Warranty insurance definition Idea

Home » Trend » Warranty insurance definition IdeaYour Warranty insurance definition images are available in this site. Warranty insurance definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Warranty insurance definition files here. Get all royalty-free vectors.

If you’re searching for warranty insurance definition pictures information related to the warranty insurance definition keyword, you have come to the ideal blog. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

Warranty Insurance Definition. This warranty implies that the matter (voyage) insured conducts in a lawful manner. The definition of warranty in an insurance is an agreement between the two parties (the insured and the insurer) that must be carried out with full responsibility by the insured. An extended auto warranty is an optional vehicle service contract offered by manufacturers, dealerships, and independent providers at an extra cost beyond the purchase price to cover the price to repair or replace certain parts for a specified period, or a certain number of miles beyond that covered by the manufacturer�s warranty. Warranties made by an insured party to an insurer.

The definition of warranty in an insurance is an agreement between the two parties (the (1) a warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. Breach of warranty clause — a lienholder�s or lessor�s interest endorsement that causes the policy to continue to protect the financial interest of a lienholder or lessor even when the insured breaches a condition, thereby voiding coverage. An indemnity, on the other hand, is a promise the seller makes at the time of sale to help the buyer make up any losses in case of the occurrence of a particular event. What does a warranty imply? Warranties are statements of assurance from a company that its products will perform as stated and that all codes and regulations were followed during its manufacturing.

(2) a statement of fact given to an insurer by the insured concerning the insured risk which, if untrue, will void the policy.

A company can void its warranty and have its claim denied if it fails to live up to the assurances given in the warranty. Warranties are relevant for product liability insurance. Warranties are statements of assurance from a company that its products will perform as stated and that all codes and regulations were followed during its manufacturing. Warranty — (1) a guarantee of the performance of a product. An introduction to warranty and indemnity insurance. For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease.

Source: thebluediamondgallery.com

Source: thebluediamondgallery.com

Reps and warranties insurance is essentially breach of contract cover designed to enhance or replace the indemnification given. Warranty insurance definition according to jrank , a warranty in an insurance policy states that something the insured person says is true. Most insurance policies do require an insured party to warrant that he or she will follow the contract. In insurance, a warranty is an ambiguous term that can mean two things depending on the context: This warranty implies that the matter (voyage) insured conducts in a lawful manner.

Source: insurancelovers.com

Source: insurancelovers.com

A warranty is a statement made by the seller at the time of sale that is factual and true. Product warranties are included within the definition of the named insured�s product in general liability policies. An introduction to warranty and indemnity insurance. (i) they help to flush out information which is inconsistent with the warranties that the seller is. What does a warranty imply?

Source: oncomie.blogspot.com

Source: oncomie.blogspot.com

In insurance, a warranty is an ambiguous term that can mean two things depending on the context: Any loss recoveries under this clause are payable only to the lienholder or lessor. Breach of warranty clause — a lienholder�s or lessor�s interest endorsement that causes the policy to continue to protect the financial interest of a lienholder or lessor even when the insured breaches a condition, thereby voiding coverage. In an insurance policy, a warranty is a promise. A warranty is a statement made by the seller at the time of sale that is factual and true.

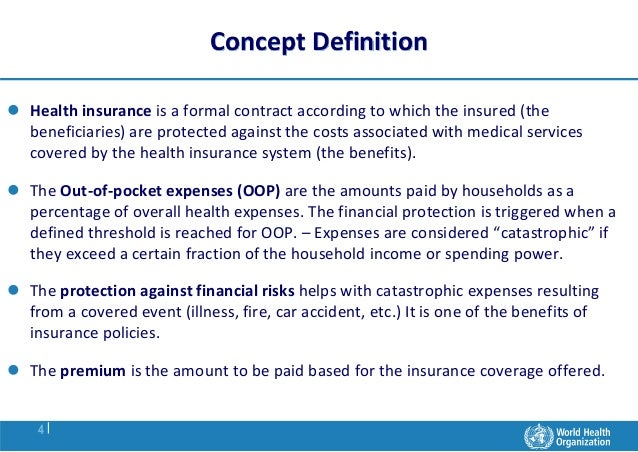

Source: slideshare.net

Source: slideshare.net

(2) a statement of fact given to an insurer by the insured concerning the insured risk which, if untrue, will void the policy. Most insurance contracts require the insured to make certain warranties. When a business is sold a seller is usually required to give various warranties to the buyer. Any loss recoveries under this clause are payable only to the lienholder or lessor. An introduction to warranty and indemnity insurance.

Source: pinterest.com

Source: pinterest.com

There is nothing standard about the sale or merger of a company and so very little is standard about the insurance that supports it. An insurance contract is written on the principle of utmost good faith, meaning each party must trust that the other is being completely truthful. Breach of warranty clause — a lienholder�s or lessor�s interest endorsement that causes the policy to continue to protect the financial interest of a lienholder or lessor even when the insured breaches a condition, thereby voiding coverage. An introduction to warranty and indemnity insurance. (2) a statement of fact given to an insurer by the insured concerning the insured risk which, if untrue, will void the policy.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

There is nothing standard about the sale or merger of a company and so very little is standard about the insurance that supports it. Warranty insurance definition according to jrank , a warranty in an insurance policy states that something the insured person says is true. It is a legal statement, where makes the aforementioned promises. For example, a health insurance plan would require the insured to warrant that he or she doesn. Warranties are statements of fact about the target business which protect a buyer in two primary ways:

Source: slideshare.net

Source: slideshare.net

A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. A company can void its warranty and have its claim denied if it fails to live up to the assurances given in the warranty. For example, a health insurance plan would require the insured to warrant that he or she doesn. An insurance contract is written on the principle of utmost good faith, meaning each party must trust that the other is being completely truthful.

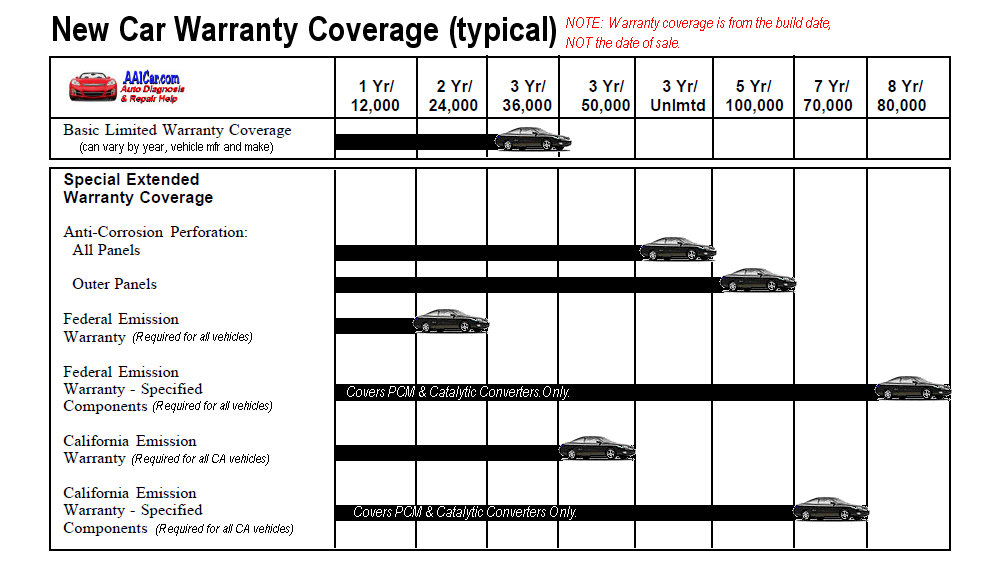

Source: aa1car.com

Source: aa1car.com

Warranties are statements of fact about the target business which protect a buyer in two primary ways: Most insurance contracts require the insured to make certain warranties. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease. A warranty, on the other hand, is an undertaking by the insured to the effect that he shall or shall not do a certain thing or that some conditions shall be fulfilled or whereby he affirms or negatives the existence of a particular state of affairs.

Source: slideshare.net

Source: slideshare.net

In an insurance policy, a warranty is a promise. For example, a health insurance plan would require the insured to warrant that he or she doesn. Warranty insurance definition according to jrank , a warranty in an insurance policy states that something the insured person says is true. An insurance contract is written on the principle of utmost good faith, meaning each party must trust that the other is being completely truthful. Warranty — (1) a guarantee of the performance of a product.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Warranties may be either express or implied. This warranty implies that the matter (voyage) insured conducts in a lawful manner. The definition of warranty in an insurance is an agreement between the two parties (the (1) a warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. (2) a statement of fact given to an insurer by the insured concerning the insured risk which, if untrue, will void the policy. A warranty, on the other hand, is an undertaking by the insured to the effect that he shall or shall not do a certain thing or that some conditions shall be fulfilled or whereby he affirms or negatives the existence of a particular state of affairs.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Warranties may be either express or implied. A warranty is a statement made by the seller at the time of sale that is factual and true. For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease. A clause in an insurance contract that requires certain conditions, circumstances, or facts to be tr A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true.

Source: rochamika.blogspot.com

Source: rochamika.blogspot.com

An introduction to warranty and indemnity insurance. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. Representation and warranties insurance is a complex solution for a complex situation. When a business is sold a seller is usually required to give various warranties to the buyer. Warranty — (1) a guarantee of the performance of a product.

Source: itstillruns.com

Source: itstillruns.com

Warranties made by an insured party to an insurer. There is nothing standard about the sale or merger of a company and so very little is standard about the insurance that supports it. Product warranties are included within the definition of the named insured�s product in general liability policies. Reps and warranties insurance is essentially breach of contract cover designed to enhance or replace the indemnification given. The definition of warranty in an insurance is an agreement between the two parties (the (1) a warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true.

The definition of warranty in an insurance is an agreement between the two parties (the (1) a warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. Representation and warranties insurance is a complex solution for a complex situation. An indemnity, on the other hand, is a promise the seller makes at the time of sale to help the buyer make up any losses in case of the occurrence of a particular event. Breach of warranty clause — a lienholder�s or lessor�s interest endorsement that causes the policy to continue to protect the financial interest of a lienholder or lessor even when the insured breaches a condition, thereby voiding coverage. That no content, object, person, or any condition, attached to the insurance policy undertaking is illegal.

Source: secretdiaryofanamericangirl.blogspot.com

Source: secretdiaryofanamericangirl.blogspot.com

A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. Warranty insurance definition according to jrank , a warranty in an insurance policy states that something the insured person says is true. Warranty — (1) a guarantee of the performance of a product. It is a legal statement, where makes the aforementioned promises. The definition of warranty in an insurance is an agreement between the two parties (the insured and the insurer) that must be carried out with full responsibility by the insured.

Source: homewarrantyreviews.com

Source: homewarrantyreviews.com

A warranty is a form of guarantee that a manufacturer offers to repair or replace a faulty product within a window of time after purchase. This warranty implies that the matter (voyage) insured conducts in a lawful manner. Warranties made by an insured party to an insurer. For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease. (i) they help to flush out information which is inconsistent with the warranties that the seller is.

Source: korweld.com.ph

Source: korweld.com.ph

Warranty — (1) a guarantee of the performance of a product. Warranties may be either express or implied. For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease. An indemnity, on the other hand, is a promise the seller makes at the time of sale to help the buyer make up any losses in case of the occurrence of a particular event. A company can void its warranty and have its claim denied if it fails to live up to the assurances given in the warranty.

Source: lisbonlx.com

Source: lisbonlx.com

Warranty — (1) a guarantee of the performance of a product. A warranty is a form of guarantee that a manufacturer offers to repair or replace a faulty product within a window of time after purchase. A clause in an insurance contract that requires certain conditions, circumstances, or facts to be tr An extended auto warranty is an optional vehicle service contract offered by manufacturers, dealerships, and independent providers at an extra cost beyond the purchase price to cover the price to repair or replace certain parts for a specified period, or a certain number of miles beyond that covered by the manufacturer�s warranty. Reps and warranties insurance is essentially breach of contract cover designed to enhance or replace the indemnification given.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title warranty insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information