Walls in insurance policy information

Home » Trend » Walls in insurance policy informationYour Walls in insurance policy images are ready. Walls in insurance policy are a topic that is being searched for and liked by netizens now. You can Download the Walls in insurance policy files here. Get all free photos.

If you’re searching for walls in insurance policy pictures information connected with to the walls in insurance policy keyword, you have pay a visit to the ideal blog. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

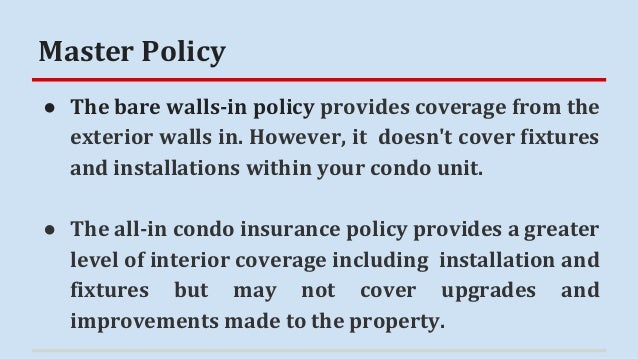

Walls In Insurance Policy. A bare walls in policy is a type of property insurance that is commonly purchased by people who live in condominiums. The ho6 is a named perils policy the ho6 is a named perils. A single entity policy covers everything a bare walls policy does, plus a bit more. The policy that the unit owner takes out is known as an ho6 policy—or contents insurance.

Does Your Master Policy Cover Improvement & Betterments? From mgriffinwriter.com

Does Your Master Policy Cover Improvement & Betterments? From mgriffinwriter.com

These policies tend to cover fixtures in the individual condo unit, but not alterations, appliances, or personal belongings. 2 | bare walls coverage: That’s where the term “walls in” comes from. An h06 or walls in policy is purchased by the unit owner through an insurance agency and for the most part, the owner decides on the level of coverage. Over the years, we’ve seen a number of lenders requiring condo unit owners to provide evidence of insurance stating that “walls in” coverage is provided by their insurance policy. The condo master policy must include the replacement of improvements and betterments to cover improvements and betterments made by the condo owner.

These policies tend to cover fixtures in the individual condo unit, but not alterations, appliances, or personal belongings.

The condo master policy must include the replacement of improvements and betterments to cover improvements and betterments made by the condo owner. It provides coverage for the walls and structure of the property, as well as things like sinks, cabinets, and refrigerators. A bare walls in policy is a type of property insurance that is commonly purchased by people who live in condominiums. Below are descriptions of each term, from narrower to broader, in terms of what part of your condo unit, if anything, is covered by the condominium building’s master insurance policy: An h06 or walls in policy is purchased by the unit owner through an insurance agency and for the most part, the owner decides on the level of coverage. Walls in insurance, also called single entity coverage or studs in coverage, covers a condo building from the exterior framing to the walls in the home.

Source: couponeasy.com

Source: couponeasy.com

That’s where the term “walls in” comes from. It provides coverage for the walls and structure of the property, as well as things like sinks, cabinets, and refrigerators. Refers to coverage of the structure of the condominium and the common areas within the condominium. This type of policy only covers exterior structural elements of a condo unit, like its exterior walls and roof. A bare walls policy may also cover damage to systems such as wiring and plumbing.

Source: slideshare.net

Source: slideshare.net

Refers to coverage of the structure of the condominium and the common areas within the condominium. To ensure neighbouring property is fully protected, the renovator must ensure that the contractor has adequate public liability insurance for negligent damage, and that there is a party wall policy in place for structural damage which is not the result of anyone’s negligence. These policies tend to cover fixtures in the individual condo unit, but not alterations, appliances, or personal belongings. What is walls in insurance? This type of bare walls policy is sometimes also referred to as a master policy.

Source: fr.slideshare.net

Source: fr.slideshare.net

Over the years, we’ve seen a number of lenders requiring condo unit owners to provide evidence of insurance stating that “walls in” coverage is provided by their insurance policy. One area of importance to remember is that these condo policies may not cover all perils. To ensure neighbouring property is fully protected, the renovator must ensure that the contractor has adequate public liability insurance for negligent damage, and that there is a party wall policy in place for structural damage which is not the result of anyone’s negligence. These policies tend to cover fixtures in the individual condo unit, but not alterations, appliances, or personal belongings. Usually, this means that things like appliances, carpeting, cabinets, and in some cases, interior walls are not covered for damage.

A named perils insurance policy specifically lists all the perils that the policy will insure. This type of bare walls policy is sometimes also referred to as a master policy. It provides coverage for the walls and structure of the property, as well as things like sinks, cabinets, and refrigerators. Also known as all inclusive and the most comprehensive of the three coverages, insuring all property in your development and fixtures in your unit. Business insurance built around your needs and requirements.

Source: classiccarwalls.blogspot.com

Source: classiccarwalls.blogspot.com

Refers to coverage of the structure of the condominium and the common areas within the condominium. To ensure neighbouring property is fully protected, the renovator must ensure that the contractor has adequate public liability insurance for negligent damage, and that there is a party wall policy in place for structural damage which is not the result of anyone’s negligence. A named perils insurance policy specifically lists all the perils that the policy will insure. The insured receives a business insurance contract, called the insurance policy, which details the conditions and circumstances under which the insured will be financially compensated. It differs from a bare walls policy, which only covers the walls and structure.

To ensure neighbouring property is fully protected, the renovator must ensure that the contractor has adequate public liability insurance for negligent damage, and that there is a party wall policy in place for structural damage which is not the result of anyone’s negligence. If an event damages or destroys property that is not included on the list of perils covered in the policy, the ho6 will not insure the belongings damaged as a result of that particular event. What is walls in insurance? The policy that the unit owner takes out is known as an ho6 policy—or contents insurance. A single entity policy covers everything a bare walls policy does, plus a bit more.

Source: savinjones.com

Source: savinjones.com

Ho6 insurance steps in to pick up where the hoa’s master policy leaves off, meaning it protects the walls and ceiling of your unit, its floors, and all its contents. If an event damages or destroys property that is not included on the list of perils covered in the policy, the ho6 will not insure the belongings damaged as a result of that particular event. It only applies to the common areas of the condo, such as the entryway, and does not cover anything inside the individual units, such as the fixtures, installations, and appliances. The ho6 is a named perils policy the ho6 is a named perils. A bare walls policy may also cover damage to systems such as wiring and plumbing.

Source: pinterest.com

Source: pinterest.com

Ho6 insurance steps in to pick up where the hoa’s master policy leaves off, meaning it protects the walls and ceiling of your unit, its floors, and all its contents. To ensure neighbouring property is fully protected, the renovator must ensure that the contractor has adequate public liability insurance for negligent damage, and that there is a party wall policy in place for structural damage which is not the result of anyone’s negligence. The unit owner (or the unit owner’s insurance carrier) will then be responsible to reconstruct the interior. Ho6 insurance steps in to pick up where the hoa’s master policy leaves off, meaning it protects the walls and ceiling of your unit, its floors, and all its contents. Walls in insurance, also called single entity coverage or studs in coverage, covers a condo building from the exterior framing to the walls in the home.

Source: amazon.com

Source: amazon.com

If an event damages or destroys property that is not included on the list of perils covered in the policy, the ho6 will not insure the belongings damaged as a result of that particular event. It only applies to the common areas of the condo, such as the entryway, and does not cover anything inside the individual units, such as the fixtures, installations, and appliances. These policies tend to cover fixtures in the individual condo unit, but not alterations, appliances, or personal belongings. A bare walls in policy is a type of property insurance that is commonly purchased by people who live in condominiums. A single entity policy covers everything a bare walls policy does, plus a bit more.

Source: mgriffinwriter.com

Source: mgriffinwriter.com

The condo master policy must include the replacement of improvements and betterments to cover improvements and betterments made by the condo owner. The policy that the unit owner takes out is known as an ho6 policy—or contents insurance. The amount of money charged is called the premium. Below are descriptions of each term, from narrower to broader, in terms of what part of your condo unit, if anything, is covered by the condominium building’s master insurance policy: If an event damages or destroys property that is not included on the list of perils covered in the policy, the ho6 will not insure the belongings damaged as a result of that particular event.

Source: loanwalls.blogspot.com

Source: loanwalls.blogspot.com

Walls in insurance, also called single entity coverage or studs in coverage, covers a condo building from the exterior framing to the walls in the home. These policies tend to cover fixtures in the individual condo unit, but not alterations, appliances, or personal belongings. This type of policy only covers exterior structural elements of a condo unit, like its exterior walls and roof. A single entity policy covers everything a bare walls policy does, plus a bit more. Over the years, we’ve seen a number of lenders requiring condo unit owners to provide evidence of insurance stating that “walls in” coverage is provided by their insurance policy.

Source: dreamstime.com

Source: dreamstime.com

This type of bare walls policy is sometimes also referred to as a master policy. This type of policy only covers exterior structural elements of a condo unit, like its exterior walls and roof. These policies tend to cover fixtures in the individual condo unit, but not alterations, appliances, or personal belongings. Bare walls coverage this includes the walls, floors and ceilings of the unit but not anything attached to them, such as carpets, light fixtures, appliances. An h06 or walls in policy is purchased by the unit owner through an insurance agency and for the most part, the owner decides on the level of coverage.

Source: slideshare.net

Source: slideshare.net

It’s a mystery how this term has perpetuated itself through the mortgage, and now insurance, industries. Business insurance built around your needs and requirements. The condo master policy must include the replacement of improvements and betterments to cover improvements and betterments made by the condo owner. Walls in insurance, also called single entity coverage or studs in coverage, covers a condo building from the exterior framing to the walls in the home. To ensure neighbouring property is fully protected, the renovator must ensure that the contractor has adequate public liability insurance for negligent damage, and that there is a party wall policy in place for structural damage which is not the result of anyone’s negligence.

Source: noclutter.cloud

Source: noclutter.cloud

Bare walls coverage this includes the walls, floors and ceilings of the unit but not anything attached to them, such as carpets, light fixtures, appliances. Bare walls coverage this includes the walls, floors and ceilings of the unit but not anything attached to them, such as carpets, light fixtures, appliances. It provides coverage for the walls and structure of the property, as well as things like sinks, cabinets, and refrigerators. An h06 or walls in policy is purchased by the unit owner through an insurance agency and for the most part, the owner decides on the level of coverage. The ho6 is a named perils policy the ho6 is a named perils.

Source: buywalls.blogspot.com

Source: buywalls.blogspot.com

These policies tend to cover fixtures in the individual condo unit, but not alterations, appliances, or personal belongings. Business insurance built around your needs and requirements. One area of importance to remember is that these condo policies may not cover all perils. The amount of money charged is called the premium. What is walls in insurance?

Source: policyreviews.com

Source: policyreviews.com

A bare walls policy may also cover damage to systems such as wiring and plumbing. Over the years, we’ve seen a number of lenders requiring condo unit owners to provide evidence of insurance stating that “walls in” coverage is provided by their insurance policy. Usually, there is a section on “insurance” which outlines this information. A bare walls in policy is a type of property insurance that is commonly purchased by people who live in condominiums. A named perils insurance policy specifically lists all the perils that the policy will insure.

Source: nolacondos.net

Source: nolacondos.net

Below are descriptions of each term, from narrower to broader, in terms of what part of your condo unit, if anything, is covered by the condominium building’s master insurance policy: The condo master policy must include the replacement of improvements and betterments to cover improvements and betterments made by the condo owner. Also known as all inclusive and the most comprehensive of the three coverages, insuring all property in your development and fixtures in your unit. The hoa walls out policy generally means that it will cover damage to the exterior walls, roofs, and other property contained inside the exterior framing, but not anything inside the unit. The ho6 is a named perils policy the ho6 is a named perils.

Source: dandavisins.com

Source: dandavisins.com

Over the years, we’ve seen a number of lenders requiring condo unit owners to provide evidence of insurance stating that “walls in” coverage is provided by their insurance policy. This type of bare walls policy is sometimes also referred to as a master policy. A bare walls in policy is a type of property insurance that is commonly purchased by people who live in condominiums. It provides coverage for the walls and structure of the property, as well as things like sinks, cabinets, and refrigerators. 2 | bare walls coverage:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title walls in insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information