Waiver of premium life insurance Idea

Home » Trend » Waiver of premium life insurance IdeaYour Waiver of premium life insurance images are ready. Waiver of premium life insurance are a topic that is being searched for and liked by netizens today. You can Get the Waiver of premium life insurance files here. Get all royalty-free vectors.

If you’re searching for waiver of premium life insurance images information connected with to the waiver of premium life insurance keyword, you have come to the right site. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

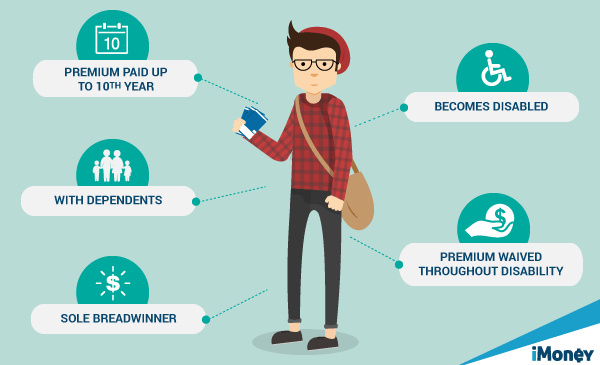

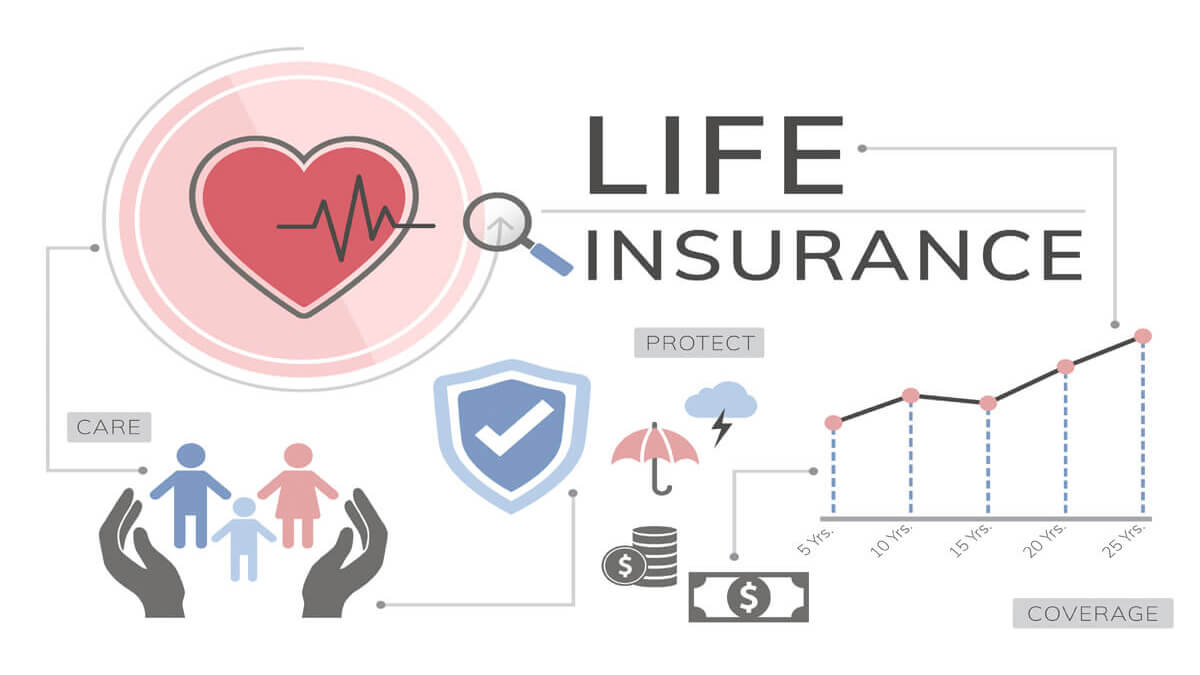

Waiver Of Premium Life Insurance. Waiver of premiums are most common as a �rider� on life. Many employer benefit plans also include a provision that entitle a disabled individual to receive group life insurance at no cost. A waiver of premium rider protects your policy from lapsing if you become disabled and can no longer pay your policy’s premiums. Waivers of premium are one such rider that makes it possible to avoid policy lapses should the insured become disabled and can�t meet their premium.

Smart Investment What Do Waiver Of Premium & Payor Riders From kei18kun-smartinvestment.blogspot.com

Smart Investment What Do Waiver Of Premium & Payor Riders From kei18kun-smartinvestment.blogspot.com

Waiver of premium is a life insurance rider # that prevents a policy from lapsing due to the failure of premium payments by the policyholder. Waiver of premiums are most common as a �rider� on life. The waiver of premium rider maintains your life insurance coverage while you are unable to work, freeing up cash flow for other critical needs. With a waiver of premium rider, you won’t need to make your premium payments—they are waived for the duration of your disability. This is commonly referred to as a “waiver of premium” or “disability premium waiver” benefit. Most individual life insurance policies.

Waiver of premiums are most common as a �rider� on life.

A waiver of premium is a rider which can be attached to an insurance policy, typically a life insurance policy, ensuring that the policy will continue to be in effect even if the policyholder experiences a loss of income. Typically, if you miss a monthly premium with life insurance products, your policy will be cancelled. A waiver of premium rider is an insurance policy clause that waives premium payments if the policyholder becomes critically ill, seriously injured, or disabled. This protects the insured from a policy lapse. What is waiver of premium rider in life insurance? Waiver of premium is a life insurance rider # that prevents a policy from lapsing due to the failure of premium payments by the policyholder.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

What is a waiver of premium? It allows you to miss monthly payments while maintaining your level of cover if you are unable to work due to illness or injury. Waivers of premium are one such rider that makes it possible to avoid policy lapses should the insured become disabled and can�t meet their premium. A waiver of premium benefit covers your life insurance premiums when you�re disabled. Japanese mom, dad, and daughter.

Source: kei18kun-smartinvestment.blogspot.com

Source: kei18kun-smartinvestment.blogspot.com

The primary feature of a waiver of premium rider # is that the life insurance policy continues to be valid even if certain events in the life of the policyholder bring about a pause in the stream of premium payments. In other words, you can forego the premium and still retain your life insurance policy. The waiver of premium rider maintains your life insurance coverage while you are unable to work, freeing up cash flow for other critical needs. Most individual life insurance policies. This is commonly referred to as a “waiver of premium” or “disability premium waiver” benefit.

Source: blog.bankbazaar.com

Source: blog.bankbazaar.com

Once your disability or unemployment periods end, you’ll need to start making premium payments to maintain your coverage. This is commonly referred to as a “waiver of premium” or “disability premium waiver” benefit. It helps prevent your life insurance coverage from becoming invalid if you’re not able to continue the payments. Waiver of premium life insurance refers to a policy that has a waiver of premium rider attached. What is waiver of premium rider in life insurance?

Source: icaagencyalliance.com

Source: icaagencyalliance.com

Waiver of premium is a life insurance rider # that prevents a policy from lapsing due to the failure of premium payments by the policyholder. It helps prevent your life insurance coverage from becoming invalid if you’re not able to continue the payments. With a waiver of premium rider, you won’t need to make your premium payments—they are waived for the duration of your disability. The waiver of premium life insurance claim denial. It is also called a waiver of premium for disability.

Source: bobatoo.co.uk

Source: bobatoo.co.uk

A waiver of premium rider is a policy underwritten by the insurance company that will cover the total cost of the premium if you become disabled. Think of a waiver of premium rider as insurance for your insurance policy. The primary feature of a waiver of premium rider # is that the life insurance policy continues to be valid even if certain events in the life of the policyholder bring about a pause in the stream of premium payments. Waiver of premium life insurance refers to a policy that has a waiver of premium rider attached. And, with a whole life policy, your cash value is guaranteed to grow.

Source: policybachat.com

Source: policybachat.com

In the case of waiver of premium, the rider allows you to forgo making monthly premium payments under certain circumstances. A waiver of premium benefit covers your life insurance premiums when you�re disabled. A waiver of premium is a rider which can be attached to an insurance policy, typically a life insurance policy, ensuring that the policy will continue to be in effect even if the policyholder experiences a loss of income. The waiver of premium life insurance claim denial. It can cover your monthly premiums if you can’t work because you’ve been seriously injured or are critically ill.

Source: i-brokers.com

Source: i-brokers.com

The primary feature of a waiver of premium rider # is that the life insurance policy continues to be valid even if certain events in the life of the policyholder bring about a pause in the stream of premium payments. With the waiver of premium rider, the idea. Waivers of premium are one such rider that makes it possible to avoid policy lapses should the insured become disabled and can�t meet their premium. These premiums are most classically used in life insurance so that the policy will fully mature and be available to the survivors of the. A waiver of premium rider protects your policy from lapsing if you become disabled and can no longer pay your policy’s premiums.

Source: youtube.com

Source: youtube.com

It can cover your monthly premiums if you can’t work because you’ve been seriously injured or are critically ill. The purpose of a rider for your life insurance policy is to customize your coverage in a way that better meets you and your beneficiaries� needs. Waiver of premium life insurance refers to a policy that has a waiver of premium rider attached. The available life insurance often comities for the duration of the disability,. With a waiver of premium rider, you won’t need to make your premium payments—they are waived for the duration of your disability.

Source: getwalnut.com

Source: getwalnut.com

This type of rider is especially attractive if you work in an occupation that puts you at greater risk of disability. In the case of waiver of premium, the rider allows you to forgo making monthly premium payments under certain circumstances. What does waiver of premium mean in life insurance? Happy asian young family homeowners bought new house. What does waiver of premium mean in life insurance?

Source: aga.ca

Source: aga.ca

It is also called a waiver of premium for disability. The primary feature of a waiver of premium rider # is that the life insurance policy continues to be valid even if certain events in the life of the policyholder bring about a pause in the stream of premium payments. Reserving for waiver of premium benefits in long duration accident and health insurance products has traditionally been an overlooked, if not neglected, issue in life insurance valuation due to gray areas of the law, immateriality of the affected business, and lack of actuarial resources. Once your disability or unemployment periods end, you’ll need to start making premium payments to maintain your coverage. What does waiver of premium mean in life insurance?

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

What is waiver of premium rider in life insurance? A waiver of premium rider is a clause in an insurance policy that provides life insurance coverage in the event of critical illness, serious injury, or total disability and does not require premium payments. A waiver of premium rider is a policy underwritten by the insurance company that will cover the total cost of the premium if you become disabled. Happy asian young family homeowners bought new house. A waiver of premium rider is a type of insurance policy clause that waives the policyholder’s premium payments if they become disabled, seriously injured, or critically ill.

Source: bestlifequote.com

Source: bestlifequote.com

Waiver of premiums are most common as a �rider� on life. Japanese mom, dad, and daughter. With the waiver of premium rider, the idea. The available life insurance often comities for the duration of the disability,. It can cover your monthly premiums if you can’t work because you’ve been seriously injured or are critically ill.

Source: ftlife.com.hk

Source: ftlife.com.hk

Think of a waiver of premium rider as insurance for your insurance policy. The waiver of premium life insurance claim denial. What is a waiver of premium? This is commonly referred to as a “waiver of premium” or “disability premium waiver” benefit. Waivers of premium are one such rider that makes it possible to avoid policy lapses should the insured become disabled and can�t meet their premium.

Source: themoneyadvantage.com

Source: themoneyadvantage.com

Most individual life insurance policies. Most individual life insurance policies. A waiver of premium benefit covers your life insurance premiums when you�re disabled. Japanese mom, dad, and daughter. A waiver of premium rider is an insurance policy clause that waives premium payments if the policyholder becomes critically ill, seriously injured, or disabled.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

What does waiver of premium mean in life insurance? The waiver of premium life insurance claim denial. This is commonly referred to as a “waiver of premium” or “disability premium waiver” benefit. The available life insurance often comities for the duration of the disability,. A waiver of premium rider is an insurance policy clause that waives premium payments if the policyholder becomes critically ill, seriously injured, or disabled.

Source: freepricecompare.com

Source: freepricecompare.com

With a waiver of premium rider, you won’t need to make your premium payments—they are waived for the duration of your disability. This is commonly referred to as a “waiver of premium” or “disability premium waiver” benefit. A waiver of premium rider is a type of insurance policy clause that waives the policyholder’s premium payments if they become disabled, seriously injured, or critically ill. And, with a whole life policy, your cash value is guaranteed to grow. Happy asian young family homeowners bought new house.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

In other words, you can forego the premium and still retain your life insurance policy. In other words, you can forego the premium and still retain your life insurance policy. Waiver of premium is a life insurance rider # that prevents a policy from lapsing due to the failure of premium payments by the policyholder. It keeps your policy active if you become disabled or unemployed and can’t pay your premiums. (waiver of premium explained) waiver of premium provision in a life insurance policy is a provision under which payment of premiums or insurance charges are waived should the policy owner becomes totally and permanently disabled.

Source: themoneyadvantage.com

Source: themoneyadvantage.com

A waiver of premium refers to a provision or clause in an insurance policy that relieves the policyholder of their obligation to pay any further premiums under certain conditions. With the waiver of premium rider, the idea. Reserving for waiver of premium benefits in long duration accident and health insurance products has traditionally been an overlooked, if not neglected, issue in life insurance valuation due to gray areas of the law, immateriality of the affected business, and lack of actuarial resources. With a waiver of premium rider, you won’t need to make your premium payments—they are waived for the duration of your disability. This type of rider is especially attractive if you work in an occupation that puts you at greater risk of disability.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title waiver of premium life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information