What are reserves in insurance information

Home » Trending » What are reserves in insurance informationYour What are reserves in insurance images are ready. What are reserves in insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the What are reserves in insurance files here. Get all free photos and vectors.

If you’re searching for what are reserves in insurance images information related to the what are reserves in insurance interest, you have come to the ideal blog. Our site frequently gives you hints for viewing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

What Are Reserves In Insurance. Some accountants are frustrated with reserves, as they have an enormous impact on financial statements, but they are shrouded in mystery. Why does an insurance company need claim reserves? Insurance reserves means any reserves, funds or provisions for losses, claims, premiums, loss and loss adjustment expenses (including reserves for incurred but not reported losses and loss adjustment expenses) and other liabilities in respect of the insurance or reinsurance contracts issued by the reinsurance subsidiaries. Reserves reflect an insurance company’s ability to pay claims on the claim�s closing date.

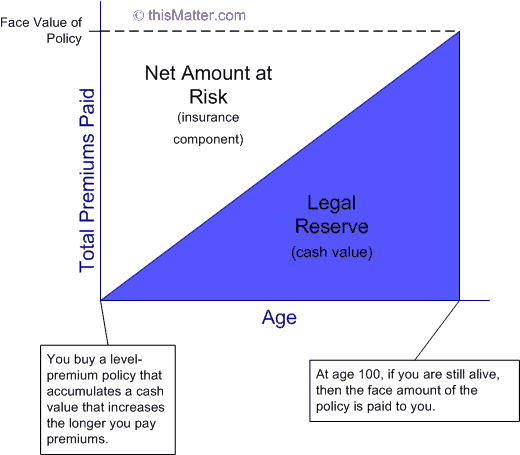

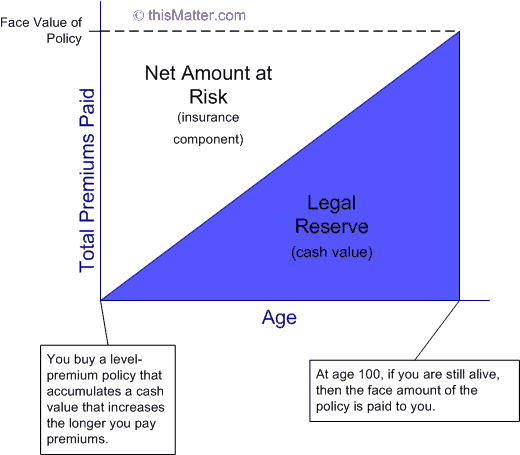

What is a legal reserve From mitpalmmin.myewebsite.com

What is a legal reserve From mitpalmmin.myewebsite.com

Insurance companies have the obligation to reserve for claims to incur in the future. Reserves reflect an insurance company’s ability to pay claims on the claim�s closing date. Unearned premium reserves show the aggregate amount of premiums that would be returned to policyholders if all policies were canceled on the date the balance sheet was prepared. There are several different types of reserves. (1) life insurance reserves (as defined in section 816(b)); Some accountants are frustrated with reserves, as they have an enormous impact on financial statements, but they are shrouded in mystery.

Insurance technical reserves means the insurance technical reserves in accordance with applicable laws and regulations, in each case of the business entity in relation to which the term is used, and shall, in relation to the winterthur group, be deemed to include, in particular, the.

The items described in section 807(c) are: Insurers establish unearned premium reserves and loss reserves indicated on their balance sheets. Reserves are the average future insurance obligations of an insurer. Some accountants are frustrated with reserves, as they have an enormous impact on financial statements, but they are shrouded in mystery. In the liability insurance segments in particular, however, some claims are only discovered with a certain time lag, or the claims settlement process takes more than one. Considered as liabilities in its accounting books, the payments have the possibility of being returned to the clients.

Source: blog.tsibinc.com

Source: blog.tsibinc.com

Reserves reflect an insurance company’s ability to pay claims on the claim�s closing date. Insurance companies have the obligation to reserve for claims to incur in the future. Insurers establish unearned premium reserves and loss reserves indicated on their balance sheets. Insurance technical reserves means the insurance technical reserves in accordance with applicable laws and regulations, in each case of the business entity in relation to which the term is used, and shall, in relation to the winterthur group, be deemed to include, in particular, the. The part of the reserve of an insurance company to be absorbed from the initial reserve in any year in payment of losses — compare investment reserve.

Source: fred.stlouisfed.org

Source: fred.stlouisfed.org

The insurer also must maintain the solvency level of the tabarru fund. Insurance reserves means any reserves, funds or provisions for losses, claims, premiums, loss and loss adjustment expenses (including reserves for incurred but not reported losses and loss adjustment expenses) and other liabilities in respect of the insurance or reinsurance contracts issued by the reinsurance subsidiaries. Insurance technical reserves means the insurance technical reserves in accordance with applicable laws and regulations, in each case of the business entity in relation to which the term is used, and shall, in relation to the winterthur group, be deemed to include, in particular, the. (1) life insurance reserves (as defined in section 816(b)); Some accountants are frustrated with reserves, as they have an enormous impact on financial statements, but they are shrouded in mystery.

Source: fred.stlouisfed.org

Source: fred.stlouisfed.org

Unearned premium reserves show the aggregate amount of premiums that would be returned to policyholders if all policies were canceled on the date the balance sheet was prepared. An actuarial reserve is used to account for the amount of money that an insurance company will be liable to pay (in the event of a claim) based on an estimate of the present value of all future income that is derived from a contingent event. The insurance regulators, the irs, and fasb make up a ton of rules about reserves. Term insurance, pure endowment, and endowment with unitary benefit. Insurance reserves means any reserves, funds or provisions for losses, claims, premiums, loss and loss adjustment expenses (including reserves for incurred but not reported losses and loss adjustment expenses) and other liabilities in respect of the insurance or reinsurance contracts issued by the reinsurance subsidiaries.

Source: keikaiookami.blogspot.com

Source: keikaiookami.blogspot.com

Insurance technical reserves means the insurance technical reserves in accordance with applicable laws and regulations, in each case of the business entity in relation to which the term is used, and shall, in relation to the winterthur group, be deemed to include, in particular, the. Insurance technical reserves means the insurance technical reserves in accordance with applicable laws and regulations, in each case of the business entity in relation to which the term is used, and shall, in relation to the winterthur group, be deemed to include, in particular, the. This unrealized liability is funded by the insurer’s assets, regardless of asset type or origin. The ibnr, which is the abbreviated form of incurred but not reported reserves (ibnr), are the reserves for claims that become due with the occurrence of the events covered under the insurance policy, but have not been reported yet. There were also a different understanding in the industry, where

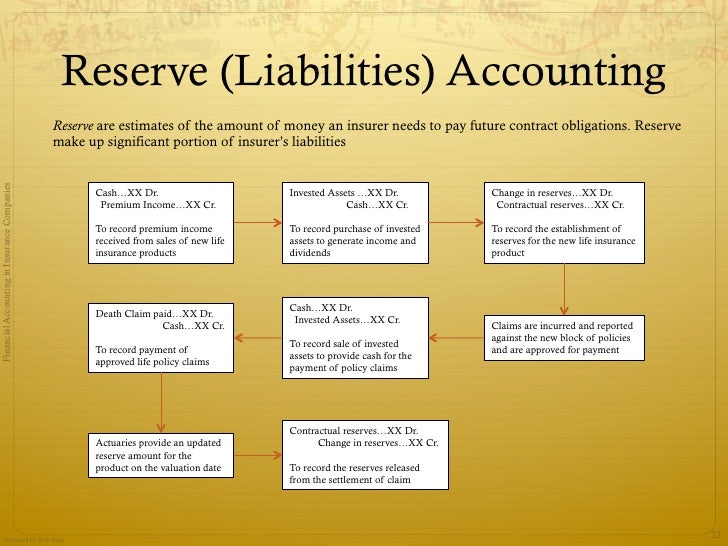

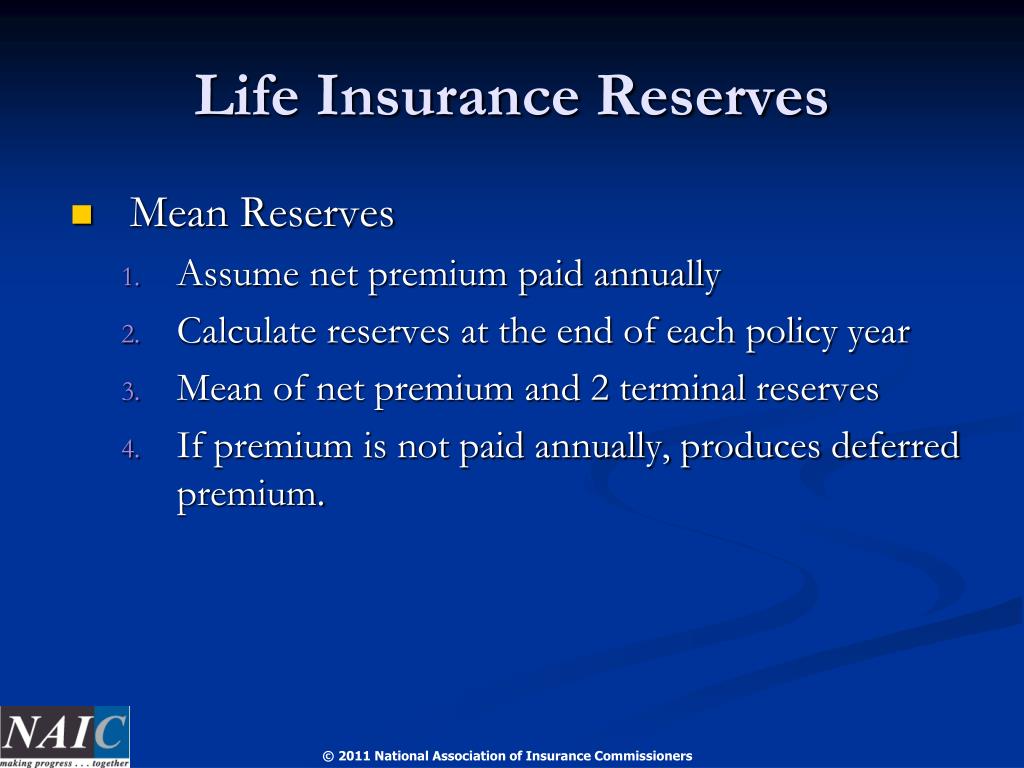

Source: slideshare.net

Source: slideshare.net

All insurers calculate some form of reserve amount, and record it on their balance sheets as a liability. In the insurance context an actuarial reserve is the present value of the future cash flows of an insurance policy and the total liability of the insurer is the sum of the actuarial reserves for. State insurance departments set minimum reserve requirements in the state�s insurance code. Insurance reserves means any reserves, funds or provisions for losses, claims, premiums, loss and loss adjustment expenses (including reserves for incurred but not reported losses and loss adjustment expenses) and other liabilities in respect of the insurance or reinsurance contracts issued by the reinsurance subsidiaries. The ibnr, which is the abbreviated form of incurred but not reported reserves (ibnr), are the reserves for claims that become due with the occurrence of the events covered under the insurance policy, but have not been reported yet.

Source: semanticscholar.org

Source: semanticscholar.org

It is generally equal to the actuarial present value of the future cash flows of a contingent event. It is generally equal to the actuarial present value of the future cash flows of a contingent event. (3) amounts that are discounted at the appropriate rate of interest to satisfy obligations under insurance and annuity contracts that do not involve life, accident or health contingencies when the. In the liability insurance segments in particular, however, some claims are only discovered with a certain time lag, or the claims settlement process takes more than one. The items described in section 807(c) are:

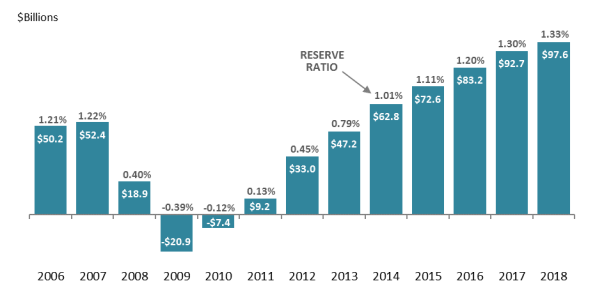

Source: fred.stlouisfed.org

Source: fred.stlouisfed.org

When an insurer agrees to provide cover under an insurance policy, it undertakes to pay all claims covered under this policy. The period between 2 dates as. When an insurer agrees to provide cover under an insurance policy, it undertakes to pay all claims covered under this policy. Don’t let unexpected expenses or a sudden drop in income ruin your finances. Reserves reflect an insurance company’s ability to pay claims on the claim�s closing date.

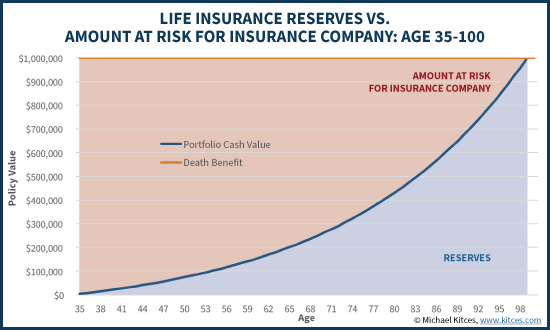

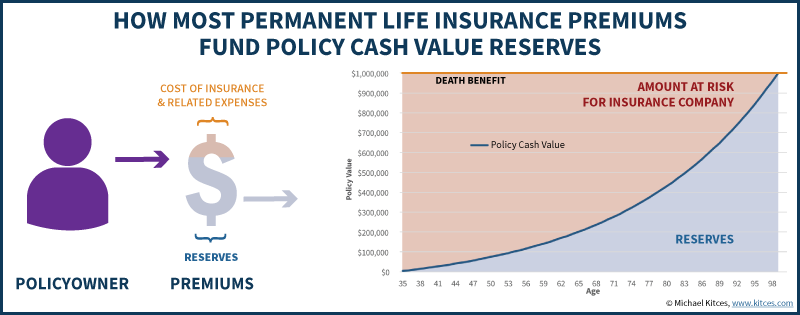

Source: kitces.com

Source: kitces.com

Unearned premium reserve is an account where an insurance company places advance insurance payments. The reserves are calculated for the three basic types of life insurance: Insurance companies have the obligation to reserve for claims to incur in the future. The part of the reserve of an insurance company to be absorbed from the initial reserve in any year in payment of losses — compare investment reserve. Think of a reserve as the mean future payments an insurer has to make.

Source: researchgate.net

Source: researchgate.net

In the liability insurance segments in particular, however, some claims are only discovered with a certain time lag, or the claims settlement process takes more than one. The part of the reserve of an insurance company to be absorbed from the initial reserve in any year in payment of losses — compare investment reserve. This unrealized liability is funded by the insurer’s assets, regardless of asset type or origin. Reserves reflect an insurance company’s ability to pay claims on the claim�s closing date. Reserves are the average future insurance obligations of an insurer.

Source: mitpalmmin.myewebsite.com

Source: mitpalmmin.myewebsite.com

Reserves reflect an insurance company’s ability to pay claims on the claim�s closing date. It is generally equal to the actuarial present value of the future cash flows of a contingent event. An actuarial reserve is used to account for the amount of money that an insurance company will be liable to pay (in the event of a claim) based on an estimate of the present value of all future income that is derived from a contingent event. The period between 2 dates as. Unearned premium reserve is an account where an insurance company places advance insurance payments.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

In the liability insurance segments in particular, however, some claims are only discovered with a certain time lag, or the claims settlement process takes more than one. Don’t let unexpected expenses or a sudden drop in income ruin your finances. Insurance reserve on the tabarru fund, allowing for expected future benefit payment. When an insurer agrees to provide cover under an insurance policy, it undertakes to pay all claims covered under this policy. The ibnr, which is the abbreviated form of incurred but not reported reserves (ibnr), are the reserves for claims that become due with the occurrence of the events covered under the insurance policy, but have not been reported yet.

Source: slideserve.com

Source: slideserve.com

The insurer also must maintain the solvency level of the tabarru fund. Term insurance, pure endowment, and endowment with unitary benefit. Why does an insurance company need claim reserves? In insurance, an actuarial reserve is a reserve set aside for future insurance liabilities. All types of insurance, including life, health and auto, have reserve requirements.

Source: fred.stlouisfed.org

Source: fred.stlouisfed.org

The reserves are considered a company’s liabilities (money that is owed and will be paid in the future). Don’t let unexpected expenses or a sudden drop in income ruin your finances. The period between 2 dates as. There were also a different understanding in the industry, where Why does an insurance company need claim reserves?

Source: slideteam.net

Source: slideteam.net

Unearned premium reserve is an account where an insurance company places advance insurance payments. Reserves reflect an insurance company’s ability to pay claims on the claim�s closing date. The insurance regulators, the irs, and fasb make up a ton of rules about reserves. (2) unearned premiums and unpaid losses included in total reserves; In the insurance context an actuarial reserve is the present value of the future cash flows of an insurance policy and the total liability of the insurer is the sum of the actuarial reserves for.

Source: everycrsreport.com

Source: everycrsreport.com

Term insurance, pure endowment, and endowment with unitary benefit. Reserves are the average future insurance obligations of an insurer. In the liability insurance segments in particular, however, some claims are only discovered with a certain time lag, or the claims settlement process takes more than one. Unearned premium reserves show the aggregate amount of premiums that would be returned to policyholders if all policies were canceled on the date the balance sheet was prepared. Statutory reserves are the minimum amounts of cash and readily marketable securities that insurance companies must hold.

Source: researchgate.net

Source: researchgate.net

When an insurer agrees to provide cover under an insurance policy, it undertakes to pay all claims covered under this policy. Some accountants are frustrated with reserves, as they have an enormous impact on financial statements, but they are shrouded in mystery. These typically amount to about 10 percent. Term insurance, pure endowment, and endowment with unitary benefit. Considered as liabilities in its accounting books, the payments have the possibility of being returned to the clients.

Source: kitces.com

Source: kitces.com

The period between 2 dates as. In order to establish accurate reserves, insurance companies require their adjusters to make regular adjustments to the value of claims. The insurance regulators, the irs, and fasb make up a ton of rules about reserves. The reserves are calculated for the three basic types of life insurance: When an insurer agrees to provide cover under an insurance policy, it undertakes to pay all claims covered under this policy.

Source: carriermanagement.com

Source: carriermanagement.com

The insurer also must maintain the solvency level of the tabarru fund. It is generally equal to the actuarial present value of the future cash flows of a contingent event. An actuarial reserve is used to account for the amount of money that an insurance company will be liable to pay (in the event of a claim) based on an estimate of the present value of all future income that is derived from a contingent event. Statutory reserves are the minimum amounts of cash and readily marketable securities that insurance companies must hold. There were also a different understanding in the industry, where

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what are reserves in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Swinton insurance customer service information

- Sterling bridge insurance agency information

- Tenant insurance north york information

- Student ski insurance information

- Western insurance spokane wa Idea

- The general insurance spartanburg sc information

- Swinton car insurance reading Idea

- Shield life insurance Idea

- Renters insurance washington state Idea

- Property protection insurance information