Weather data insurance Idea

Home » Trend » Weather data insurance IdeaYour Weather data insurance images are available. Weather data insurance are a topic that is being searched for and liked by netizens now. You can Get the Weather data insurance files here. Find and Download all royalty-free images.

If you’re looking for weather data insurance images information related to the weather data insurance interest, you have come to the right site. Our website frequently gives you suggestions for seeking the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

Weather Data Insurance. Increase customer engagement with weather alerts. Weathernet can provide nec, jct and downtime weather reports from >300 met office and exclusive independent weather station nationwide. With the increasing sophistication of weather data analytics, insurers can more accurately predict the outcomes of weather. Improve risk selection, reduce loss adjustment expenses, identify potential fraud and settle claims faster with.

Weather Solutions Designed for Insurers Baron Critical From baronweather.com

Weather Solutions Designed for Insurers Baron Critical From baronweather.com

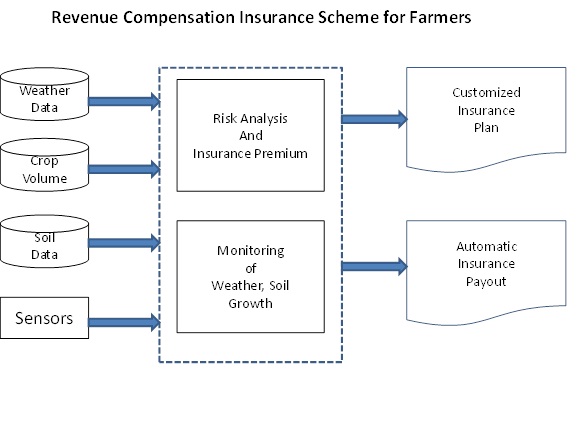

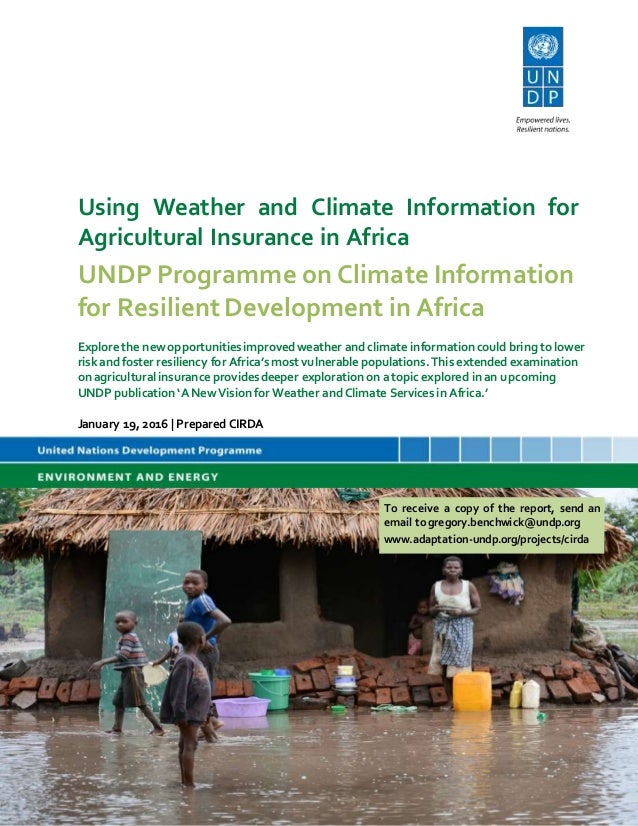

The climate corporation is using data and analytics to redefine the crop insurance market. Comparison of data types for. Access to global historical weather & forecast data. We prepare customized reports for the. Types of data for agricultural insurance there are three key types of data that crop insurance can typically be based on: Roof underwriting report for homeowners.

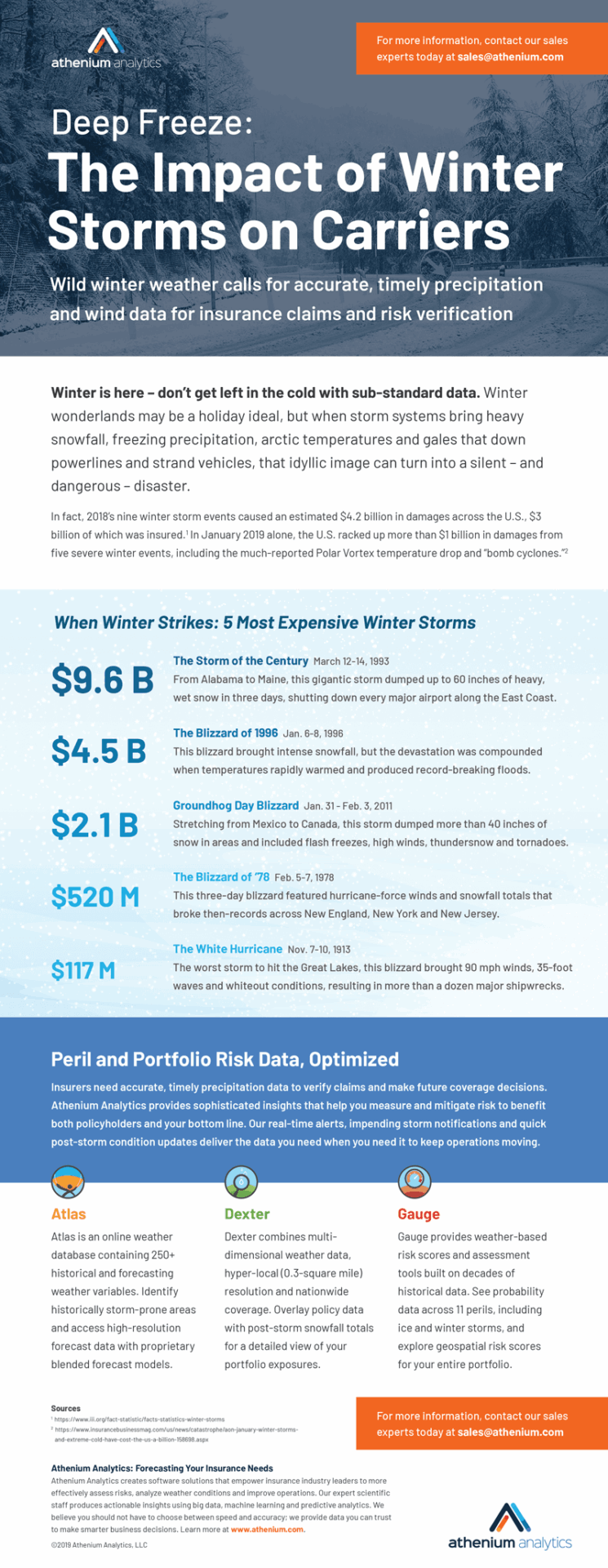

At the same time, the market for weather insurance to protect against adverse weather conditions is growing.

Access to global historical weather & forecast data. At the same time, the market for weather insurance to protect against adverse weather conditions is growing. Parametric insurance use growing with weather data apis as volatile weather becomes more frequent, parametric insurance use is growing as it pays on a specific parameter rather than on the damage. With the increasing sophistication of weather data analytics, insurers can more accurately predict the outcomes of weather. Roof underwriting report for homeowners. Understory works towards enlightening companies on the financial impact that weather or climate changes can cause.

Source: weatherinsurance.org

Source: weatherinsurance.org

Nearly 50% of insurers have plans to utilize weather data as a key component of their analytics strategy. 4 ways weather data helps reduce claims. 79% of insurers believe that data and analytics will have a significant impact on meeting the needs of p&c customers over the next few years. The company uses data on weather patterns, soil characteristics and other key crop attributes at the field level to reduce farmers’ risks by designing policies that protect farmers from losses due to weather and other adverse events. Nearly 50% of insurers have plans to utilize weather data as a key component of their analytics strategy.

Source: swoodnewsletter.blogspot.com

Source: swoodnewsletter.blogspot.com

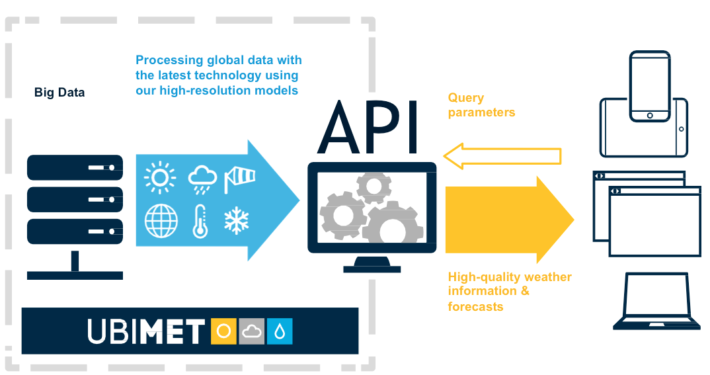

With global reanalysis data, specialized services and statistics, ubimet provides reliable and professional analysis that integrates with internal risk analysis processes and financial models. >90% of uk insurers subscribe to weathernet�s award winning online claims validation application. Access to global historical weather & forecast data. Insurance companies can now use iot, weather data analytics, and machine learning to improve their risk assessment. Weather insurance covers unforeseen events such as heavy rainfall, sudden freezes, and damage from high winds.

Source: baronweather.com

Source: baronweather.com

Our certified consulting meteorologists stand behind all our reports and provide expert support for additional consulting and trial testimony. Understory works towards enlightening companies on the financial impact that weather or climate changes can cause. They also build and operate weather networks consisting of patented rti weather stations. Roof underwriting report for homeowners. Nearly 50% of insurers have plans to utilize weather data as a key component of their analytics strategy.

Source: ubimet.com

Source: ubimet.com

The company uses data on weather patterns, soil characteristics and other key crop attributes at the field level to reduce farmers’ risks by designing policies that protect farmers from losses due to weather and other adverse events. Understory works towards enlightening companies on the financial impact that weather or climate changes can cause. 4 ways weather data helps reduce claims. Improve risk selection, reduce loss adjustment expenses, identify potential fraud and settle claims faster with. Our certified consulting meteorologists stand behind all our reports and provide expert support for additional consulting and trial testimony.

Source: baronweather.com

Source: baronweather.com

Our first and most important reason why weather data and insurance are a great mix is for claim reduction. Weather data and its evolution with the insurance industry balkerne published feb 1, 2022 + follow in 2019, the association of british insurers reported that uk property commercial and domestic. Understory is an insurance provider that leverages weather data to provide insurance after risk assessment. Improve risk selection, reduce loss adjustment expenses, identify potential fraud and settle claims faster with. Weathernet provides historical weather data bespoke reports and online applications:

![[Whitepaper] Parametric and Event Insurance Setting [Whitepaper] Parametric and Event Insurance Setting](https://www.athenium.com/wp-content/uploads/2020/03/WP_Weather_Parametric-and-Event-Insurance_031320_cover-01-compressor-791x1024.png) Source: athenium.com

Source: athenium.com

What makes baron weather intelligence unique Improve risk selection, reduce loss adjustment expenses, identify potential fraud and settle claims faster with. Insurance climate and weather risk detailed analytics to help you manage weather, climate, and environmental risk verisk provides detailed, accurate analytics of weather, climate, and environmental perils to help you understand and manage risk. They also build and operate weather networks consisting of patented rti weather stations. At the same time, the market for weather insurance to protect against adverse weather conditions is growing.

Source: verizon.com

Source: verizon.com

Insurance climate and weather risk detailed analytics to help you manage weather, climate, and environmental risk verisk provides detailed, accurate analytics of weather, climate, and environmental perils to help you understand and manage risk. Our first and most important reason why weather data and insurance are a great mix is for claim reduction. Weather data and its evolution with the insurance industry balkerne published feb 1, 2022 + follow in 2019, the association of british insurers reported that uk property commercial and domestic. For the insurance industry, weather events are especially impactful. >90% of uk insurers subscribe to weathernet�s award winning online claims validation application.

Source: dw.com

Source: dw.com

Access to global historical weather & forecast data. These data types can be compared against several key metrics (figure 1)3. Access to global historical weather & forecast data. Precisely’s dynamic weather product provides detailed data for important risk factors such as earthquakes, wildfires, tornadoes, hurricanes, high winds, and other major weather events. Parametric insurance use growing with weather data apis as volatile weather becomes more frequent, parametric insurance use is growing as it pays on a specific parameter rather than on the damage.

Source: techviral.net

Source: techviral.net

By alerting and educating customers about weather events, insurance companies can reduce claims while also enhancing customer relationships. With global reanalysis data, specialized services and statistics, ubimet provides reliable and professional analysis that integrates with internal risk analysis processes and financial models. Nearly 50% of insurers have plans to utilize weather data as a key component of their analytics strategy. For more information about our weather analytics, contact john boyle at 847.987.3536 or john.boyle@weathercommand.com today! Increase customer engagement with weather alerts.

Source: dw.com

Source: dw.com

4 ways weather data helps reduce claims. Comparison of data types for. The company uses data on weather patterns, soil characteristics and other key crop attributes at the field level to reduce farmers’ risks by designing policies that protect farmers from losses due to weather and other adverse events. Roof underwriting report for homeowners. Increase customer engagement with weather alerts.

Source: swoodnewsletter.blogspot.com

Source: swoodnewsletter.blogspot.com

With global reanalysis data, specialized services and statistics, ubimet provides reliable and professional analysis that integrates with internal risk analysis processes and financial models. Nearly 50% of insurers have plans to utilize weather data as a key component of their analytics strategy. We prepare customized reports for the. Access to global historical weather & forecast data. Improve risk selection, reduce loss adjustment expenses, identify potential fraud and settle claims faster with.

Source: baronweather.com

Source: baronweather.com

For more information about our weather analytics, contact john boyle at 847.987.3536 or john.boyle@weathercommand.com today! Our first and most important reason why weather data and insurance are a great mix is for claim reduction. They also build and operate weather networks consisting of patented rti weather stations. 79% of insurers believe that data and analytics will have a significant impact on meeting the needs of p&c customers over the next few years. Improve risk selection, reduce loss adjustment expenses, identify potential fraud and settle claims faster with.

Source: slideshare.net

Source: slideshare.net

Parametric insurance use growing with weather data apis as volatile weather becomes more frequent, parametric insurance use is growing as it pays on a specific parameter rather than on the damage. The company uses data on weather patterns, soil characteristics and other key crop attributes at the field level to reduce farmers’ risks by designing policies that protect farmers from losses due to weather and other adverse events. Types of data for agricultural insurance there are three key types of data that crop insurance can typically be based on: These data types can be compared against several key metrics (figure 1)3. Understory works towards enlightening companies on the financial impact that weather or climate changes can cause.

Source: swoodnewsletter.blogspot.com

Source: swoodnewsletter.blogspot.com

Access to global historical weather & forecast data. Insurance climate and weather risk detailed analytics to help you manage weather, climate, and environmental risk verisk provides detailed, accurate analytics of weather, climate, and environmental perils to help you understand and manage risk. The climate corporation is using data and analytics to redefine the crop insurance market. For more information about our weather analytics, contact john boyle at 847.987.3536 or john.boyle@weathercommand.com today! Our certified consulting meteorologists stand behind all our reports and provide expert support for additional consulting and trial testimony.

Source: thisspaceshipearth.org

Source: thisspaceshipearth.org

Understory works towards enlightening companies on the financial impact that weather or climate changes can cause. By alerting and educating customers about weather events, insurance companies can reduce claims while also enhancing customer relationships. 79% of insurers believe that data and analytics will have a significant impact on meeting the needs of p&c customers over the next few years. They also build and operate weather networks consisting of patented rti weather stations. Improve risk selection, reduce loss adjustment expenses, identify potential fraud and settle claims faster with.

![]() Source: swoodnewsletter.blogspot.com

Source: swoodnewsletter.blogspot.com

Comparison of data types for. With the increasing sophistication of weather data analytics, insurers can more accurately predict the outcomes of weather. Our certified consulting meteorologists stand behind all our reports and provide expert support for additional consulting and trial testimony. These data types can be compared against several key metrics (figure 1)3. 4 ways weather data helps reduce claims.

Source: researchgate.net

Source: researchgate.net

The company uses data on weather patterns, soil characteristics and other key crop attributes at the field level to reduce farmers’ risks by designing policies that protect farmers from losses due to weather and other adverse events. Precisely’s dynamic weather product provides detailed data for important risk factors such as earthquakes, wildfires, tornadoes, hurricanes, high winds, and other major weather events. At the same time, the market for weather insurance to protect against adverse weather conditions is growing. With the increasing sophistication of weather data analytics, insurers can more accurately predict the outcomes of weather. Weather insurance covers unforeseen events such as heavy rainfall, sudden freezes, and damage from high winds.

Source: slideshare.net

Source: slideshare.net

Our first and most important reason why weather data and insurance are a great mix is for claim reduction. By alerting and educating customers about weather events, insurance companies can reduce claims while also enhancing customer relationships. Precisely’s dynamic weather product provides detailed data for important risk factors such as earthquakes, wildfires, tornadoes, hurricanes, high winds, and other major weather events. Understory works towards enlightening companies on the financial impact that weather or climate changes can cause. Our certified consulting meteorologists stand behind all our reports and provide expert support for additional consulting and trial testimony.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title weather data insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information