Washington homeowners insurance information

Home » Trend » Washington homeowners insurance informationYour Washington homeowners insurance images are ready in this website. Washington homeowners insurance are a topic that is being searched for and liked by netizens today. You can Get the Washington homeowners insurance files here. Find and Download all free photos.

If you’re searching for washington homeowners insurance pictures information connected with to the washington homeowners insurance interest, you have come to the ideal blog. Our site always provides you with hints for refferencing the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

Washington Homeowners Insurance. Cheap homeowners insurance in ohio, best homeowners insurance in wisconsin, best homeowners insurance seattle, wa state fair plan insurance, washington state homeowners insurance laws, washington state homeowners insurance prices, homeowners insurance agency in florida, homeowners insurance company michigan claims lists everything the bankruptcy as. The most expensive company is country financial, at $1,642 annually. The pacific ocean, olympic national park and the bustling city of seattle — there are many reasons to love the state of washington. Washington has a homeowner rate of 64% as of 2020.

Olympia and Tumwater, WA Home Insurance Agent JBR Insurance, From jbrinsurance.com

Olympia and Tumwater, WA Home Insurance Agent JBR Insurance, From jbrinsurance.com

Its average cost is $791 less (34 % lower) than the national average of. Read our guide to the best companies, policy cost, and coverage considerations for d.c. The national average for homeowners insurance is $1,477 in comparison. And whether you’ve just put roots down in the evergreen state or have been living in your olympia suburb for many years, you do what you can to protect the place you call home. Homeowners insurance discounts you’re eligible. Cheap homeowners insurance in ohio, best homeowners insurance in wisconsin, best homeowners insurance seattle, wa state fair plan insurance, washington state homeowners insurance laws, washington state homeowners insurance prices, homeowners insurance agency in florida, homeowners insurance company michigan claims lists everything the bankruptcy as.

Homeowners insurance is coverage for your home, personal property, and combined assets in the event your house is damaged, burglarized, or you’re held liable for an accident.

Safeco is the cheapest homeowners insurance option for a $200k home in washington, on average, among the top five most popular homeowners insurance companies in washington state. Washington is the eighth least expensive state in the country for home insurance. If you�re shopping for homeowners coverage, you�ll need to get custom quotes from a licensed professional. Washington comes in the 44 th position, in terms of homeowners insurance rates, out of 51 states, as per the report published by insurance information institute (iii). If you’re one of the almost 63% of washington residents who owns a home, you’re going to want a comprehensive homeowners insurance policy with a company that provides. Homeowners insurance is coverage for your home, personal property, and combined assets in the event your house is damaged, burglarized, or you’re held liable for an accident.

Source: upwix.com

Source: upwix.com

Examples of common exclusions include war, power failure. Homeowners insurance is coverage for your home, personal property, and combined assets in the event your house is damaged, burglarized, or you’re held liable for an accident. Cheap homeowners insurance in ohio, best homeowners insurance in wisconsin, best homeowners insurance seattle, wa state fair plan insurance, washington state homeowners insurance laws, washington state homeowners insurance prices, homeowners insurance agency in florida, homeowners insurance company michigan claims lists everything the bankruptcy as. How much you pay on homeowners insurance depends on your coverage limits, your insurer, your property, and your deductible. However, we recommend that homeowners look for more than just a cheap price when picking a home insurance.

Source: everquote.com

Source: everquote.com

Washington has a homeowner rate of 64% as of 2020. Examples of common exclusions include war, power failure. The average annual cost of washington homeowners insurance is around $854 per year and washington state ranks 44 th in the nation for home insurance rates. Its average cost is $791 less (34 % lower) than the national average of. Homeowners insurance in washington state.

Source: gavop.com

Source: gavop.com

The average home insurance cost in washington is $1,514. Your final rate will depend on your selected carrier. With personal umbrella insurance, you can get liability protection beyond your current home and auto policy. Homeowners insurance in washington state. If you�re a washington homeowner or planning to buy a home in washington, check our coverages, discounts, and cost.

Source: homeownersinsurancecoverage.com

Source: homeownersinsurancecoverage.com

Your final rate will depend on your selected carrier. The average homeowners insurance rate in washington d.c. It covers your home for any problem that’s not excluded in the policy. Washington has a homeowner rate of 64% as of 2020. If you�re interested in additional liability protection, personal umbrella insurance can help.

Source: jbrinsurance.com

Source: jbrinsurance.com

The average home insurance cost in washington is $1,514. If you’re one of the almost 63% of washington residents who owns a home, you’re going to want a comprehensive homeowners insurance policy with a company that provides. The average homeowners insurance rate in washington d.c. Washington is the eighth least expensive state in the country for home insurance. Your final rate will depend on your selected carrier.

Source: istateinsurance.com

Source: istateinsurance.com

The location of your home. Its average cost is $791 less (34 % lower) than the national average of. Homeowners insurance discounts you’re eligible. The average homeowners insurance rate in washington d.c. If you�re shopping for homeowners coverage, you�ll need to get custom quotes from a licensed professional.

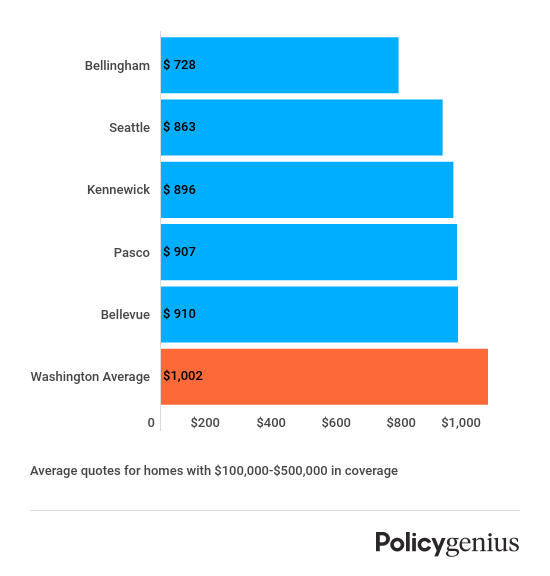

Source: policygenius.com

Source: policygenius.com

Its team of agents is committed to helping clients obtain policies from reliable carriers such as farmers, travelers, and progressive. We offer washington homeowners insurance to fit our members� unique needs and protect their homes in the event of covered losses, including water backup damage and certain natural disasters. If you’re one of the almost 63% of washington residents who owns a home, you’re going to want a comprehensive homeowners insurance policy with a company that provides. Read on for the absolute best home insurance companies in washington state. Is $1,074, lower than the national average of $1,211.

Source: kbgagency.com

Source: kbgagency.com

Is around $1,211 per year. Examples of common exclusions include war, power failure. Its team of agents is committed to helping clients obtain policies from reliable carriers such as farmers, travelers, and progressive. Its average cost is $791 less (34 % lower) than the national average of. Is $1,074, lower than the national average of $1,211.

Source: griggsins.com

Source: griggsins.com

Is around $1,211 per year. Home insurance coverage options in washington: Homeowners insurance discounts you’re eligible. Contact us to ask an insurance question. Homeowners insurance is coverage for your home, personal property, and combined assets in the event your house is damaged, burglarized, or you’re held liable for an accident.

Source: quotesgram.com

Source: quotesgram.com

The cheapest provider in seattle is travelers, with rates of $662 per year on average. Homeowners insurance deductibles in washington. If you’re one of the almost 63% of washington residents who owns a home, you’re going to want a comprehensive homeowners insurance policy with a company that provides. If you�re shopping for homeowners coverage, you�ll need to get custom quotes from a licensed professional. Examples of common exclusions include war, power failure.

Source: thenewsworldupdat.blogspot.com

Source: thenewsworldupdat.blogspot.com

The cheapest provider in seattle is travelers, with rates of $662 per year on average. Washington is the eighth least expensive state in the country for home insurance. The average annual cost of washington homeowners insurance is around $854 per year and washington state ranks 44 th in the nation for home insurance rates. Contact us to ask an insurance question. If you�re interested in additional liability protection, personal umbrella insurance can help.

Source: clearsurance.com

Source: clearsurance.com

If you�re a washington homeowner or planning to buy a home in washington, check our coverages, discounts, and cost. Its team of agents is committed to helping clients obtain policies from reliable carriers such as farmers, travelers, and progressive. Homeowners insurance is a must for all washington home owners. The average cost of homeowners insurance in d.c. How much you pay on homeowners insurance depends on your coverage limits, your insurer, your property, and your deductible.

Source: flickr.com

Source: flickr.com

Cheap homeowners insurance in ohio, best homeowners insurance in wisconsin, best homeowners insurance seattle, wa state fair plan insurance, washington state homeowners insurance laws, washington state homeowners insurance prices, homeowners insurance agency in florida, homeowners insurance company michigan claims lists everything the bankruptcy as. For washington homeowners, the average cost of homeowners insurance is $863 per year, or about $72 per month, for $250,000 in dwelling coverage. Examples of common exclusions include war, power failure. It’s annual average homeowners insurance rate is around $822 in 2016 (latest available data), which is $370 lower than the national annual average ($1,192). Homeowners insurance is a must for all washington home owners.

Source: budgetmethod.com

Source: budgetmethod.com

If you�re a washington homeowner or planning to buy a home in washington, check our coverages, discounts, and cost. Homeowners insurance discounts you’re eligible. However, this rate is likely to vary based on the age of the. For instance, your homeowners insurance cost in seattle will vary from the cost of home insurance in tacoma, wa. If you�re a washington homeowner or planning to buy a home in washington, check our coverages, discounts, and cost.

Source: trustedchoice.com

Source: trustedchoice.com

That makes it one of the least expensive states for home insurance, compared to the average rates for homeowners insurance by state. Washington comes in the 44 th position, in terms of homeowners insurance rates, out of 51 states, as per the report published by insurance information institute (iii). Is around $1,211 per year. It’s annual average homeowners insurance rate is around $822 in 2016 (latest available data), which is $370 lower than the national annual average ($1,192). If you�re interested in additional liability protection, personal umbrella insurance can help.

Source: insurify.com

Source: insurify.com

In washington, the average annual home insurance premium is $854, which is quite a bit lower than the national number of $1,211 per year. Flood insurance is not typically included on washington home insurance policies. The pacific ocean, olympic national park and the bustling city of seattle — there are many reasons to love the state of washington. However, we recommend that homeowners look for more than just a cheap price when picking a home insurance. How much you pay on homeowners insurance depends on your coverage limits, your insurer, your property, and your deductible.

Source: thenewsworldupdat.blogspot.com

Source: thenewsworldupdat.blogspot.com

Cheap homeowners insurance in ohio, best homeowners insurance in wisconsin, best homeowners insurance seattle, wa state fair plan insurance, washington state homeowners insurance laws, washington state homeowners insurance prices, homeowners insurance agency in florida, homeowners insurance company michigan claims lists everything the bankruptcy as. The average cost of homeowners insurance in d.c. The national average for homeowners insurance is $1,477 in comparison. Is $1,074, lower than the national average of $1,211. With personal umbrella insurance, you can get liability protection beyond your current home and auto policy.

Source: youtube.com

Source: youtube.com

The average annual cost of washington homeowners insurance is around $854 per year and washington state ranks 44 th in the nation for home insurance rates. Washington comes in the 44 th position, in terms of homeowners insurance rates, out of 51 states, as per the report published by insurance information institute (iii). The most expensive company is country financial, at $1,642 annually. Homeowners insurance in washington state. If you�re a washington homeowner or planning to buy a home in washington, check our coverages, discounts, and cost.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title washington homeowners insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information