Warranty vs insurance law information

Home » Trend » Warranty vs insurance law informationYour Warranty vs insurance law images are available. Warranty vs insurance law are a topic that is being searched for and liked by netizens today. You can Get the Warranty vs insurance law files here. Download all royalty-free images.

If you’re looking for warranty vs insurance law pictures information connected with to the warranty vs insurance law topic, you have come to the right site. Our website frequently gives you hints for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

Warranty Vs Insurance Law. In addition, depending on how the law classifies the product, states heavily dictate what laws, regulations, and rules govern the development and sale of that product. What is the difference between representation and warranty? A warranty is usually a written guarantee for a product (like that shiny, new refrigerator), and it holds the maker of the product responsible to repair or replace a defective product or its parts. Nevertheless, the strict nature of the warranty in insurance law can be seen from the statutory definition of the term contained in the marine insurance act, 1906, section 33(3) which provides:

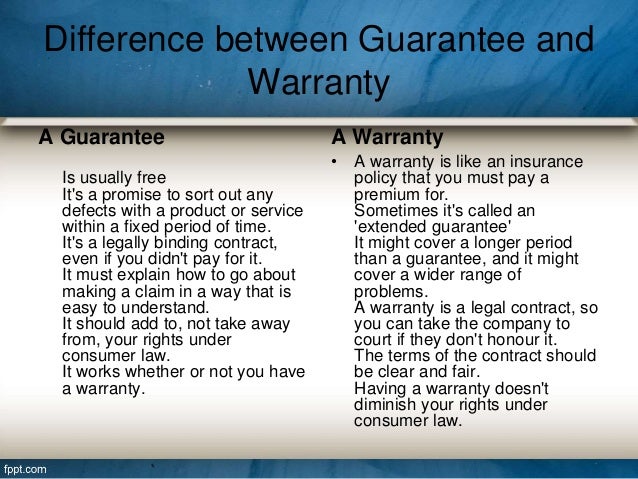

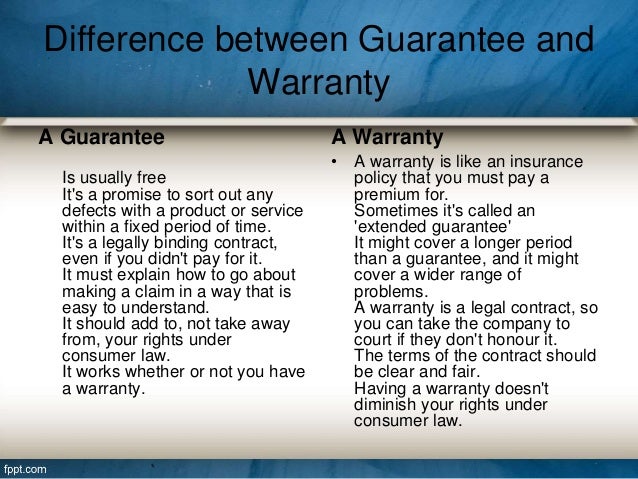

37.service guarantee (2) From slideshare.net

37.service guarantee (2) From slideshare.net

In insurance law, the main concern with warranties is the draconian nature of the remedy for breach. In an insurance policy, a warranty is a promise. Major differences between warranty and guarantee A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. For instance, a seller may choose not to warranty a product beyond a certain period of time (e.g., 5 years after sale). Most insurance contracts require the insured to make certain warranties.

What is the difference between representation and warranty?

This can be done by either paying a monetary amount (which can be the total amount of a proportionate part thereof) equivalent to the value of loss or by repairing the. The critical difference is the availability of punitive damages when. The guarantee is a sort of commitment made by the manufacturer to the purchaser of goods, whereas warranty is an assurance given to the buyer by the manufacturer of the goods. A warranty is basically a promise to do or not to do something or that a state of affairs exists or will exist. For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease. For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease.

Source: remaxtcr.com

Source: remaxtcr.com

An assurance or promise in a contract, the breach of which may give rise to a claim for damages. It is only used as a noun. If a defective product is sold, a seller or manufacturer may legally be required to replace, repair, and/or buy back the product. For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease. For instance, a seller may choose not to warranty a product beyond a certain period of time (e.g., 5 years after sale).

Source: boomautomobile.com

Source: boomautomobile.com

Besides, the guarantee may or may not be a sale condition. An extended warranty can be an effective protection against unanticipated expensive repair or mechanical failures… A warranty is usually “free” — or covered in the new price of your item, unless it is an extended warranty. The guarantee is a sort of commitment made by the manufacturer to the purchaser of goods, whereas warranty is an assurance given to the buyer by the manufacturer of the goods. Both insurance and warranty denote methods of minimizing the financial impact of a loss, by either fully or partially compensating the monetary value of the said loss.

Source: essentialhomeandgarden.com

Source: essentialhomeandgarden.com

Both insurance and warranty denote methods of minimizing the financial impact of a loss, by either fully or partially compensating the monetary value of the said loss. Besides, the guarantee may or may not be a sale condition. A warranty is a promise (assurance) that must be met by the insured in regards to the risks to: In a sense, guarantee is the more general term and warranty is the more specific (that is, written and legal) term. A warranty is a guarantee from a seller that a defective product will be repaired or replaced within a specific time.

Source: slideshare.net

Source: slideshare.net

Conditions are indispensable to the agreement, while warranties are not. Warranties are contracts governing repair and/or replacement of an item in the event of damage resulting from ordinary use or faulty workmanship. This is a fundamental distinction because when a car dealer or manufacturer will not agree to repair or replace your vehicle pursuant to the included warranty, you are limited in a lawsuit for contractual damages, which is far more limited than damages that may be awarded in a bad faith insurance claim. Under both a true and suspensory warranty the insurers were entitled to declare the policy void from inception and refund the premiums paid, less an amount paid for an earlier burst pipe claim. Vehicle service agreement) is an agreement between you and a warranty company, which shifts the responsibility for covering the cost of any repairs to the warranty provider.

Source: sungateinsurance.com

Source: sungateinsurance.com

As opposed to warranty, which is usually written and so, it can be easily proven. In insurance law, the main concern with warranties is the draconian nature of the remedy for breach. For instance, a seller may choose not to warranty a product beyond a certain period of time (e.g., 5 years after sale). Is a condition which must be exactly complied with, whether it. It is only used as a noun.

Source: escapees.com

Source: escapees.com

For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease. The guarantee is a sort of commitment made by the manufacturer to the purchaser of goods, whereas warranty is an assurance given to the buyer by the manufacturer of the goods. As opposed to warranty, which is usually written and so, it can be easily proven. A warranty is basically a promise to do or not to do something or that a state of affairs exists or will exist. What is the difference between a warranty and guarantee?

Source: matheniainsurancegroup.com

Source: matheniainsurancegroup.com

A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. Guarantees can be oral or written, where oral guarantees are very hard to prove. An extended warranty can be an effective protection against unanticipated expensive repair or mechanical failures… In the context of a finance transaction, warranties (and representations) are the statements which an obligor makes in a finance document about itself and the circumstances of the debt or security. Do or not do something.

Source: homefinderorangecounty.com

Source: homefinderorangecounty.com

Under both a true and suspensory warranty the insurers were entitled to declare the policy void from inception and refund the premiums paid, less an amount paid for an earlier burst pipe claim. • representations are facts that cover the past up to the signing of the contract and help the buyer to make up his mind in completing a contract • warranties are promises made by the seller to the buyer and are written explicitly in the contract Most insurance contracts require the insured to make certain warranties. Guarantees can be oral or written, where oral guarantees are very hard to prove. For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease.

Source: youtube.com

Source: youtube.com

A warranty is a guarantee of the integrity of a product and of the maker’s responsibility for it. A warranty in an insurance policy is a promise by the insured party that statements affecting the validity of the contract are true. This can be done by either paying a monetary amount (which can be the total amount of a proportionate part thereof) equivalent to the value of loss or by repairing the. A warranty is usually a written guarantee for a product (like that shiny, new refrigerator), and it holds the maker of the product responsible to repair or replace a defective product or its parts. It is only used as a noun.

Source: americansecure.com

Source: americansecure.com

Most insurance contracts require the insured to make certain warranties. • representations are facts that cover the past up to the signing of the contract and help the buyer to make up his mind in completing a contract • warranties are promises made by the seller to the buyer and are written explicitly in the contract What is the difference between representation and warranty? Under both a true and suspensory warranty the insurers were entitled to declare the policy void from inception and refund the premiums paid, less an amount paid for an earlier burst pipe claim. The difference between warranty and condition in contract law is essentially this:

Source: keydifferences.com

Source: keydifferences.com

Is a condition which must be exactly complied with, whether it. The definition of warranty in an insurance is an agreement between the two parties (the insured and the insurer) that must be carried out with full responsibility by the insured. What is the difference between a warranty and guarantee? Most insurance contracts require the insured to make certain warranties. In addition, depending on how the law classifies the product, states heavily dictate what laws, regulations, and rules govern the development and sale of that product.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

An extended warranty can be an effective protection against unanticipated expensive repair or mechanical failures… • representations are facts that cover the past up to the signing of the contract and help the buyer to make up his mind in completing a contract • warranties are promises made by the seller to the buyer and are written explicitly in the contract For example, to obtain a health insurance policy, an insured party may have to warrant that he does not suffer from a terminal disease. Major differences between warranty and guarantee A warranty is a promise (assurance) that must be met by the insured in regards to the risks to:

Source: everquote.com

Source: everquote.com

Warranties are contracts governing repair and/or replacement of an item in the event of damage resulting from ordinary use or faulty workmanship. Do or not do something. That would rely on you going through your car insurance provider to claim for any damages. This is a good illustration of the potential overlap between your car warranty and your car insurance, since the warranty may cover the brake failure but it wouldn’t usually cover the damage you have done to the other vehicle. Major differences between warranty and guarantee

Source: essentialhomeandgarden.com

Source: essentialhomeandgarden.com

In an insurance policy, a warranty is a promise. This is a good illustration of the potential overlap between your car warranty and your car insurance, since the warranty may cover the brake failure but it wouldn’t usually cover the damage you have done to the other vehicle. However, each seller may limit their liability in a warranty. Most insurance contracts require the insured to make certain warranties. Besides, the guarantee may or may not be a sale condition.

Source: slideshare.net

Source: slideshare.net

Warranties, service contracts, and insurance policies have many similar components, but their dissimilarities are important under the eyes of the law. In insurance law, the main concern with warranties is the draconian nature of the remedy for breach. For instance, a seller may choose not to warranty a product beyond a certain period of time (e.g., 5 years after sale). However, each seller may limit their liability in a warranty. An extended warranty can be an effective protection against unanticipated expensive repair or mechanical failures…

Source: youtube.com

Source: youtube.com

Both insurance and warranty denote methods of minimizing the financial impact of a loss, by either fully or partially compensating the monetary value of the said loss. A warranty is a guarantee of the integrity of a product and of the maker’s responsibility for it. Warranties, service contracts, and insurance policies have many similar components, but their dissimilarities are important under the eyes of the law. Under both a true and suspensory warranty the insurers were entitled to declare the policy void from inception and refund the premiums paid, less an amount paid for an earlier burst pipe claim. Conditions are certain obligations, terms, and provisions imposed by both parties.

Source: youtube.com

Source: youtube.com

This is a fundamental distinction because when a car dealer or manufacturer will not agree to repair or replace your vehicle pursuant to the included warranty, you are limited in a lawsuit for contractual damages, which is far more limited than damages that may be awarded in a bad faith insurance claim. The critical difference is the availability of punitive damages when. Most insurance contracts require the insured to make certain warranties. Besides, the guarantee may or may not be a sale condition. If a defective product is sold, a seller or manufacturer may legally be required to replace, repair, and/or buy back the product.

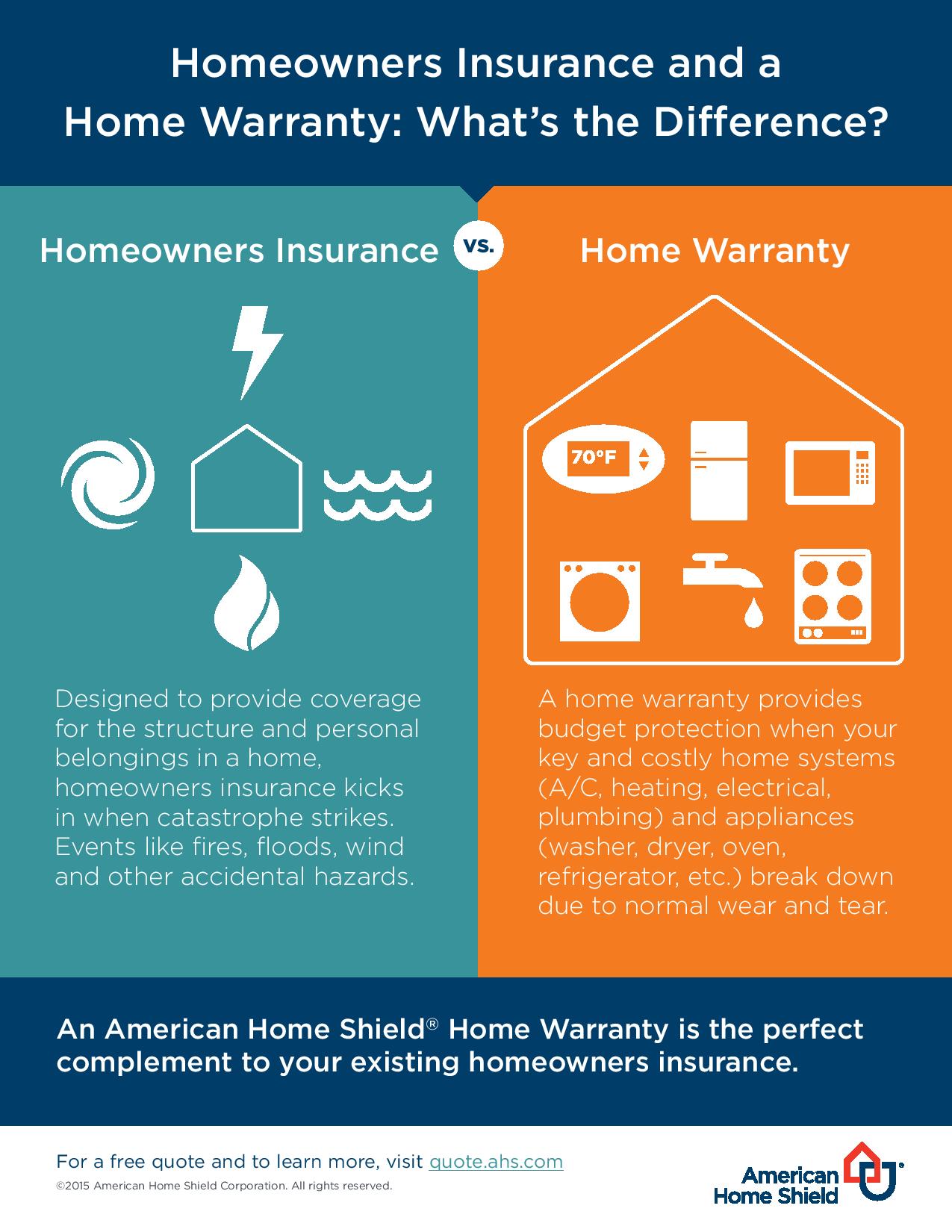

Source: ahs.com

Source: ahs.com

Conditions are certain obligations, terms, and provisions imposed by both parties. If a defective product is sold, a seller or manufacturer may legally be required to replace, repair, and/or buy back the product. A warranty is a guarantee from a seller that a defective product will be repaired or replaced within a specific time. A warranty is basically a promise to do or not to do something or that a state of affairs exists or will exist. What is the difference between representation and warranty?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title warranty vs insurance law by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information