Water backup insurance Idea

Home » Trending » Water backup insurance IdeaYour Water backup insurance images are available. Water backup insurance are a topic that is being searched for and liked by netizens now. You can Download the Water backup insurance files here. Find and Download all royalty-free photos and vectors.

If you’re looking for water backup insurance images information connected with to the water backup insurance keyword, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

Water Backup Insurance. You should constantly work closely with your insurance agent or broker whilst purchasing insurance, however understanding some of the terminology and concerns will help you. Water backup insurance offers protection for any damage to your home caused by a blocked sewer line, broken sump pump, or clogged drains. Yes, it’s probably a good idea to get water backup insurance as a renter. Coverage can assist when dealing with water damage resulting from incidents caused by sewers, drains, and sump pump wells.

Water Backup vs Flood Insurance What’s the Difference From plazare.com

Water Backup vs Flood Insurance What’s the Difference From plazare.com

Add sewer backup insurance for peace of mind if you endure a water disaster! As a renter, do not depend on the homeowner to supply sewer backup insurance, be safe and purchase your own. Water backup coverage is offered as an endorsement by most homeowners insurance companies, and you can typically opt for coverage of $5,000 to $25,000 in $5,000 increments. The cost can be as low as $40 per $5,000 per year with some product offerings. Don’t delay in adding this important rider to your insurance policy. Water backup coverage is an optional endorsement that must be added onto a standard homeowners, condo or renters insurance policy.

Water backup coverage is an optional endorsement.

Your homeowners insurance company may not include it in your policy. It’s generally inexpensive to add onto your homeowners or renters insurance , and it can be a huge help if you find. It also protects you from mold damages caused by water or sewer backup. What is not covered by water backup insurance? It can be caused from sewers, blocked drains, tree roots, gutters, and more. You can buy coverage in $5,000 increments up to $250,000 with some insurance products offered from our agency.

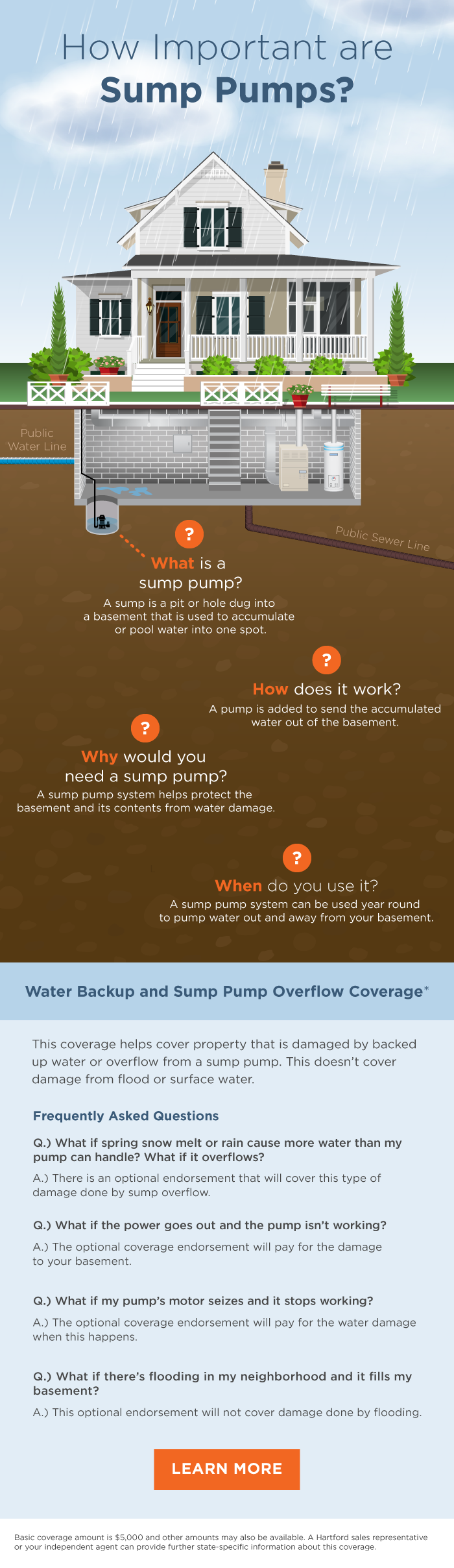

Source: extramile.thehartford.com

Source: extramile.thehartford.com

Your homeowners insurance company may not include it in your policy. Generally, water backup pertains to the incident(s) when something blocks or stops the natural flow of drains from the pipes that exit your home. What is water backup coverage? Water backup is a term commonly used in the insurance industry. What is water backup coverage?

Source: neplox.com

Source: neplox.com

Without the endorsement, you would be stuck paying for the cost of cleanup or damages caused by a sump, sump pump or similar equipment that’s not considered a plumbing system or household appliance. The hanover offers both, with amounts ranging from $5,000 in coverage, all the way up to the replacement cost of your home (depending on. Depending on how much coverage you get, it usually only adds about $40 to $300 to your homeowners premium each year. What is covered by water backup insurance? Water backup coverage, also called sewer or sump pump backup coverage, is one of the more popular and useful homeowners insurance endorsements that you can add to your policy.

Source: absoluteinsurance.ca

Source: absoluteinsurance.ca

What is not covered by water backup insurance? It covers your home and personal property in the event of water damage from a sump pump, drain, or sewer overflow or backup. Water backup insurance, also known as sump pump failure insurance, protects you against the damage caused by water backing up into your home. If a sewer backs up, causing freshwater or wastewater to enter your home, water backup insurance is designed to cover the cleanup. What is water backup coverage?

Source: onfocus.news

Source: onfocus.news

Water can come through sewers, drains, sump pumps or any other plumbing equipment located. You should constantly work closely with your insurance agent or broker whilst purchasing insurance, however understanding some of the terminology and concerns will help you. If your home insurance policy settles losses on a replacement cost. What does water backup insurance protect? You can buy coverage in $5,000 increments up to $250,000 with some insurance products offered from our agency.

Source: hanniganinsurance.com

Source: hanniganinsurance.com

Coverage can assist when dealing with water damage resulting from incidents caused by sewers, drains, and sump pump wells. It also protects you from mold damages caused by water or sewer backup. Water backup coverage is an optional endorsement that must be added onto a standard homeowners, condo or renters insurance policy. You can protect your home and belongings with water backup coverage. Your homeowners insurance company may not include it in your policy.

Source: lg-ig.com

Source: lg-ig.com

What is water backup insurance? Don’t delay in adding this important rider to your insurance policy. As a renter, do not depend on the homeowner to supply sewer backup insurance, be safe and purchase your own. It usually has to be endorsed for coverage to apply. The hanover offers both, with amounts ranging from $5,000 in coverage, all the way up to the replacement cost of your home (depending on.

Source: stolly.com

Source: stolly.com

It also protects you from mold damages caused by water or sewer backup. As a renter, do not depend on the homeowner to supply sewer backup insurance, be safe and purchase your own. What does water backup insurance cover? What does water backup insurance protect? Water backup is a term commonly used in the insurance industry.

Source: eckburg.com

Source: eckburg.com

Talk to your independent insurance agent to find the level of coverage that is right for you. Water backup coverage expands your coverage to any internal water damage that wouldn’t be covered with a standard policy. Water backup coverage is an optional endorsement. However, most insurance providers offer water backup cove Coverage can assist when dealing with water damage resulting from incidents caused by sewers, drains, and sump pump wells.

Source: quoteble.com

Source: quoteble.com

Generally, water backup pertains to the incident(s) when something blocks or stops the natural flow of drains from the pipes that exit your home. Water backup insurance can help pay for water damage caused by a sewer or drain backup or a sump pump overflow. However, most insurance providers offer water backup cove Water backup coverage is an endorsement option that protects against damage to your home or personal property because of water that backups through sewers, drains, and discharges or overflows from a sump, sump pump, or related equipment. It can be caused from sewers, blocked drains, tree roots, gutters, and more.

Source: hgway.com

Source: hgway.com

Water backup coverage is an optional part of your home insurance policy that covers you for most types of water damage that could happen in your home. What is water backup coverage? Yes, it’s probably a good idea to get water backup insurance as a renter. Depending on how much coverage you get, it usually only adds about $40 to $300 to your homeowners premium each year. Your homeowners insurance company may not include it in your policy.

Source: gilbertsrisksolutions.com

Source: gilbertsrisksolutions.com

Water backup coverage is an optional endorsement. Water backup coverage is an optional endorsement that must be added onto a standard homeowners, condo or renters insurance policy. Water backup insurance is different from flood insurance, neither being part of a homeowner’s policy, covering different claims. What is not covered by water backup insurance? A basic water or sewer backup coverage endorsement reimburses you for damage caused by water to the structure of your home, business, or personal property if it’s discharged water or the water overflows from the following:

Source: effectivecoverage.com

Source: effectivecoverage.com

Depending on how much coverage you get, it usually only adds about $40 to $300 to your homeowners premium each year. As a renter, do not depend on the homeowner to supply sewer backup insurance, be safe and purchase your own. You have to add it to a standard homeowners, condo, or renters insurance policy. It could save you thousands in repairs and replacements. The cost can be as low as $40 per $5,000 per year with some product offerings.

Source: aaaliving.acg.aaa.com

Source: aaaliving.acg.aaa.com

It offers coverage, in varying amounts that extends to damage done by. Coverage can assist when dealing with water damage resulting from incidents caused by sewers, drains, and sump pump wells. You can buy coverage in $5,000 increments up to $250,000 with some insurance products offered from our agency. Water backup coverage is an optional endorsement that must be added onto a standard homeowners, condo or renters insurance policy. What is water backup coverage?

Source: neckerman.com

Source: neckerman.com

What is water backup coverage? Water backup insurance offers protection for any damage to your home caused by a blocked sewer line, broken sump pump, or clogged drains. Standard renters insurance policies don’t cover water backup damage by default, but almost every company offers a water backup rider, which is an addition to your policy that expands your coverage to include drain and sewer backups and sump pump failures. The hanover offers both, with amounts ranging from $5,000 in coverage, all the way up to the replacement cost of your home (depending on. Material and labor for repairs.

Source: rathbunagency.com

Source: rathbunagency.com

Water backup insurance, also known as sump pump failure insurance, protects you against the damage caused by water backing up into your home. What does water backup insurance protect? Your homeowners insurance company may not include it in your policy. The cost can be as low as $40 per $5,000 per year with some product offerings. Replacement appliances and other items.

Source: applegateinsuranceco.com

Source: applegateinsuranceco.com

Water backup coverage is offered as an endorsement by most homeowners insurance companies, and you can typically opt for coverage of $5,000 to $25,000 in $5,000 increments. Water backup insurance is different from flood insurance, neither being part of a homeowner’s policy, covering different claims. Without the endorsement, you would be stuck paying for the cost of cleanup or damages caused by a sump, sump pump or similar equipment that’s not considered a plumbing system or household appliance. The average cost of water backup and sewer coverage may range from $50 to $250 per year, with limits of coverage from $5,000 to the full replacement cost of your home. As a renter, do not depend on the homeowner to supply sewer backup insurance, be safe and purchase your own.

Source: plazare.com

Source: plazare.com

Water backup coverage is offered as an endorsement by most homeowners insurance companies, and you can typically opt for coverage of $5,000 to $25,000 in $5,000 increments. The hanover offers both, with amounts ranging from $5,000 in coverage, all the way up to the replacement cost of your home (depending on. What is water backup insurance? You should constantly work closely with your insurance agent or broker whilst purchasing insurance, however understanding some of the terminology and concerns will help you. What is water backup coverage?

Source: getjerry.com

Source: getjerry.com

Talk to your independent insurance agent to find the level of coverage that is right for you. Water backup coverage is an optional part of your home insurance policy that covers you for most types of water damage that could happen in your home. Water backup coverage, also called sewer or sump pump backup coverage, is one of the more popular and useful homeowners insurance endorsements that you can add to your policy. As a renter, do not depend on the homeowner to supply sewer backup insurance, be safe and purchase your own. Water can come through sewers, drains, sump pumps or any other plumbing equipment located.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title water backup insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information