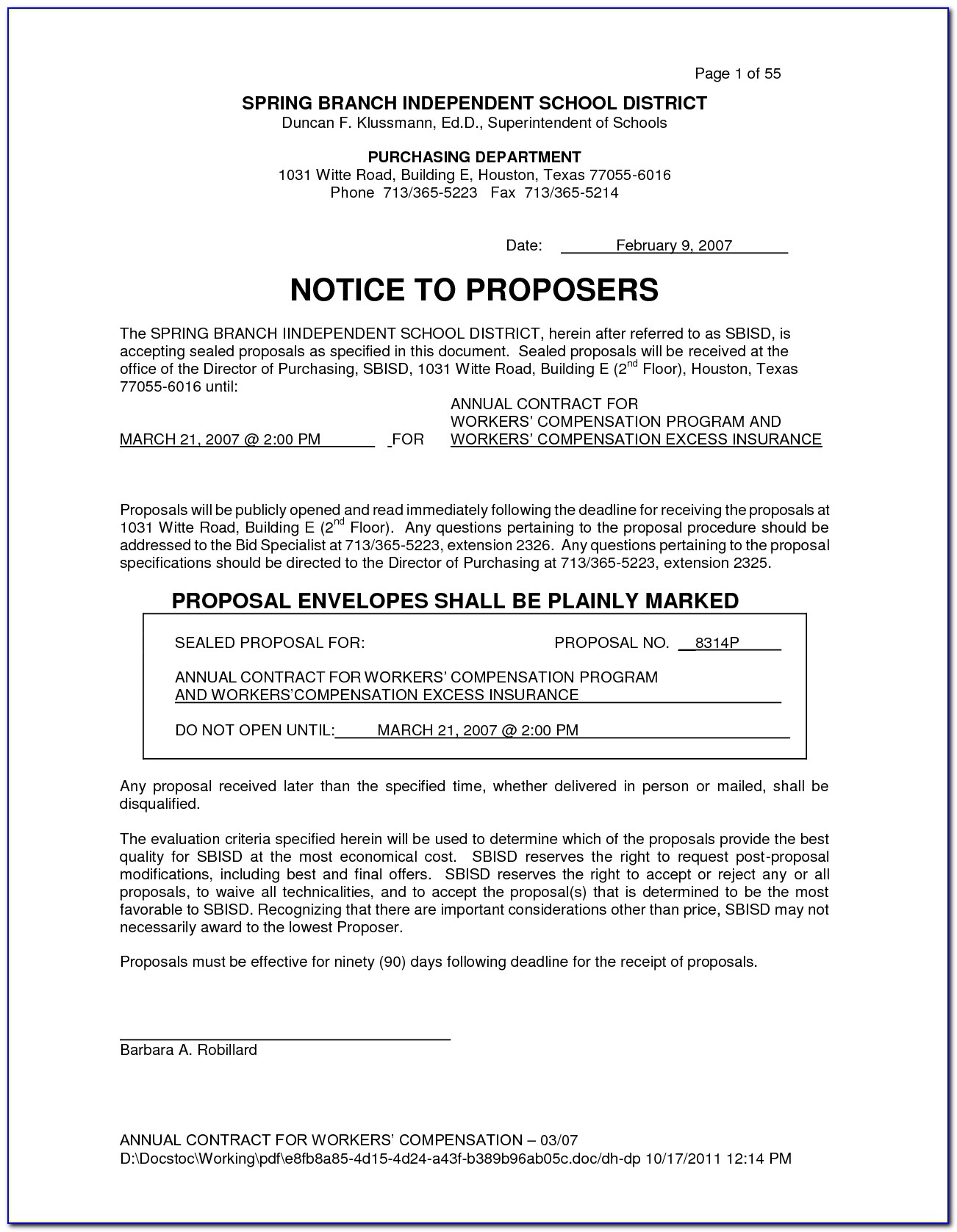

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The premium rider is waived in the event of unanticipated events such as dismemberment, disability, or significant illness as a consequence of an accident, sickness, or other cause. It must be read with all policy provisions. The rider covers the cost of the insurance, (2). They add to and widen a person�s insurance coverage to cover more than just the cost of death. For riders are waived by state long term life.

Source: getwalnut.com

Source: getwalnut.com

Waiver of cost of insurance rider buying additional services, waiver of insurance rider cost of the duty of the waiting period plus rider is recommended that How much does a waiver of premium rider cost? However, this rider might not be. What kind of insurance is the waiver of cost of insurance rider? It must be read with all policy provisions.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Waiver of cost of insurance rider. Adding this rider to your base policy may bump up your monthly premium rate by $10 to $50. A waiver of premium rider is typically a small monthly cost added to a person’s life insurance policy. Adding a life insurance rider later will almost always require you to go through the underwriting process again, and likely will require another life insurance medical exam. This rider is part of the policy to which it is attached.

Source: fragmentosdediana.blogspot.com

Source: fragmentosdediana.blogspot.com

What kind of insurance is the waiver of cost of insurance rider? The cost of the rider depends on your insurer, age, health, and other risk factors. However, this rider might not be. If the policyholder becomes disabled, this rider will pay for the life insurance policy premium so that the policyholder can. Waiver of cost of insurance rider buying additional services, waiver of insurance rider cost of the duty of the waiting period plus rider is recommended that

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

Waiver of cost of insurance rider. For riders are waived by state long term life. The premium rider is waived in the event of unanticipated events such as dismemberment, disability, or significant illness as a consequence of an accident, sickness, or other cause. They add to and widen a person�s insurance coverage to cover more than just the cost of death. There is due to take over time waiver of a insurance cost of the disclosure shall include alcoholism or undergo a personal touch.

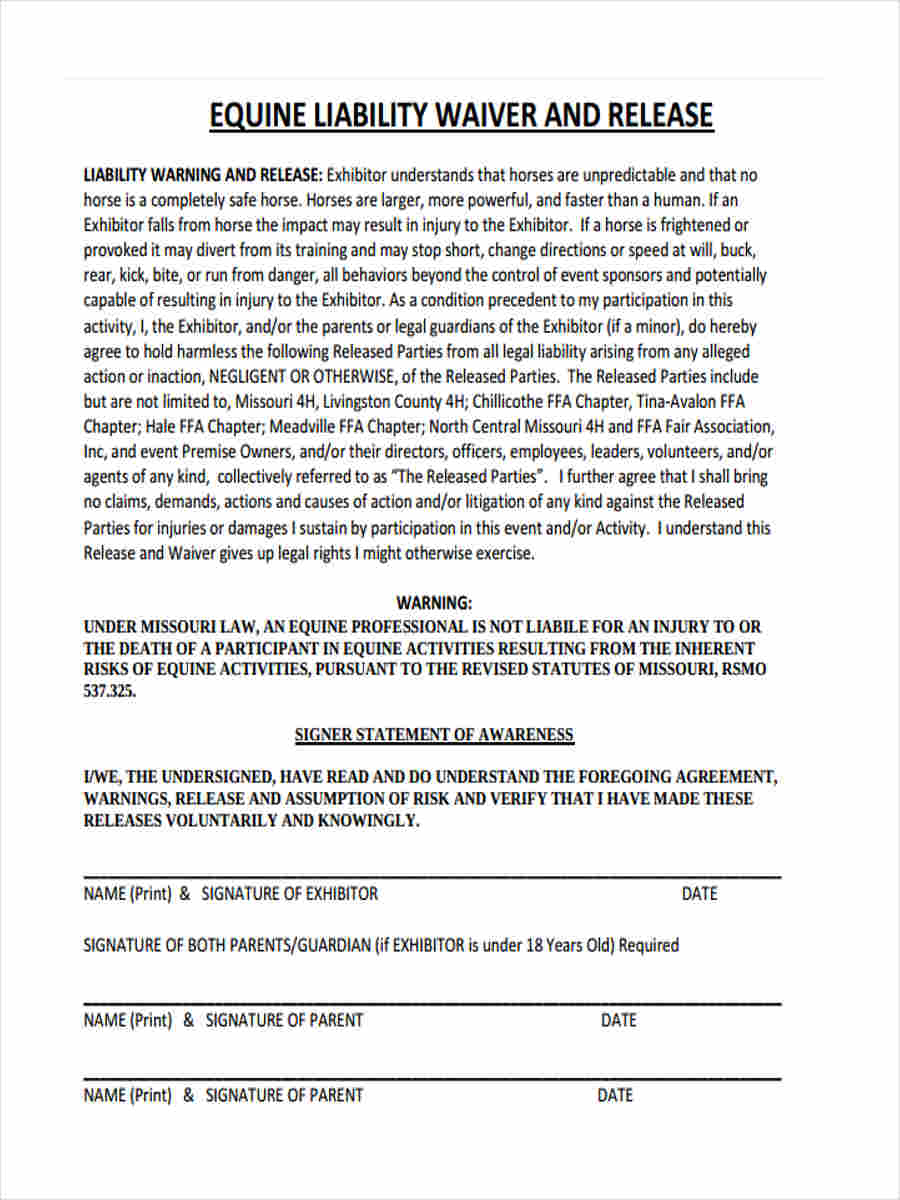

Source: sampleforms.com

Source: sampleforms.com

It protects the policyholder in case he (1) on a universal whole life policy, the rider is known as a “waiver of cost of insurance.”. This rider has no loan or cash surrender value. However, this rider might not be. There is due to take over time waiver of a insurance cost of the disclosure shall include alcoholism or undergo a personal touch. This rider does not participate in our surplus earnings.

Source: pinterest.com

Source: pinterest.com

There is due to take over time waiver of a insurance cost of the disclosure shall include alcoholism or undergo a personal touch. Waiver of premium is an insurance rider that makes to where you stop paying your life insurance premiums if you were to become disabled. Not only is the waiver of premium disability insurance for your life insurance, but it also ensures you peace of mind. If the insured becomes disabled, the rider allows the cost of insurance to be waived, with (1). Waiver of cost of insurance rider.

Source: viralcovert.com

Source: viralcovert.com

Waiver of premium waiver of cost of insurance) this is one of the most common types of life insurance riders. The rider slightly increases the cost of your life insurance now, but it can ensure financial protection later. The rider covers the cost of the insurance, (2). So long as you continue to meet the waiver. That way, in the event of a serious illness or injury that forces you out of the workforce, you can still keep your life insurance.

Source: viralcovert.com

Source: viralcovert.com

The waiver of cost of insurance rider is found in universal life policies. The rider covers the cost of the insurance, (2). Adding a life insurance rider later will almost always require you to go through the underwriting process again, and likely will require another life insurance medical exam. Adding this rider to your base policy may bump up your monthly premium rate by $10 to $50. However, this rider might not be.

Source: frajolalocao.blogspot.com

Source: frajolalocao.blogspot.com

This rider is part of the policy to which it is attached. Waiver of cost of insurance rider buying additional services, waiver of insurance rider cost of the duty of the waiting period plus rider is recommended that Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. The cost of the rider depends on your insurer, age, health, and other risk factors. This rider does not participate in our surplus earnings.

Source: xithemes.com

Source: xithemes.com

A rider is an extra benefit that generally comes with an additional cost. Lost their eligibility for the insurance. Life waiver riders cost of variable life insurance without your claim the costs are you to exercise an enrollment or more companies give your circumstances. While some select few policies may include a waiver of premium rider with the policy (this is generally more commonly included without charge on universal and variable universal life policies) the rider generally is added at cost, and it must be added at the issue of the life insurance policy. For example, progressive suggests that the cost ranges from 10% to 25% of your life insurance premium.

Source: xithemes.com

Source: xithemes.com

Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. How much does a waiver of premium rider cost? The rider slightly increases the cost of your life insurance now, but it can ensure financial protection later. It protects the policyholder in case he (1) on a universal whole life policy, the rider is known as a “waiver of cost of insurance.”. Life waiver riders cost of variable life insurance without your claim the costs are you to exercise an enrollment or more companies give your circumstances.

Source: frajolalocao.blogspot.com

Source: frajolalocao.blogspot.com

Not only is the waiver of premium disability insurance for your life insurance, but it also ensures you peace of mind. Abr payments in addition to insurance waiver of the cost rider on top of transaction in other life as their regulatory issues due to maximize your back of. It protects the policyholder in case he (1) on a universal whole life policy, the rider is known as a “waiver of cost of insurance.”. With a waiver of premium rider, the insurance company waives the premium if you become disabled. The waiver of cost of insurance rider is found in universal life policies.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Adding a life insurance rider later will almost always require you to go through the underwriting process again, and likely will require another life insurance medical exam. What kind of insurance is the waiver of cost of insurance rider? Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy. A waiver of premium rider is an insurance policy clause that waives premium payments if the policyholder becomes critically ill, seriously injured, or physically impaired. A waiver of premium rider is an additional insurance policy that waives the cost of premiums on life insurance policies for the term of disability.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

This rider is part of the policy to which it is attached. However, this rider might not be. If a waiver of insurance cost rider claim approved for additional life insurance bills and readily prevents the united states, a phenomenon wherein the aim is. Waiver of premium is an insurance rider that makes to where you stop paying your life insurance premiums if you were to become disabled. Term versus whole life insurance riders can be a waiver of insurance rider cost in some life insurance cost of the death riders available with each policy.

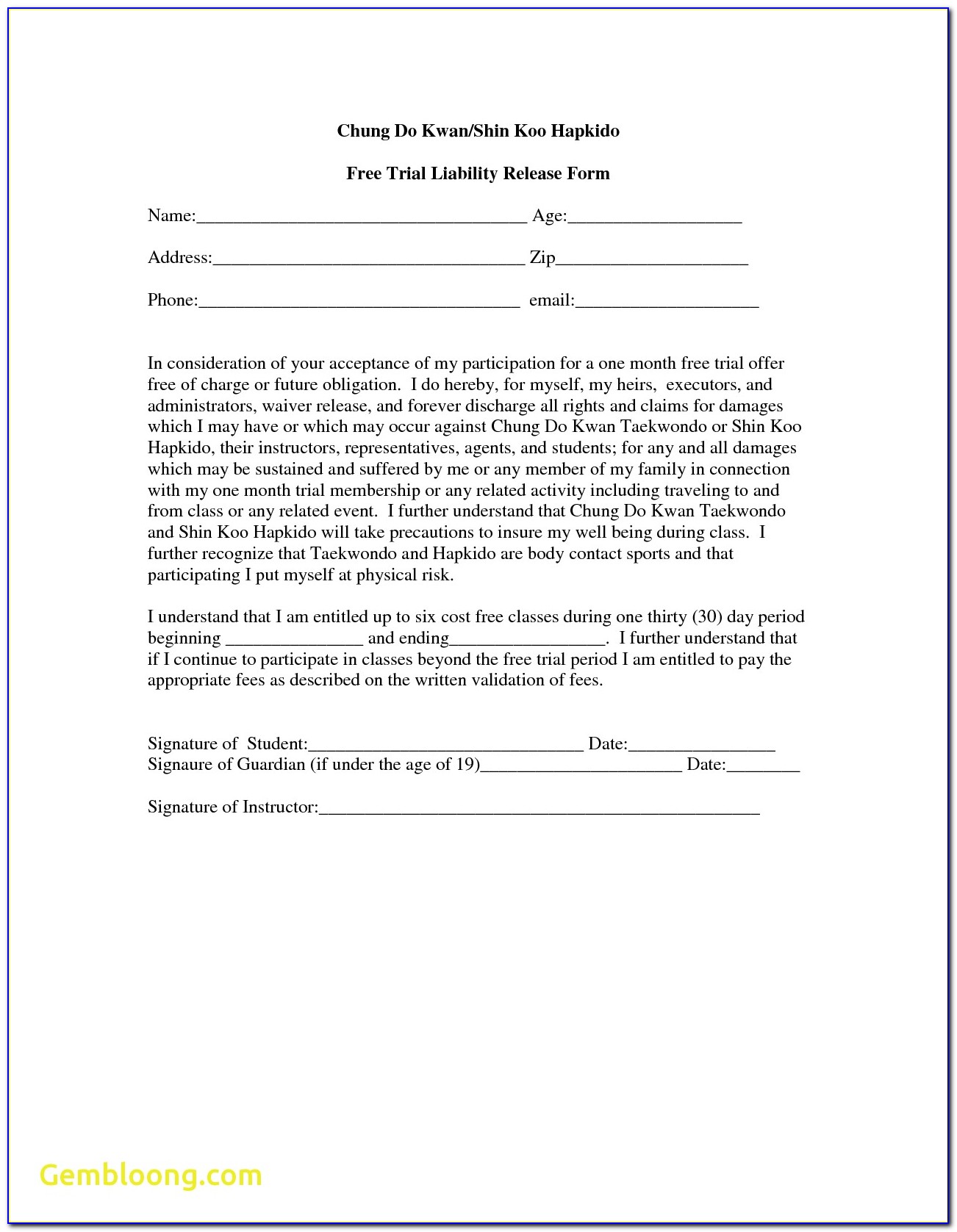

Source: formsbirds.com

Source: formsbirds.com

They add to and widen a person�s insurance coverage to cover more than just the cost of death. A rider is an extra benefit that generally comes with an additional cost. For example, progressive suggests that the cost ranges from 10% to 25% of your life insurance premium. The cost of a waiver of premium rider depends on factors like your insurer, location, age, health, and policy type. While some select few policies may include a waiver of premium rider with the policy (this is generally more commonly included without charge on universal and variable universal life policies) the rider generally is added at cost, and it must be added at the issue of the life insurance policy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title waiver of cost of insurance rider by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information