What are the 5 parts of an insurance policy information

Home » Trend » What are the 5 parts of an insurance policy informationYour What are the 5 parts of an insurance policy images are ready. What are the 5 parts of an insurance policy are a topic that is being searched for and liked by netizens today. You can Download the What are the 5 parts of an insurance policy files here. Find and Download all free vectors.

If you’re looking for what are the 5 parts of an insurance policy images information related to the what are the 5 parts of an insurance policy interest, you have visit the ideal blog. Our website frequently gives you hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

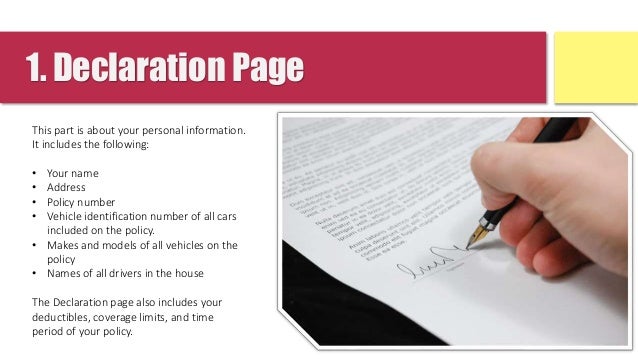

What Are The 5 Parts Of An Insurance Policy. While those guidelines are crucial to reading and recognizing, they’re now no longer consistently easy to recognize. The type or name of the coverage being provided. Insurance policy files incorporate the nuts and bolts of your coverage. The 5 parts of an insurance policy declarations page the declarations page is also called the “dec page,” though it can be longer than one page.

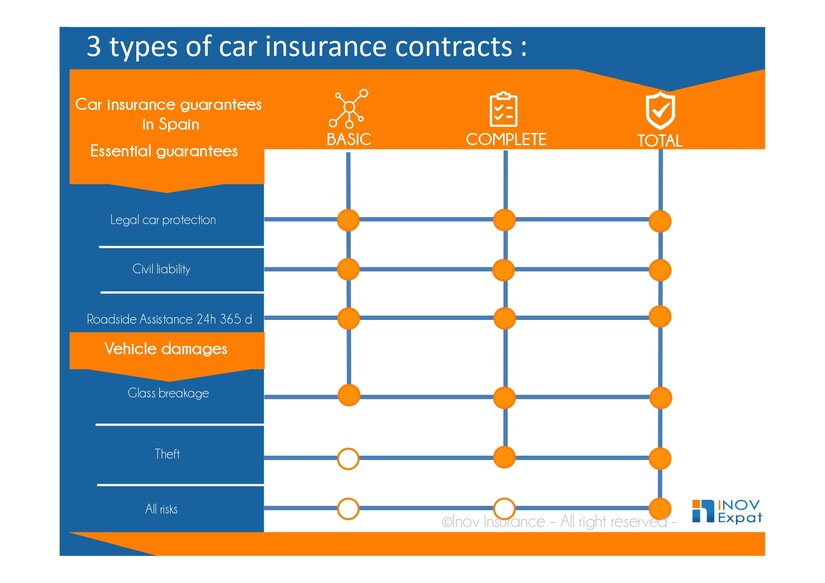

Understanding The 5 Parts Of Car Insurance Contract From slideshare.net

Understanding The 5 Parts Of Car Insurance Contract From slideshare.net

Use these sections as guideposts in reviewing the policies. Most policies cover your personal property while you are away from home and it is with you. Part a explains the liability coverage, part b explains the medical payments coverage, part c explains the coverage for uninsured motorists, and part d explains the coverage for damage to the car. If the conditions are not met, the insurer can deny the claim. Broadly, there are 8 types of insurance, namely: All of the following are considered parts of the policy structure except exclusions insuring clause conditions provisions provisions.

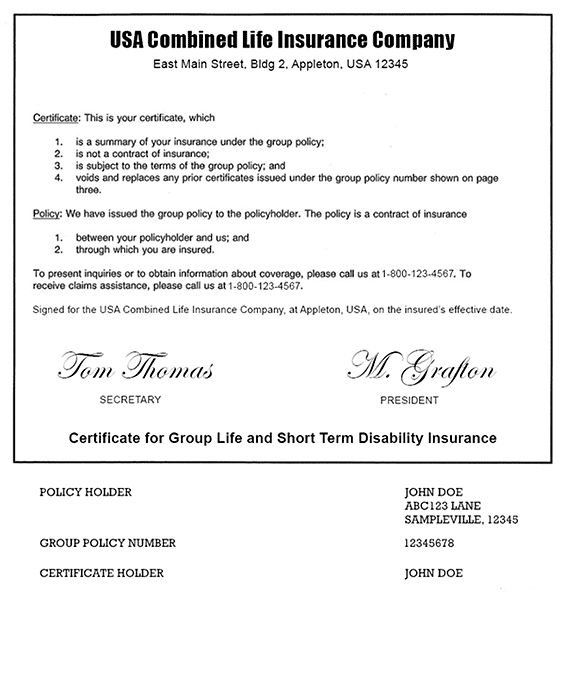

This page lists the policy owner, insured, the face amount of.

Talk with licensed agents to find out the best ways to make these policies work for you. Endorsements additional forms known as endorsements can be attached to policies. The liability portion of a homeowners insurance coverage offers some protection from lawsuits due to bodily injury or property damage for which you are liable. Four of which consist of types of coverage and the remaining two consisting of general provisions and the duties of a policyholder following a loss or accident. Names of the people covered and assets (if applicable). Sections or clauses of an insurance policy that communicate the policy�s benefits, conditions, etc.

Source: damianswiecki.blogspot.com

Source: damianswiecki.blogspot.com

The amount which can be taken is an annual cumulative 1/20th of the amount invested, commonly referred to as the 5% tax deferred allowance. Use these sections as guideposts in reviewing the policies. The type or name of the coverage being provided. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. It summarizes the key details of your policy, and is the first part you’ll encounter.

Source: slideshare.net

Source: slideshare.net

Sections or clauses of an insurance policy that communicate the policy�s benefits, conditions, etc. It summarizes the key details of your policy, and is the first part you’ll encounter. In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay. If the conditions are not met, the insurer can deny the claim. Endorsements additional forms known as endorsements can be attached to policies.

Source: lifeinsurance0000.blogspot.com

Source: lifeinsurance0000.blogspot.com

In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay. The liability portion of a homeowners insurance coverage offers some protection from lawsuits due to bodily injury or property damage for which you are liable. It includes rules of conduct, obligations, and duties required to be met by the insured. Auto, property, health, disability, and life are the top types of insurance that help you protect yourself and your assets. A car insurance policy consists of six different parts;

It summarizes the key details of your policy, and is the first part you’ll encounter. Start studying 5 parts of an insurance policy. Anything could happen to us, and that includes accidents. An insurance policy declarations page is the part of the insurance contract that includes the general policy information. It summarizes the key details of your policy, and is the first part you’ll encounter.

Source: slideshare.net

Source: slideshare.net

Policy details like the policy period, number, and premium. Policy details like the policy period, number, and premium. All of the following are considered parts of the policy structure except exclusions insuring clause conditions provisions provisions. The first section of the personal auto insurance policy defines terms that are used frequently in the contract verbiage. The type or name of the coverage being provided.

Source: pathwaysbyamica.com

Source: pathwaysbyamica.com

But you should also think about your needs. When policies are issued, a declarations page and policy form will be included which lists the types of coverage, insuring agreement,. Four of which consist of types of coverage and the remaining two consisting of general provisions and the duties of a policyholder following a loss or accident. Talk with licensed agents to find out the best ways to make these policies work for you. If the conditions are not met, the insurer can deny the claim.

Source: pinterest.com

Source: pinterest.com

Use these sections as guideposts in reviewing the policies. An investment is defined as an asset or item that is purchased that is expected to be of use in the future. Sections or clauses of an insurance policy that communicate the policy�s benefits, conditions, etc. They spell out your coverage’s phrases and conditions, and they’re a reference factor for both you and your insurer about coverage, exclusions, rules, and declaratory procedures. Defined terms include who is an insured, what is a covered auto, and the policy coverage territory.

Source: damianswiecki.blogspot.com

Source: damianswiecki.blogspot.com

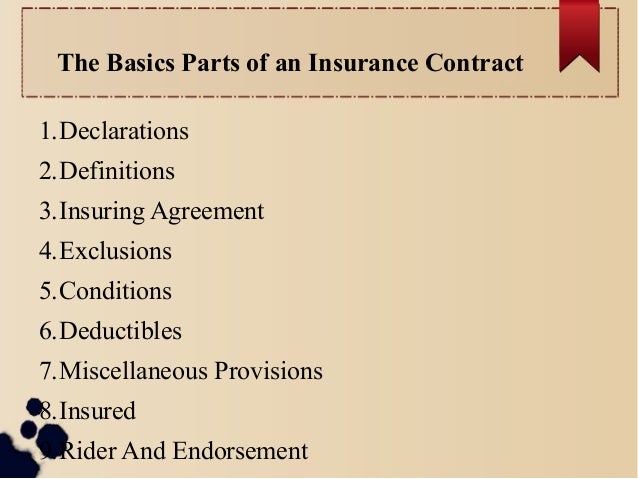

Every insurance policy has five parts: It includes rules of conduct, obligations, and duties required to be met by the insured. As for health insurance policies, this section might be called a summary of benefits and will include information about your premiums, maximum benefit limits, deductibles, copay, and coinsurance (to find out how these work, see all the ways you pay: Anything could happen to us, and that includes accidents. The 5 parts of an insurance policy declarations page the declarations page is also called the “dec page,” though it can be longer than one page.

Source: slideshare.net

Source: slideshare.net

Four of which consist of types of coverage and the remaining two consisting of general provisions and the duties of a policyholder following a loss or accident. Insurances decrease any kinds of the financial burden. If the conditions are not met, the insurer can deny the claim. While those guidelines are crucial to reading and recognizing, they’re now no longer consistently easy to recognize. Simply knowing the various insurance policies does not help.

Source: slideshare.net

Source: slideshare.net

Insurance and insurance policies are actually a form of investment. Names of the people covered and assets (if applicable). Policy details like the policy period. There are four basic parts to an insurance contract: The type or name of the coverage being provided.

Source: damianswiecki.blogspot.com

Source: damianswiecki.blogspot.com

The type or name of the coverage being provided. Current rules allow policyholders to make part surrenders or part assignments of up to an annual cumulative 5% allowance of the premium paid without incurring a tax charge. An insurance policy declarations page is the part of the insurance contract that includes the general policy information. What are the 5 parts of an insurance policy? Anything could happen to us, and that includes accidents.

Source: bankrate.com

Source: bankrate.com

Insurance policy files incorporate the nuts and bolts of your coverage. Four of which consist of types of coverage and the remaining two consisting of general provisions and the duties of a policyholder following a loss or accident. It summarizes the key details of your policy, and is the first part you’ll encounter. Insurances decrease any kinds of the financial burden. In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay.

Source: frogcars.com

Source: frogcars.com

Many policies contain a sixth part: Part e lists the insured�s responsibilities after a crash while part f lists any other provisions in the policy. When policies are issued, a declarations page and policy form will be included which lists the types of coverage, insuring agreement,. Simply knowing the various insurance policies does not help. Sections or clauses of an insurance policy that communicate the policy�s benefits, conditions, etc.

Source: slideshare.net

Source: slideshare.net

It summarizes the key details of your policy, and is the first part you’ll encounter. This page lists the policy owner, insured, the face amount of. Insurance policy files incorporate the nuts and bolts of your coverage. A car insurance policy consists of six different parts; The remainder of the policy is divided into sections, or parts, from a to f:

Source: pinterest.com

Source: pinterest.com

Names of the people covered and assets (if applicable). The dollar limits on coverages and your corresponding deductibles. An insurance policy declarations page is the part of the insurance contract that includes the general policy information. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Use these sections as guideposts in reviewing the policies.

Source: assetbenefit.com

Source: assetbenefit.com

Part a explains the liability coverage, part b explains the medical payments coverage, part c explains the coverage for uninsured motorists, and part d explains the coverage for damage to the car. Insurances decrease any kinds of the financial burden. 3.1 methods of insurance 4 insurers� business model 4.1 underwriting and investing 4.2 claims 4.3 marketing 5 types 5.1 vehicle insurance 5.2 gap insurance 5.3 health insurance 5.4 income protection insurance 5.5 casualty insurance 5.6 life insurance 5.7 burial insurance 5.8 property 5.9 liability 5.10 credit 5.11 cyber attack insurance Every insurance policy has five parts: 1.2 the current rules allow policyholders to withdraw cash from their policies (a part surrender) or sell part of it (a part assignment) without incurring an immediate tax charge.

Source: slideshare.net

Source: slideshare.net

Part e lists the insured�s responsibilities after a crash while part f lists any other provisions in the policy. It includes rules of conduct, obligations, and duties required to be met by the insured. All of the following are considered parts of the policy structure except exclusions insuring clause conditions provisions provisions. The dollar limits on coverages and your corresponding deductibles. Simply knowing the various insurance policies does not help.

Source: infographicszone.com

Source: infographicszone.com

In these circumstances, any gain is instead accounted for when the policy matures. The first section of the personal auto insurance policy defines terms that are used frequently in the contract verbiage. The type or name of the coverage being provided. This page lists the policy owner, insured, the face amount of. Anything could happen to us, and that includes accidents.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what are the 5 parts of an insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Vicarious liability insurance definition Idea

- Staples insurance information

- Youi car insurance claim Idea

- T mobile insurance for iphone x information

- Shelter insurance fayetteville ar information

- Roger smith insurance Idea

- Scotia insurance eastern caribbean limited Idea

- Toronto condo insurance average rates information

- Sell life insurance policy calculator Idea

- Velox insurance hiram information